Eurusd traded at a high of 1.4000 during May 2014 and today it’s doing around 1.1800.

In terms of relative strength, Eurusd is one of the weakest now.

Thus I would look to favor shorts on Eurusd compared to other currencies like Audnzd, Nzdusd or Usdcad.

Trade Plan

You should not be thinking in terms of price being oversold or it is going to reverse.

Instead you should be asking yourself where you will look to short and get on board the trend.

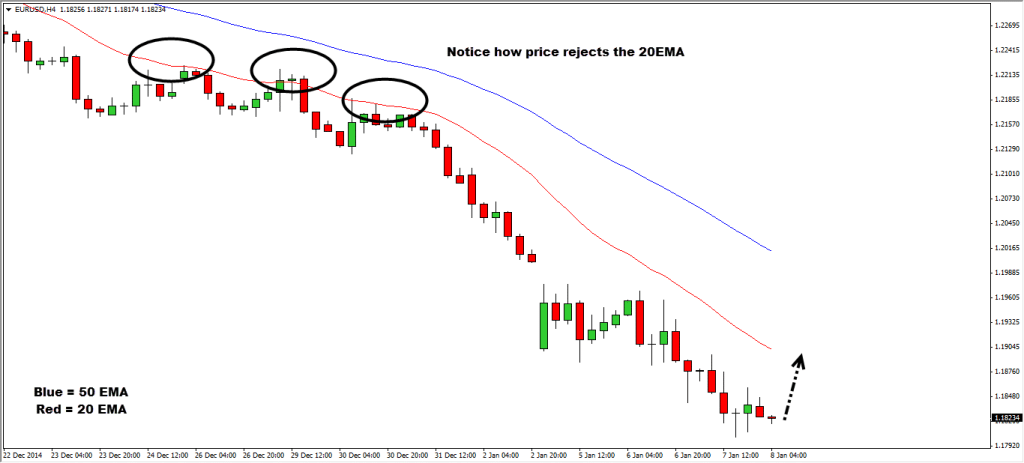

For me, I will look to short if price retraces back towards the 20EMA with stops of 2ATR.

And assuming I do get stopped out, it doesn’t mean the trend is over. Rather I will continue to look for shorts at a better price.

So, where will you look to short Eurusd?

Same line of thought

Hey Derrick!

Yup, preparing to re-short if i do get stopped out.

Just a what if scenario.

Rayner

Hi,

thks for the tips.

Which trading platform u used to trade oil ?

Hi Stephanie,

I hope you don’t take it as trade recommendation as that’s not the purpose of it.

Oanda offers commodities so you may want to check it out.

Rayner

Thks.

Will find out more from them.

What do u look out for end of trend ?

I came, I read this article, I couneerqd.

Thanks for stopping by Wanita 🙂

If an uptrend,

I will watch if price formed a lower high and low.

Also a break of trendline and moving average crossover.

No hard and fast rules, but just some guidelines.

Rayner