I know you might be thinking:

“What are the things that I should focus on?”

“How do I get an objective view of the markets?”

“How do I become a better trader?”

Well, I want you to focus on the price, otherwise known as price action trading.

Price action trading

This is a term that might be familiar with you.

But first and foremost, I want to dispel the myth on what price action trading is…

Many traders think that price action trading is about support and resistance, chart patterns, candlestick patterns, etc.

I’m here to tell you that price action trading is not about all that. Instead, price action trading can be summed up in one simple line:

It’s about identifying the current market condition so you can adopt the right price actions trading strategy at the right time.

For example in a house, you have things like the bathroom, the bedroom, the chairs, the TV, the guest room, etc. These are components that make up the house.

Similarly for price action trading, things like candlestick patterns, support, and resistance, trend lines, etc. are components that make up price action trading.

Price action trading is the framework and concept. The tools that you use will be things like support and resistance, candlestick patterns, etc.

Don’t get confused between the two. This is important because we’ll look at this concept later on and this has to be clear in your head.

Why do you want to be a price action trader? Why do you want to focus on price?

I’ll explain each price action trading secret in detail…

Price action secrets: You trade what you see

You’ve seen earlier that indicators which can be manipulated by changing the settings to give you different biases where bearish can become bullish, or vice versa.

But when it comes to price action trading, the price is the price. The closing price is the closing price, the highest is the highest. You can’t manipulate it.

That gives you an objective view of the markets because it cannot be distorted to fit your bias.

In essence, if you see:

- The market heading higher, you want to look for buying opportunities.

- The market heading lower, you want to look for selling opportunities.

This is the key thing – you trade what you see and not what you think.

Price action secrets: You can “predict” what the markets will do

As a price action trader, you can predict what the markets will do.

What do I mean by predicting?

When I talk about predicting, I’m not trying to say I can predict how high the S&P 500 will reach before it reverses, nor the lows of the market.

No, I’m not talking about those kinds of predictions.

The kind of prediction that I am talking about, is knowing what the market will likely do whether will it continue moving higher or lower?

As a price action trader, if you follow the price, more often than not the price will tend to continue in its initial direction. It doesn’t matter whether the news is good or bad.

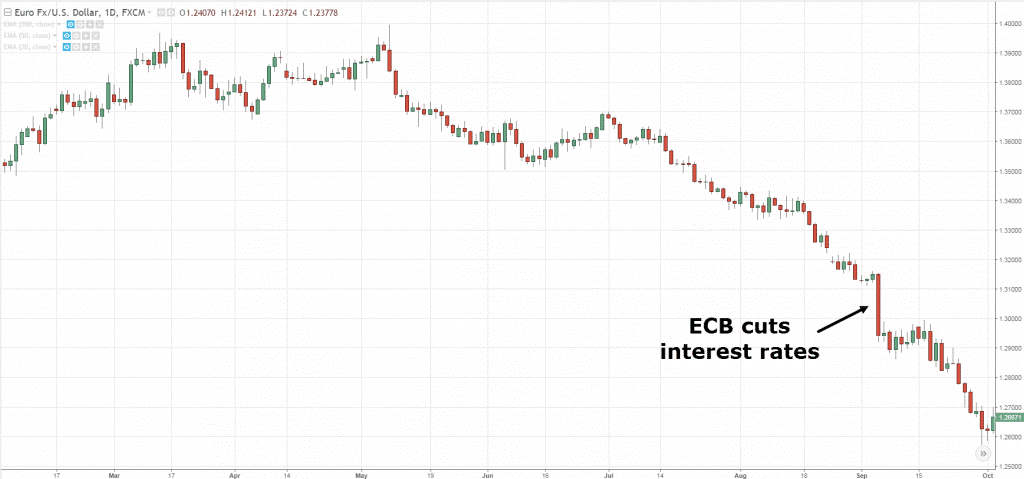

Here’s an example on EUR/USD:

You can see that on this bar, the European central bank (ECB) had cut interest rates and that is bearish for the Euro. The market continued lower from there.

But if you look at this chart even before the news is released:

You can see that the market is already in a downtrend. It has a series of lower highs and lower lows.

This should give you a big clue that this market is likely to continue lower, even before the news is out.

Here’s the thing:

When the market is in a long-term trend, one macro-economic piece of news isn’t likely to reverse the entire trend. More often than not, the trend will continue.

But sometimes what could also happen is that the news is against the price action.

Here’s what I mean…

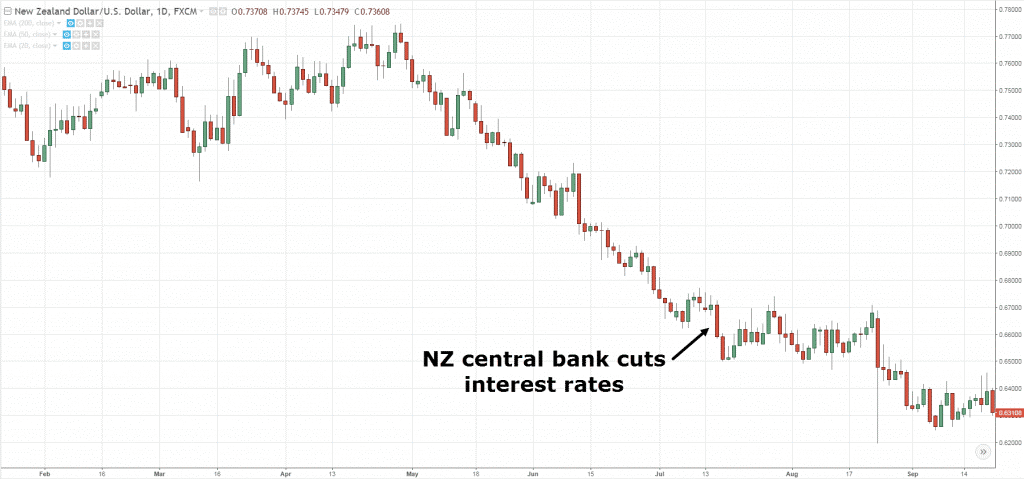

NZD/USD

The Central Bank cuts interest rate on this bar over here.

But if you look left, prior to it, the market is in a downtrend. Price is heading lower over time.

If the fundamental news is out should it be a surprise to you? No.

Because if you just follow the price, this should be something that you already anticipated. This is why I say you can predict what the markets would do.

If you just follow the price, more often than not, the news would escalate the current price movement. But sometimes the news is against the price.

Look at NZD/USD:

The central bank of New Zealand cut their interest rate yet the candle is bullish and the price goes up.

But what I’ve seen and experienced is that this is usually just a pullback or a retracement.

After the pullback, the market will continue lower.

Here are a few scenarios that can happen after the news is out:

- The price moves further in the direction of the trend

- The price retraces before moving in the direction of the trend

Don’t forget this price action trading secret…

As a price action trader, you will be in the direction of the trend more often if you just follow the price without indicators.

Price action secrets: You can better time your entries and exits

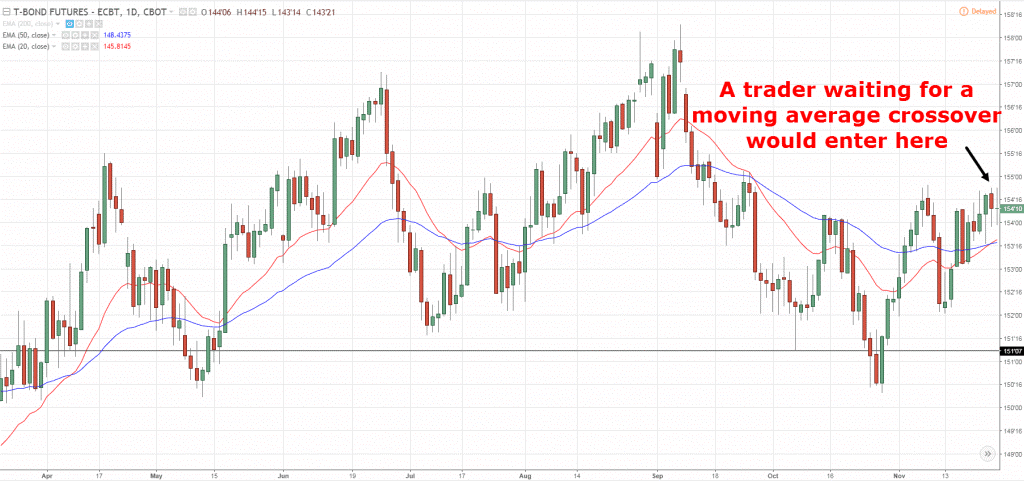

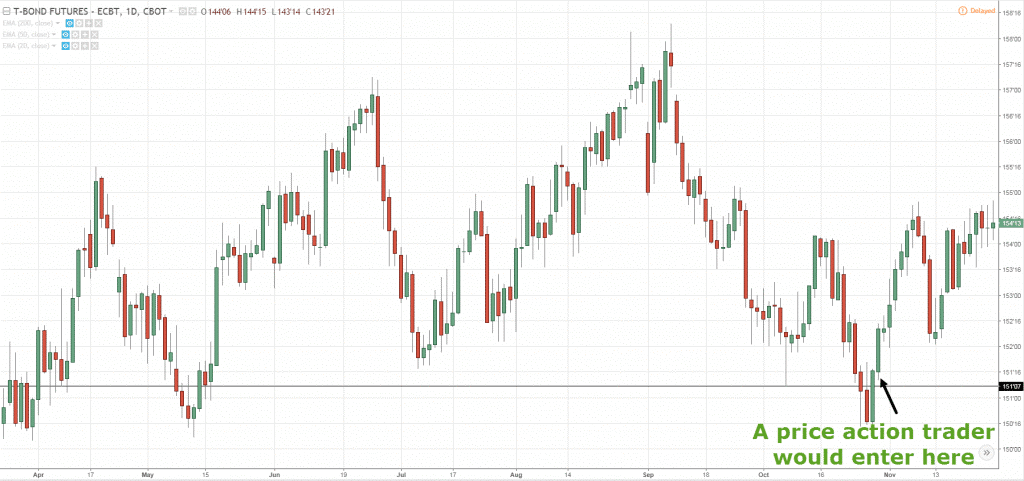

As a price action trader, if you use indicators to time your entry, like a moving average crossover, you will always enter your trades late compared to a trader who can read the price of the market.

Let’s say you use the 20 and 50 moving average crossovers for entry. So when the 20MA crosses over the 50MA you’ll be buying somewhere here:

But a price action trader who can time their entries using price action of the markets, where will they enter the trade?

They’ll enter near the lows.

So as a price action trader:

- You can get in the trade much earlier compared to someone who relies on indicators to time their entry

- You can exit your trades at the swing high as the market moves in your favour

Compare to the moving average trader who just entered the trade, you’ve already exited the trade to book your profits.

That’s the difference between a price action trader and a trader who relies on indicators to time your entries and exits.

Price action secrets: You are in control

Let me explain why this is important as a price action trader.

1. You know what to do at any point in time

You trade what you see and not what you think. You know whether to be a buyer or a seller, whether to stay out of the market because you can read the price action of the markets.

You know what to do at any point in time across any timeframes and any markets.

2. You know when to enter and exit your trades

You can identify potential buying and selling pressure to enter and exit your trades.

3. You know how to manage risk

You know how many units or shares or currencies to buy so you don’t blow up your trading account.

You don’t have to rely on fundamentals to manage your risk.

As you’ve seen, by the time fundamental news is out you can lose a huge chunk of capital.

As a price action trader, you are focusing on technical analysis and that helps you to manage your risks

4. You never have to rely on signal services, expert advisors or copy trading

You never have to rely on someone or somebody or any entity because you are in control – it’s all on you.

Price action secrets: You can ignore the news

We have spoken about it earlier, but I just want you to share a few more examples to nail the point.

Often traders are wondering, “What’s the latest piece of news I need to be aware of?”

But as a price action trader, I’m going to show you why you can ignore the news.

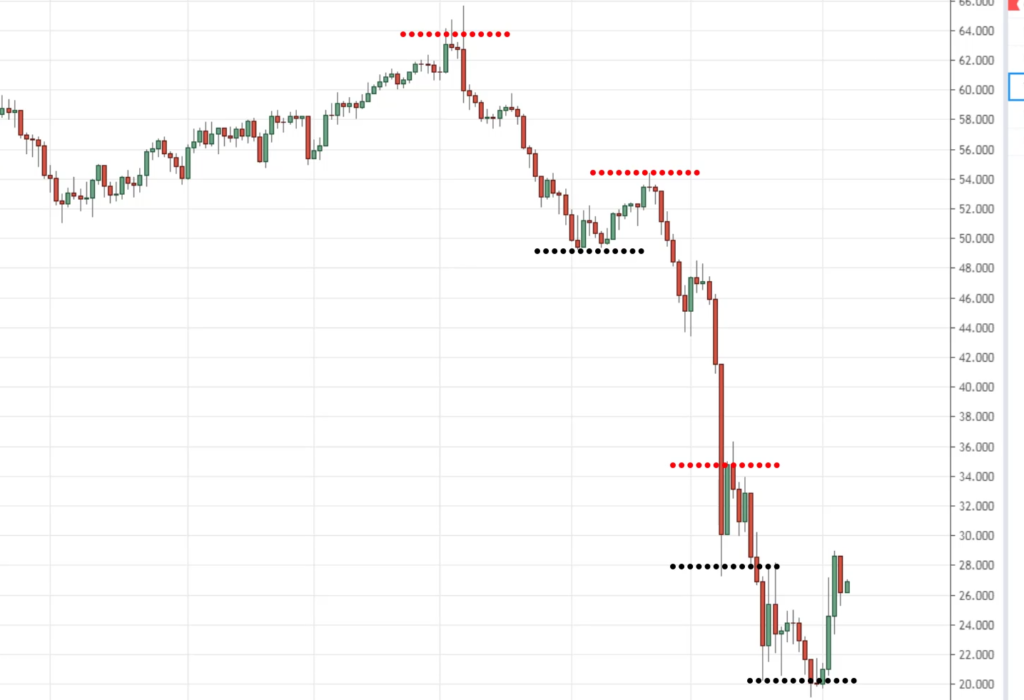

An example on Crude Oil:

In the daily timeframe, I have no idea what the news is for this market right now, but as a price action trader, I know one thing.

I want to be selling in this market condition. Why? Because the overall trend is towards the downside.

If you recall, we said earlier that price action trading is about identifying the current market condition so you can use the right price actions trading strategy at the right time for that given market condition.

So firstly, what’s the current market condition?

This market is in a downtrend, otherwise known as a declining stage. It has a series of lower highs and lower lows.

In this market condition, I want to be selling because that’s the path of least resistance.

With that said, let’s do a quick recap.

Recap

- You trade what you see, not what you think

- You can “predict” what the market is likely to do

- You can better time your entries & exits

- You can ignore the news

- You’re in control

The first 3 NZD/USD chart look different than the other 3 charts. Why?

Rayner needs to answer this, if not I will think he photo-shopped those chat to fit his teaching. A very wrong thing to do. Rayner answer this question

Hey Dan S & Guest,

What Rayner is trying to do is to visualize a concept on what the market might be. and how we would react to such scenario.

Skip to 6:20 if the video.

Cheers!

To me, If you look very closely to the charts, they are the same exact, difference here is that there has been new candles added to the RHS of the charts…

So what are you saying? Rayner is dealing with historical charts, as examples, so, of course there will be an RHS. Or am I missing something here?

Thanks for sharing this great piece.

Hey Chinyeaka,

You are most welcome!

@Reyner.. thanks for this piece

Hey Collinx,

You are welcome!

Hey Paul,

Check out this post…

https://www.tradingwithrayner.com/trading-multiple-timeframes/

Tochukwu, Thanks. I did already see that video. I am reviewing either entering on a 15 min chart or 1 hr chart with using a 4x chart for direction. Just keep on getting into the wrong side of the trade. Guess I have to look at the chart a little more closely. I am missing something.

That’s so helpful

Hey Erastus,

Thank you!

Wow! This was mind blowing. Thank you

Hey Peace,

I’m glad to hear that!

Thank you this can help a lot in our trading business

Hey Gani,

I’m glad to hear that!

THANK YOU SIR FOR YOUR VALUABLE GUIDANCE.

Hey Arunima,

You are welcome!

Wow, thank you so much bro Rayner, i got a lot of lesson from your article.. God bless

Hey Donny,

You are most welcome!

Fantastic !!

Hey Arif,

Thank you!

Thank you for this great master piece sir……..can wait to see entry and exit market point

Hey Ogunbote,

You are welcome!

Rayner, this is more powerful. “Trade what you see, not what you think!”

Hey Justus,

I’m so glad to hear that!

Thanks for this. I guess it’s better to be a price action trader.

Hey Adegoke,

I’m glad to hear that!

I want you to be my friend, friends in CAMERA if my request could be accepted. I’m a Nigerian, a christian, educated.

Hey Ossai,

We are all family!

I’ve been trading for 10+ years and it is still beneficial to me to go over some of the basics in trading. Thank you so much for your videos!

Hey Dan,

I’m glad to hear that!

thanks sir…..

Hey Satya,

You are welcome!

This is wonderful.

Hey Opex,

You are most welcome!

Cant wait for the next video to show how to enter and exit based on this video, thanks Rayner

Hey Nitro,

Thank you!

Excellent information, it is helpful.

Hey Micheal,

Thank you!

Rayner, isn’t the 50MA & 200MA useful to find out buying and selling opportunties.

Hey Yk,

Moving averages are momentum indicators

You can use them for swing opportunities.

Check this post out…

https://www.tradingwithrayner.com/swing-trading-strategies/

Hey Mbasa,

Check this post out…

https://www.tradingwithrayner.com/how-to-trade-pullbacks-and-breakouts-successfully/

Excellent piece of information!!

Hey Samir,

You are most welcome!

this is best platform for learning

Hey VIshal,

I’m glad to hear that!

thank you Rayner T for simplifying price action trading strategies. I have been following your post for some times now, its really an eye opener. please, can you make a video about trailing stop on mt5.

Hey Nosakhare,

I’m glad to hear that.

MT4 and MT5 are the same things but with just a little upgrade on MT5

Apply the same strategy on MT5

https://www.tradingwithrayner.com/trailing-stop-loss/

Hi Rayner,

I am intraday trader. Sits before screen almost 12-15 hours. I have made huge losses in couple of year. I don’t want to recover my losses, I left job 6 months back and trading full time. Atleast I want to cover my basic needs. I am not asking trading system. But needs something to turn my mind. I am doing mistakes – like 1. Quickly book profit

2. Do not use SL and never give up till expiry of last penny in hope market will be turn around in my hope direction.

3. Always fear to enter in trending market.

4. Always took trades in opposite of market trend in hope it will reverse back.

And so many like wise problems.

Hey Pravin,

You need an EDGE in the market and working on your psychology.

Check these posts out…

https://www.tradingwithrayner.com/trading-psychology-6-practical-tips-to-master-your-mind-and-money/

https://www.tradingwithrayner.com/profitable-trader/

Hi,

Do you keep a trading journal? That is your number 1 mentor. You can review your trades daily and journal a trading rule. Read your trading rules daily before you start your trading hours. You’ll be surprised at how much you can learn from yourself.

Dee

Hey Dee,

I’m glad to hear that!

It’s awesome Rayner.

Hey Peter,

You are most welcome!

Simple logic.. Seeing practically is reality.. Nice.

Hey Subramanian,

Thank you!

Than you soo much its Really Good examples , educative

Hey there,

You are most welcome!

Please I want to know how to get a SL price and TP price in trading. By the way I love everything you do…I appreciate it you great..

Hey Certice,

Check out this post…

https://www.tradingwithrayner.com/set-stoploss/

Awesome

Hey Fayaz,

Thank you!

Hi Tochukwu,

How is everything going with your trading with price action?

Feels like trading naked?

Dee

Hey Dee,

Hahaha. Good.

Cheers.

mr Rayner, i have been trying 2 apply the multiple T F analysis to my trading on H 1 for entry. it is possible am not doing it right but i do not know whats wrong.

Hey Kayode,

Check out this post…

https://www.tradingwithrayner.com/trading-multiple-timeframes/

Rayner, thank you, truly from my heart, so much gratitude for your wisdom. I’m a new trader (1 month), in the beginning I had some great success, but over the past couple of weeks I found myself chasing news, getting absorbed in news, and getting lost in my trades. I’m going to go back to trading what I see. Right now it seems like everyday the market as a whole is celebrating economic recover, and the next day contracting because of COVID. It’s an interesting time to be learning to trade.

Hey Micheal,

You are most welcome!

Check out the trading academy, it’s FREE

https://www.tradingwithrayner.com/academy/

Thank you for this info Rayner it helps a lot

Hey Ralph,

It’s my pleasure!

Very nice sir

Great explain bhai (LOL)

This is very good instruction. I have been following the news and I agree sometimes it doesn’t influence the direction of the stock. Sometimes price increases with no news at all which is always puzzling. Thanks for your perspective.

Thanks Rayner, an excellent piece of a practical tutorial.

Hi Nigel,

You are most welcome!

I think this makes sence … i Rayner U are the best

Awesome, Takundanashe.

Thank you. As a new trader, I am learning a lot from you. May you continue to gain hugely as you serve to others.

Hi Ishakanta,

You are most welcome!

Rayner Rayner Rayner, you are such a gem in our time. You have made Forex trading very simple to understand. I am your unknown best friend for life.

Hi Jasper,

Thank you!

Bushido Trader

Thank you for your help

Hi Paul,

You are most welcome!

Thanks Raynor, very good content.

Hi Sparks,

You are most welcome!

Hi bro, you are amazing,

I hope there will be another chapter about this price action trader, can you please explain more what I should learn to be a price action trader? You just explained the reason behind it.

Btw are you trading base on Daily chart? because you mostly explain with Daily chart, so I guess you hold your entry position for days till it hit the target, am I right?

I have a difficulty as a beginner, trading Daily chart require a bigger account. Can you please explain how to day trade (in and out in the same day)?

Thank you so much, GBU

you are unbelievable…and give me hope….i was going to throw in the towel this weekend ….but after reading you email…i will have one more go at the markets..

Thanks a lot Sir, now you’ve given me more courage to work harder as a price action trader and your insights has been helpful

Hi Vincent,

I’m glad to hear that!

Goodluck.

Informative, eye opener & helpful

Hi Damien,

Thank you!

Hey Rayner..,

Thanks for the video. Crystal clear.

Hi Bharath,

You are most welcome!

Youre the Beeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeeest

Hi Ebenezer,

Consistency would take you to greater heights.

Cheers.

great ! info for all traders

Thank you for this! It makes so much sense because there are people always looking for service signals and it has been failing them over time. Thank you again. Look forward to the next video and lesson

Hi Peedee,

You are most welcome!

I THINK I AM A PRICE ACTION TRADER.THANKS BRO

Hi Wilson,

I’m glad to hear that!

Thanks Rayner, sincerely I have been following your training materials and I have learnt a lot. I am not blowing account anymore and I hope to turn profitable soon. I have been referring my friends to your site.

Thanks

Hi Anthony,

Nice having you around!

Cheers

Excellent!

Hi Finsaam,

Thank you!

Wawoo wonderful thank you so much. Didn’t know anything about trading, but now l believe l can place a trade.

Hi Sibongile,

I’m so glad to hear that!

Nice one. Very interesting. Just for me to familiarized with the lesson

Hi Sunday,

You are welcome!

Nice tutorial, I got more knowledge about price action from here.

Hi Legacy,

I’m glad to hear that!

Interesting yet very simple to digest. Just one question what is the timeframe you look at to identify the long term trend in the examples shown by you.

Hi Surya,

Rayner’s teaching is mostly on the Daily and H4 timeframes.

I’m surely in control by ignoring the news and less pay attention to indicators..you enlightened me…thank you R!!.. I can’t wait for the next take in.!!

Hi Gift,

I’m just so glad to hear that!

Educative

Hi Phyl,

You are most welcome!

That’s makes sense to me, look forward to the next video

Hi Quentin,

Thank you very much!

Good job, thanks

Hi Solomon,

You are most welcome!

You are a true teacher man

I am from India love you

Hi Ankit,

Thank you!

Excellent explanation. thank you

Hi Mario,

You are most welcome!

Very nice tricks

Hi Jayanta,

Thank you!

Thank you for this email, Mr. Teo! I am now making small trades. I notice I still get out too early, but making a little money.

Hi Laura,

I’m so glad to hear that!

Excellent Explanation! You made the case for Price Action.

Hi Richard,

Thank you!

I like it. Less stress, less confusion. Less complication

Hi Adebisi,

I’m glad!

Cheers.

Hi… its fantastic add on my journey as biggener in forex trading. I hope to absorbed it and control into consistent profitable trader.

Thank you and i wish you the best.

Hi Joseph,

You are welcome!

For identifying trend should we consider latest Higher High, Higher lows or Lower High Lower Low or we need to look at the entire short because I can see both it looks like both uptrend and downtrend.

Hi Ravivarma,

Check out this post…

https://www.tradingwithrayner.com/200-day-moving-average/

https://www.tradingwithrayner.com/50-day-moving-average/

Cheers.

But why do videos about indicators then only tell me to be a price action trader, I could stick to one thing and work on that

Hi Pule,

Indicators are for confirmation, combined with price actions gives you a clearer picture.

Cheers…

Thank you, Rayner, for the insight. Are the same principles applicable in day trading?

Hi Tar,

Yes, You are most welcome!

this is really helpful i, m waiting for the next video . thanks

Hi Ankur,

Thank you!

Thanks Rayner. That’s amazing ,,

Hi Daff,

You are most welcome!

Thank man God bless your teachings are every solid and clear thanks for sharing and caring am on my way to be a better profitable trader all thanks to you

Hi Tafadzwa,

Thank you!

Cheers…

Well emphasized…thanks a lot.

Hi JC,

You are welcome!

Cheers…

Great article.Keep it up.Thank you.

Hi Parasbhai,

You are most welcome!

When determining the trend of the market, what timeframe do we use?

Hi BP,

Higher timeframe Weekly/Daily.

Yooo man rayner i have been predicting what the market will do amd many times it turns out am wrong but ….with what you just taught me it’s just so super bazukaaaaa

Hi Tefolicius,

I’m glad to hear that!

Cheers…

The idea is perfect.

Hi Franklin,

Thank you!

Very enlightening…. will try to implement this knowledge to practice…

Hi Michael,

Thank you!

Cheers…

Hey Raynor I’ve been price action trading for a bit now and I still noticed the market going against me no matter what I do. As a result I tend to abandon good trading habits (as they don’t seem to work for me) and trade emotionally. Chasing parabolic moves etc which we know is a no no. I always suffer has a result. Is there anything u think ohhh help with having a better entry or maybe picking the right pair at the right time. I’m tired of losing money. My account is bleeding. Best regards your friend, Free

Hi Free,

Check this post out…

https://www.tradingwithrayner.com/profitable-trader/

thanks rayner for additional knowledge. you are such a gifted guy.

Hi D’llema,

You are most welcome!

I appreciate you subject sir.. I would like to follow you more and more..

Thanks so much..

From Tanzania

Hi Nelson,

You are most welcome!

Ever since i followed your YouTube channels and your blogs. my trading skills have improved a lot. My trading accounts are a proof of that. Well said, im never going to rely to anyone. Thank you

Hi Lwando,

I’m so happy for you!

I want you to know you are the best teacher ever. I hope I can meet you one day. I love your method of teaching Thank you sooooo much.

Hi Pat,

I’m so glad to hear that!

Very usefull

Hi Rajendra,

Thank you!

I am amazed at all your knowledge and to share it as you do is just great. Thanks.Keith

Hi Keith,

You are most welcome!

Hey Rayner,

This is so enlightening, thanks for all the efforts you put into tutoring and mentoring, it does not go unappreciated.

Kind Regards

Hi Temitope,

I’m so glad to hear that!

Hi, great video . very much eager to see your next video….

Hi Anant,

Thank you!

I think important to know about foundation for Price Action Trading especially Framwork(Fundamental), Concept(Various Ideas & Applications) and Tools(,Proper Usage & Understanding)

Hi Ungku,

Thank you!

As always, very informative, easy to understand, helpful. More power to you Rayner and your team. Thank you for sharing your knowledge!

Hi Perci,

You are most welcome!

Raynor, thank you very much I have learned more from you in 2 weeks than I have in years paying so called experts. You are a inspiration.

Hi Graham,

It’s my pleasure to see you succeed!

Cheers…

Excellent thanks Rayner, highly appreciated. How much time do u think is need to master these learnings and then be disciplined: that is where lies the key! But I see no crystal ball, that is why the price action technology seems to be the best approach. I would appreciate if you can list down steps that a newbie needs to know for riding the ladder of this great journey of money making!

Hi Tahir,

Check out the trading academy, it’s FREE!

https://www.tradingwithrayner.com/academy/

As a new trader in the forex markets, I’m beginning to learn a lot regarding price action. Your tutorials are very helpful for me as a beginner.

Hi Nickson,

I’m so glad to hear that!

Cheers…

Its very useful information for any trader. We would like to know how to enter and exit with strategy. please advise

Thanks.. this is wonderful.. This gives a good idea overal, but i believe News does play an important role.. This might not be applicable to Stock news like TSLA split and AAPL split..

Hi Rayner, thanks for the succinct presentation on price action trading. Sounds like a useful method. Only way to find out is to find out for myself 🙂

Hi Sy,

Glad to hear that form you!

Cheers…

your doing the one of the best thing in the world which is sharing your knowledge keep doing good bless your eagerly waiting for your next video…

Hi Ganesh,

You are most welcome!

Thanks very much. I have been following you as a beginner not long ago and you’re helping me a lot .

Hi Daniel,

I’m glad to hear that!

I feel iam lucky that I ran into you. This Price Action Trading which you are explaining about seems to be very down to earth, understandable and with practice and familiarisation can develop my ability to be in sync with market moves.

However I have one question, as price action focuses on the current market condition, how confidently can I assume that what I buy i can keep it till my intended target is touched?

thankyou lynar

Hi Ken,

You are welcome.

Cheers!

Fantastic presentation as always.

Completely agreed & experiencing as you have put it in your video.

Thanks a lot.

Shrirang

Hi Shrirang,

You are most welcome!

Cheers…

Thank you for your lesson. You make the lesson very simple and easy to understand.

Hi Diane,

You are most welcome!

Cheers…

Thank you very much. Because I really do prefer videos they are easier to understand.

Hi Dimpho,

You are welcome!

Thanks Rayner…i will apply this …

Hi Rodel,

Good luck!

Cheers…

Great explanation. Very helpfull

Hi Erwin,

You are most welcome!

Cheers…

Thanks for this explanation. Good insights and will try it out. Great job putting all these together Rayner.

Hi Andrew,

It’s my pleasure.

Thank you!

I am new to trading and this is my very first video of yours that I have seen .After watching your video I am likely to understand what actually trading is. I will sure gonna apply this Price Action technique. Thank you.

Hi Mohammed,

Check out the trading academy, it’s FREE!

https://www.tradingwithrayner.com/academy/

Cheers…

Nice concept. When I started watching ur videos ive let go of all indicators i now base my trading on price action. Pls we need more of this videos to better our knowledge

Hi Sadiq,

I’m so glad to hear that!

Cheers…

Very understandable, thank you very much

Hi Joel,

You are most welcome!

Yes trend is going sometimes I get confused with buying selling . I like to do better with fewer pairs. Are u on telegram how much u charge ..do we get clues to trade with you certain pairs ..

Hi Ken,

Join the telegram channel.

https://t.me/tradingwithrayner

Cheers…

Fantastic knowledge Sir Ji

Hi Dinesh,

You are most welcome!

Cheers.

That was Great Rayner

Simple and easy to understand

Keep going

Hi Medhat,

Thank you!

I am eagerly waiting for your next video

Hi Satya,

There are loads of it coming your way…

Cheers.

Thanks bro getting enlightened with your articles day by day. To earn we have add L before earn=learn

Hi KD,

I’m glad you understand that concept now!

Cheers.

Good stuff Rayner! Thank you so much….!

Hi Sushi,

You are most welcome!

Thanks alot Rayner!

Hi Brian,

You are most welcome!

Nice one Rayner.

I become a better trader just watching your videos and reading your books. May what ever you believe in bless you

Hi Arling,

I’m glad to hear that.

Amen to your prayer…

Thanks man. I like your materials. Trying to learn a lot.

Hi Tim,

Thank you.

Cheers…

My mentor told me to trade with MA and I noticed by myself that I always enter the market very late and in no time the market will reserve and I will loose alot of money Sometimes 100USD hoping for the chart to turn back appreciating but it all in vain.

Thank you very much bro for this wonderful insight.

I will now be a price action trader

Hi Awwal,

I’m glad to hear that. Your MA should act as a confirmation tool for trends.

Check this post out…

https://www.tradingwithrayner.com/moving-average-indicator-trading-strategy/

Thanks Rayner, I understand. What happens in the current market situation in India, where it seems the uptrend looks like it is running out of steam and the market may turn downwards? There is no downward move yet, so should one stay in cash and wait for a trend to appear?

THANKS RAYNER,AM IVAN FROM UGANDA AFRICA BUT LOVE YOUR VIDEOS,KEEP INSPIRING US

Hi Ivan,

Thank you so very much!

Cheers.

Interesting and would be very useful for trading.

Hi Razak,

I’m glad to hear that!

Wow….did not realised that is what I am and what I have been doing all along. A Price Action Trader.

Have no clues until lately about MA or MACD or RSI or BolingerBand….am just relying on uptrend and downtrend to buy or sell. Thanks Rayner….you put a perspective into my trading practices.

Hi there,

I’m glad to hear that!

Great as always Rayner. As traders we do need to be constantly reminded of these basics as we can all be compulsive at times (I have). Keep up your great service Rayner and thank you again for your invaluable advice.

Hi Peter,

You are most welcome.

Its crisp and clear. Easy to understand. thanks.

Hi Sanjeev,

You are most welcome!

Sir superb but can’t get how to enter exit

Hi K,

There are various ways for entry and exits, depending on your trading strategy.

Check out this video…

https://youtu.be/lxm4s11XyNo

Great, i use indicators but i’ll try price action

Hi Okey,

I’m glad to hear that!

Try to know the function of the indicators and complement it with price action for better results.

Cheers…

Thanks Rayner! Its a lot to sink in. Practicing the right way of doing it is the road to price action trading mastery.

Hi Hersey,

I’m so glad to hear that!

Cheers.

Great Explanation. I like your analysis

Hi Shyamal,

Thank you!

How to define stop loss in long trend if i want to exit with some profits

This is enlightening sir

Thanks God bless you more

Hi Samuel,

Thank you!

Thank you Rayner just bagged some pips today with this information.

Hi Chris,

I’m so glad to hear that!

Cheers.

Thanks again , I really want to trade price action on only day trade within opening secession , don’t like trade overnight. Still building good strategy for myself and collecting knowledge from all available sources.

Well noted all of your advice and thank you.

Soe Naing,

Hi Soe,

Thank you for your contribution!

Cheers.

Thank you dear.you are the real master.Can you send me some more price action charts for practice

Hi Deepesh,

You are most welcome.

Follow the telegram channel

https://t.me/tradingwithrayner.com

I am getting a confidence in my trading after viewing ur videos

Keep it up

Hi Jagdish,

I’m so glad to hear that!

Sir i need this book

Hi Ejiakor,

You can order for your copy through this link

https://priceactiontradingsecrets.com/

Thanks for your knowledge sharing..tell me is there a need to consider the spread before trading

Hi Nwanna,

You are most welcome!

Wow, I can’t wait for the next video please make it quick. And I deeply thank you for your time and skills you keep giving us. Guys this guy deserves a big applause. ( I do have one request though in the next video may you please tells us more about futures trading ? )

Thank you.

I enjoy your lectures always. this one is so easy to understand. thank you

Hi Grace,

I’m glad to hear that!

very informative I had a struggle on when to enter the market on time

Hi Philip,

I’m glad to hear that!

that was great tutorial, thank you for sharing

Hi there,

You are most welcome!

Very good advice.

Thank you

Hi Catherine,

You are welcome!

Hey Rayner,

Thank you for explaining the fundamentals of price action trading in an easy to understand way. Will wait for next article in this series. Appreciate your passion & sincerity in sharing knowledge of Price action trading for beginner’s like me. Have a wonderful day!

Hi Santosh,

You are most welcome!

Hi, I am Dilip from India, You are a very good teacher and you know why I am saying it? A good teacher is not only very knowledgeable in his area but he has the art of explaining the basics and concepts in a very simple way for the audiance or students to comprehend and understand easily. I see both these things in you, you are not just the expert of the subject you deal with but your articulation and simple methods to explain are exceptional. we look forward to continued inputs from you to enable us understand and excell in practicthank you so much sir

Dilip

Hi Dilip.

Thank you!

Thank you sir, for your kindness in sharing your knowledge about forex. I am grateful. May God will bless u with more wisdomand good health so u can help others too

Hi Glorivee,

You are most welcome,

Great lesson! Very detailed analysis!

Hi Dannie,

You are most welcome!

Quite a nice piece of article on price action. Am really learning a lot from you Rayner. Thanks a million!

Hi Sunny,

You are most welcome. I’m so glad to hear that!

Thanks a lot Ray I’ve been trading for a little under a year now and with your content I’ve become quite consistent I appreciate all the help you have given me.

HI Ashiv,

I’m so glad to hear that!

how to be confident when entering a position?

Thank you Sir for your valuable guidance. I am really learning a lot from you . Thank you

Hi Philip,

You are most welcome!

Hey Rayner, Thanks bro it’s my learning phase and it’s good to learn from you. Can you suggest me some good stuff to start with

Very productive and informative

Hi Priyesh,

Thank you!

Thank you very much. I pray that you begin teaching about technique analysis. You are good.

Hi Malika,

You are most welcome!

excellent, very useful

Hi Ajit,

You are most welcome!

Thank you so much Rayner for the information..it felt like you we’re talking to me about relying on someone’s else signals as I am very new to trading I have a mentor or someone who teaches us how to become better traders who sends us signals …but I feel like I need to Learn on my own to be in control of my own trades …Thanks again Sir

Hi Ntomboxolo,

I’m glad to hear from you!

Cheers.

Awesome

Hi Jag,

Thank you!

Great … awaiting the next lesson.

Hi Manbir,

You are welcome!

Cheers.

Wow Rayner, I am new in trading and looking to start. Your explanations are simple and understandable thank you

Hi Fezlie,

I’m glad to hear that!

Cheers

Thank you sir

Hi Nuri,

My pleasure!

I am a day trader and continued loosing money for 1 year. I Always failed in trading due to wrong prediction.

Its a new and unique post which seems link a morning star for me.

I will try this.

Thanks for giving a new idea

Hi Jay,

You are most welcome!

You are looking at historical data to prove your strategy. The actual proof is in predicting the correct entry & exit

Hi Rasheed,

Thank you for contributing.

I found this very comforting;

I had a stroke and couldn’t do my profession anymore to earn money, but I can attempt to trade. I was prepared to learn all the different indicators, but your short video tells me I don’t need to; which takes a lot of anxiety from me.

thank you!…I’ve ordered your book and look forward to reading it. my goal is £500 per month

marvellous

Hi Barrie,

You are most welcome.

Learn before you earn.

Cheers.

Eye-opening interpretation of price-action! As I said before, brilliant analysis.

Hi Ranganathan,

You are most welcome!

Cheers.

How best can you read a trend? Do you use a weekly, minute or monthly view to determine the trend? And which platform are you using it looks easy unlike what I use the background is black and candlesticks are both green for bullish and bearish.

Hi Geoffrey,

It’s best on a higher timeframe.

Check out this post.

https://www.tradingwithrayner.com/200-day-moving-average/

I am gonna use in my practice and master it

Hi Kgosana,

I’m glad to hear that!

Cheers.

How do I sign up for this program?

Hi Alix,

Check out this post.

https://priceactiontradingsecrets.com/

Cheers.

Pls when is your next video coming….

I would lobe to watch it…..today’s own was really helpful Sammyerom8@gmail.com

In this video example you choose to buy in a down trend market , what’s the rational behind it ? How to find such deviations ?

Thank you so much for your great job Rayner .

The higher highs and lower lows I have understood . But what are the other factors of this concept? How can I recognize the moment to take action based on price action strategy?

Thank you Rayner .

Please explain and show much more precise what do mean by price action trading since this topic is very compact for my mind.

100% helpful. Thanks a bunch!

Hi Elizabeth,

It’s my pleasure.

Cheers.

am just a month old in the trade but i get the impression am in the right place

Hi Denis,

I’m glad to hear that!

Cheers.

thanks allot

Hi Denis,

You are welcome!

Cheers.

igonor the news … i thought we have to observed the news cause somethings the bad new in he country such as covid-19 spreading in their country … is that that time the money of that country going down?

regards from Andy Lam

AndyLam2000@yahoo.com

Hi what is best time frame to use please?

Hi Mike,

There are always trading opportunities in every time frame.

Learn to use multiple timeframe analysis.

https://www.tradingwithrayner.com/trading-multiple-timeframes/

thanx. waiting for next part

Thank you so much for this precious information on Price Action.

I would request you to keep sharing information on Price Action to make this perfect and become a successful trader. Thank you so much.

Thank you! Prashant.

Hi, as you said, when a market is in a range, we need to know when to enter and exit.

but how do u know that it is on a up trend. (wrt to 2nd last figure)

It’s difficult to see without MA to trade can u teach me how?

bro thanks for this. ur just amazing. hope we get the same info in 2.

I think the concept is really great can’t wait for the next video. Thanks

Hi Wesley,

You are most welcome!

Hello Ryner

when you are skeptical about taking a trade when the market structure tells you to do so

in other wards how many higher high and higher lower you need to defined the market structure

I believe this principle of Price Action Trading will be applicable to Stock Trading as well.

Thanks lot

Thank you, i really enjoy it, i also like the first point “Trade what you see and not what you think” thanks

love it

You’re the best Rayner!

Hi Rayner,

Thanks for this. I am a big fan of price action trading.

I’ve looked at a number of your videos and wanted you to know that they have all been very helpful, easy to understand and have improved my trading.

Just one question though…..

Is it important to know when the major news events are happening. To avoid placing trades during these events that can cause high volatility or slippage?

U are great

Thank you, Eytan!

i have gained alot from this piece. Thank you sir for the in-depth insight

Dan, I’m glad to hear that!

Hello am realy bless by your efforts bought on facebook, youtube twitter concerning trading but i really need more knowledge on trading i done mine if you can be my mentor please

You are the best i realy don’t know how to thank you but my God would surely bless u

Hi Platini,

You are welcome!

Cheers.

You got me thinking…

Great content.

Thank you, Jaanii.

I really enjoyed the lecture. From now on I will trade without fully depending on fundamental.

Thank you so much.

Be blessed.

Glad to hear that, Godwin!

Thank you very much for such great content

Thank you, Treasure!

How would you u scan for these opportunities using trading view?

Very Great Trading Tools as always Ryner,My question is how to tell that market condition is about to change by only using price action Strategy