So…

In my earlier posts, you’ve learned why trading indicators, fundamentals news, and signal services actually hurt your trading results.

Then, we discussed the power of price action trading and what it can do for you.

In case you missed it, here it is…

Why Most Traders Fail And How You Can Avoid It

Now:

Unlike what you’ve seen on the internet, trading forums, or from trading books, price action trading is not what you think.

It’s more than just trading Engulfing pattern, Hammer, Support & Resistance, and etc.

Instead…

Price action trading is about reading what the market is doing, so you can use the correct trading strategy in the right market condition.

Now if you want to learn how to be a real price action trader, then today’s lesson is for you.

You’ll discover:

- How to identify high probability breakouts trades (and avoid false breakouts)

- How to tell when Support will break so you don’t get caught on the wrong side of the move

- Why your stop-loss always gets eaten and what you can do about it

- How to profit from “trapped” traders

- And much more…

Are you ready?

Then let’s begin…

#1: The SECRET to trading breakouts like a pro

Trade breakouts with buildup.

You’re probably wondering:

“What is buildup?”

A build-up is a tight consolidation otherwise known as volatility contraction.

And the location where a buildup occurs gives you a BIG clue to where the market is likely to breakout.

For example, if there’s a buildup formed at Resistance, the market is likely to breakout higher.

Let me explain…

You know Resistance is an area to short the markets (after all the textbook says buy Support and sell Resistance).

But what if you go short Resistance and the price is still hovering at that area.

What does it tell you?

To an amateur price action trader, they will think Resistance is getting stronger as the price fails to break above it.

But…

To the seasoned price action trader, this is a sign of strength from the buyers.

Why?

Because if there is a strong selling pressure, the price should move quickly away from Resistance.

The fact that price is still at Resistance is telling you there are buyers willing to buy at higher prices — and that’s a sign of strength.

And that’s not all…

When the price breaks above Resistance, it will trigger a cluster of stop-loss (from traders who are short) which fuels buying pressure.

Plus, breakout traders will long the break of the highs which adds even more, strength to the move.

An example:

So…

Whenever you see buildup form at Resistance, it’s likely the price will breakout higher (and vice versa for Support).

Continue reading…

#2: How to tell when Support will break so you don’t get caught on the WRONG side of the move

Old Rayner: “Oh look! The price is coming to Support, time to long this market.”

New Rayner: “Not so fast…”

Here’s the thing:

You don’t go long just because the price is at Support.

Why?

Because how the price approaches Support matters — a lot.

For example, if you see lower highs coming into Support, it’s a sign of weakness.

It tells you the sellers are willing to sell at lower prices and the buyers are unable to push price higher (than it did previously).

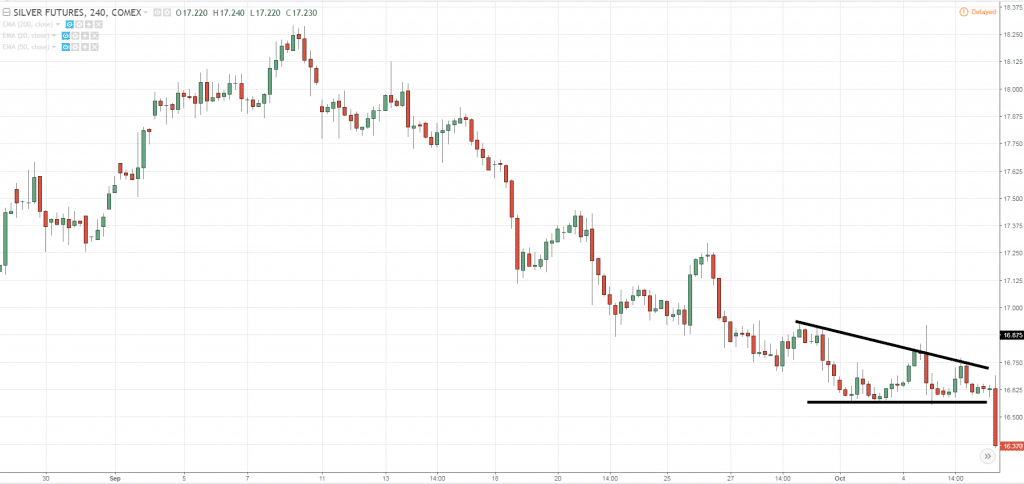

And this looks like a Descending Triangle on your chart:

Can you see the lower highs approaching Support?

That is a sign of weakness.

And more often than not, the price breaks down lower.

#3: Why most traders get stop hunted and how to AVOID it

Let me ask you…

Do you always get stopped out, only to see the market reverse back in your direction?

Well, that’s because you place your stop loss at the same level as everyone else, and this gives the smart money an incentive to hunt your stop loss.

So what can you do?

Simple.

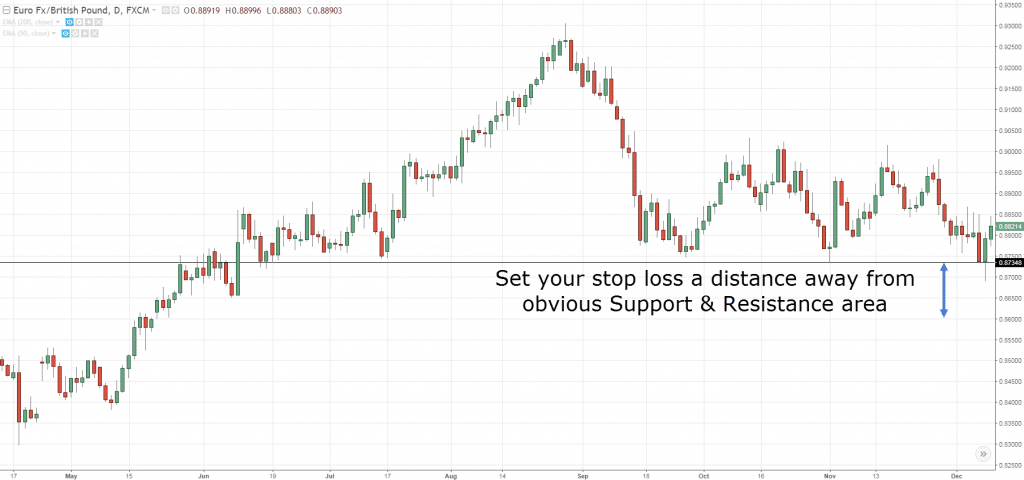

Don’t put your stop loss at an obvious level.

Now you’re probably wondering:

“So where should I set my stop loss?”

Well, the trick is this…

Identify the level on your chart where it’ll invalidate your trading setup — and give your stop loss a buffer away from the level.

Let me explain…

Most traders place their stop loss below Support and above Resistance (after all that’s what the textbooks and courses tell you to do).

But the problem with this is that’s where everyone else places their stop loss — which makes it easy for you to get stop hunted.

Instead, a better way is to set your stop loss a buffer away from Support and Resistance, away from the noise of the markets (or everyone else).

An example:

And this same concept applies to Trendline, moving average, and etc.

Read on…

#4: When is the best time to trade pullback (hint: when the trend just started)

A pullback is when the price temporarily moves against the trend. And this provides an opportunity for traders to get on board the trend.

In my experience, the best pullback is the first pullback after a breakout.

Here’s why…

When the market is in a long-term range, it will have to breakout eventually. And when it does, the breakout tends to be huge.

That’s why you hear… “The longer it range, the harder it breaks”.

Now when the market finally breaks out, traders who miss the move can’t wait to enter on the first sign of a pullback.

These pullbacks usually have shallow retracement as not many traders want to trade against the strong momentum.

And this offers a high probability pullback trade.

Here’s what I mean:

Now you’re wondering:

“How do I find such high probability pullback trades?”

Simple.

Just follow this 3 step process:

- Identify markets which are in a range

- Let the market breakout

- Trade the first pullback

Now let’s move on to my final hack…

#5: How to profit from “trapped” traders

Has this ever happened to you?

You noticed the market broke out of the highs and you think to yourself…

“This breakout is real. Just look at the HUGE bullish green candle.”

So, you immediately go long… hoping to catch a BIG move.

But shortly after you entered the trade, the market reverses in the opposite direction!

And it doesn’t take long before you get stopped out of your trade.

Here’s what I mean…

So, what just happened?

Well, this is what I call a False Breakout.

It’s when you trade a breakout only to get “trapped” and have the market reverse against you.

Now you’re probably wondering:

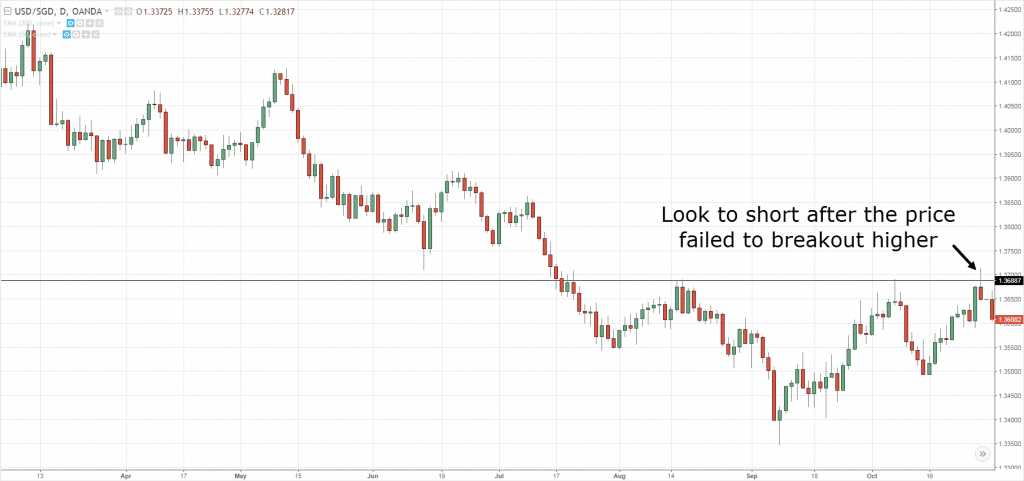

“How can I profit from the False Breakout?”

Here’s how:

- Identify the key Support and Resistance where traders will look to trade the breakout

- Wait for the breakout to fail when the price trades back into the range

- Trade in the direction of the False Breakout

Here’s an example:

So right now…

You’ve learned 5 powerful price action trading hacks that work (and it doesn’t involve Pinbars or Engulfing patterns).

With this knowledge, you can now better time your entries & exits in the markets.

Of course, there’s much more you can do if you want to improve your price action trading skill… far more than I can fit into one blog post.

That’s why I’m opening up the doors to my premium training program, The Ultimate Price Action Trader (UPAT).

It opens on 4th May, Tuesday, and is perfect for you if you want to learn how to become a consistently profitable trader, without relying on fancy indicators, fundamental news, or black-box algorithms.

So if you want to join The UPAT, then keep a lookout for my next email.

Excellent blog Rayner!

Thank you, Jan!

Since ive been following ur price action trading strategy… I am improvibg bit by bit…. Thank Rayner

Awesome!

I`m liking your TA techniques

Super!!!

cheers

best tekniks!

I appreciate it!

Hey my Guy thanks for sharing your trading knowledge it is much appreciated! Please share your 5 trading Patterns including the Head and Shoulders Pattern.

You can check out my blog for it. I’ve written a few guides on chart patterns.

THANKS TO YOUR EDUCATIONAL PROGRAMS. IT IS A BIG HELP TO THOSE TRADER WANT TO GAIN THEIR TRADING LIKE ME.

The pleasure is mine 🙂

Thank you Rayner!

You’re welcome, Jothy!

Awesome

cheers

Hi Rayner, thanks a lot for your blog here. Really helpful for me and I’m sure for other traders too. Keep up the great work Bro….

I’m happy to hear that!

Thanks for showing the better side of price action

You’re welcome.

1. Identify markets which are in a range……. please explain This further. I a newbee. Seeking to gain more knowledge before I get more serious drawdowns on my account.

Thanks so much for the knowledge shared. Because of it I am beginning to feel more comfortable in the trading market. I look forward to your reply.

A range market is where the highs and lows are contained “within a box”.

Thanks I understand I did further reading.

Regards

Ok best!

I love the insight. Thank you

Glad to hear that.

Great write up.. We are looking for price action with Volume analysis.. Can you pls add volume with in it..

I don’t use volume so I can’t comment on it…

Wow, thanks a lot Rayno

Welcome bud!

Thanks for giving clearity to price action, you simplified it.

Awesome!

Thanks for the most useful info Rayner…… one can even create some rules with help of this article….good stuff!

You’re welcome!

Perfect Knowledge…

Thanks…

Cheers

Would be great to see this working in Real Time?

You can watch my weekly market analysis where I use these trading principles over again.

Thanks for sharing!

Welcome!

Brother greetings from India. You said you dont buy on support just like that, how the price approaches Support matters, you showed a pic of lower highs.

Then can you clarify when to buy?

Should it be when it creates a higher high after hitting the support .

Thanks for your guidance.

Roy

You shouldn’t be looking to buy when you see lower highs into Support.

Look for short instead.

great work Ryan !

My pleasure!

Thanks

cheers

Thank you Rayner for sharing your experience and knowledge. I found your videos and blog about 2 months ago and already see an improvement in my trading.

One guestion I have, what do you think is the best way to tell if its a real breakout with a pullback compared to a fake breakout. If I wait for confirmation wont I miss the move or just set my risk at 1% and let the markets decide

No way to tell for sure, that’s why we have stops in place.

But identifying a buildup prior to breakout increase the odds of it.

Thank you for replying Rayner I look forward to your PATI course when available

Take care and happy trading

You’re welcome!

Im learning.. thanks

Awesome!

Hi Rayner, if your breakout is only refer to ranging? Does it also apply while steadily trending upwards (with higher high and higher low) and broke down below previous low.

You can also trade breakouts in strong trending markets.

#King of Forex….@Reyner Teo.

My King..

cheers

Great work Rayner! I agree wholeheartedly with # 3 and am already applying it. Thanks for the tips. Your explanations make a lot of sense.

Glad to hear that!

Just amazing!

Thank you!

How to be part of PATI?

Is it classroom or web based?

Fee?

Thanks

Hi Sunil

I’ll send an email out.

If you didn’t receive it, let me know.

cheers

Am few months old in trading, am hungry to learn and I have been following you on you tube. Thank you.

You’re welcome!

Hello Rayner, your blog is the most useful trading blog I’ve come across in my 6yrs of trading , thanks for all the resources . This is how I have recently started using price action , I use the 200 EMA as dynamic support and resistance and I make my decision based on price action in respect to the EMA level, so I watch to see if price will cross the 200 EMA or pullback from it , the response of price action to that level informs my trade decision .

Thank you for sharing!

Hi Rayner,

Thank you so much for providing very valuable informations.

I request you to write an article about Trader Affirmations’.

Thank you again.

Siva.

I’ll look into it, cheers.

Hi Rayner thank you so much for the incredible information you have given me. Because of you my trading has improved a lot. I would love to be part of your Trading Programme UPAT.

Hey Nita

I’ll update you when enrolment is open. cheers

Hi Rayner,

I’m a newbie in trading and this by far is the hest channel to learn from. Thanks a lot for sharing this knowledge.

God bless you!

Thank you, Byron.

I appreciate it.

Yet again Rayner your explanations are perfect !!

Thank you, Martin!

Thank you Rayner

You are during a great job

I appreciate it, Deborah.

Superb article, hi rayner is there a training program in which i can learn from you in sequence?

Hi Tahir

I’ll open The Ultimate Price Action Trader in a few days time.

If you’re on my email list, I’ll send an email and update you. cheers

Thank you Rayner

You are doing a great job

Cheers

Good job. Thank a lot

You’re welcome, Long.

Thanks man, lots of golden nuggets. Let me ask you, what makes you start to trade forex instead of stock market?

I started with Forex since it has more liquidity and a lower barrier to entry (in terms of capital size).

Very thankful for your insight, now gathering a wealth of knowledge from your blogs that are improving my trading experience.Keep it up sir for the good work to community, you such a blessing to me.

I’m glad to help, Martin.

thank you sir for your time and not being stringy with knowledge. realy appreciate sir. am following lots of your teaching but am still struggling with time frames, which time frame can you suggest that we can learn with the one that you know its appropriate when applying your teachings.

I usually trade off the 4hour and daily timeframe.

But the concepts can be applied across different timeframes (as long as there’s enough liquidity).

thanks rayner

Its really a new and handy way to trade, thanks Rayner

You’re welcome, Lucy!

Hi Rayner,

Just wanted to say thanks for sharing knowledge that you have built over years .

God Bless….Now i eagerly wait for your mails .

You’re welcome, Gurpreet!

Thank you for your support.

Thanks alot bro

honestly speaking ,

my understanding of price action is more and more better than was before ,

this is becouse of your simple and direct explanation.

Awesome to hear that, Khalil!

God bless you Rayner

Thank you, Mtemi.

thanks for sharing your knowledge

My pleasure!

Hey Rayner, As I starded to trade the first pullback after a breakout I started doing much better. Because when i’m entering the first pullback i’m very early on the trend and breakout has been confirmed. Thus it increases the odds of capturing a big trend.

Awesome to hear that!

Yes, the first pullback usually offers the greatest profit potential as it’s the “early” part of the trend.

Such a powerful information.

Thanks allot.

You’re welcome, Pranesh!

Hey Rayner, Thank you. It is now, I am beginning to understand little by little what I should look out for, though, it is still not easy when I am in the front of a real chart.

Take your time, baby steps. cheers

Hi Rayner,

Concerning the Buildup at Resistance advice that it will likely break through higher, what do you think about OMXS30’s recent Buildup at Resistance, it built up some weeks ago to 1677 but couldn’t break through 1680 , and it was it’s 2nd or 3rd attempt, and then it crashed, together with s&p 500 and DAX indexes. If it has tried more than 2 3 times, is there a variation of this Buildup at Resistance advice that should be applied instead?

Regards

Another variation of a buildup is the ascending triangle pattern.

Higher lows into Resistance is a sign of strength (and vice versa).

Please give a printing link(beside the sharing link) ,so that the whole matter is printed as a book.

I don’t have that.

May I know which time frame you are using for price action ? daily ?

I trade off the 4-hour and daily timeframe.

Hi Rayner,

I got a question under point #3. When you say “give your stop loss a buffer away”, how many pips should “a buffer” be ? Do you have a guideline ?

This will help… https://www.tradingwithrayner.com/use-atr-indicator-set-stoploss-2/

Thanks Rayner. Got it. 🙂

hello rayner

i am a follwer for you and i miss UPAT

i read the email late so how can i join

i get massage invalid request

Hi Wail

Enrolment is closed.

I’ll update you when it’s available again. cheers

Thank you so much for providing such highly valuable content in such a condensed way!

Hi Rayner,

Point #4. How to determine ‘shallow retracement’ at the first pullback? is there any specific fib level?

I don’t use Fibs, but generally, it shouldn’t exceed 50MA.

Thank you sir.but I would like to know what’s meant by stop hunted

This post will help… https://www.tradingwithrayner.com/stop-hunting/

Just started following your teachings and they are quite fascinating. Really love them.

Thanks for the good job.

Cheers Samuel

Yep. I definitely see the market differently now. And there is so much rest of mine too. Thanks Rayner

Glad to help!

THANK YOU RAYNER!

You’re welcome, Dennis!

I’m joel jmk from kenya and I really happy for these you are teaching it is truly if I follow that price action the way you teach me I see I can go far far far than the way I am and I will have for you keep it up and continue to help us please

Wow you are such a good mentor even though you don’t know me I am learning a lot from you I have improved on price chart analysis since I started following you big up my brother keep on doing great work may the Lord continue to increase and multiply you

From south Africa Lubabalo makalima

Nothing better than your blog posts. keep up the great work.

Thank you!

Hey Rayner. Great job. What if the false breakout candle is just more than one? I have seen take outs with three candle set. Thanks

That’s possible.

The key thing about false breakout is the price makes a strong reversal back into the range. It could take anywhere from 1 – 5 candles (or more).

Hi Rayner! Thank you for your Price Action Trading Hacks you taught me, my trading knowledge get better and more each an every time I read or listen to your teachings, my God bless you.

Glad to hear that!

Most grateful about the hacks, I now have a hint at the price Action strategies, thanks bro.

Cheers

Good insight to new ways to look at Price Action! Thanks for sharing your thoughts.

Cheers

I really enjoyed reading your blog & watched your training videos. Thanks for everything my friends day by day I’m making profit trading forex. Keep on doing it as your’re helping more traders out there becoming profitable traders!

Awesome to hear that!

Great article. Love your work and encouragement.

Thnx I Learnt Something New Which Is The Stop Hunt SL

Nice!

Excellent explanations, you see one permanently in the graphics but does not analyze it in that way and continues to empty the account, Like all your posts out of series, I imagine that when we involve chartist patterns and have an open mind to the global chart, ( always observing what the price does) our operations must improve substantially. Thank you Rayner.

Translated by Google

My pleasure, Hernando!

Hi, regarding #5 point 3 regarding false breakout, don’t you mean that a trade should be taken in the ‘opposite’ direction of the false breakout? e.g as in your chart example, if price breaks out higher but then pulls back into the lower range below resistance then you should look to place a ‘short’ trade. Therefore going ‘short’ would be the opposite direction of the false ‘upwards’ breakout.

I’d say the key is to understand the message instead of getting caught up with the exact words to describe. You got my concept right.

i love the way how u explained the charts, make me understand more on price action.

Awesome to hear that!

Hi rayner, please it be very good if you made payment for the UPAT available in variety of methods accessible by most people, like e-wallet thanks

Yes price action works… Well explained… Thank you

My pleasure!

Super

Cheers

Insightfull lessons Rayner! THANK YOU !!!

Reggie

My pleasure!

Thanks sir.

You’re welcome!

As always, Rayner’s presentation is highly useful content.

Cheers

Super…….. Rayner, you are the best. Have learned alot from your blogs and YouTube videos. But just out of curiosity, can these strategies and lessons be applied to binary trading? Thanks

I don’t trade binary so I can’t comment on it.

Yes price action trading is good but what can one do about some false candle pattern like fake hammer etc

Thanks Ray, it’s been a wonderful experience reading your material. Quite understandable. I can now see the market as my hunting field. Those analysis are real.

Real nice!

Anyone who takes the time to share as much information as you do is definitely blessed. It’s much appreciated.

My pleasure!

Wow!!! Sure I do see the market differently now

Nice!

Hi bro,simply marvelous.ur teaching is simple.i follow plain naked charts to trade now and it works wonders.thanks and highly appreciate your efforts.

Cheers

Rayner you are just awesome with this new knowledge of price action. am now seeing the market in difference light. This simply implies that one should not throw all his weight behind all the moving averages and all the oscillators of this world. Teacher([instructor) i wish to appreciate your efforts, thanks.

Cheers

Damn bro. ur the best. I have learned so much from u. Sinds watching ur vids, ive stopped using many indicators. Clean charts makes it so much easier to trade tbh. Thanks again.

Awesome to know that!

You have really widened my view of the market. Its huge knowledge from you bro. Thanks and may God bless you. Gracious

Awesome!

Thanks Rayner for this great insight. Yes indeed l do see the market differently. Hope to learn more from your blog on price action trading.

You’re welcome!

Evritym i read wth ur guides my knowledge keeps on widening

I’m happy to hear that!

Yes sir, I want to join your The UTPA courses. Please help me sir because I lost my all money.

price action is the way to go thanks for sharing i want learn more

Glad to help!

Thanks for the 5 tips of price action trading. It helps me a lot as a newbie in this field. Those guide will surely win win solution for me! Thanks!

Awesome, let me know how it works out for you! 🙂

simple words SIR RAYNE, Thank you n be blessed

Cheers bud

I’m a newbie to FCPO trading and will definitely try UPAT

Excellent Sir.The mail came at 3:30pm IST.Market will be closed at that time .Today i saw one stock named India bulls housing finance.I was wondering why my indicators arent working.Today the stock gave multiple breakouts.Now i understood the power of price action trading

The article talks about the entry point? How about the exit point?

Check this out… https://www.tradingwithrayner.com/stop-loss-order/

Its wonderful experience reading your posts and watching videos on YouTube… I learnt a lot from you…

Appreciate your hard work and support to small traders…

You’re welcome!

Thanks Rayner. Excellent article.

Thank you!

Rayner, thanks a lot, I appreciate you.

Thank you!

Thank you Rayner for the eye opener

Glad to hear that!

Great teaching. Real eye-opener to FX trading. Well-done Rayner.

Thanks bud!

Thanks for your generosity in sharing your knowledge in trading Rayner.

I have learnt a lot from you Rayner. Thank you.

My pleasure, Phil!

Very Brilliant Idea Rayner!!

Thank you, Zakir!

You are a great teacher and you know what you are teaching. Keep helping us who are still behind you.

Glad to help out!

Sounds interesting and exciting. I’m looking forward to making a kill with the strategy as a new trader

Learnt a lot, keep doing the good work thanks

My pleasure!

Good.it is logical

I can resonate with this! Thanks for sharing 🙂

My pleasure!

Thank you Mr. Rayner,

I have not begone trading yet. I am more comfortable about what a chart is telling me , because of your guidance. I expect to begin in a couple more weeks. What I need to find now is access to something that will allow me to scan the charts. So I can start selecting non-irratice price lines. Thank you so much.

Scott.

Yes Rayner you’ve helped me a lot from this past 7 to 8 weeks I started watching your YouTube videos and studying both of your books…. But am still ready to learn more… I don’t get tired of this knowledge you share with us day by day.. Thanks a lot…. May to good lord bless you and see many more years.

Thank you for your support, Lawless!

what a good move, Rayner.

Good post , picked up a lot of valuable information that I shell look out for ,

Thanks.

Cheers Russell!

Its absolutely different now ,I had spent my time reading books about buy support ,selling resistance and candlesticks but hey this different.

Hope it helps!

Thanks Reyan sir

My pleasure!

thanks man , i appreciate the efforts , god bless !

Cheers

In tip 5 – isn’t the punch line to trade in the opposite direction of the false breakout (not the SAME direction of the false breakout)? A typo? Or am I missing a key point? Thanks.

You are considered to be a very good coach at your age. I will pay you a visit when I come to Singapore.

I will recommend my friends in Indonesia to learn professional trading from you.

Wow! It’s such a joy to have more insight on price action.

Thanks brother,, am grateful for the knowledge have received.

My pleasure!

You are the best man!

Cheers

Good material

Cheers

Hi, on #5 – how do you differentiate whether it is real or false break-out?… bcos if you were anticipating for break-out and it does happen, then you go in the direction of actual break-out… but detecting the false-break out requires to wait whether the break-out holds or not… so does it mean that you never play the initial break-out from the build-up?… thanks!

Broh price action trading hacker really working thanks for help me find the better signals recycle resistance or support

You’re welcome!

I feel lyk laughing at myself Mr Rayner,am sitting in front of the screen as am reading your mail and all u said is happening right in front of my eyes,thank u so much Rayner for opening my eyes into your very effective strategies.

You’re welcome, glad to help!

Just wanna say thanks, for sharing with us your trading hacks. I personally appreciate! I just love the way you break things down in Your teachings. Thanks plenty.

can you plz talk about PinBars!

I wrote about it. Here you go… https://www.tradingwithrayner.com/pinbar-trading-strategy/

Thank you so much Rayner. Youve corrected my psychology when it comes to build ups and breakouts at resistance. I always thought the more price hit resistance, that it meant its all coming down, and id get into a loss and not know why. Now I know, when price continually hits resistance severally its more likely to blow through it. Crucial lesson. Thanks.

My pleasure!

Thanks a lot for sharing these. Please keep enlightening us. Cheers.

My pleasure!

Excellent blogs, very simple to understand and logical. Just got into trading and wanting to learn more. I hope to be your new student.

thanks much Raynor for your lectures. I’m getting more and more enlightened. pliz send me more..

Will do!

This price action lessons have helped me a lot and still do.I not oblivious to what’s happening in the market and I make profits here and there.

Nice, thanks for sharing!

Elaborated and Simple Trading Strategies! Illustrated with Unique Trading Platform samples.

that’s great thank you for this..

My pleasure!

There is a lot I didn’t know about price action. I was one of the people who was chasing the market even enter when I see a big candle stick,in your language the energy has already been realesed

Well it’s never too late to learn, cheers.

Did not fully understood the point no.

#5: How to profit from “trapped” traders?

Would you please elaborate more or guide me to the “guide” from where I can understand it.

Hi rayner, i’ve lost my lot of money. Totally i wexed but nw u opened my eyes little bit.. i hope u will train me coming days..

Hi Rayner

I have been trading with success for 10 years.

In the early days I did attend a couple of expensive ‘training courses’.

You are doing a great job educating and helping newbies to avoid the ‘snake oil’ salesmen that seem to be out in force during the current climate.

I have enjoyed your videos on youtube.

Good health to you and your very fortunate followers

John

Glad to help out, John!

Its a very good article… I’ve learned something…

Glad to hear that!

You nailed it Rayner

Cheers

I really enjoyed it. It broadens my understanding of how the market works.

Awesome to hear that!

Really Great

Many thanks Surya!

A wonderful insight. The difference is clear.

Thank you, Rayner.

Hey Nsukaba,

You are most welcome!

Cheers

Thanks sir,

you’re really great Boss

Hi Monirul,

I’m glad to hear that!

Cheers.

Yes, I do see the market differently with price action, I want to learn price action strategies

Hi R,

Check out the blog…

https://www.tradingwithrayner.com/category/blog/

superb! informative.. keep on sharing and thanks a lot..

Hi Medz,

You are most welcome!

You improved my trading Rayner. Thank you

Hi Christopher,

I’m glad to hear that!

I like price action trading than any other strategy. It tells you what is happening not what you think. Thank you Rayner.

God bless you.

Hi Peter,

You are most welcome!

Yes

Very interesting!

Hi Walter,

Thank you!

Great reading Rayner

Hi Mukesh,

You are most welcome!

Using your price action theory in a range set up I had 5 out of 6 successful trades this week!

Hi Randall,

I’m so glad to hear that!

Thumbs up.

Cheers.

Thanks sir

Hi Saikrishna,

You are welcome!

Cheers.

The information provided was very helpful im looking forward to see a huge improvement in my trading analysis…Thank you so much for your generosity and knowledge

Hi Lizwelakhe,

Thank you very much!

Cheers.

With my limited knowledge on price action, GameStop been rolling higher with hope of a short squeeze, been up a few days in a row until this Friday . Trying to put this price action into play.

Hi Yen,

Nice one.

Cheers.

Price action does seem to be the answer to profitable trading for me. My indicators often contradict one another and others put me into a trade too late. I am very interested in learning your PA strategies. Please let me know when you are opening up your course.

Thanks, TommyD

Hi Tommy,

I’m glad to hear that. You will be notified via email for the courses.

Cheers.

Thanks Rayner. I will love to hear more from you about more strategies. Love from Nigeria

#Reform Nigeria#

Hi Bede,

You are most welcome!

Cheers.

Hi Ray, this Rocco from NY. I am new to trading and my basic knowledge is in Forex. I would like to thank you for all the knowledge you’ve shared I am truly grateful…Thanks a Million…

Hi Rocco,

You are most welcome!

Check out the trading academy.

https://www.tradingwithrayner.com/academy/

Great info my friend

Hi Sheldon,

You are welcome!

Thank for a very nice topic!

Hi Suy,

It’s my pleasure!

Cheers.

your TA will work for all regions.Thanks for sharing the knowledge.

Hi Sch,

You are most welcome!

Valuable information , I love your price action strategies . Am growing my skill

Yes I it deferrently Thax alot

Your blogs are simple yet powerful

I love it!

Excellent, JOB thanks for sharing to as

Thanks for the priceless lesson. I will always refer to it in the course of my trading. Gradually I am making some progress thanks to your simple but effective lessons.

You are great!

simplyfying the entry without getting stopped out

Great stuff! Thanks.

Rayner thank you for very valuable information as always

Thanks a lot Rainer for this god bless you..

i think today with this article I could understand the real price action definition… Thanks Ryner bro

Hopefully Price action is the grand strategy

Thanks rayner, hopefully Price action is the grand strategy

Yes. I see a great difference. I learnt many things and I saw what lagging by my eyes from your example of the two SMAs.

Yes

Thanks a lot, have learned a lot from you bro.and am sure it’s not only me

This article is spot on and I have managed to identify many of my mistakes. One is that I jump when I see the big green candle. I don’t wait for the pull back and have often been trapped. The other is getting stopped out only to see the stock go in the direction I was hoping for so quick that I don’t even have time to re-enter the trade. Thank you!

I do see it different I feel like sometimes I rush my trade gotta work on that

There’s 2 things that made me progress in my trading approach : Rayner and Fibonacci. (2 guys in fact)

What about fibos Rayner? Do you use it sometimes? I don’t remember hearing you about it?

Very useful information …It will surely help.

Rayner is a wonderful and most trusted teacher in forex trade. I was one of his students last year before I dropped out. Warming up to join his UPAT God willing.

kudos, my brother. thanks for eyes opener, how many trade and setup, do you entered in a day,week,month ,even in a year? what about does that have smaller account. on your ebook you said for forex to paid you every month you have to use the law of large number. can use smaller amount in year and earn profit every month? thanks for knowledge, may god almighty bless you and your household.

Wonderful insights to apply . Thanks my friend Rayner

Another “Ah ha!” moment for me…Thanks Rayner!

Yes, Reyner, with your insights on Price Action, I’m able to look at market differently..it’s amazing… your strategies are invaluable.. your knowledge is based on experience rather than bookish…. thanks for invaluable stuf on PAT !

You the man…

I generally take appropriate positions at support / resistance area as the price comes there ,without waiting to see if it is holding but keeping appropriate stop loss.

Observed that movements at this areas are so quick that if I wait to see whether it is holding, I have to buy it at much higher level.

As a day trader it has helped me to trade as explained above. If my stop loss is x amount, generally I earned more than 2x amount when in profit. After taking the position if it is not moving as expected, can always close the position taking taking some losses.

It’s a very useful tip Rayner.

I have lost lots of money buy following indicators movement.. so after that I haven’t started tarding . Since than m applying ur techniques. So far its so good.. hopping to start ah real account trading.. thankyou

I’m much more confident in reading charts and predicting the next market move, finally feel highly motivated to start trading on a real account thanks Rayner ❤️

doing commendable jobs and appreciate your selfless effort GOD bless you with great health and wealth thx.

Hi Anil,

Thank you!

God bless you too.

I’ve been learning for the last five months. Tried everything from robots to every indicator and strategy out there (ok, I exaggerate slightly) so now I’m learning price action. As soon as I feel confident and I’m making consistent demo money, then I’ll start to live trade again. Yes two weeks after opening my first ever demo account having never even heard of trading, I stuck in a grand and promptly lost it. Woe is me.

Hi Steve,

I’m glad to hear that!

Oh yeah, I have a better understanding what price action is.

I’ve got all wrong for a long time. Thanks rayner

Hi Emmanuel,

I’m glad to hear that!

Very interesting and inspiring stuff. As always from you, Rayner. Now it needs more practical details and examples of how to do it. Thanks a lot, Rayner.

Hi Stefan,

You are most welcome!

Price action is the king.

The knowledge that you give us in trading is priceless. Thank you Rayner

Hi Ameen,

You are welcome!

Wow Rayner, I absolutely loved to read this PAT. It cleared my doubts. You’re the one

Hi George,

I’m glad to hear that!

Cheers.

Tons of useful knowledge in Your blog and youtube videos. Well done Rayner! Keep it up! I see market now with a different approach and all that candles start speaking to me! 🙂

Hi Pawel,

I’m happy to know that!

Listening to you has given me a different perspective to the market. I think this will greatly affect my trading decisions.

Hi Osu,

You are most welcome!

The explanation is very detailed and cleared, but still cannot put it into practice because am still

a learner and I will like to participate in ur complete forex training paid class .Thanks

Hi Ojo,

I’ll be glad to have you in the trading classes.

Cheers.

Yes, which is reassuring.

Really… Thanks for this!

Hi Olumide,

You are most welcome!

Cheers.

thanks for additional learnings, rayner.

Hi D’llema,

You are most welcome!

Your teaching about the support and resistance is very understandable.

Hi Tuesday,

I’m glad to hear that!

Cheers.

A very big thanks to you Rayner for changing my trading life.

You make price action strategy look so simple for me. Thanks for the good work