Thanks to quantitative easing, most stock markets around the world are in a bullish tone right now. But which markets are the strongest in terms of relative strength?

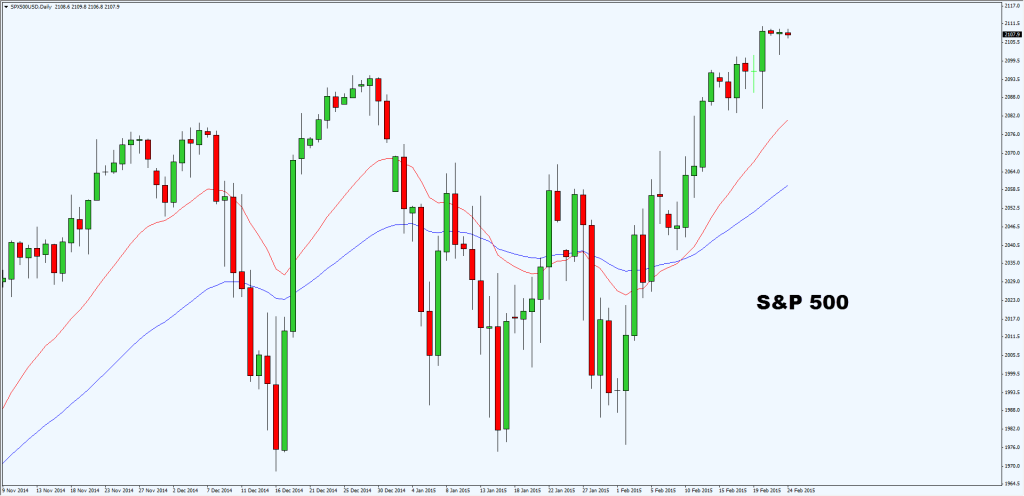

The S&P Chart:

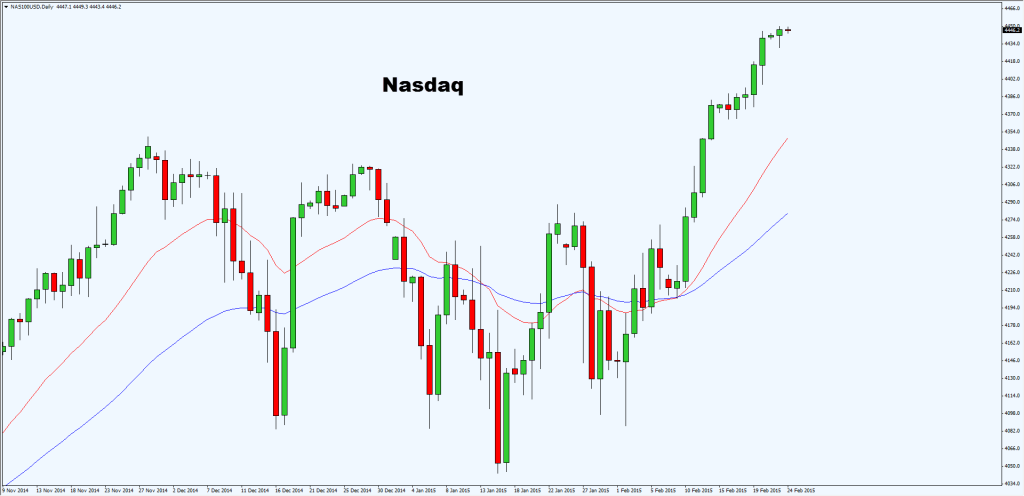

The Nasdaq Chart:

The Dax Chart:

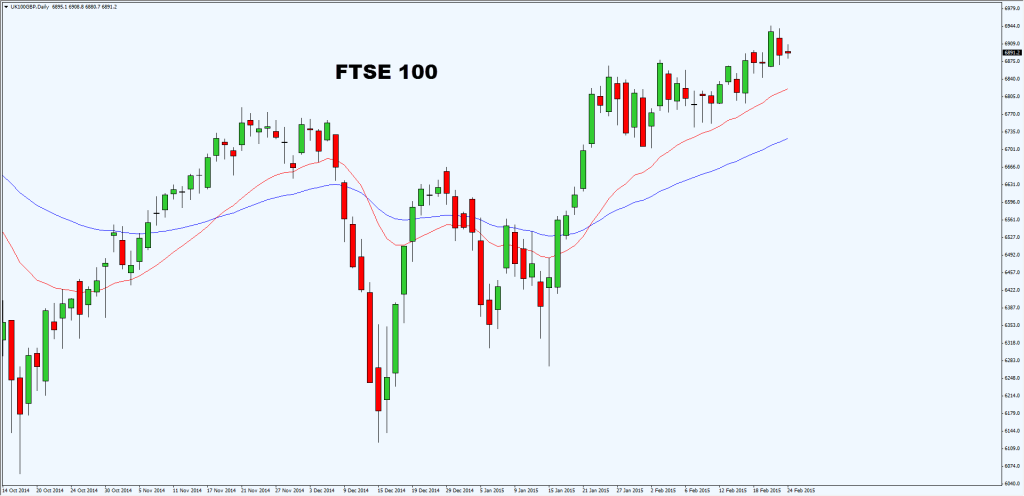

The FTSE Chart:

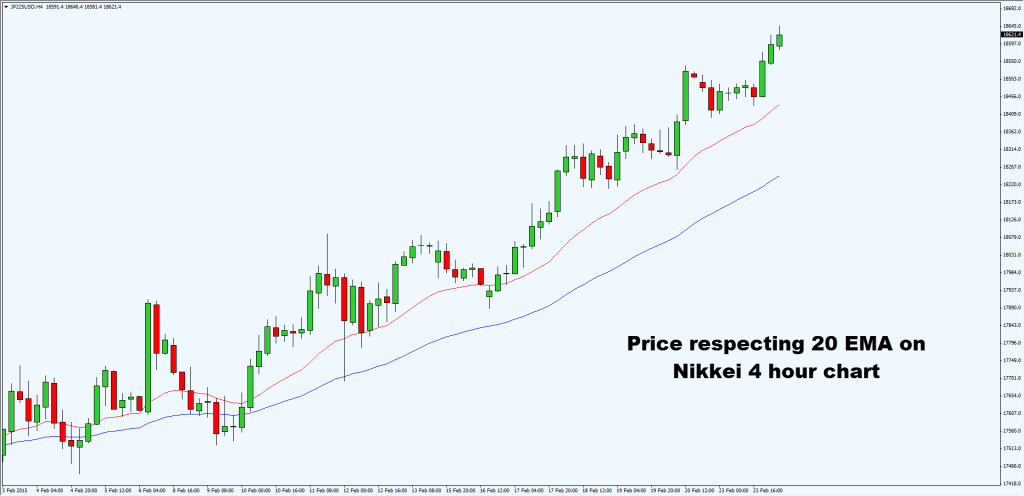

The NIKKei Chart:

Looking at the charts above Nasdaq, Dax and Nikkei are the most bullish. Thus if you are looking for stock indices to trade, these 3 would be favorable longs.

Trading setups

Here you see price respecting the 20 EMA on both Nikkei and Nasdaq. You can look to either trade the pullback towards the 20 EMA or breakout to the upside.

So, which stock markets are you looking to trade right now?

Hi Rayner:

My first question is: did you miss me?

I absolutely didn’t miss you. Why should I miss you 🙂

And my second question:

Why you decide to use 20 and 50 EMA?

Do they give you better results than other moving average?

Thank you!

FYI, I didn’t miss you at all, because I was so busy reading your posts in Babypips (exactly 20 pages!).

Hi Eugene,

Thank you for reaching out.

I use 20 & 50 because it suits my trading approach.

To be honest there’s nothing magical about it. You could use 25 and 55, and I’m sure it would work just fine.

It’s not the exact parameters of the moving average that determines a trading profitability, but the entire trading system that comes together.

Risk management, entries, exits, discipline etc.

Rayner