What is Forex trading and how does it work?

Forex trading refers to the buying and selling of different currencies — so you can profit from the difference.

(It’s like Stock trading but, you’re dealing with currencies instead.)

For example:

If you feel the Malaysian Ringgit is “cheap”, you can short SGD/MYR (this means you sell Singapore Dollar and buy Malaysian Ringgit).

If you want more details, check out this free Forex trading course.

So, what are the advantages of Forex trading?

Enter and exit trades easily – Forex is the largest market in the world with over $5,000,000,000,000 traded each day. That’s Trillion with a “T” This means you can enter and exit positions easily with minimal slippage.

Low barrier to entry – Most Forex broker allows you to open an account with as little as $100.

Better risk management – You can trade micro-lots which allows you to better manage your risk. And unlike Stocks, the Forex market seldom has gaps which mean you will rarely lose more than intended.

Trade anytime you want – The Forex market is open 24/5. This means you can place your trades anytime from Sunday around 5 pm EST to Friday around 4 pm EST (depending on daylight savings).

Low transaction cost – Unlike Stocks, most brokers don’t charge you a transaction cost. You only pay for the spread.

Moving on to Forex Singapore…

Forex trading hours in Singapore time

Although the Forex market is open 24 hours a day, it behaves differently during different sessions.

You’ve got Australian session, Tokyo session, London session, and New York session — and these 4 sessions start and end at different times.

So, here are the start and end time for each session (in Singapore time) …

Summer period (October to March):

- Australian session: 6 am to 3 pm

- Tokyo session: 7 am to 4 pm

- London session: 3 pm to 12 am

- New York session: 8 pm to 5 am

Winter period (March to October):

- Australian session: 5 am to 2 pm

- Tokyo session: 7 am to 4 pm

- London session: 4 pm to 1 am

- New York session: 9 pm to 6 am

When is the best time to trade Forex in Singapore?

If you’re an intraday trader (trading below the 1-hour timeframe), then the best time to trade Forex is during the London session.

Because the London session is the time the Forex market move the most (which means you get more trading opportunities).

(Source: Oanda)

However, if you’re a longer-term trader, then there’s no best time to trade Forex because your trades would last days or even weeks, and the time you enter/exit your trades don’t matter at all.

Next…

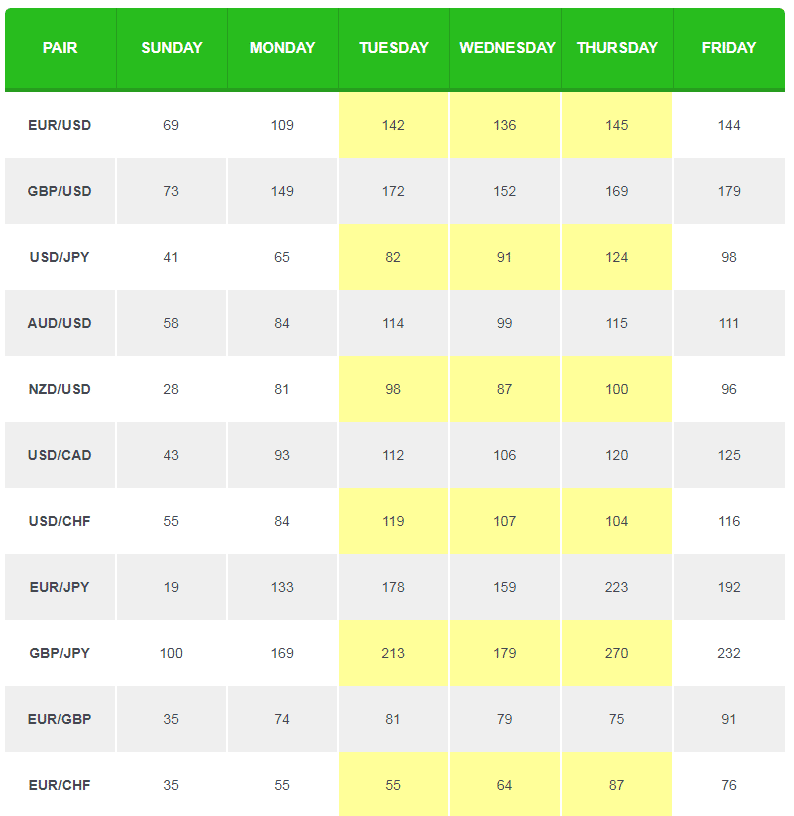

When is the best day to trade Forex?

To answer this question, you want to know which days of the week does the Forex market move the most (high volatility = more trading opportunities).

So looking at the table below, the best days to trade Forex is on Tuesday, Wednesday, and Thursday as volatility is the highest during these days.

(Source: Babypips)

Pro Tip:

If you’re a swing trader, you can look to enter your trades around Tuesday and possibly exit around Thursday (thus capturing the bulk of the move for the week).

Now at this point, you might be thinking of how to start Forex trading in Singapore.

But before we get there, I want to share more on…

How to learn Forex trading in Singapore?

Now, there are two ways you can go about it:

- Take up Forex trading course in Singapore

- Learn Forex trading online

If you ask me, it’s better to learn more about Forex trading online. Here’s why…

#1: Forex trading is not for everyone

Here’s the thing:

Forex trading is not for everyone.

It involves risk, managing your emotions, and the ability to accept uncertainty.

So, the last thing you want is to pay for a Forex trading course in Singapore (which easily cost $3000), only to find out this endeavour is not for you.

#2: Information is free online

If you’re not sure whether Forex trading is for you, then it’s best to learn about it online (and it’s free).

This way, you get a taste of what you’re getting involved with and can make a better decision if you want to invest in your Forex trading career.

If you want to learn more about Forex Trading (for free), then check these out…

Forex Trading Course for Beginners

The Essential Guide to Forex Trading for Beginners

#3: Online Forex trading courses have benefits not found in live seminars

Now, if you’re ready to invest in your trading education, then online trading courses is a “safer bet”.

Here’s why…

- Online Forex trading courses are cheaper compared to live seminars

- You can review the materials as many times as you want 24/7

- Most online Forex trading courses have a refund policy

- Most online trading courses offer continuous updates

- You can study at your own time and pace

Clearly, online trading courses come with many benefits.

Still, it’s not for everyone.

And sometimes, it’s better for you to sign up for a Forex trading course in Singapore.

So, who should sign up for a Forex trading course in Singapore?

This is for you if:

- You want to meet up with like-minded traders and make new friends

- You’re prepared to invest a few thousand dollars for your education

- You need hand-holding and someone to guide you step by step

- You want to ask questions and get answers immediately

- You learn better in a classroom environment

If you answer yes to at least 3 of the above, then I recommend you sign up for a Forex trading course in Singapore.

More on Forex Singapore next…

How to choose a Forex Broker in Singapore

When you’re choosing a Forex broker, there are 5 important questions to answer:

- Is the Forex broker regulated in strict countries (like Singapore, Australia, etc.)?

- Does it offer good customer support (like live chat)?

- Can you get your money back quickly from withdrawals?

- Does it offer the trading platform you want?

- Does it offer the markets you want?

For the full breakdown, you can read this post here… How to Choose a Good Forex Broker so You Don’t Get Scammed.

Next…

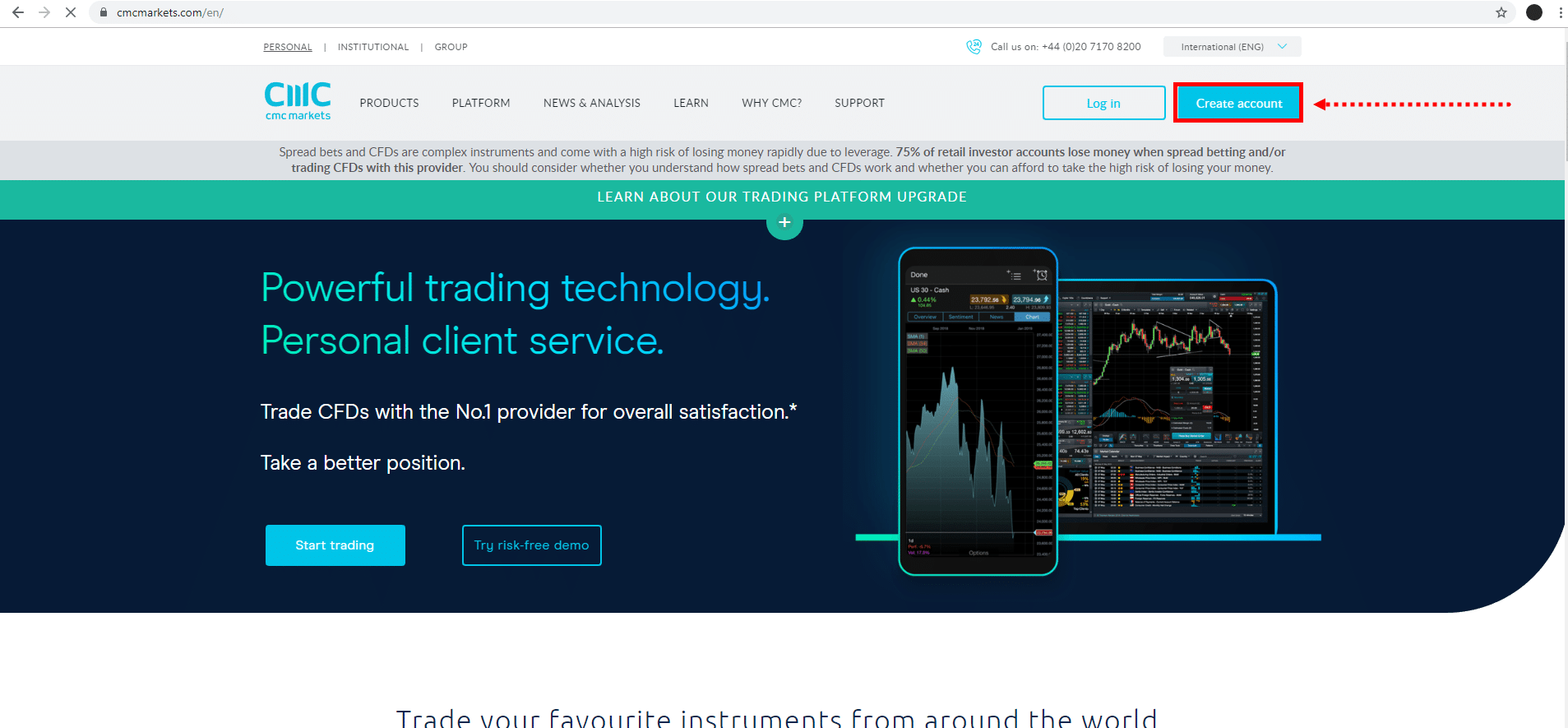

How to open a Forex trading account in Singapore

Most Forex brokers allow you to open an account online.

All you need to do is find the “Sign Up” link and follow the instructions on it.

Here’s an example from CMC…

Alternatively, if a Forex broker has a physical office in Singapore, you can go down and open an account.

Also, here are a few things that are required:

- Proof of your identity (Passport, IC, etc.)

- Proof of your address (Billing statement or anything that shows your house address)

- Bank account details (Bank account number that’s linked to your name)

Pro Tip:

If you don’t want to go live, you can always start with a demo account first (and it’s free).

CMC, IG and Oanda — are they any good?

If you’re based in Singapore, you know the 3 popular Forex brokers here are CMC, IG, and Oanda.

So, are they any good?

Well, they are regulated by MAS (Monetary Authority of Singapore) which makes them “safer” compared to overseas Forex brokers.

However, because of regulations, these Forex brokers only offer a maximum leverage of 1 to 50 (which is low considering overseas Forex brokers can easily offer 1 to 400).

So, if you don’t need much leverage, then a Forex broker regulated by MAS is a decent choice.

But if you want higher leverage, then you’ll have to look at overseas Forex brokers (and the 5 questions I shared earlier would help you choose the right one.)

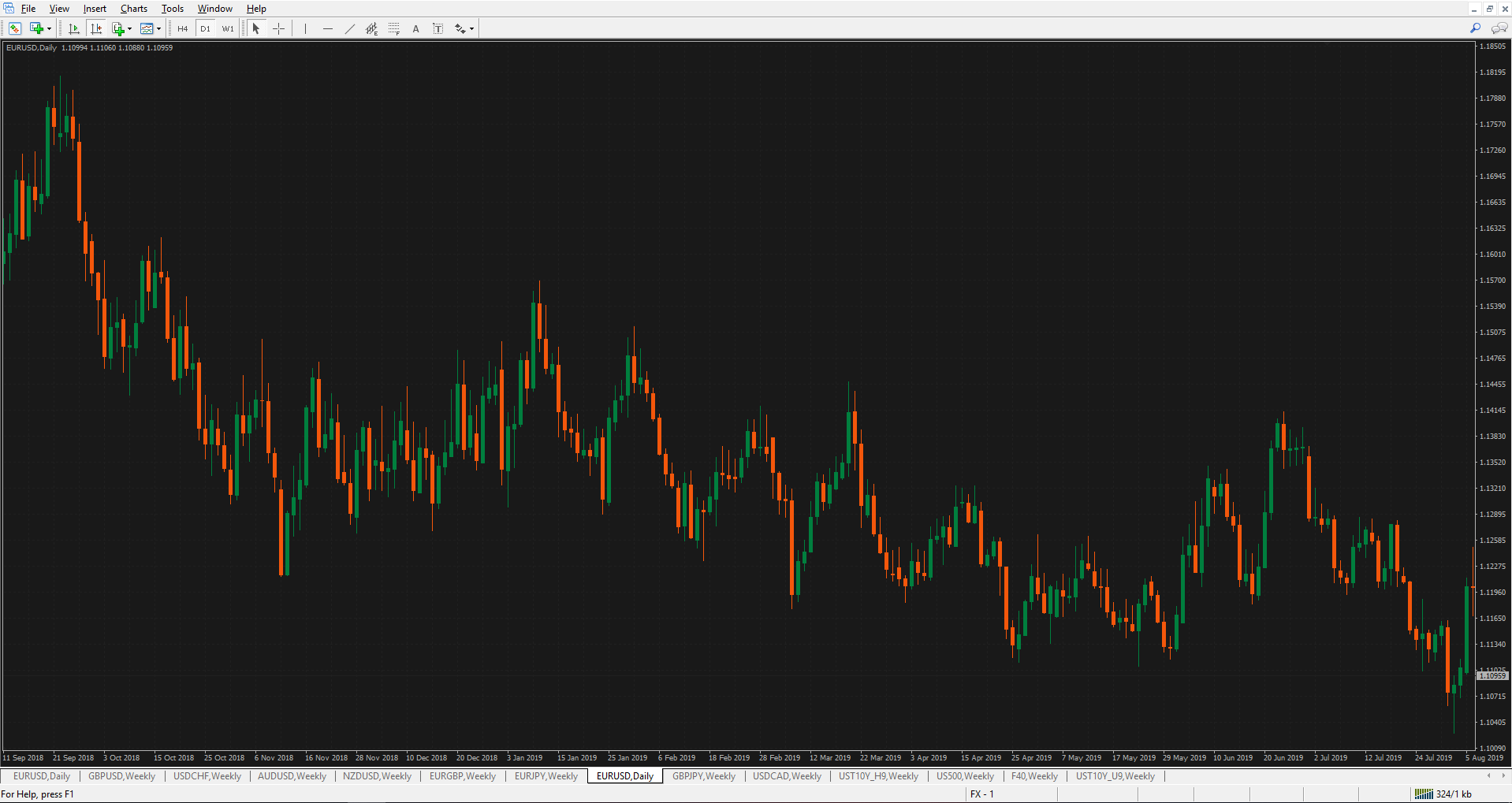

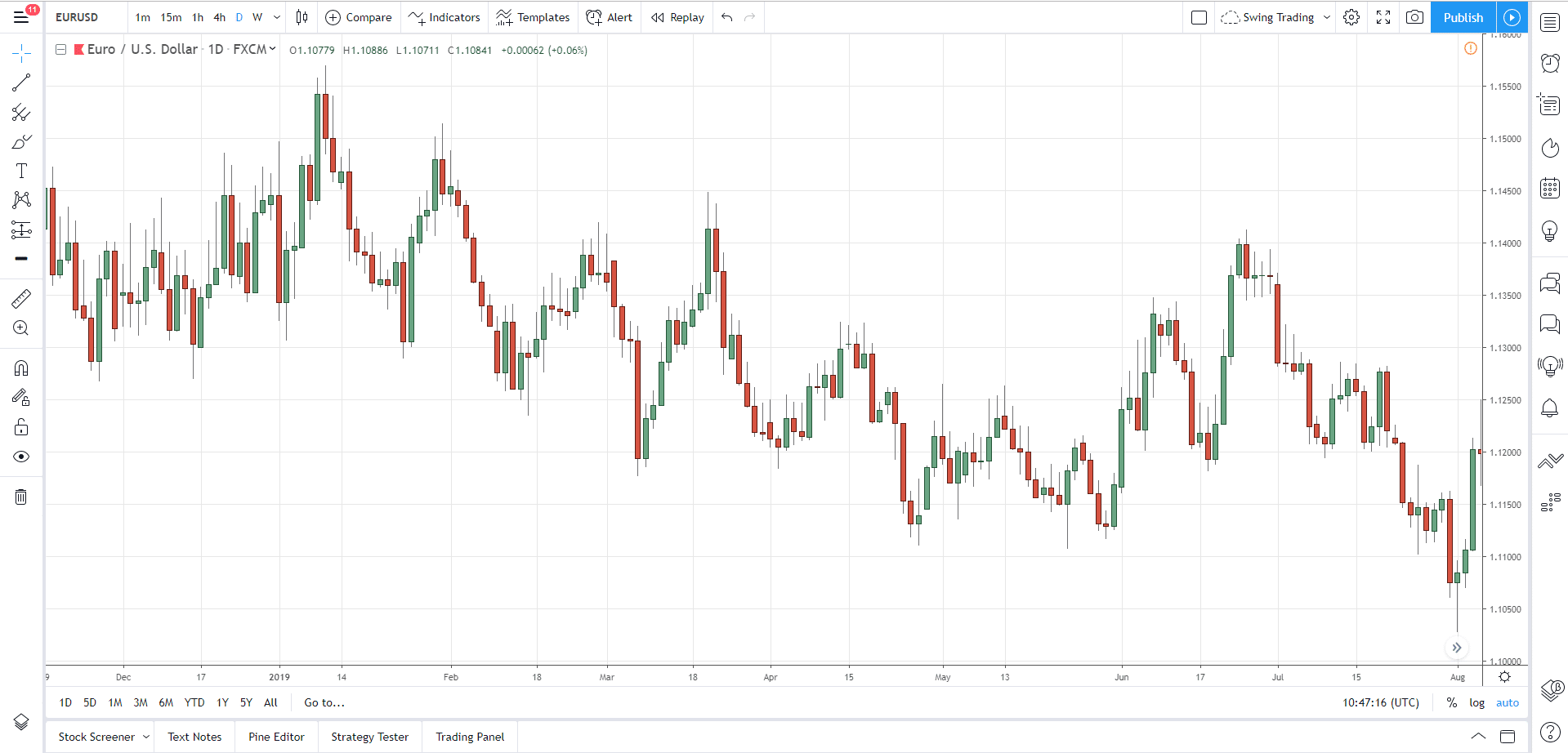

Which Forex trading platform should you use?

A trading platform is an “application or software” which allows you to view charts, plot indicators, draw lines, etc.

Right now, the 2 most popular Forex trading platforms are MT4 and TradingView.

Let me explain…

MT4

MT4 is has been the longest in business when it comes to retail Forex trading platform and it’s a desktop application.

Pros:

- It’s free

- It’s fast

- You can execute trades on MT4 directly

Cons:

- There’s no support for it

- There are a few bugs on it (like the “flying” trendline)

- Limited trading indicators (and you’ll have to code it yourself or sourced from the internet)

Moving on…

TradingView

TradingView is the new kid on the block and it’s a cloud-based application.

Pros:

- It’s free (but you can upgrade to unlock more features)

- Plenty of trading tools and indicators

- Beautiful charts and layout

- Covers Forex, Futures, Stocks, CFDs, and Cryptocurrencies

Cons:

- Advertisements on the free version

- Can’t execute trades for most Forex brokers (this is more for charting purpose only)

- Can only insert 3 indicators at any one time

The verdict?

If you must execute your trades on the same platform, then go with MT4.

If you want more features, then go with TradingView.

Bonus: Forex trading tips which could save you thousands of dollars

At this point:

You’ve got all you need to start your Forex trading career.

But before you go, I want to share with you a few Forex trading tips that could reduce your learning curve and save you thousands of dollars in the long-run.

These golden tips apply to trading and not just Forex Singapore—so you’ll want to pay close attention.

Here goes…

#1: Forex trading is a get rich slow scheme

Forget about making 20% a month consistently.

Forget about quitting your job and trade full-time.

Forget about taking a few hundred dollars and turning it into millions.

I’m not saying it’s impossible but, the odds of you pulling it off is 0.0001% or less.

Because here’s the truth…

- You need time to validate your trading strategy

- You need time to develop your trading skill

- You need time to compound your returns

So if anyone promises you “fast money” — pause, turn around, and run FAST.

And if you want to know how much you can really make from trading, then check this article out.

#2: Know your goal, then develop your strategy

Here’s the deal:

Different traders have different trading goals.

And different trading goals require a different trading strategy.

For example:

If you want to trade for an income, then you’ll need to adopt an intraday trading approach.

If you want to grow your wealth, then swing or position trading suits you.

If you want to trade without discretion, then systems trading is for you.

If you want the adrenaline rush, then trade with 100 times leverage just before NFP.

The bottom line is this:

Know your goal, then develop your trading strategy.

#3: Good defence is more important than offence

I’ll explain…

Imagine:

There are two traders, John and Sally.

John is an aggressive trader and he risks 25% of his account on each trade.

Sally is a conservative trader and she risks 1% of her account on each trade.

Both adopt a trading strategy that wins 50% of the time with an average of 1:2 risk to reward.

Over the next 8 trades, the outcomes are:

Lose-Lose-Lose-Lose-Lose-Win-Win-Win-Win

Here’s the outcome for John:

-25% -25% – 25% – 25% = BLOW UP

Here’s the outcome for Sally:

-1% -1% -1% -1% +2% +2% +2% +2% = +4%

See my point?

So the lesson is this…

You can have the best trading system in the world.

But without proper risk management, you’ll still blow up your trading account.

It’s not a matter of if, but when.

#4: You must have a trading plan

Every profitable business in the world has a consistent set of actions:

For example, a restaurant:

- Has a fixed open and closing hours

- Has more staff during peak hours

- Make sure the food is always prepared the same way

And it’s the same for trading.

If you want to be a consistently profitable trader, you must have a consistent set of actions.

That’s why you must have a trading plan.

You’re wondering:

“How do I create a trading plan?”

By answering these 6 questions…

- What markets are you trading?

- What’s your entry trigger?

- How much do you risk per trade?

- How many shares/units do you buy?

- How will you exit the trade when you’re right?

- How will you exit the trade when you’re wrong?

If you want to see a sample, then check this out… How to be a consistently profitable trader within the next 180 days.

Conclusion

Forex trading in Singapore is just like any other business.

You won’t get rich quick.

You won’t master it over a weekend seminar.

You won’t turn a few hundred dollars into 6-figures any time soon.

But if you “get it”, you can compound your returns for the rest of your life — which makes it all worth it.

Now here’s what I’d like to know…

Why do you want to learn Forex trading?

Leave a comment below and share your thoughts with me.

Hey Rayner, I do appreciate the hard work you are doing to help retail traders. The article is very helpful

Awesome to hear that!

Hey Rayner, I have traded CFDs for a quite long and when I look back I came to realize that the transaction costs are the killer to my trading, then I decided to look for Futures markets but I find difficulty to tell the pros and cons of futures markets, how to find brokers as many of them I do find, offer CFDs markets, how to tell whether this market is futures market without subjectivity! Can you publish the article on this, like you did on CFDs?

Thanks

I’ll look into it, cheers.

Good to hear that, thanks

I am opening myself up to the possibility of making more money with out the usual mindset of working 9-5. I’ve had a couple of pointers to FX so I have begun to learn.

Enjoying the site so far

Awesome to hear that!

Great job, Rayner. Been following your tutorials for a while. FX is what I haven’t done, actually. What I don’t understand about FX trading is, you might profit tons of AUD against CAD (just an example). But in the end of the day, you must get paid in your currency. And how do you know that while you made more AUDs, your ccy didn’t appreciate against AUD, wiping out all of your gains once you do the conversion. Thank you

To achieve financial freedom and to be able to spend more time with family which is a rare case for me because of my full time job nature.