The German 10 Year Bond otherwise known as the ‘Bund’ is a market that is not spoken of much.

It traded at a low of 138.5 in Dec 2013 and today it’s doing around 158.6, more than 20,000 ticks in the futures market.

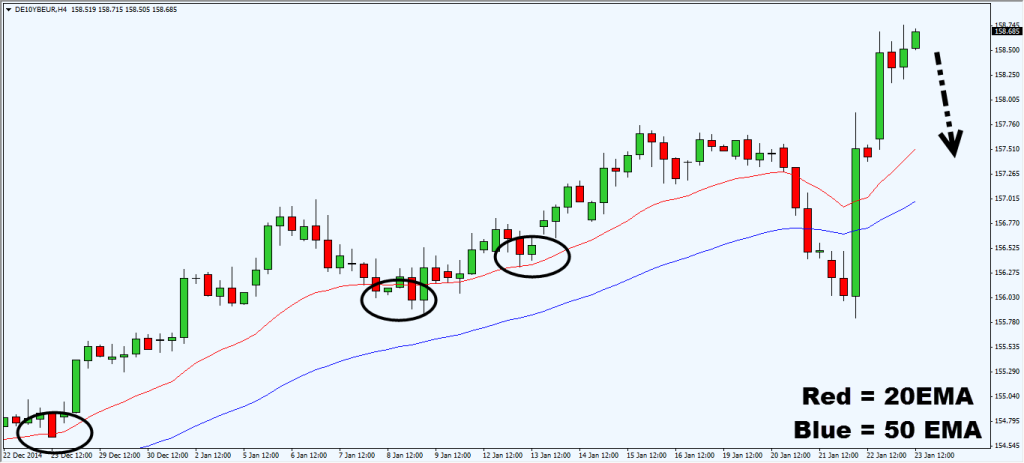

In terms of relative strength, the ‘Bund’ is one of the strongest in the bond market.

Thus I am looking to long this particular market in anticipation of further upside. (I’m already long and looking to scale in further)

Trade Plan

You might be thinking that price is too high and it is unsafe to go long at such high levels.

But remember what’s high can go higher. The only thing that is unsafe is not having stops in place!

Thus I will look to long if price retrace back towards the zone between the 20 & 50 EMA, with stops of 2ATR.

So, will you look to long the Bund?

looks interesting !

Hi Dandkn,

Yes would be interesting to watch how price reacts towards the 20 & 50 EMA zone.

Rayner

Hi Rayner, are you still in this trade? If not, what was the result of the initial trade?

Thanks.

Peter

Hi Peter,

Yes i’m still in it. I’ve attempted to scale in a few times here but resulted in hitting my stop loss.

The core position is still there though.

Rayner