While the major currency pairs are not making any impulse move in the market, there could be a chance that exotic pairs are the ones moving.

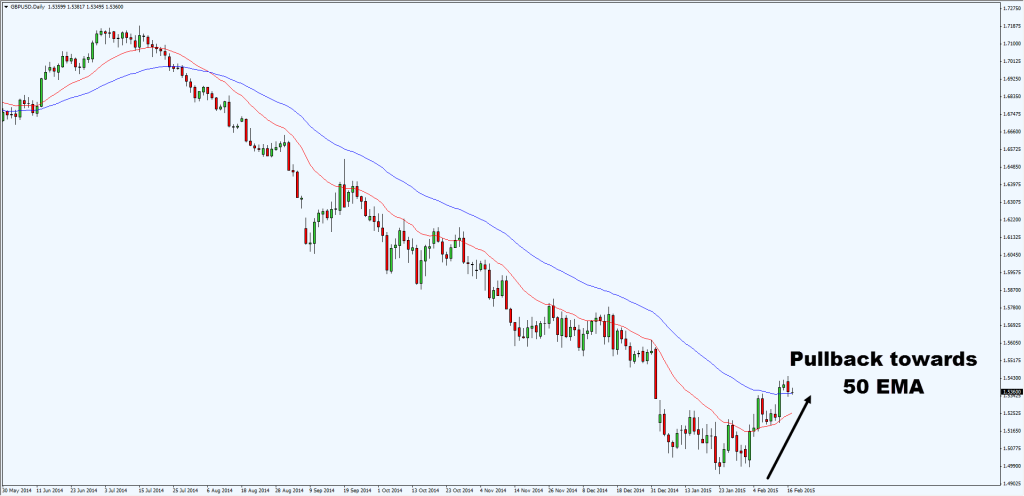

Looking at Gbpusd daily, it has pullback towards the 50 EMA which is something we have not seen over the last 7 months.

Gbpusd Daily Chart:

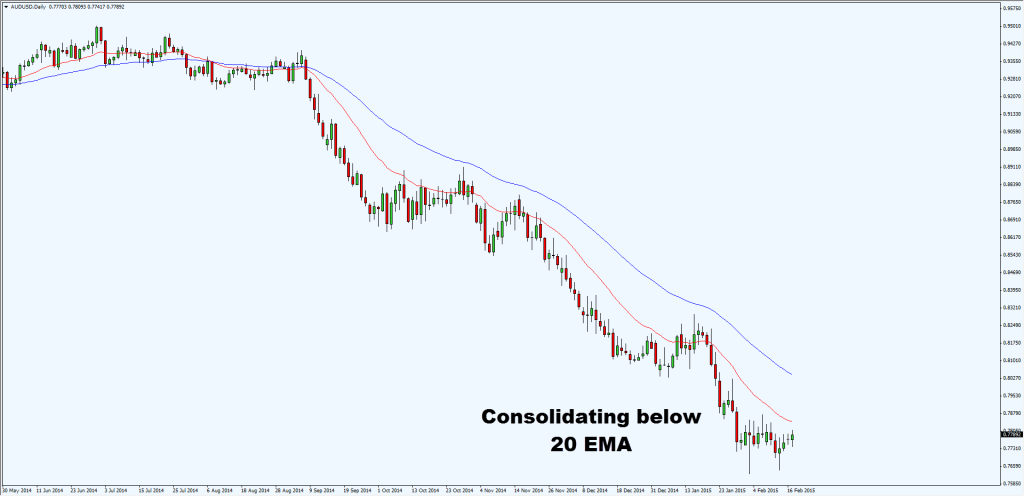

Audusd daily is still relatively weak as price is still hovering below the 20 EMA

Audusd Daily Chart:

Since Gbpusd is gaining traction and Audusd is weak, you can expect a trend in Gbpaud, right?

Here we see that Gbpaud weekly has broke out of it’s key resistance 3 weeks ago.

On 4 hour we see price has been respecting the area between 20 & 50 EMA, and approaching previous resistance turned support. It will be interesting to watch how this plays out in the coming weeks, whether the support will hold or fold.

So, which trending markets are you looking at now?

Hey Rayner! I too am observing gbpaud and as of now it is not respecting 20 and 50 EMA on H4 time frame. in fact, price has breached 50 EMA so would love to get your opinion on how u would handle such a scenario.

When this happens, would it be reasonable to switch focus to a higher time frame for entry opportunities? Since H4 entry guidelines have been violated, but looking at D1 time frame, price is still far from 20 EMA. Would u totally stay away from trading this pair until further observation or look for entries on D1?

My reason for asking is that the violation of EMA guidelines on H4 could mean the start of a small retrace but the trend on D1 is still in play. It would be safer to avoid entries on H4 for the time being and focus on the higher time frame, D1.

Hope i am making sense here. Sorry for the long query!

Hi P,

There’s really no right or wrong down here. Because price could simply trade below the 50ema before bouncing higher. Or likewise it could retrace further against the current trend.

The only thing to do is have a trading plan and trade it. If you’re long, then stay long till your exit mechanism is triggered.

If you’re on the sideline, then ask yourself whether you want to trade it or stay out completely? If you want to trade it, how will you enter and exit?

Rayner

wow thanks so much for the swift reply! Cheers!

You’re most welcome buddy, cheers!

Rayner