I was in university when one day, a Forex broker came to my school and organized a trading competition.

I took part in it immediately thinking…

“How difficult can it be?”

Well, I blew up my account in 2 days.

And that’s the official start to my trading journey.

Now despite the setback, trading opened a new world of possibilities for me.

I realized…

You can make an unlimited amount of money because there’s no “ceiling” to stop you.

Your trading skill is yours to keep forever (no one can take it away from you).

You’ll never be replaced by someone “better and cheaper” than you.

You’ve got no office politics to get involved with.

You don’t have a boss (or anyone) to answer to.

So…

When I had this revelation, I was running around like a headless chicken, excited by the future that lies ahead of me.

So, what did I do?

I studied everything I could find on trading.

Stuff like candlestick patterns, chart patterns, trading indicators, RSI, MACD, etc.

Sure, I was gaining knowledge like mad.

However…

My trading results got worst.

Here’s why…

If you’ve studied Technical Analysis, you know the information can be conflicting.

For example:

The market is in an uptrend but the candlestick pattern shows a Bearish Engulfing Pattern.

So which signal do you follow?

Or how about…

There’s a bullish RSI divergence, but the MACD indicator shows overbought.

So, do you buy or sell?

Clearly, there’s lots of conflicting information out there.

And that’s not all…

Because I was also lured by the “holy grail” syndrome — always trying to find new trading strategies.

I’ve tried harmonic trading, price action trading, indicators, and what not.

But here’s trading truth I came to realise:

By trying different trading strategies, it leads me to have an inconsistent set of actions.

And if my actions are inconsistent, how can I get consistent results?

Now at this point…

I was frustrated, confused, and mildly depressed.

But I’m not willing to give up just yet.

I wanted to know…

What are professional traders doing, that I’m not?

So, I went down the rabbit hole to look for answers.

And by sheer luck…

My answers came when I was hired as a trader at a proprietary trading firm.

Here’s what I discovered…

Every single profitable trader I came across has this ONE thing…

…an edge.

Now you’re probably wondering:

“What’s an edge?”

Well, an edge is something that gives you a positive result over a number of trades.

Imagine:

I make a bet with you.

If every time I toss a coin and it comes up head, I win $1.

And if it comes up tail, you win $2.

Let me ask…

Over the long run, who will win?

You, of course!

Because you have an edge in the coin toss (your winners are larger than your losers).

And it’s the same for trading!

You must have an edge in the markets if you want to be a profitable trader.

So when I had this “AHA” moment…

I went ALL IN to find my edge in the markets.

I studied research papers, winning traders, books, and backtest reports.

And using that information, I developed trading strategies that hopefully could give me an edge in the markets.

Did it work out?

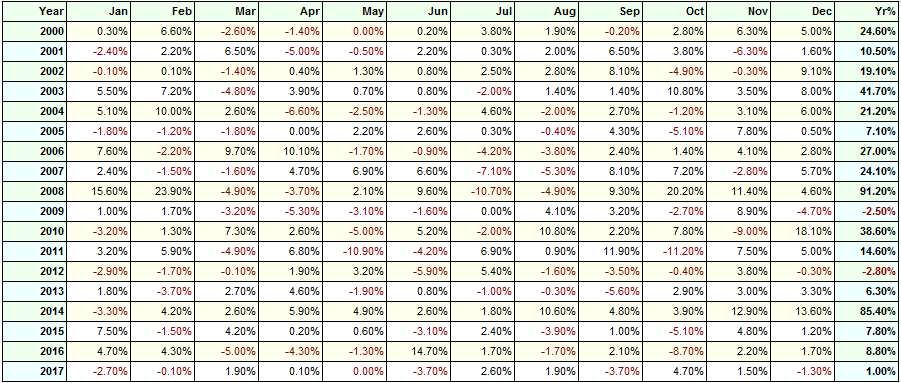

Well, here’s the results of one strategy I developed…

And do you know how I feel?

Vindicated.

Because all my effort has NOT been wasted.

Now:

I know I have an edge in the markets.

I’ve got a skill no one can take away from.

I’ve got something which could feed me and my family for the rest of our lives.

The best part?

I don’t have to rely on anyone or anything (no bosses, colleagues, politics, etc.).

It’s all on ME now.

I’m in control.

Now, you’re probably thinking:

“But how can a retail trader like me find an edge and beat the markets?”

Well, that’s what I’ll cover later.

But first, let me explain why traders don’t have an edge in the markets.

This is important, so please read carefully…

Trading Truth #1: Why Fundamental Analysis will cause you to fail

Here’s a true story…

Before I became a trader, I actually attempted to be an investor.

I bought a stock called Blackberry (its symbol back then was RIMM).

Anyway…

The reason I bought the stock was because revenue was strong and earnings were increasing year on year — it’s the darling of Wall Street.

It seemed like a no-brainer because the stock is fundamentally strong, and I should buy.

And that’s what I did… I bought Blackberry at $75.

Do you know what happen?

Well, the stock starting sliding lower.

From the highs of $80, it trickled to $70…

Then to $60…

Then to $50…

Then to $40…

Suddenly, all hell broke loose and Blackberry collapsed to single digits.

I was puzzled.

Wtf is going on?

And looking back on hindsight, Blackberry was “too slow” to catch up with the Smart Phone technology.

Players like Apple and Samsung came in and gobbled up market share, fast.

This led to the demise of Blackberry.

Here’s another example…

AMD had negative earnings in 2014, 2015, and 2016,

But, the share price gained 700% within the next 12 months.

You’re probably thinking…

“Wtf?”

So here’s the tough trading truth…

The market can go up on bad news and go down on good news.

It’s near impossible to trade based on fundamentals, and it sure as hell difficult to find an edge from this approach.

Next…

Trading Truth #2: Technical Analysis works, but it’s not what you think…

Unlike Fundamental Analysis, Technical Analysis relies on past prices (like candlestick charts, trading indicators, chart patterns, etc.) to make your trading decisions.

But, the same rule still applies!

If you want to be a profitable trader — you must have an edge in the markets.

So now the question is…

“How do you use Technical Analysis to find an edge in the markets?”

Here’s how…

1. Develop a trading strategy based on a set of rules

Perhaps its candlestick patterns, Support & Resistance, and etc. It doesn’t matter. What’s important is to define your set of rules so you can test it and see if it works.

2. Back test your trading strategy

If you don’t have programming knowledge, you have to do this manually.

You’ve got to scroll back the charts to the earliest date and “pretend” you’re trading live.

Then, you’ll identify your trading setups and record the results of each one of them.

3. Forward test your trading strategy

The other approach is to forward test your trading strategy.

This means you take your trading strategy and trade it in the live markets. It can be on demo, it doesn’t matter.

What matters is to see how your trading strategy performs in real-time.

Now:

What you’ve just learned is how discretionary traders find success in the markets.

However, there are a few problems with it.

I’ll explain…

Why manual back testing is a LIE

Here’s the trading truth:

When you’re doing manual back testing, you “see” the future prices ahead of time (as you scroll through the charts).

Now, if you know the market is about to move into an uptrend, you’ll focus only on long trading setups and ignore the short ones.

This means your back test results are inaccurate as you take trades which are “favorable” for you.

And it’s no wonder why your live trading results are worse than your back test results.

Moving on…

Why most traders give up on trading

Now you’re probably wondering:

“What about forward testing?”

Well, this is more accurate than back testing as you’re testing your strategy in the live markets.

But if you trade on the Daily or Weekly timeframe, it’ll take you months or even years to find out whether your strategy works, or not.

And if it doesn’t work, you’ve wasted many months (or even years) of your life.

After one or two failed attempts, most traders would give up on forward testing and claim that trading doesn’t work — and it’s a scam.

So now the question is:

How do you find an edge in the markets — without wasting time on strategies that don’t work?

That’s what you’ll discover in my next post.

But for now, here’s what I’d like to know…

What’s the ONE thing that frustrates you the most in trading?

Leave a comment below and share your thoughts with me.

Not able to be in profitable trade and waiting for stop loss hit in loosing trade, how to overcome it???

booking early in profitable trade and let me tell you rayner i am learning from your post various chart patterns most importantly support and resistance level and back testing it live market and it works fine

Awesome to hear that, Vickky!

There’s a lot of factors that could attribute to it and it’s not possible to go into details.

So go check out hese posts…

https://www.tradingwithrayner.com/set-stoploss/

https://www.tradingwithrayner.com/2-how-to-know-when-is-the-best-time-to-exit-your-trades/

Rayner, whats your view on cutting a losing trade before it reaches stop loss target if the trade exceeds an expected timeframe to have reached closure?

Also, do you think its ok to pull orofits below target levels if the market appears to start ranging?

What’s best strategy can I apply am using candlestick charts help me out thanks teo.

I’ve written about candlesticks extensively here… https://www.tradingwithrayner.com/candlestick-patterns/

Thank you for sharing this knowledge. What fustratrates me the most in trading is the use of trendlines. As the name implies TREND lines. The market is said to trend 30% and consolidate 70%. I prefer three points of contact not two points because any two points can be connected on the chart. I find trendlines to be confusing. How can one properly draw trendlines and channels.

Do not use them at all, instead try to focus on key levels

I did a video on trendline, check it out… https://www.youtube.com/watch?v=IwAEoJC4DNs

Thank you Rayner

Cheers

Scammers I don’t like the fact that there are more people making money on there you tube accounts then actually trading. If your starting out you can waste a LOT of money following the wrong crowd. There are only two people I listen to and your one of them Ray. Thank you for giving back and helping others learn as well…

Whose the other one

Thank you for your kind words, Tom.

I appreciate it!

…what frustrates me most in trading is that I don`t know where or what to look for when a trend is over and its reversing, i`m new to trading and love to watch,read and really learn a lot from your articles, I also do a lot of practising on demo.Thank you for sharing with us.

This post might help… https://www.tradingwithrayner.com/how-to-identify-trend-reversal/

I always appreciate the content you provide. Thank you! What I would really like to have is a very basic strategy that I can begin with and then ‘modify’ it to suit my trading style so I can finally find the ‘edge’ you speak about.

Hey Vincent,

The next few posts will be of interest to you. cheers

Rayner You are best in the best

Thanks bud!

Build up your mindset50%+strategy30%+skill20% and make it simple as you can.

Thank you for sharing, Yip.

Thing frustrates me the most is that, I diverts from the initial trading strategy on which basis I started trading..may coz I want more and more of trades….sir but your comment on back testing strategies have opened my eyes

Thank you for sharing, MM.

actually Teo i would more happy if i find that edge …..still looking

The next few posts will discuss it.

Stay tuned!

The one thing that frustrates me in trading is that, if the price of the stock drops very little, it immidiately produces big loss. But if the price goes up significantly, it only gives little gain. I think it’s so unfair!!!

I understand how you feel. That has nothing to do with being fair though, it’s just Math.

$100

-$50 (Market drops, 50% loss)

——–

$50

If market gains 50%, your money only gains $25

Market has to go up 100% just to get where you were at.

Have seen that comparisons many times

When i have 100$ and i lend to you $50

Thats 50% From my total

When you give it back to me it is 100% from my total

It still is the same value

It doesnt matter Imo

This post will help with your risk management and position sizing

https://www.tradingwithrayner.com/forex-risk-management/

Hi Rayner, is it possible to set take profit on MT4 platform trailing with a moving average automatically or you always have to exit trade manually when market trade below the moving average?. If so please send me video link if you have one.

Mankgodi (south Africa)

You can do it with an EA on MT4. I don’t have one.

I fail every time to find the right entry and end up missing opportunities

These posts will help with your entries…

https://www.tradingwithrayner.com/high-probability-trading/

https://www.tradingwithrayner.com/when-is-the-best-time-to-enter-a-trade/

Thank you for sharing. My biggest issues are, Fear of missing out, unable to change the sentiment (I made a few dollars being Long, now I am long biased even though the market is going down and I am stubbornly trying to make it being Long!!!), unable to take a loss and discounting my own trading plan.

I am looking forward to your next one that discusses the edge.

Thank you for sharing, Raj.

Rayner, you are the guy that rightly talk what Forex is all about.

Thanks for your open mind.

You’re welcome bud!

I always seem to be 2 steps too late in my trading. As if the market knows I am coming and then waits to catch me out…. I am sure I am not alone.

You definitely aren’t.

Thanks for sharing!

Reynard inexperience what you are sharing, I am new in this industry and I want to learn more from you, you are a blessing to many people, I’m excited for your next post.

God bless you more and more.

Thank you, Bobie!

Stay tuned!

Thanks for sharing, you are correct. For me, the ONLY thing that matters is real time price action and how it is interacting with my price levels.

Thanks for sharing, Lawrence.

I spent 2 years backtesting to prove to myself it can be done, that I am able to developing winning strategies and an edge and profit over time. Once that was done, I started live trading, both demo and funded. That is a whole ‘nother story. Backtesting is easy, forward testing is where my natural tendencies and habits take over. This is the hard part. I never knew how stubborn I was until I started live daytrading. The most frustrating thing about trading is breaking the rules that I made, losing a bunch of money, and afterwards seeing that if I just stuck to my rules my account would be exponentially bigger!

I know what you mean.

Still, thank you for your honesty!

Just want to thank you & congratulations Rayner

Cheers Jesse.

How can I develop an edge in options trading?

I can’t help since I don’t trade options.

Hmmm… You got me there Rayner, trust me. As I was waiting to read the main point, you took it away by telling us to wait.

Thanks, I’m patiently waiting as I need an edge. I’ve been compiling my own rules though as I’m looking forward to profiting from breakouts and strictly following trends. Thanks for your regular updates.

You’re welcome, Damilola!

hi Rayner,

Thanks so much for your teachings. One of my major problem is when i use 200Ma to know the long term trend, then 20 and 50ma for short term trend. Let’s say the trend is up in daily timeframe but down in the four hours and in the four hours it is showing nice lower lows and lower highs as well as respecting either 10ma, 20ma or 50ma. Do I trade the down trend in the 4hrs timeframe or should I wait till I see the start of a new higher highs and higher lows in the 4hrs timeframe.

I discuss trend in this video here… https://www.youtube.com/watch?v=cSWC2WwbhHE&t=139s

Good content for beginners. Everything is designed around larger accounts. Not much for good content for people with small to micro accounts. Rayner provides some of the best content I have found even though I have not traded forex yet.

Thank you for your kind words, Myron.

After one year of some success and some failure, and hopping from one strategy and time frame to the next, I have recently decided to take finding my system seriously and started learning how to program in Pine (TrandingView). In just a short time I can see how different time frames impact trades, commissions pile up, trading against the trend can hurt, etc. Automating these backtests allows you to discover so much more so quickly. Highly recommended.

Glad to hear that, Ryan!

thanks Rayner, the new strategy that has worked for me on demo, trying it today and yesterday on my live account, it’s hasn’t worked well and that’s could be frustrating. but with the result you shared am going to stick to it and hope it gives me good result

Let me know how it works out for you. cheers.

how to enter and exit a trade. how to set up tranding system.

These posts will help with your entries…

https://www.tradingwithrayner.com/high-probability-trading/

https://www.tradingwithrayner.com/when-is-the-best-time-to-enter-a-trade/

These post will help with your exits…

https://www.tradingwithrayner.com/set-stoploss/

https://www.tradingwithrayner.com/2-how-to-know-when-is-the-best-time-to-exit-your-trades/

Most Frustating – you exit trade n your strategy works. It seems it’s waiting for you to exit.

If you decide to break rule n stay few more moment; it cuts your throat n make you bleed.

In short exit with small profit or exit with hefty loss – this is one of the most frustrating and seems to be in DNA of most loosing traders.

I know what you mean. Thanks for sharing!

looking for profitable strategies so i can day trade established stocks (not low float stocks) Any recommendations for such strategies included in books or videos and/or sellers of such strategies will be appreciated.

Health and happiness to you my friend and everybody else

I’ll share more in the next few posts. cheers

Trading is frustrating just blew my whole account in two days but your comments help and will continue to push. Blessings Rayner

Keep on pushing!

Theo nice shares everytime

Think that the things frustrating also have an opportunity

You self have to find this

Thanks for sharing, Pete.

What frostrated me the most in trading was trying to be successful with a tiny account 50-100. Made me neglet all the rules and hunt endlessly for trades. The greatest myth is that you can become a profitable trader trading a tiny account.

Thanks for sharing, Damico.

You have said it all Rayner Teo….thanks always for valuable information about trading.

Ray, thanks much for the support you really rendered am grateful, not quite long I blew my account based on wrong management but reading your post I felt the possibility doing it wright again,,,,but little confused on trading support and resistance levels, when entering a trade in these levels.

You can learn more about SR here… https://www.youtube.com/watch?v=PuboYnBc0t8

My biggest frustration Rayner is entry point on a trade setup and when the market turns around and there’s a reversal. All of a sudden I’m stopped out

These posts will help with your entries…

https://www.tradingwithrayner.com/high-probability-trading/

https://www.tradingwithrayner.com/when-is-the-best-time-to-enter-a-trade/

Thanks for sharing. I just found you on youtube and I’m impress with the way you teach and share experiences. You come across as someone who is genuine.

I appreciate it.

It is nice explanation i waiting for next subjek, thank you

Stay tuned!

Best timeframes. Daily weekly 1 hour 2hour 4hour

Thanks for sharing!

I am having difficulty switching from demo to live trading and be profitable

Start on a really small live account to make the transition.

The thing that frustates me the most in trading is being in a winning trade, seeing the price running against it and being stoped out at a much lower profit or even at a loss. I find me asking why I had to wait instead of getting out earlier, as I lose time and money…

I know what you mean. Thank you for sharing!

The ONE thing that frustrates you the most in trading, I find a trade, all looks good, take the trade.

I walk away, trade progresses into profit all is going well, I leave it be, go to bed or go out.

Come back to the trade and I am stopped out!!

Hah, we’ve all been down that road!

Self doubt. When a successful strategy starts to consistently fail and then I feel like all trading could be based on luck and I potentially know nothing!

It happens to even the best of us. I know right…

Inconsistency of my own habbit…

Thanks for sharing.

Thank you for kind heart Rayner are just wonderful, am Stilheart from Cameroon in Africa my big time challenge is i made profit and i end up giving it back that really frustrate me.That is cause by lack of discipline and taking more trade at the same time. I will not risk more than 1 percent of my account but in most cases when am late to take a position i still force to take it and risk more just to see price reverse and wipe me out. that is killing me.

You’re welcome and thank you for sharing!

Thanks for sharing. I have recently started following you on you tube and I must say your webinars and guidance is pretty straight forward and easy to follow. The most frustrating thing for me is every day I decide that I wont follow the same mistake next day but when I am in live market I forget those decisions and make same mistakes again and again 🙁 Do make a video or post on how to control emotions…Thanks Again!!

I’ll look into it, cheers.

Hi Rayner,

Greetings from India,

I am very big of yours.

I have learned a lot from you.

according to me, the most frustrating thing is not following trading principles strategies.

in the morning I faced huge loss due to my own mistake of not following my own trading principle and this was the biggest lesson of my life and after reading your this post I got my confidence back.

thanks a lot.

keep it up, buddy.

Thanks for sharing, Mayur!

I want to know how to be smart in trade.

That’s interesting, thanks for sharing.

Meddling with my open trades, allowing my stop loss to hit but closing winning trades before hitting my take profit.

I know what you mean, thanks for sharing!

Hallo Rayner,

because of your very valuable as well as practical and instructive lessons I’m a true ‘admirer’ of you.

What so far turned not out clearly to me is the answer of the question whether based on your trading experience a successful strategy should be based exclusively on Price Action ( including Moving Averages) or a combination of PA and the traditionally popular Indicators (f.e. RSI, Stochastic, MACD).

My personal experience so far is mixed.

Your reply is very much appreciated as always.

Joerg

Nothing is exclusive.

There are traders who focus 100% on price action, some use a combination of price action and indicators, and etc.

Hi, when I read your post I wonder, will Rayner read me my mind? Well, the great memory of what you say has happened to me, what will be the solution? Thank you Rayner, I’ll wait for your next post.

Coming soon!

How can you me trade successfully?

I can’t.

I hate when a trade stop like a pip before my tp then turn around and hit my sl

I totally get you.

The one thing that frustrates me is one strategy does not work in all kinds of market. You need to have atleast 2 strategies which will work depending on the market conditions. It’s frustrating if one strategy doesn’t work and really demotivates me.

No one strategy works all the time, that’s why drawdown occurs.

But having multiple uncorrelated strategies does smooth out the equity curve over time.

What fustrates me is when l enter a trade on 15 or 1 hour chats it gets into profits creates hope in me and then later on the the trades reverses into los sometimes up until it hits my stop lossn

Thanks for sharing, Noel.

What frustrate me most is not finding the setups that I am looking for e.g a clear uptrend or down trend.another thing frustrates me is waiting for setups to be formed sometimes it takes hours.

Thank you for sharing, Dinna.

It requires full time monitoring both day and night, I don’t rest or sleep well like before since I started

You might want to consider trading the higher timeframes.

Letting emotions control a trade, instead of letting it go and do it’s thing I’d close it out early or buy or sell too early and get stopped out.

Thanks for sharing!

You add somethings in ma journey which I can’t forget.

I hope it’s a good thing? heh.

i need a basic strategy that works which i could modify to suit me. i have had too many blown accounts.

Most frustrating is taking a position and right after that the market takes a hard turn or having a fall back. I would like to know if the direction I spotted is ‘the right one’.

I’ve watched some vids from you and I had a lot of ‘aha’ moments. Thank you for that 🙂

I’m happy to hear that!

Thank u Ray, i quit Trading since 2013 because of indiscipline. I blown up many accounts. But am beginning to find joy again in trading because of ur selfless service. Thanks a lot. Any time am going live again, i will be armed.

Thanks for sharing Emmanuel.

Take baby steps, there’s no rush. cheers.

Im struggling in exiting the market

Great explanation and I feel identified with it, it frustrates me not finding consistency, evaluating me because my mistake was in operating in very high time frames ((Dia-4H and 1H), because when the operation went wrong but another If I was positive, I was scared and closed the positive operation very quickly, not allowing my risk reward relationship to reach what was stipulated and therefore the losses were greater than the earnings and my account was gradually reduced. I got 4H as my main framework – 1H to look for my operations (Main) and sometimes 15M to improve my entry, and my nervousness ended up being positive.

I don’t know if I’m doing badly but so far I feel comfortable with her and most importantly I’m not losing my capital.

Thank you Rayner for your teachings, See you from Colombia.

(translated by Google)

Blowing my account or bringing my account to a big drawdown

Thank you for sharing, Hernando!

What frustrates me the most is when the market moves sideways in consolidation and I cannot take even one trade. Also, when volume is so low the market isn’t moving at all. How am I suppose to make a living as a trader if I cannot trade at all. I am a prop trader as well but the amount they started me out with is tiny (i.e. no leverage at all) How am I suppose to make a living when I am only allowed to trade $1 to $2 a pip? I have an 87% win rate when I do trade. My results are good if not great. I know if I had a $100,000 to trade on instead of $2000 that I could make a great living even if I were only able to trade one day a week due to a slow market.

Knowing the right combination of strategies that will help me be a successful trader.

finding the right strategy that works with me

Good work Rayner. Don’t stop giving us knowledge. I have followed you closely in your YouTube channel. God bless you

I’ll do my best.

I’ve read you must determine whether the market your trading is oscillating or in a momentum mode. how do you determine that?

I just want to know the secret about traders, of which i can see it on trading the market. We approach the same tools on market but for me they not work.

Hi there!

Your posts are answering many of my questions.

One problem I face is when to get out of a losing trade. I wait too long and end up losing a lot.

Suggest me a way to overcome this deficit of mine.

I’m just trading gold. I’m using trailingstop as you recommended in one of your papers. I use MA144 and just H1, H4 and daily. Nice profits last two months. Do you reccomend Cryptocurrencies? any particularly? I’m not there yet. I see a lot of traders making good money with cryptocurrencies.

I like the way you set your strategies and share your knowledge.

Thanks Rayner you motivate me to work harder I just blow my 100$ account bcs am greedy of gain and entering the false break out. U are the good mentor of all time.

Losing all profit because of overtrading and blow up my account after that AND repeated againt after next deposit !!!

Stop trading immediately.

Find out why you’re overtrading. If you can’t find the root cause, the same thing will happen again.

I like trading but like all other valuables in life you have to invest in it, at least in terms of time.

Definitely!

I’ve been 3+ years in the trading field, but i still struggle with everything, from entering a trade and exiting a trade to reading charts. Now that i am following you, things become a little better. But still can’t find a strategy. It will work for 2 x days and then all of a sudden its not profitable. I trade without a stop loss: Reason being > every time i put one it gets stopped out. even if i put it big/far it still gets triggered and the market goes in my original direction and i say every time it happens. But one thing for sure, with your coaching i refuse to give up. Especially now that i am following you. Thanks for your help in advance.

Cheers bud

I like your story, it’s the struggle of every aspiring trader. Do you trade equity or just forex? If you trade equity, I’ll like to know your edge please. Thanks

What frustrate me most is gaps in the trading. Why do gaps appear in trending market some times for good profits, most times at a great loss.

When I enter trading,the stock goes in reverse direction, what could b the reason?

lol i know the feeling its like the market or the broker is against you frustrates me

Being in profit for few hours and deciding to have patience and then boom!, im on huge loss

still looking for an edge…

Always scare to hold on to a position in anticipation that the trade news might knock me oof my trade.

Hey Rayner it’s Siphelele Luwaca here from South Africa, I’ve been your follower for quite sometime now, all I can say about you you’re a God sent your advices are the top range. Well one thing that frustrates me the most is fact that I really struggling to find the working strategy, I have blown accounts left and right, I even thought of giving up forex. Even up to day I really find my way. If you can please help

lol have read books pdfs first few months was making profits …boom now i blew my account twice its like i have no clue of wat im doing i enter good trades after doing my own analysis but i get cold feet soon as i see red i exit…

This happens with me also.

Same scenario.

Thank you Rayner for the boost up

Fear of blowing accounts. I have done before but now i am demo trading and learning the candlesticks from your post.

Why stocks goes down after a FDA approval… How do u know if a stock is priced in..

Ive been trading for 3 months now and Ive blown my account twice already can you give any tips on how to make a trading plan. I still dont want to give up but I also dont want to lose more money. please help

This will help… https://www.tradingwithrayner.com/profitable-trader/

To early at this moment to be frustrated as i am a starter with trader. For now i would say slow moving market.

the reduction of leverage to x30 in the uk as im poor and im forward testing a swing trend following strat. 13 trades in and have to wait till there complete due to margin requirements 🙁

Always entering the trade late, hence a bad risk to reward.

Hi Rayner. I can really relate to your mail since currently I feel the same with my inconsistent trading results. What frustrates me most is Trailing Stop. Sometimes I put it at S2 then saw my floating profits turned into loss when market dropped and hit my TS. Hence, I change my TS position into S1 after my trades have floating profit, thenthe shares price dipped, hit my TS and continue uptrend.

Would really appreciate if you could advise me on this. Thank you very much.

Ivan

Wow! Powerful reading!

I started to follow you a few months ago.. I try to trade with the an EMA strategy because I thought it seems easy to apply but that was a HUGE mistake.. now I’m working in my discipline I have a few rules thanks to you and others professionals traders that have good will to share they knowledge with us.

So thank you so much. I made a promise all this time I invested in my trading path is going to worth.

You’re welcome!

Being discipline and consistent

Yes true you need set rules

The market unpredictable movement

My frustration in trading is am just new to it and it seems to have a lot of work to be done on it and I don’t just know where to start from. Whether to start with candlestick or price action, or trend following etc. That’s just my frustration on it, though I love trading even though I have being losing but it still trade. The joy of being called trader is much more in my heart than working for people. James Eboh

I’m a total new comer, trying to get into trading. But dare not get my foot in, because I know nothing yet. It’s just that I love this trading thing and lucky to come across your lessons. But I’m so new that I don’t know where or how to start yet. Thanks for your guidance. I hope to learn more, so that I can join in the fun.

Hey Rayner.

I am not an experienced trader, but have been demo trading for a while, and trying diligently to keep records of my trades. Looking back through my records I have been frustrated as to how often, the moment I place a trade it turns the opposite way….its as if it reads my mind.

Hi Rayner, Interesting reading. I disagree with your statement that back-testing is a LIE. If done properly, by hiding future pricing on the chart and making decisions on only what you can see back-testing can be very effective in ‘proving’ a trading strategy.

You have to use the future price action to test your strategy, in other to know if your strategy is working.

I look forward to learning about your ‘Edge’ in the next post.

Good day.I noticed that markets keep on changing. Most times,I will be so sure of a move and conditions satisfied.On entering,it will go against me and when I close the trade,it will now go in my direction. Its frustrating and it makes me lose money.

Obiajulu.

Most frustrating is it when I go with my gut feeling than trusting the indicators, expecting a breakout bc its consolidating. #bitcoin #neverchasebreakouts #lessonlearned

I’m looking @ trading differently now, thanks to u. Didn’t know much, jst jumped in n lost nearly all my account!

Where can I get good software for manual back testing?

The biggest thing that frustrates me while trading is the same point you mentioned before about conflicting between MACD and RSI when one of them guiding you up and the other down and I wrote to you about that before asking which one I should follow.

It’s difficult for me to read or interpret the RSI

Can you please do a video on how to place a stop loss and take profit

Can this edge and your other strategies be applied to binary trading

Brokers can frustrate the most. Rayne I’ve been watching ur videos and so impressive but m still struggling to find a btta broker. Myb if u can assist with few numbers of least brokers dat use KWD, GBP n USD

thanks for the post Please I have a question .can you combine all time frame chart while while trading.for example i want to trade for one hour i set my entrie ….do i have to be looking at 1minutes trade chart ,10minutes trade chart …….etc to know if i am on right track or my technical analysis should only base on my one hour chart …thanks

Dear Songo..The time frame you use to execute your trade depends on the type of trade..For example if you are a day trader you may use the 15 min chart to execute ur trade..( 5min if you r more agressive) and use the 1 hr and Daily chart before the execution to establish and get a confirmation of the trend and favourable execution levels…Hope this helps….Cheers and happy trading

What’s the edge? Help us man!

Sir, it’s Discipline

Thanks to you I make some money in trading. What has changed in my trading strategy is how I see and analize. I think where can be stop loses, TP, where big banks can set up a trap. What most traders might do and what I shouldn’t do to have the edge in trading.

What I don’t like about trading is that I don’t have enough time to spend on trading, also I don’t like when my emotions take control. I need to work on this a bit but I belive when you can address the issue you can fix it 🙂

I know its just the beggenning.

Thanks for your help, and for what you do, it means a lot to me.

My pleasure, Sebastian.

Thank you for sharing!

I have been trading for now for about 6 months. I have some moments but also some bad ones. My issue is I am trying to find an edge which will put me on a winning trades.

Thanks for sharing!

you are indeed a great trader, GOD will bless u more rayner. i can’t wait for the next video

Coming right up!

1. finding mentorship.

2. Under standing and utilizing technical analysis

3. Finding consistent and reliable source for trading tips

Bro, I can say that I am able to find some good trade set ups. but the problem is i always going out of the trade and jumping to another trade that believes to move faster. Then seeing the one I left behind fly high=( always get frustrated after.

One thing is frustrating thing in trading is that candlestick pattern shows uptrend in the last day, and analysts said it goes to strong buy on another day. While I’m using 200ma indicator to buy an stock, it is also shows uptrend, I’ll wait for couple days until I reach my profit percentage but it goes reverse trend as I expected. I lose my capital in this manner.

When my set up works most of the time (i.e. WTI CRUDE OIL 5 &15 min, Bollinger + SMMA 7, MACD)

After a successful trade (sometimes let it run using a trailing stop) I close it then follow the ebs and flows sometimes winning well, sometimes losing lots of coin.

So for a beginning trader like me you would suggest Technical analysis rather than Fundamental analysis?

Hi sir I want you to be my mentor pls

A number of times..the trade I have chosen blooms only after, in most cases, immedeately after, I exit it..Nothing can be more frustrating or exasperating..

Will be willing to see the next post as soon a possible. Tryna find an edge

Rayner what frustrates me is my entry, I like multiple time frame strategy after identifying the trend on a higher time frame and wait for the market to retrace in a lower time frame before entry I find it difficult to know the exact time enter because if I enter early it may continue to retrace and I will be in a loss

Is there a right place to start learning trading?, with access to so much information, risk management is barely touched on by many teachers.

Here you go… https://www.tradingwithrayner.com/category/blog/risk-management/

How can I make profie consistently in trading?

Thank you very much for your guide. The challenge I am having is that’s my focus is on 4hrs chart. But most time after confirming the trend, and place order in the direction of the trend. Price will go against the trend.

Trade in the direction of the daily trend. And also, enter trades near market structure like SR.

Hey Rayner, thank you for the informative article! My challenge when I get into the Market is confidence in my Analysis and Taking trades that I have Analysis for, I tend to Listen to some of my friends who are traders and In the long run I am at a Loss… Do you have any advice for me..?

Check this out… https://www.tradingwithrayner.com/profitable-trader/

Hello bro

My name venu. I’m trying 3 years ly to become pro in forex trading but I will blow my account in so many times and still I not got proper strategy so recently I following your telegram group and YouTube channel so you are telling about edge How to guess perfect edge plz tell me on next post.

I’d say focus on your risk management first, this will help… https://www.tradingwithrayner.com/forex-risk-management/

Always letting a winning trade to turn a losing one.

What frustrates me the most i still not sure to entry evrn though i use my strategy

How do I get to learn my trading strategy, cause it has frustrated me a lot

Great information there. Thank you

My pleasure!

not knowing how to use MT4

Your trading skills is very good I will like to learn from you

I get frustrated when I can’t really decide if it’s an uptrend or downtrend and I get confused with so many ideas, chart patterns, MAs and tendlines.

This post was awesome

I mainly got frustrated of not following the discipline.

You know what you have to do but your own behaviour is the root cause of failing in the markets.For example, impatience,impulsiveness and FOMO.This are some among the many.

Glad it helped you, Saurabh!