In this training video, you’ll discover the fastest way to become a profitable trader.

So, if you’re lost in this world of trading right now and you’re looking for answers…

This video is for you:

Video Transcript

You’re watching this video because you’re sick and tired of losing consistently.

Witnessing losses after losses.

Perhaps you’re not losing, but you’re stuck at break-even for the longest time. You just want to know what it takes to become a profitable trader.

Well, whichever category you belong to, don’t worry because, in today’s video, I’m going to share with you the fastest way that you can become a profitable trader even if you have tried everything else and failed.

But first…

Here’s a true story, I know of a trader called Sam, though not his real name.

He’s someone who wanted to learn about trading because of the opportunities that it offers.

Sam has been relatively successful in life, graduating first class honors, and getting a relatively high-paying job and he keeps finding success.

Trading is an Endeavor he wanted to pursue.

How did Sam learn to trade?

Well, he started like you know how most traders will go about doing it.

He figured things out on his own, risking his own money and through trial and error.

What happened to Sam is that he spent years trying to learn how to trade the markets.

Along the way he blew up multiple trading accounts, he lost five figures in this endeavor and eventually, the losses became too much for him to Bear.

Eventually, the time and effort that he spent wasn’t justifying a positive ROI return on investment.

Sam had to call it quits and give up on trading altogether.

If you ask me like what is the mistake that Sam made?

It’s quite simple…

Sam tried to reinvent the world he tried to figure things out on his own.

By doing so, you’re going to waste a lot of time effort, and money, trying to you know solve the puzzles of the market.

My first suggestion, to traders who are not yet profitable, and who are struggling is this…

Don’t reinvent the wheel

There are systems out there that already are proven to work in the market.

Use those as your foundation, as a base to develop your trading strategy, and to give you some idea about it here are some books trading books with backtest results…

- Following the Trend… Andreas Clenow

- Trading systems… Urbane & Emilio

- Automated stock trading… Laurens Bensdorp

- Short-term trading strategies that work… Larry & Cesar

- Building Reliable Trading Systems… Keith Fitschen

These books will change your trading forever.

I’m not asking you to copy the trading system in this book but rather, to learn from this book what are some of the proven trading systems that work.

Then use that as a foundation and then go out there and tweak the trading strategy to your own needs.

Maybe trading a different time frame, trading on different markets whatsoever.

But use this as a foundation so you’re not starting from scratch.

Does it make sense?

Now if you are a price action trader or a discretionary trader, don’t worry, I got you covered as well…

Price Action Setup

Here’s a trading strategy that you can use to build upon to develop your price action strategy.

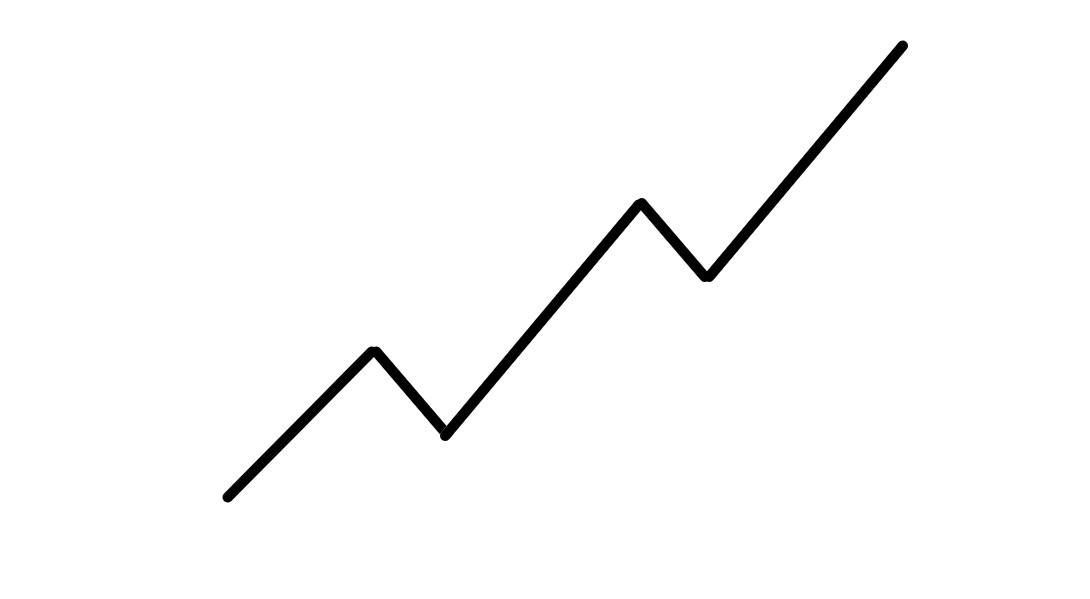

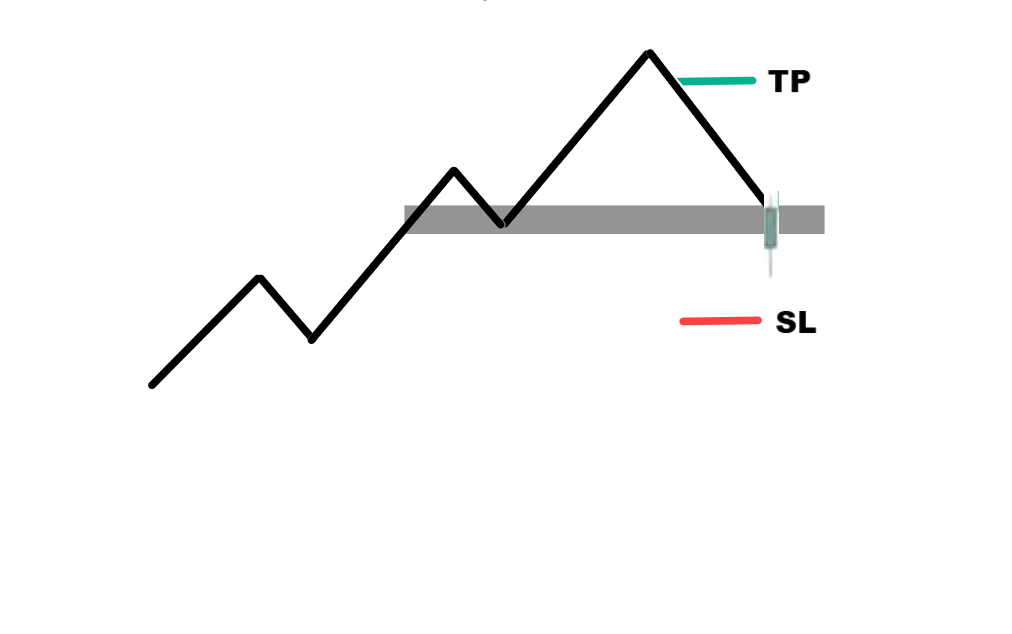

What I’d like to do is to trade with the trend and identify markets in an uptrend. Here’s what I mean…

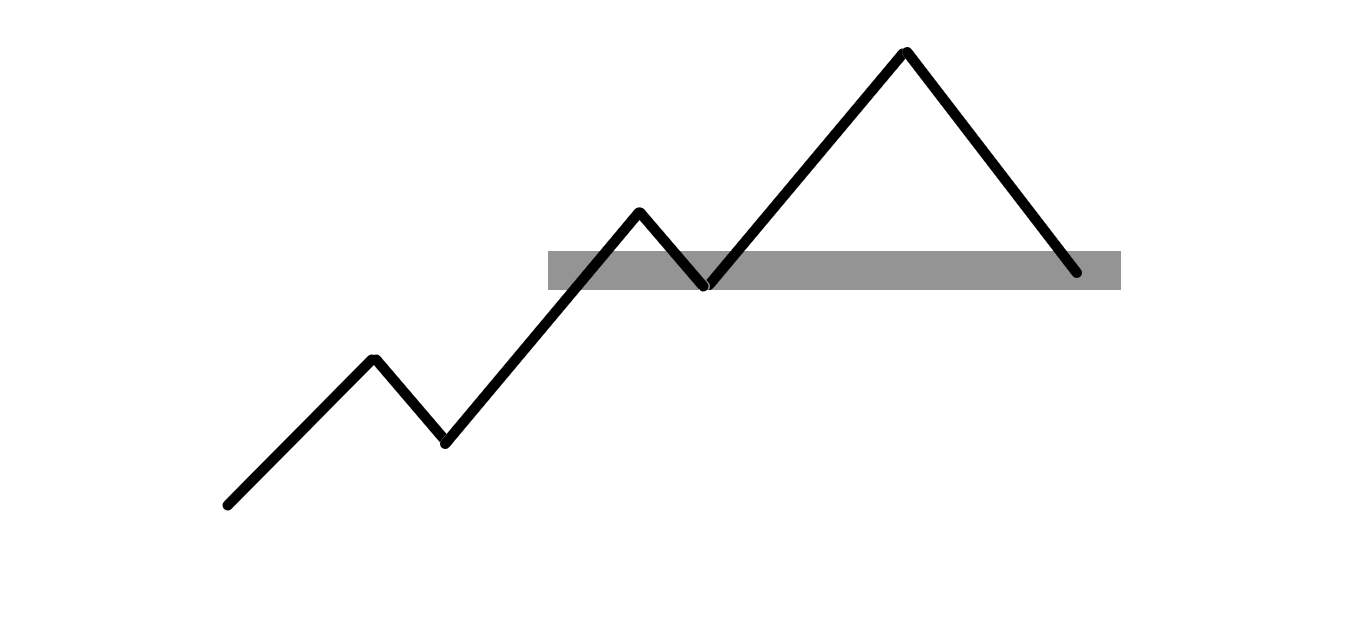

Then I let it pull back and retrace to an area of value like an area of Support. Here is what I mean…

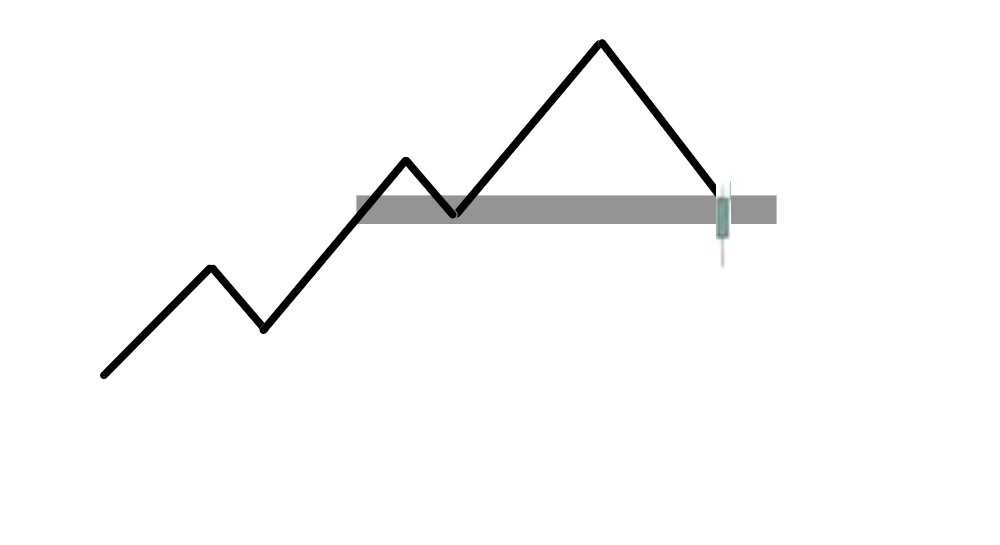

Then what I look for next is a valid entry trigger to go long. That could be something as simple as a bullish reversal candlestick pattern like a hammer. This is what I mean…

Then look to enter on the next candle open, stop loss is usually a distance below the lows.

Target usually just before this recent swing high, here is an example…

This is a relatively simple straightforward strategy that you can use to trade in a trending market.

Example

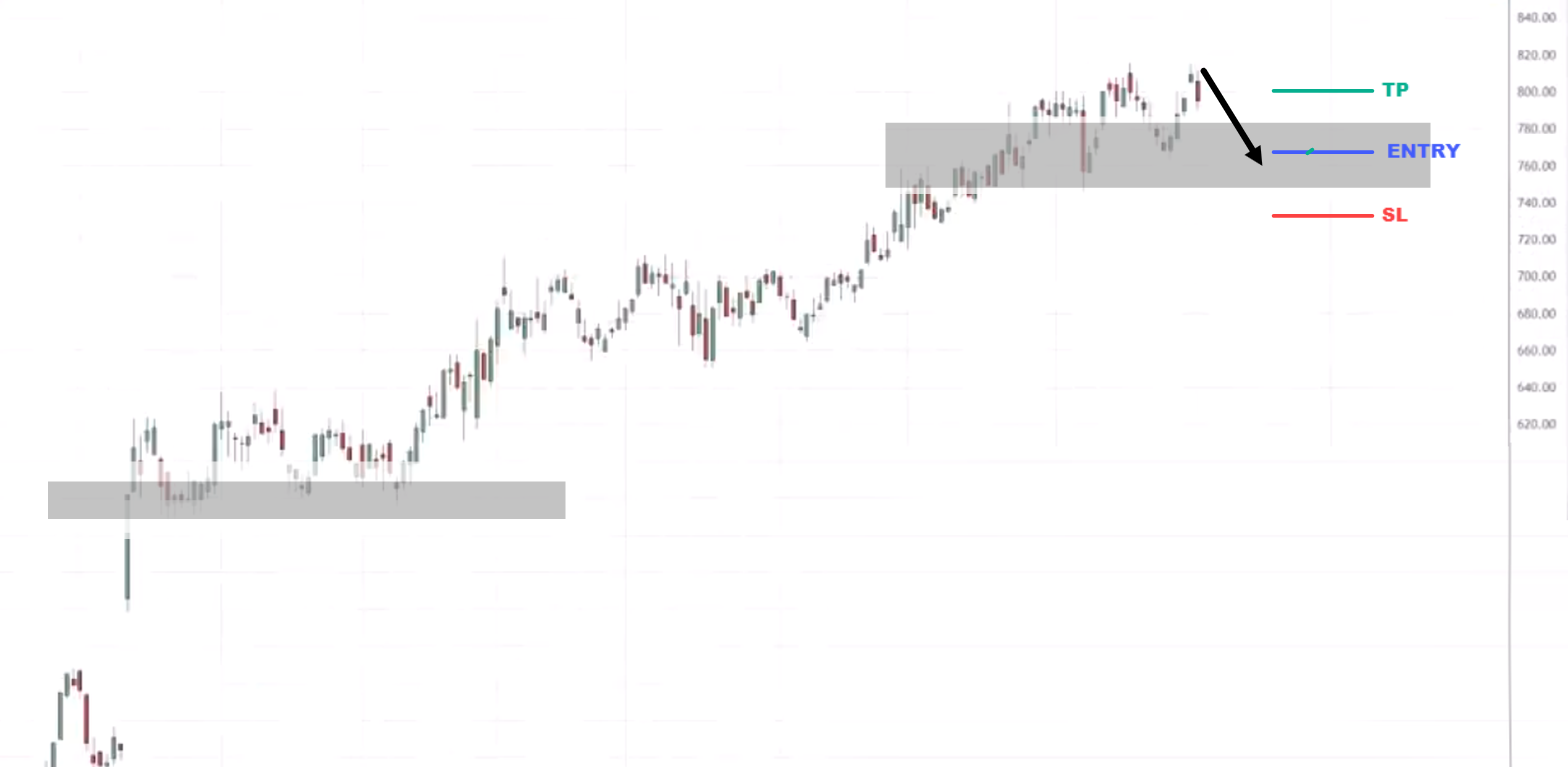

Fair Isaac Corporation:

This stock is in an uptrend. This is what I mean…

If you look at the previous area of value, look at the price action around it.

This is what I mean…

And this over here…

Notice how this market came back towards this area of support…

Took the lows out and then it rallied up higher…

Same for this zone…

The market made a pullback towards the support, took out the low, and then rallied higher.

Currently, you can see that this market is potentially making a pullback, here is what I mean…

This is the area of support.

I’m looking to see if the price can come lower take out the lows and reverse up closing higher backup of support.

If that happens, I’ll be interested to buy on the next candle open.

Here is an example…

You can tweak it to your needs to different market time frames or whatever.

Manage Your Risk

I know you’re probably thinking you know I’ve heard this a thousand times.

This is important so pay close attention because what I’m about to share with you is something that you have likely never heard before.

Imagine this…

John and Sally are two traders.

They both have $1,000 trading accounts and they have a 50% winning rate on their trading system, and they have an average of a 1…2 risk-reward ratio.

Let’s assume… Over the next few trades, this is the results of their trades…

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

This is the outcome for the next few trades.

Let’s say John risked 50% of his account on each trade which is about $500 and Sally, risked $20 of her account per trade.

John… $500

Sally… $20

Let’s have a look at John first, having $500

-500, -500, -1000

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

John has essentially blown out his trading account.

What about Sally?

–20, -20, +40

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

How much did Sally make?

It’s 40 because as you’ve seen over here, we have an average of 1…2 risk-to-reward ratio.

Her winners are twice the size of her loss.

In total, how much money did Sally make or lose?

Sally made a total of $120 which is about a 12% gain of her account.

Can you see how important this is?

If both John and Sally are trading the same system but one of them blew up his trading account and the other one made the 12% return on the account.

What’s the point I’m trying to make?

The point is this…

You can have a proven trading strategy that works out without proper risk management, you will still lose.

Are you with me so far?

Consistent action = Consistent results

I know this sounds a little bit vague so let me give you an example so you understand how this works…

Imagine your trades. The outcome of the next few trades is something like this…

LOSE-LOSE-LOSE-WIN-WIN-WIN-WIN

Let’s say you’re trading with a proven trading system and you’re following your rules.

As you can see here. Your first three trades are losers.

When the fourth trade comes, you decide to skip it because of the recent losses that you had you think.

Guess what?

It turns out to be a winner over here.

Then your fifth trade comes along.

You decide to skip the trade because of the recent losses that you have encountered, the pain is still very wrong so let me skip the trade again.

Again, turns out to be a winner over here.

Then comes the next trading opportunity, and now you’re stuck. Thinking should I skip the trade?

Because the recent losses are still too much to bear, you decide to let your emotions take over and skip the trade.

Then guess what?

Another winning trade that you missed.

Then guess what? Another winning trade that you missed.

At this point, you can’t take it anymore.

You decided to follow your trading strategy because if not, you might miss out on further again.

We decided to take the next trade that came along and finally, you caught this winner over here.

However, if you look back your winner is not enough to cover your losses the three losses that you had earlier.

If you look at this from a big-picture standpoint, if you had followed your rules you would have come up profitable because you had four winners over compared to your earlier losses that you had earlier.

Four winners against three losers, you would have made money over this series of trades.

But because you didn’t follow your rules, because of emotions your actions were not consistent, and that’s why you didn’t get consistent results.

You can see that if you want to be a consistently profitable trader, you must have a consistent set of actions whenever the setup presents itself.

You have to take it so you don’t second guess yourself…

Because guess what? if you end up skipping trades, your results will not be consistent because your actions are not consistent.

Keep Moving Forward

Here’s the deal…

There will be a time when everything looks so bleak.

Things are not working out for you.

You can have proper risk management and be consistent with your actions and you can be the most disciplined trader out there.

But because maybe for the fact that your trading strategy doesn’t work, you still end up losing at this point.

Most Traders will give.

This reminds me of a quote from Sylvester Stallon (Rocky)…

“It ain’t how hard you can hit but how hard you can get hit and keep moving forward.”

That’s how winning is done. This is the same for trading.

You might have known some failures along the way in trading.

But guess what?

It just tells you that whatever you’ve been doing is how you should not trade the markets.

Go back to the drawing board. Get new trading ideas, and strategies to trade the market and you know, read the books I shared with you earlier.

Then start to apply proper risk management.

If you keep following this process that I’ve shared with you, there’s no reason why you will not succeed as a trader that’s winning.

Always Be a Student of The Market

Always be a student of the market.

Let me share with you a quick story…

This is me back in my prop trading days, hungry and free

Back then, I was trading the Nikkei Futures otherwise known as the Japanese stock market.

Many of us prop Traders, were trading the Japanese Market back then and one of the core strategies that they were using is what we call arbitraging.

Why arbitraging?

It’s because the Nikkei Futures is traded on four different exchanges.

By trading on multiple exchanges, they can find arbitrage opportunities.

Let’s say a trader, buys from exchange “A” a decay contract at $100 and then quickly sells it at exchange “B” for $101

I’m just simplifying things.

When you do this many times a year you can make six to seven figures arbitrage opportunities.

Back then, a lot of traders made a lot of money from this particular trading approach then slowly something happened.

They realize that the profits are getting smaller and smaller.

Why is that?

That’s because the algorithms the machines enter the market.

As you know machines are always faster than human traders.

Before you can even click buy the machine has already buy and sell.

The machine came into the market and eroded this age that they had for several years.

What happened next is that I believe about 90-95% of these traders, couldn’t adapt to this market conditions and they quit and left trading altogether.

Some even became cab drivers.

There is no shame in that but that’s pretty much what happened to them.

The lesson here is this…

“There’s no guarantee in trading”

Just because a trading strategy has worked in the past doesn’t mean it will work in the future forever.

This is why you must always remain a student of the market to be adaptable to change when the times have changed.

Conclusion

No matter what others tell you…

Being a profitable trader is never easy.

There is no shortcut.

But what matters is how fast you implement the concepts I’ve shared with you today.

And the best part?

Anyone can do it!

Nonetheless, here’s what you’ve learned in today’s video…

- Gather proven strategies from trading books and use it as a foundation to develop your own strategy

- Managing your risk is the number one key to surviving in this trading business

- Being consistent in your trading puts you closer to identifying your edge in the market

- When things aren’t going your way, be persistent and keep pin-pointing and improving on your weak points

- Time and time again, the market will always humble arrogant traders, so always be a student of the market

Now that I shared with you the fastest way to become a profitable trader…

Is there anything you have in mind to add to the list?

Let me know in the comments below!