So…

In my previous post, you’ve learned the power of Systems Trading.

You discovered it allows you to…

- Become a consistently profitable trader even if you have zero trading experience

- Grow your wealth to $1,311,816 even if you have small trading capital

- Beat the markets in less than 30mins a day

- And much more…

If you’ve not read the post yet, then do it right now.

Here’s the link: Systems Trading Secrets

Now…

You’re probably wondering:

“But how do I find systematic strategies or a trading system that work?”

Well, that’s what you’ll discover right now.

So read on…

How to ethically “steal” trading systems that work

Now:

A big mistake I see traders make is… they try to re-invent the wheel.

They want to develop their own system trading strategies from scratch.

Sure, it could work.

But more likely than not, you’ll fail.

So now the question is… is there a better solution?

You bet.

And that’s to “steal” from winning traders.

Do you want to know how?

Here’s the secret…

You read trading books and research papers.

But hey, not just any trading books because most of them are filled with fluff and it’s near impossible to validate the system trading strategies or techniques.

Instead, you want to read trading books that reveal systematic strategies that you can back test.

You’re probably thinking:

“There are thousands of trading books out there. Where do I begin?”

Well, I’ve done the hard work for you.

Here are some books and research papers you can look into…

Trading books

Mean Reversion Trading Systems – Howard Bandy

Short-term trading strategies that work – Larry and Cesar

Building Reliable Trading Systems – Keith Fitschen

Research papers

Does Trend Following work on Stocks? — Cole Wilcox

Two centuries of Trend Following — M. Potters Etal

Analysis of Trend Following Systems — Jose Cruset

Now…

I know you’re tempted to start trading these systems immediately.

But wait, not so fast.

Because you never know if the trading systems really work, or not.

That’s why you must do your own “homework” to validate these trading systems.

And that’s what I’ll cover next.

Read on…

How to verify if a trading system works, or not?

Well, the best thing to do is run a back test over (at least) 10 years of market data.

And during those 10 years, the market conditions should change (like uptrend, downtrend, and range.).

This way, if your trading system “survives” the back test, it is likely a trading system that works in the live markets.

But if it fails, then you’ve just saved yourself a ton of money and heartache.

So now the question is:

How do you back test your trading system?

Here’s what you need…

- Market data

- Back testing platform

- Code for your trading system

I’ll explain…

Market Data

When you do any back testing, you must have data to work with.

This data can be as simple as the open, high, low and close (of the Daily candles).

So, where do you get your market data?

Well, you can get it free from sources like Yahoo (but I won’t suggest it because it’s prone to errors).

So, my recommendation is to purchase a data feed.

The difference between paid and free is the paid version will be checked for irregularities and errors.

So when you run with accurate data, your back test results are more reliable.

If you want a recommendation, you can look at Norgate Data or CSI Data.

Next…

Back testing platform

The next thing you need is a back testing platform to back test your strategy.

Again, there are free and paid ones available.

But I don’t recommend the free ones because of limitations like…

- You can’t back test your strategy as a portfolio

- You are limited to a few markets

- Poor reporting metrics

The solution?

Get a proper back testing platform (and it’s usually paid).

If you want a recommendation, you can look at Amibroker or Right Edge.

Moving on…

Code for your trading system

Once you’ve defined your trading system, you need to put it into “computer language” so your back testing platform can run it.

Now if you’re familiar with coding, then you’ve got what it takes to back test a trading system successfully.

But some of you might be thinking:

“But Rayner, I don’t know how to code, HELP!”

“How do I backtest my system trading strategy now?!”

Well don’t worry.

Because I don’t know how to do either, hah.

So here’s what I suggest:

Find someone who can code and get them to do it for you.

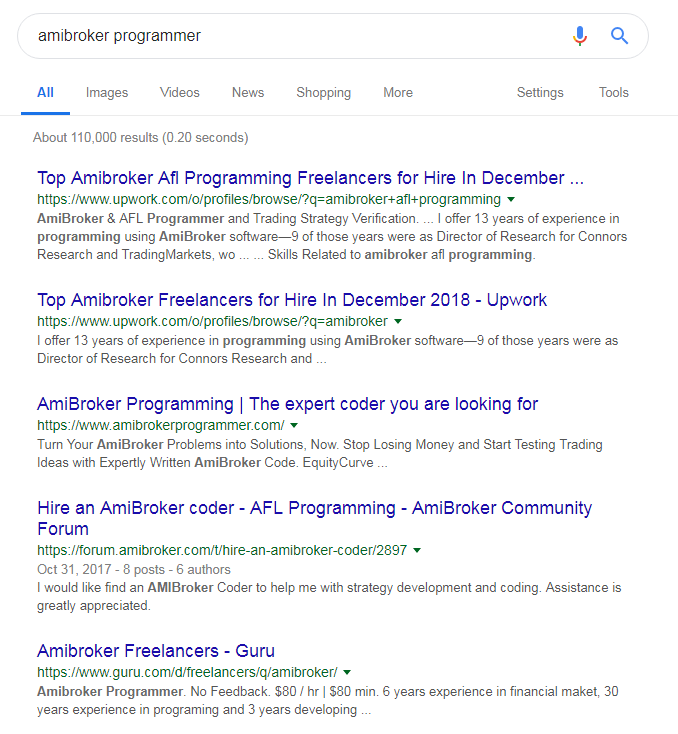

So, where can you find such programmers?

Just Google it.

Look what I found…

Not difficult, right?

Now at this point…

You have everything you need to get an edge in the markets.

You know where to find systematic strategies that work, market data, back testing platform, and programmers to code your trading system.

However, you might be thinking:

“I’m not confident if I can do it.”

“I don’t want to hire a programmer to back test my strategies.”

“I don’t want to spend thousands of dollars trying to figure this whole thing out.”

Well, here’s the good news…

Because over the next few days, I’ll open enrolment to The Ultimate Systems Trader.

This is my premium training program where you’ll get access to my treasure chest of systematic strategies that work.

Every strategy has been back tested for at least 10 years in different market conditions (uptrend, downtrend, and range) — so you can be confident it has an edge in the markets.

Sounds good?

Then keep a lookout for my next email because I’ll reveal the full details with you.

But for now, here’s what I’d like to know…

Do you think systems trading can give you an edge in the markets?

Leave a comment below and share your thoughts with me.

Ahh Good Stuff Thanks my friend!

You’re welcome!

Hey, I sent an email to you using the contact page on your website since the 26, and you’re still to reply. I also noticed The Ultimate Systems Trader is not part of your premium bundle offer, is it a separate bundle? You can reply thru me email, thanks.

I don’t see that email, could you send again?

yeah i think so, and you’re doing a great jon

Cheers

Wonderful, thank you so much Rayner

My pleasure!

HI Seleejane

I’m looking for someone whom I can learn with or a mentor, im in JHB, It would be nice to have your numbers.

Given the explanations on system trading, I think the “AHA” moment is very near

Awesome to hear that!

How do you feel about TradingView’s backtesting platform? Any reason why Amibroker and Right Edge are better?

Plenty of reasons.

Amibroker and Rightedge are built for backtesting whereas tradingview is for charting purpose.

You get a lot of stuff from these platforms that tradingview don’t offer like backtesting a portfolio of markets, important metrics, and etc.

System trading is mostly winning.

Cheers

The systems trading is the only way of making consistant profit.Everything else is hoping and gambling…..I will be waiting for your next post Rayner….true follower from Bulgaria

Cheers

Rayner, I’m not but I’ve heard good systems can make you a consistent profit. So perhaps you can teach me.

I’ll share more in the next post. cheers

yes i sure do from what i read and it will help me alot cause i am now start out n dont have all that time to sit at the computer because of work and when i do hv time the markets is close

Thanks for sharing, Troy.

Malufet

I had to google that word, cheers.

When you trade to a system, it helps psychologically. It hurts making a bad trade, but if the system makes a bad trade it’s the system’s fault, not yours.

That’s another way of looking at it…

Or simple the cost of doing business.

Rayner, does the system apply also to stock market traders?

Yes, I’ve got a trading system for stock traders.

cheers

is there a rayner trades copier?

I don’t have such a service.

As usual, I’ve been inspired by you sir. Thank you. I can’t really say for now if systems trading would be profitable for me now because I am a short term trader and from the little I know, the system seems long run, but I am sure it would be of help in the nearest future as I grow as a trader. Thanks once again!!!

You’re welcome!

Your teaching are simple and practical.I want to believe that a tested trading system will work.

Sure, I’ll share more details soon.

cheers

Believe it will workout great. Good job . Thanks.

Cheers

Hey, Rayner thanks for sharing these incredible stuffs! How much we have to pay for your premium ultimate systems trader?

I’ll share more details soon, check your email.

great stuff by u rayner, does this system trading work in any market or does it only for forex. n how much to pay pls …..

It depends on the trading systems, it won’t work for all markets and it’s best to trade the markets I suggest.

I’ll explain more in details in my next email.

Rayner, I want to believe so. I must say you have been doing a great job ditching what works over time.

So many strategies. I want something simple, mechanical and objective that has at least a 65% win rate for day trading. Does that exist Rayner?

I don’t know of any day trading system that has a 65% win rate. But that’s just me.

Thanks for the info Rayner

My pleasure!

Rayner, the systems trading is actually a good idea. It gives an advantage to trade with a refined strategy and reduce on mass losses

And instil great confidence too!

Having a system brings everything together makes entry and exit easier and most of all reduces FOMO

Hey Thanq Rayner your teaching on online trading is easy to follow.countme I

Hello sir rayner. What about fibonacci. Do you have any trading strategy using it?

Thanks. Pls I’m having difficulties finding this books, if you have softcopy of them, can you make them available. Through Rayner I’ve got to understand that online is the worst place to learn forex, lots of bullshit. so after Rayner and the books you prescribe, i don’t want to venture elsewhere. Thanks for everything.

Good day Rayner, thanks for the great Job u are doing. U have saved many from financial suicide which am a part of the many that got saved. Once again, thanks

You’re welcome, James!

Thank you for sharing

I find this info as a great value

Glad to hear that!

Try it and let me know how it works out for you.

Oh yes my friend, excellent.

How do l trade volatility

Thanks Rayner for the information about system trading but I still want to learn more

Thanks for your hard work. I think you are the only one who’s willing to share knowledge and experience without paying big bucks. Always very informative and helpful. Certainly will subscribe soon. Take care mate

My pleasure!

Do you have team for trading fund or investing ?

Yes I do think system trading can give me an edge on the market .

Quite informative Love your brain

yes to a certain extent