Ever opened a news site or scrolled through social media, only to find the markets “crashing,” “surging,” or “on the brink of collapse”?

Every day, traders are hit with a tidal wave of headlines, expert opinions, breaking alerts, and hot takes. It can all feel urgent, emotional, and important.

If you’re not careful, it can completely hijack your decision-making and, in turn, your trading results.

The truth is, financial media isn’t there to make you a better trader.

It’s designed to keep your attention.

And while that doesn’t mean you should ignore the news altogether, you need to understand how it works and what effects it can have on you.

Interestingly, most traders think they’re reacting to information when they hear or see news.

But in reality, they’re simply reacting to how that information is framed.

Fear-based headlines. Overconfident predictions. Expert noise.

It all chips away at your ability to stick to your plan.

I’m going to show you how media in trading mislead traders, and how to overcome it.

Specifically, in this article, you’ll learn:

● How financial media works, and why it’s built to amplify emotion, not accuracy

● The subtle ways traders get misled by headlines, narratives, and experts

● The psychology behind news, why your brain is drawn to noise and stories, even when they hurt your edge

● Real examples of media-driven panic… and how the smart money usually moves the other way

● Most importantly, how to build a system that filters the noise and keeps you in control

Let’s get into it.

The Role of Media in Trading

Headlines are built for emotion, not accuracy.

Most financial media isn’t there to educate you.

It’s there to grab your attention by using headlines that trigger emotion: fear, greed, and urgency.

Words like “crashes,” “skyrockets,” or “meltdown” aren’t just dramatic, they’re deliberate. They’re chosen to make you feel something, rather than help you make better trading decisions.

The result? Traders start reacting emotionally. Chasing green candles. Panic-selling into red ones.

You might think you’re responding to new, valuable information… but really, you’re reacting to how that information was framed.

It’s a key difference.

So next time you see a headline that gets your heart rate up, take a moment and ask yourself:

Is this informing me? Or just trying to provoke a click?

The media is reactive, not predictive.

You’ve probably heard the phrase: trade the news.

But here’s the problem: by the time the news hits your screen, the market has already priced it in.

Big players, like institutions, hedge funds, and algorithms? They’re way ahead of you. They don’t wait for headlines, and by the time retail traders react, the move is often over.

The media doesn’t tell you what’s about to happen, but what has already happened. By wrapping the information in a confident story that sounds like it’s predictive.

That’s why trying to trade based on news articles is like trying to drive using your rearview mirror.

It might show you where you’ve been… but it won’t help you see what’s coming.

The illusion of certainty

One of the biggest dangers in media is how confidently it presents guesses as facts.

“The market dropped because of X.” “Experts say Y is next.”

It sounds certain. But it’s not reality.

The truth? Nobody knows what’s going to happen next. Not the talking heads, not the analysts, not the influencers.

Markets are messy. They move because of thousands of different inputs, sentiment, macro data, big players shifting positions, technical levels… the list goes on.

So when someone confidently tells you “why” something happened, always take it with a grain of salt. It’s more than likely a story they’ve fitted, or at most a best guess. It’s not gospel.

As a trader, you need to be okay with uncertainty. This game isn’t about predicting, but about managing risk and making decisions based on probabilities, not headlines.

If you start anchoring your decisions to what someone on the internet said “caused” a move, you’ll quickly find yourself reacting emotionally, and your edge will vanish.

Media in Trading: How Traders Fall Into Traps

Chasing Headlines Without Context

This is one of the most common mistakes: traders reacting instantly to a dramatic headline without stopping to think.

You see something like “Markets Crash on Recession Fears,” and the instinct kicks in:

Sell now! Get out!

But here’s the catch: the market might’ve already reacted.

That news might be baked into the price already. And what looked like a crash might just be a pullback inside a bigger trend.

This is how people end up panic-selling at the bottom or FOMO-buying at the top.

The smarter move?

Pause. Zoom out. Ask yourself:

- Has the market structure actually changed?

- Has the level you trade from broken or held?

- Is this headline confirming what you already saw, or trying to scare you into action?

Remember, price is always the truth

Let the chart guide your thinking.

Overvaluing Expert Opinions

Let’s be honest, it’s tempting to trust someone who sounds confident.

Whether it’s a big-name analyst, a finance influencer, or a YouTube guru with a million views, it’s easy to assume they know something you don’t.

But even professionals get it wrong.

A lot!

And more importantly, their outlook may not match your system, your timeframe, or your risk tolerance. They might be trading 5-minute breakouts while you’re holding swing trades for weeks.

So if you start placing trades based on their conviction rather than your own process, you lose more than just your edge; you lose your ability to grow.

That’s not trading – that’s outsourcing your decisions.

And it almost always ends badly.

Confusing Narrative With Causation

This is a subtle one, but it messes with traders all the time.

Financial media is brilliant at creating stories after price moves.

“The dollar dropped because of X.”

“Markets surged thanks to Y.”

Sounds neat. Feels logical. But it’s often just guesswork wrapped in confidence.

The truth is that price can fluctuate for a hundred different reasons. Trying to tie it to a single, clear cause often leads to misleading conclusions.

And when you start believing every move must have a story behind it, you end up trading narratives, not setups.

You hesitate when the story doesn’t match your bias, doubting your plan because someone on TV sounds convincing…

Or you get stuck in analysis paralysis, second-guessing every trade instead of just executing based on structure and logic…

That’s how you lose momentum and start drifting from your edge.

So now that you’ve seen how many traps are out there, let’s break down why human brains are wired to fall for them in the first place.

The Psychology Behind Media in Trading

Your Brain Loves Stories, Even When They Mislead You

Humans are hardwired to make sense of the world through stories.

Everybody wants clean explanations… to know why something happened.

So when the market moves and the media jumps in with “The Fed said X, so the market did Y,” it feels satisfying. It gives you closure… even if it’s completely made up!

The real danger? These explanations sound logical, so they feel true. They give you false emotional certainty.

And that feeling can override your logic. Instead of asking “Does this align with my edge?” You start thinking, “What if they’re right?”

Worse still, when enough people believe the same story, it can temporarily drive price… even if the story is nonsense. So you have to be careful, not just of what the media says, but of how your brain processes it.

“Breaking News” Triggers Dopamine, Not Discipline

Breaking news feels exciting, doesn’t it? It gives you that same hit of energy as a social media like or a slot machine win.

That surge is dopamine. It’s your brain’s chemical reward for stimulation and novelty.

The problem?

Dopamine isn’t designed for thoughtful decision-making. It’s designed for chasing quick rewards.

And good trading isn’t about chasing. It’s about control, routine, patience, and following your process.

So if you’re jumping into trades on a news high, whether it’s excitement, panic, or urgency, you’re not trading from discipline. You’re gambling on emotion.

That’s why structure and routines matter. You need a system that holds up even when the news is loud and your emotions are louder.

Confirmation Bias: The Trap You Don’t See Coming

Once you form a bias, bullish or bearish, your brain starts filtering out everything that doesn’t support it. It does all this subconsciously; you won’t even know you are doing it.

It’s called confirmation bias.

If you’re long, you’ll zero in on bullish headlines. If you’re short, you’ll dismiss anything that challenges your view.

The media makes this even easier, as for every opinion, there’s an “expert” backing it. It doesn’t matter what your bias is, you’ll find someone to validate it.

That’s where it gets dangerous. Even though it may feel like you’re doing research, you’re really just reinforcing your belief.

This doesn’t just cloud your thinking… It blinds you to risk.

Recognizing the bias is an important first step to defeating it. However, a robust trading system should be able to catch it before things get out of hand.

Rules. Logs. Journals. They’re your guardrails.

Let’s bring this all together with some real-world examples of media-driven chaos and how it plays out on the charts.

Real Examples of Influence in Media in Trading

When Headlines Scream, Smart Money Whispers

Let’s rewind to March 2020 — the height of the COVID crash.

The headlines were apocalyptic:

“Markets in freefall.”

“Global recession imminent.”

“Get out while you still can.”

And honestly, who could blame anyone for panicking? It was an unprecedented global crisis, and the media made it feel like the end of financial markets.

Retail traders rushed to sell. Not because they were irrational, but because everything around them screamed: “Escape now!”

But while the public panicked, institutions were quietly buying. They weren’t reacting to the headlines. They were planning beyond them.

And just months later, markets not only recovered, they printed new all-time highs.

This isn’t a one-off.

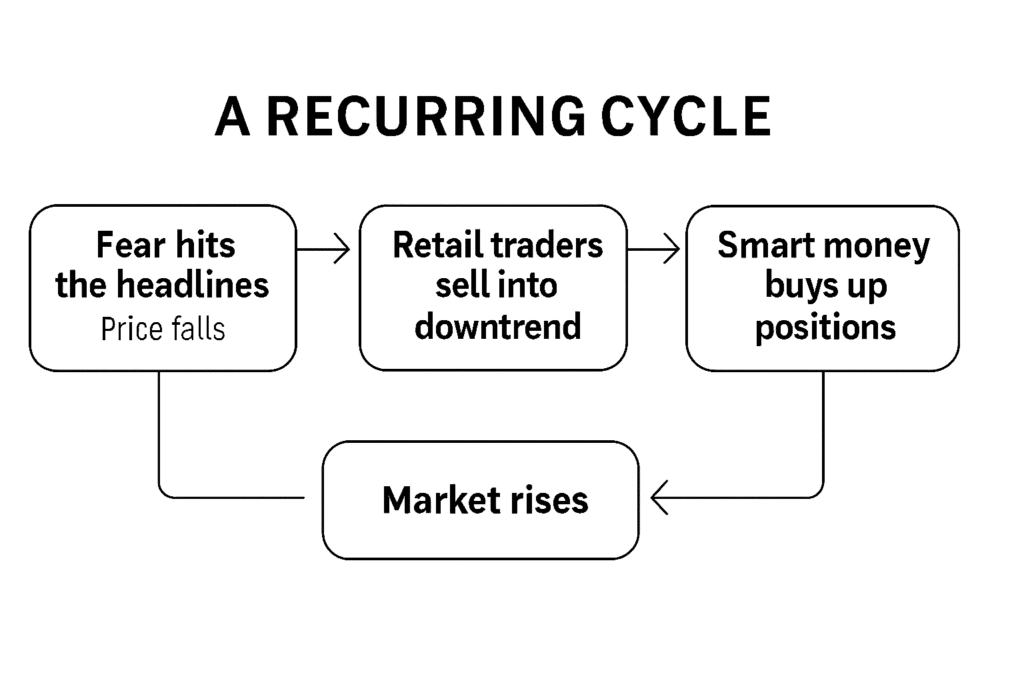

It’s a recurring cycle:

The takeaway? If you’re reacting to the news, you’re probably too late. Anyone listening to the crowd is likely on the wrong side of the trade.

The Fed Frenzy Trap

Every time the Federal Reserve makes a statement, the news explodes.

“Rate hikes could crush the market! Pivot incoming!”

Suddenly, traders scramble to reposition.

But here’s what’s really happening: In most cases, the market already knew.

Institutions already have access to economic forecasts and consensus expectations, and crucially, they act on that before the announcement ever goes public.

Unless the Fed’s decision wildly deviates from the expected outcome, most price movement is either already priced in or a quick knee-jerk reaction that fades fast.

The smart play isn’t to react to the headline. It’s to watch how the price behaves after the news.

Did the structure break? Is the trend intact?

That tells you more than any headline about what the Fed did or didn’t say.

War headlines and false panic

Geopolitical tension always sets the media on fire, with invasions, conflict, and nuclear threats. And when it hits, traders often feel pressure to do something.

But the data often tells a more measured story.

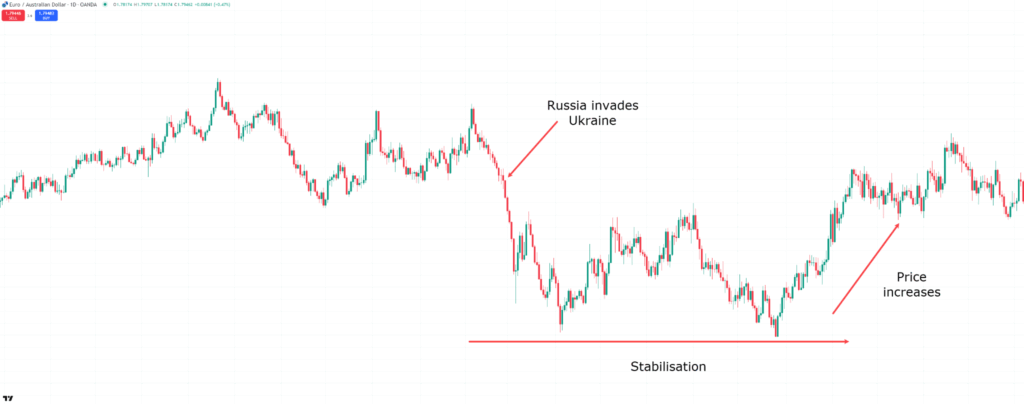

Let’s take the Russia-Ukraine conflict in early 2022, when headlines were intense…

Daily EUR/AUD Chart – Russia/Ukraine War:

The EUR/AUD sold off fast… only to recover just weeks later.

Why?

Because by the time the event was front-page news, the market had already adjusted.

Traders who reacted to fear missed the rebound. But those who waited, watched the price, and followed the structure? They stayed grounded, and many caught the recovery.

This doesn’t mean geopolitical risk should be ignored. It just means reacting emotionally is rarely the edge.

Use the news as context, but trade your system, not your feelings.

Media in Trading: How to Protect Yourself as a Trader

Use News as Background, Not a Signal

So how do you stay sharp without getting sucked into the noise?

Start by reframing the role of news. It’s not a signal, it’s background context. The media’s job is to grab attention, not help you make good trades. That’s your job!

Is there a big rate decision or economic release coming up? Perfect, mark it on your calendar. Be aware of it.

But don’t place a trade just because someone said “it’s going to move.” Instead, ask: Is the chart showing me something real?

Things like:

- Is a level breaking?

- Is a trend shifting?

- Is a setup forming within my plan?

Let price action confirm the story, never the other way around.

Build Your Process Around Structure, Not Emotion

This is where most traders go wrong. They react to what they feel, fear, excitement, and urgency, instead of what they see.

The solution? Build structure.

You need a system that’s built on process, and that you can follow on good days and bad.

A checklist that doesn’t care what the news says.

But it’s exactly where journaling becomes invaluable.

Ask yourself after every trade: Was this decision driven by my plan or my emotions?

Over time, this kind of self-review builds confidence, and that confidence is worth more than any “expert take” on TV.

Zoom Out and Stay Grounded

Here’s a trick smart traders use: when the headlines zoom in, you zoom out.

News outlets love drama: “Bitcoin plunges 5%!”

But is it a plunge… or just a pullback on a weekly uptrend?

The only way to know is to step back and look at the bigger picture. Is the price holding structure? Was that 5% pullback just the new higher low? Is it just ranging inside a larger move?

This is how you stay grounded.

Not by trying to predict what will happen next, but by understanding what’s happening now.

When you build that habit, the media stops being a source of stress… and becomes just another layer of context in your trading toolbox.

Conclusion

If there’s one thing this article should leave you with, it’s this:

Financial media isn’t designed to help you trade better; it’s designed to keep you watching, clicking, and reacting.

While the news can be useful context, it becomes dangerous the moment you let it override your process.

Headlines amplify fear. Experts speak with confidence they haven’t earned. And your brain, hardwired to chase certainty and quick answers, is more than willing to believe it all, especially in the heat of the moment.

That’s how some traders get shaken out… and why disciplined ones manage to stay in.

In this article, you’ve seen how media is reactive, not predictive, often reporting what’s already happened.

You’ve learned how stories trigger emotion, how dopamine overrides logic, and how even solid traders can fall into traps like confirmation bias or herd mentality.

But most importantly, you now know how to protect yourself from all of it.

At the end of the day, your edge doesn’t come from reacting faster, but from thinking clearly.

Price tells the truth. Your system keeps you grounded. And your job isn’t to predict the next headline… It’s to stay calm when everyone else is panicking.

That’s how pros trade!

So, now I want to know how you trade the news.

Have you fallen into the trap of being overwhelmed by the headlines?

Or have you also noticed how price reacts initially to news events, only to stabilize later?

Let me know in the comments below!

This is one of the most important piece of advice I have found on trading fundamentals. It’s redeeming from many costly trading decisions

Great to know you find it as an important piece, Linus!

Don’t fall into a trap of being overwelmed by the headlines!

Wishing you all the best.

A good reminder. The media is ALL clickbait, on every subject they cover. It’s all uber hyped sensationalism. Very little truth.

Best to read actual old fashioned books, from many sources. Then ponder, reflect, and make up your OWN mind.

Thanks, mate.

Exactly, Ed!

Read widely, think deeply, trust yourself.

Wishing you all the best!

Great insight as usual Teo, it helps, thanks

Nice to know you liked it, Jj!

Cheers!