In today’s video…

I want to share with you my own trading Journey.

How I got started, why I got started, my darkest moments in trading, the lessons that I’ve learned, and how I turned things around.

Ready to hear the journey?

Then watch the video below:

Video Transcript

You are watching this video because you are about to quit trading or you’re thinking about it.

I can understand why.

You’ve probably spent a ton of time effort and money on trading, analyzing the charts, buying courses, and starting YouTube videos, and still, there’s nothing to show for it.

Maybe accept a bleeding red account.

This is why in today’s video; I want to share with you my own trading Journey.

How I got started, why I got started, my darkest moments in trading, the lessons that I’ve learned, and how I turned things around.

Hopefully, what I’m sharing in this video inspires you and gives you ideas on how you can implement on your path to becoming a profitable trader.

Let’s go!

When I was 20 years old, I read this book called Buffettology…

The book explains how the world’s best investor Warren Buffett selects companies to invest in.

I was fascinated by how a man could accumulate so much wealth just by picking the right stocks

I mean who wouldn’t right?

After reading the book, I became a value investor. I remember the first stock that I bought was called Sembcorp

It was in 2009.

The market is recovering after the financial crisis and I thought

“This stock the fundamentals were good”

I bought Sembcorp Marine at $3.28 and I told myself

“I’m going to hold this stock forever just like Warren Buffett”

5 days later….

I sold the stock because the market went against me.

Not about to give up just yet because the market was entering a bull market, I knew that I had to get back into this scheme.

I did more research and bought even more companies with margins.

This time I bought stocks like you know Noble Group, Sembcorp, and Keppel Land and I invested about $20,000 of my capital and after two months, I was up almost $10,000!

Can you imagine the joy that I had?

This is how it’s done right?

I was feeling really good about myself.

My broker commented on it.

“Whatever stocks that you buy move up higher”

I felt confident and good about myself after I was like $10,000 up in a couple of months.

Then, two weeks later…

My unrealized profits of $10,000 went up in smoke and became vaporized.

Why is that?

It’s because the Euro debt crisis hit the markets.

There’s a lot of panic in the markets all the stocks that I’ve bought all reversed against me.

All my open profits were gone and it started to dig into my initial Capital.

I felt bad.

I had to sell all of my positions because the pain was too much to bear in mind.

I started reflecting and asking myself, what did I do wrong?

I realized that I didn’t have a plan for exits.

Plan For Exit

I started Googling on how to better exit your stocks:

When you Google such a thing long enough that’s when you realize there’s something called “Trading”

That’s how I came to know about trading.

After my failure as an investor, I thought that

“Maybe, trading would suit me”

This is where I started to learn about risk management strategies and financial markets.

I thought…

“Why would I want to invest in a stock for years when I can make money as a trader within minutes”

That made a lot of sense to me.

At this point, I thought that trading wasn’t that difficult.

All I need is a trading strategy that works which I could find online for free.

My Initial Trading Strategies

Bollinger Band Strategies

The first trading strategy that I came across was taught by a trading guru.

He taught me the “Bollinger band strategy”

Here is what I mean:

He said something along the lines of

‘Hey Rayner! it’s very simple, just wait for the price to come towards the lower Bollinger band and you buy. When it goes up higher, you sell at this upper Bollinger bond, rinse repeat boom and you’re done”

I thought that was it.

It’s as simple as it is.

But when I tried trading this trading strategy for several weeks, I realized that my losses seemed larger than my winners.

That’s where I concluded this isn’t working out let me move on to something else.

I need something more complicated.

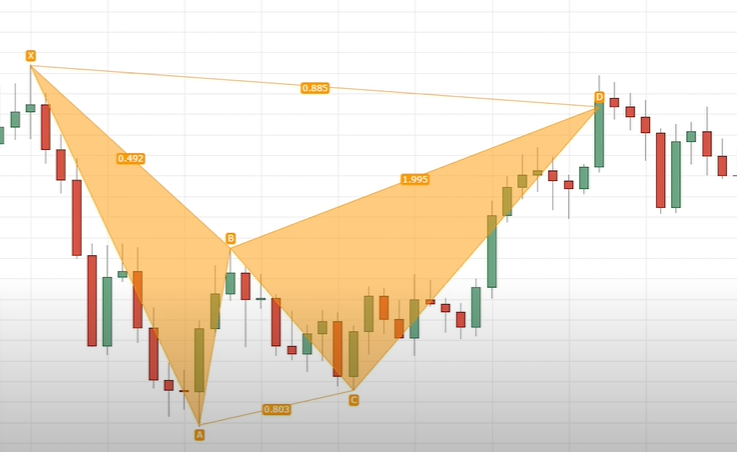

I moved on to another trading methodology, the harmonic pattern.

The Harmonic Pattern

I spent a good six months learning how to draw harmonic patterns that look something like this:

You would use a cluster of Fibonacci ratios and extensions to identify where the market might reverse, they have names like the bat and crab pattern, etc.

I tried this trading methodology and after several weeks, I was still in the red and I concluded that this doesn’t seem to be working out as well.

The Cold Hard Truth

After several years, the reality is that I was still a losing trader despite learning so many different strategies/techniques about trading.

No denying it.

You know from indicators to patterns just name it I would probably have tried it.

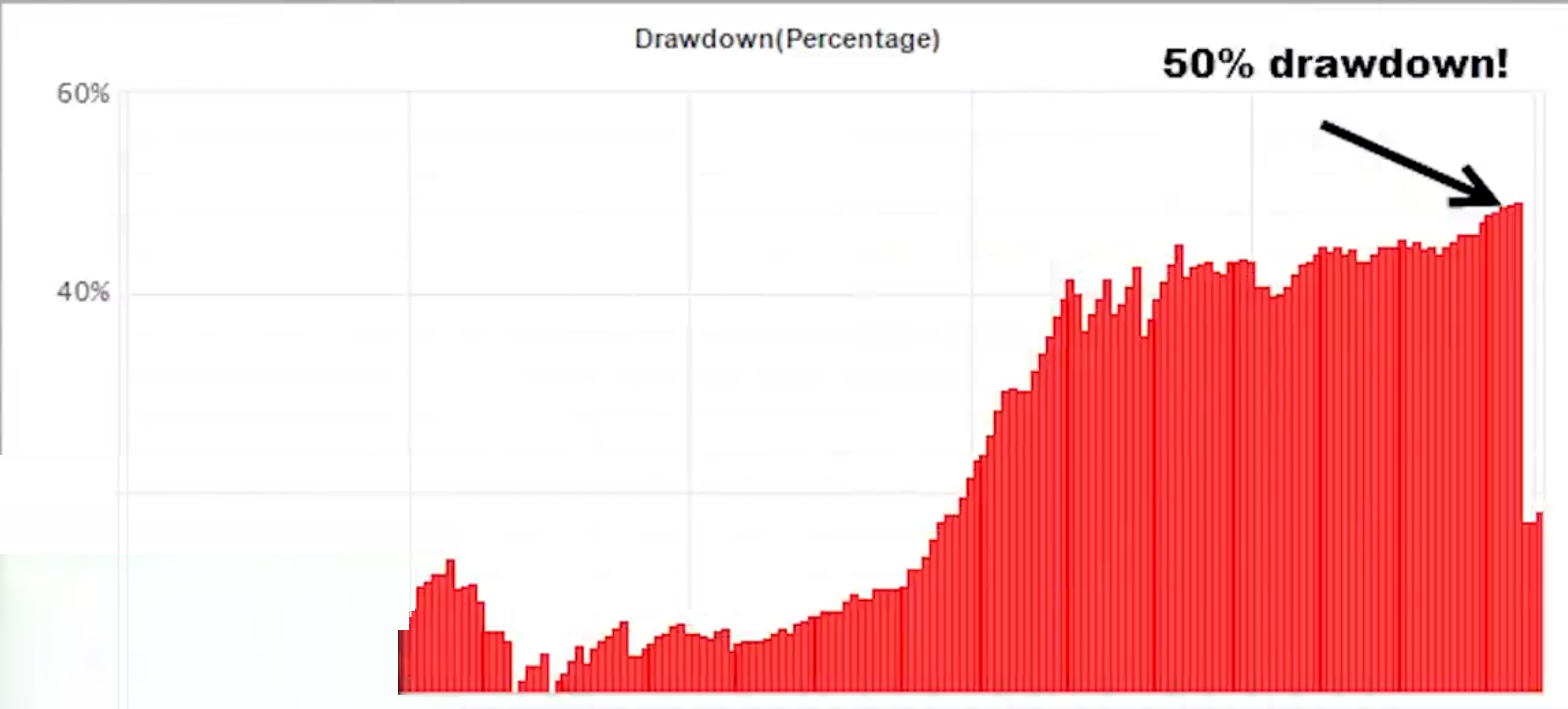

During this period, I incurred a drawdown of 50% off my trading account. This is what I mean:

You can imagine someone who spent years, 8-10 hours a day learning about trading and after a few years, the only thing that he can show is that he has lost 50% of his money.

This is actually how your trading would look like when you don’t have an edge in the market:

This is the cycle I was trapped in, this had to be one of my darkest days in trading.

The results stood right in my face

I followed my trading plan religiously; I had proper risk management but still, it wasn’t enough.

I asked myself countless times

“What must I do to become a profitable trader?”

I followed all the textbooks and I even doubted myself If I would make it as a trader.

The funny thing is that I graduated with first-class honors by the way. This shows that I’m someone who can study.

But even the first-class honors degree wasn’t enough to make me a profitable Trader.

I guess the saying is true.

“You know you can be a smart guy with a high IQ, but it doesn’t mean that you will succeed as a Trader”

I can vouch for that.

I think most traders would you know throw in the towel and give up.

I mean who would spend hours, a lot of time, money, and effort only to lose even more money than he started?

The stubborn me just refused to give up, always believing that I was always one step closer.

Now during this period, there is one quote that kept playing in my head that helped me to keep moving forward.

“There is no such thing as failure, only feedback.”

If you think about this failure would only occur if I give up. If I don’t give up, then whatever I’ve encountered so far, they are just simply feedback

Feedback that tells me what works and what doesn’t work.

After years of trying out different trading strategies, techniques, patterns, and whatnot, I have a good idea of what works and what doesn’t.

What I Learned About Myself

At the same time, I also started to learn more about myself as a trader.

What are the things that I gravitate towards, I realized a few things about myself

- I wanted to be in the markets when It is trending strongly

- I wanted to be systematic with less room for discretion

- I can accept being wrong most of the time

- I am patient and disciplined

Just when I did this reflection, this is where I got this trading methodology called the “Trend Following”

Trend Following

Initially, my impression of trend following was just

“Oh, just trade with the trend”

But as I dug deeper, I realized that Trend following is much more than that.

If you want to be a trend follower, I’m going to share with you five principles that you must embrace.

If you can do that right, there’s a good chance you will be a successful Trend follower.

5 Principles That You Must Embrace

Follow The Price

This means if the market is trending up higher, look for buying opportunities.

Don’t try to be a counter-trend trader likewise if the market is trending in a downtrend, look for selling opportunities.

Risk Management

You will be wrong many times, but you want to make sure that when you are wrong and when the market moves against you, your losses are contained in not more than 1% of your account.

Trade Many Markets

You want to trade many markets.

Let me ask you…

If you want to get your wife pregnant, are you going to shoot once a month or 30x a month?

You want to shoot as much as possible to get your wife pregnant.

It’s the same thing for trend followers. If you want to capture trends in the market, do you want to be trading one market or markets?

You’re going to be trading more markets because you increase your odds of capturing your trend.

Trailing Stop Loss

You want to have a trailing stop loss.

This means that you don’t want to have a predefined target ahead of time because you have no idea how high or low the trend can go.

This is why you would just want to trail your stop loss and ride the move till it ends.

Ignore the News

As a trend follower, you want to ignore the Newsroom because everything that you know is embedded in the price.

This means the news could be bearish but if there’s a signal to go long as a trend follower, you would go along.

Those are the five principles of trend following.

Using those principles in mind, I developed a trend-following strategy for myself.

Guess what?

Within six months I made everything back and more!

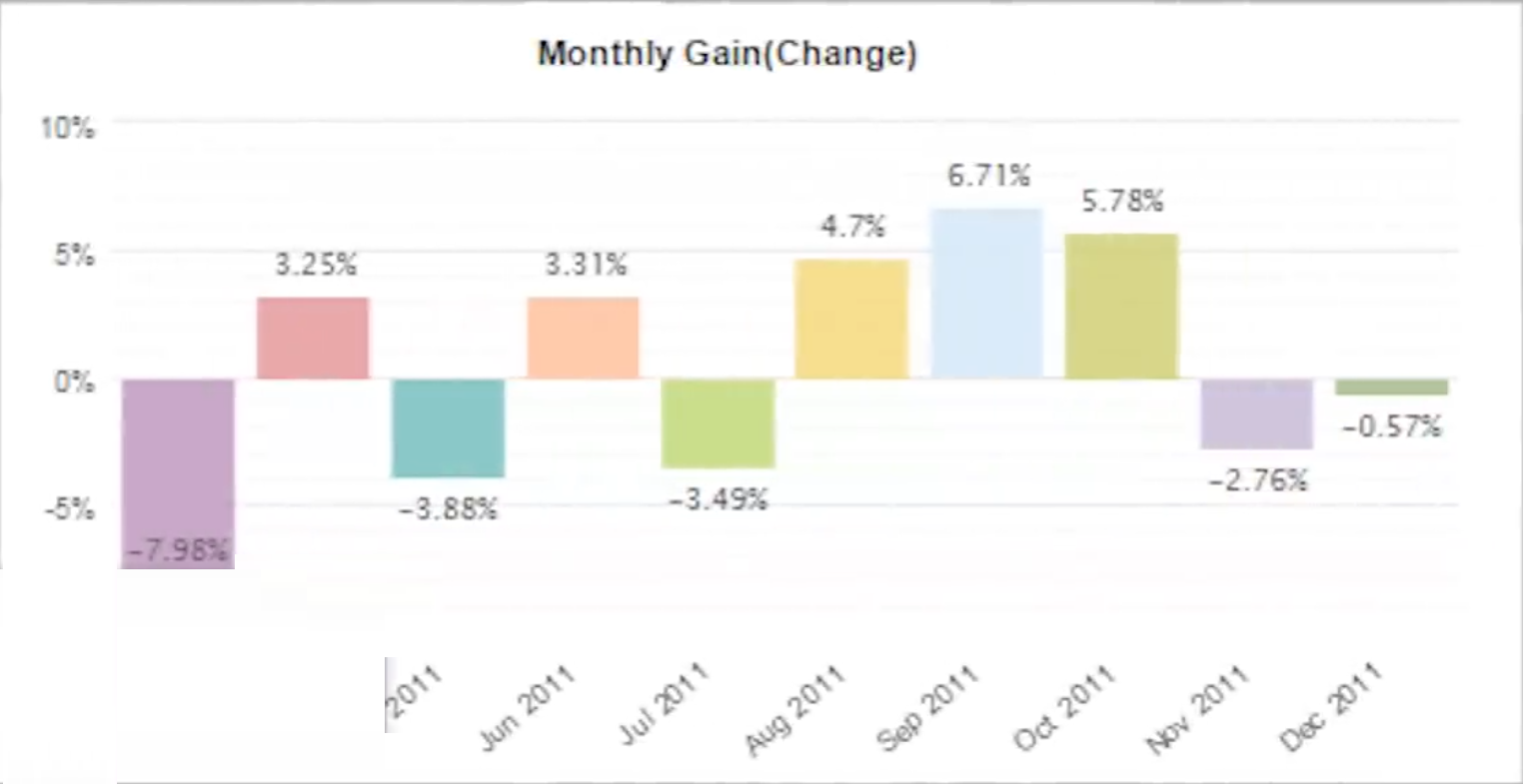

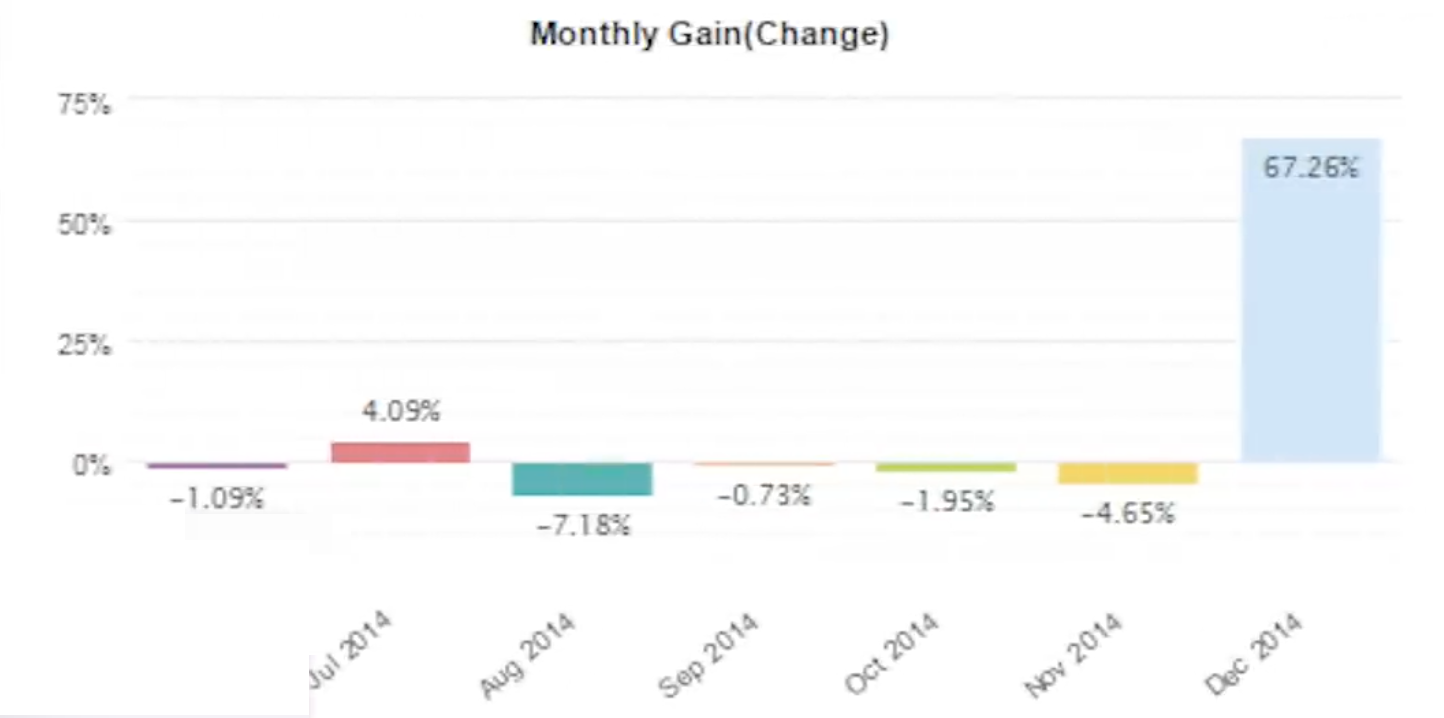

It felt good to see that my account which was in red for years finally back in the green, here is what I mean…

I was like…

“Yes! You are in money, baby! Finally!”

It’s like your dreams just coming to fruition after many years of trial-and-error effort.

Finally, you have something tangible that reflects that effort now it wasn’t life-changing money, but it was a game-changer for me.

Because it gave me the confidence that I can do it. With that confidence, I then scaled up my trading business over time.

Today, I trade multiple trading strategies across multiple markets, here is what I mean:

If you ask me, trend following holds a special place in my heart.

I still trade a variation of this trading strategy today and this is a trading methodology that brought me out of the red and into the green.

So….

If you are struggling to become a profitable trader, perhaps you’re still losing your month of the month, year after year, I want to tell you that it can be done.

Yes…

The journey is tough the obstacles are huge, and the heat is on, but the reward is worth it, and I believe you can do it.

So, go for it!

Conclusion

The bottom line is this:

Making money in trading is possible.

You can grow serious wealth.

At the same time…

You can lose them all at the same time.

But by having a system that works not only in markets but a system that suits your personality, and the confidence to execute it through ups and downs…

It’s only a matter of time before you become a profitable trader.

So, how about you?

What’s your journey?

It doesn’t matter whether you’ve “made” it your your struggling.

Let me know your story in the comment section below!

Hi Rayner,

I have also been trading for the past three years but still not being profitable. But I think as a person I am improving and I think following you and reading your posts will be helpful.

This particular post, I have watched your video but reading it is more refreshing.

Hi, Nazah!

You might also find the article below helpful on how to become profitable:

https://www.tradingwithrayner.com/how-to-be-a-profitable-trader/

Hope this helps!

Since the time I stumbled into your page on youtube, you have been a wonderful motivator to me in trading. I love to buy your course books for trading. They are just very unaffordable for me as a nigerian due to the bad economy here.

You can also explore Rayner’s free course on his Academy. You can check it here:

https://www.tradingwithrayner.com/academy/

Cheers!

Thanks Teo for the motivation. Though I’m new in forex and I’ve just blown my account. However, I’ll not quit because I know better days are coming.

I’ll go back to the drawing board and come out with better strategy by reading more books.

I believe I will succeed.

Enjoy the learning process in trading!

We wish you good luck and good trading.

Cheers!

I’ve watched this up on YouTube anytime I get angry and boring about my trading abilities. It’s been three years now but I still don’t have consistency. Like you, I’ve learned everything I can fine on YouTube, blogs, Podcasts, books and tradingwith Ryner but nothing to show yet. Just when I’m beginning to gain confidence in my system, the losses comes up and weighs me down. However, it feels like anytime them losses come I discover something new I need to do. This is way hard!

Stick on one strategy and practice it every day.

Be patient and you’ll get there.

I wish you good luck and good trading!

About to throw in the towel ,I

Think am one of those people that don’t succeed in trading !!I thought I would but turns out I was wrong

Hi, Carey!

You might find the link below interesting:

https://members.tradingwithrayner.com/topic/the-reality-of-trading-what-most-traders-will-never-find-out/

https://www.youtube.com/watch?v=XhxJKpygyr8

Hope this helps!

Actually I doing trading in forex and I havea strategy in 15 min support and resistance price action who give me a 1.2 rr return and I earn good money sometimes but know I build a differ strategy who give me 1.3 re because sometimes lquadity happens and my stop loss hit so I changed my strategy now I am broke I lose 6 trade in a row in that strategy and I feel I give up but then again I learn your lines and feel I do it in better way but how I started pls make a video how funding challage passed pls help me I what I do next

Hi, Rajat!

You might find the article below helpful:

https://www.tradingwithrayner.com/forex-trading-contest/

Hope this helps!

I started 3-4 months ago, In uptrends I waited after the market making two higher highs and two higher lows and went long after seeing a sign reversal (e.g. hammer) after the second higher low (and viceversa in downtrends), preferably at support.

I did ~150 trades (mainly Forex, BRN, XAUUSD) so far. Starting with $ 750 I have now ~$ 600 and am in doubt on how to proceed.

Most indebted for your advice.

Hey there, Onul!

You might find the link below helpful on how you can overcome your trading losses:

https://www.tradingwithrayner.com/how-to-overcome-trading-losses-and-losing-streak/

Hope this helps!