When Trading Natural Gas Trend following is easy to implement but not easy to follow. You can be stopped out many times in a row over a short period of time.

When that happens, many will start abandoning their trading system thinking it is set for failure and look for the next big thing. But if you have traded long enough, you know this is simply the cost of doing business as the markets will always find a way to humble you.

And this is my experience with Natural Gas, being stopped out 4 times in a row over a span of 2 months.

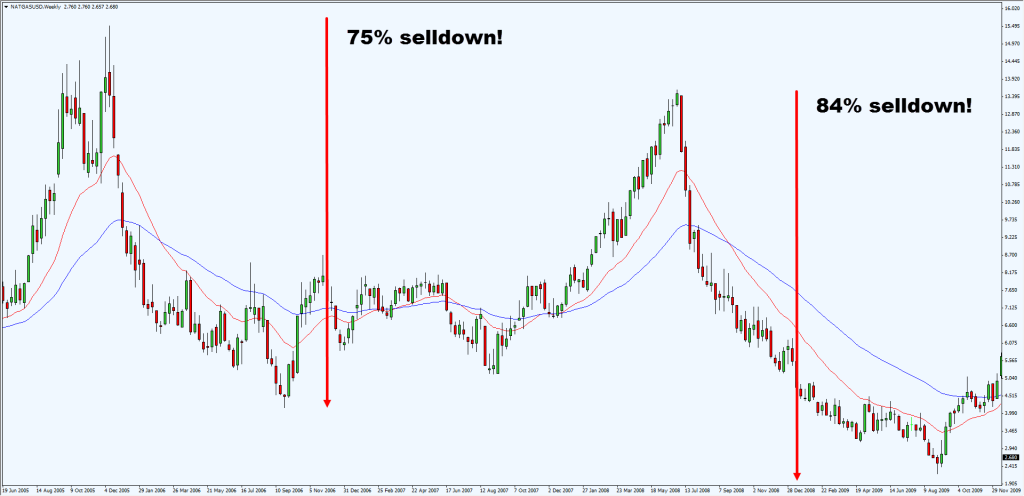

Natural Gas Trend Chart:

4 losses in a row on Natural Gas

Many of you will think I’m crazy shorting a market over again just to be stopped out. But if you are a trend follower, you know you only need 1 trend to pay it all.

And if you can overcome these draw downs using proper risk management, over the long run you will be profitable.

These 2 selldown occurred over a span of 3 years and, it is easily a 1 to 50 risk reward each time.

But it doesn’t matter how insane the risk to reward can be, if you can’t survive the draw downs that comes with it.

The elements of good trading are: 1, cutting losses. 2, cutting losses. And 3, cutting losses. If you can follow these three rules, you may have a chance. Ed Seykota

This is why you always see me emphasizing on risk management, risk management and risk management. Because you must survive the bad times to enjoy the good times! And the good times is always just around the corner when the masses have given up.

Trend following is a proven and tested approach to trading the markets, but the question is can you handle it?

I appreciate you sharing the raw trading experience. This honesty will help many to learn better.

Hey Anonymous,

Yes I believe in sharing the ups and downs to paint the reality of trend following.

Thank you for your comments!

Rayner

I find that i get stopped out more so when i try to scale in than on my initial entry LOL

Hey P,

Lol could simply be a case of being unlucky.

Give it another 30 more trades and let me know how it goes!

Rayner

Hello Rayner

it’s been awhile since i started incorporating your trend following system into my own trading and yes i have never ever been stopped out so many times in my entire life before it’s not even funny but i suppose the point is to survive long enough to hit the homerun, like your 50R trade with usd/jpy. The latest one i could do was only 6R on gbpusd short which only covered 6 of my other losses (died so many times in eurusd).

I have a few questions which i hope you don’t mind answering:

1)referring to the picture above about the 4 shorts https://www.tradingwithrayner.com/wp-content/uploads/2015/03/ng-cut2.png, can i know your trading plan behind the 3rd short? Because i thought you would let the stop be at breakeven price or something since price went down considerably further a few candles later.

2) you may cover this in your weekly video, but looking at usdjpy, it has just touched its previous high and has retraced a little, forming a hammer at the moment. For it to go higher, usd has to appreciate or jpy has to depreciate. The former seems more likely due to speculation about US rate hike, but just by trading price itself, what would be your next course of action? For me, i will definitely exercise caution because this may be a double top. Will you still wait for price to retrace back to the moving averages before going long again since it is still an uptrend? Or go for a breakout trade?

3) we all know that euro qe will cause eur to depreciate, and the us rate hike will cause usd to appreciate. these polar opposites make eurusd a really good short candidate, considering that it is still going downtrend as well, 1.00 is not even impossible if the downtrend continues at this rate.

however, i find myself being stopped out 4 times in a row (twice hitting stop loss, once breakeven and once hit a protective stop which i shifted my stop loss to protect some profit). how would you go about trading eurusd at the moment? i am waiting for a consolidation/retracement back to 20ma line on the 4h timeframe and a smaller atr. previously i was using 1h timeframe and realise the stop was too tight

Sorry to for the wordy comment!!

Regards

yun

Hi Yun,

1) I didn’t shift my stoploss as price have broke out of the support below, thus i left it as it is.

2) I’m not too interested in USDJPY as of now, there are better pairs to trade like eurusd, usddkk. In terms of relative strength, the usdjpy is definitely not leading the pack now.

3) I would trade both breakouts and pullback on the eurusd. I don’t go down into the 1 hour, unless i’m greatly in the money.

Hope that helps!

Rayner

Hey Rayner

thanks for the reply. It certainly has helped, along with your latest video regarding when to set trades to breakeven.

I wish you all the best in your (or ours) shorts in eurusd, especially next week when there’s yet another fed meeting…

yun

Hi Yun,

You are most welcome, best of luck in your trading!

Rayner