You’re a price action trader.

You know what is price action trading.

You trade Pinbar and Engulfing patterns at a key support resistance area.

But I think you’ll agree with me when I say:

Sometimes you’re waiting for a pullback that doesn’t come, and price trades higher without you.

Or perhaps..

The low number of trading setups you get makes you wonder whether you’re even trading at all.

Don’t worry, you’re not alone.

In this post, I’ll share with you the 4 biggest problems with price action trading, and how you can fix them immediately.

1) Low number of trades

Price action trading requires patience. This is because it requires the trader to wait for confirmation at support & resistance.

The confirmation could be in a form of a Pinbar or Engulfing pattern.

But by waiting for confirmation, traders tend to miss trading opportunities when price simply ‘touch and go’.

It is heart-wrenching to watch price bounce off your levels, without being in the trade.

So what can you do?

One way to overcome this problem is to not wait for confirmation. That’s right, don’t wait for confirmation.

What you can do is identify your levels as per normal, and trade without price confirming at your levels.

Try this on demo, then compare it with your own actual trading. See if there’s any difference in your frequency of trades and profitability. You may be surprised at the results.

Alternatively, you can look to trade more markets like exotic currency pairs, equities, and futures.

Now the next problem…

2) Waiting for your levels

Price action traders would always wait for the price to come to their levels.

Some of these levels could be support & resistance, or previous resistance turned support etc.

But in a trending market, often price does not come back to retest these levels due to the strong underlying momentum.

This cause price action traders to be on the sideline while the market is making a directional move. How can you fix this?

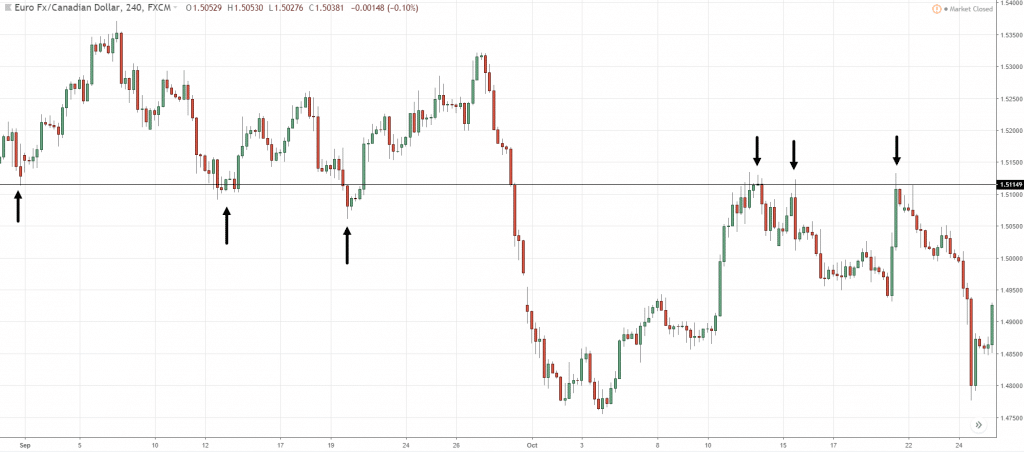

Here’s an example from the price action in forex:

What you can do is to go down into the lower time frame and look for your trading setups.

If price is making a parabolic move the daily timeframe, drill down to the 1-hour timeframe to find trading opportunities.

On the lower time frame, you will notice that it has its own set of support & resistance. You can then look to trade these levels with the bias from the higher time frame.

Below you can see 3 possible trading opportunities that are not apparent on the daily timeframe:

3) Poor placement of stops

If you read most trading books or attend trading courses, you will be taught to place your stops just beyond the highs/lows of the candle.

Thus it is no surprise that traders tend to place their stops at obvious levels. E.g. a few pips beyond the wicks of the candle, just above resistance, just below support or at round numbers.

However, dealers are not stupid and have an educated guess where your stops are, without looking at the order book. Yes, those juicy support & resistance levels.

Because of this, you find yourself being stopped out of your trades unnecessarily, only to watch the price go back in your favor. Sounds familiar?

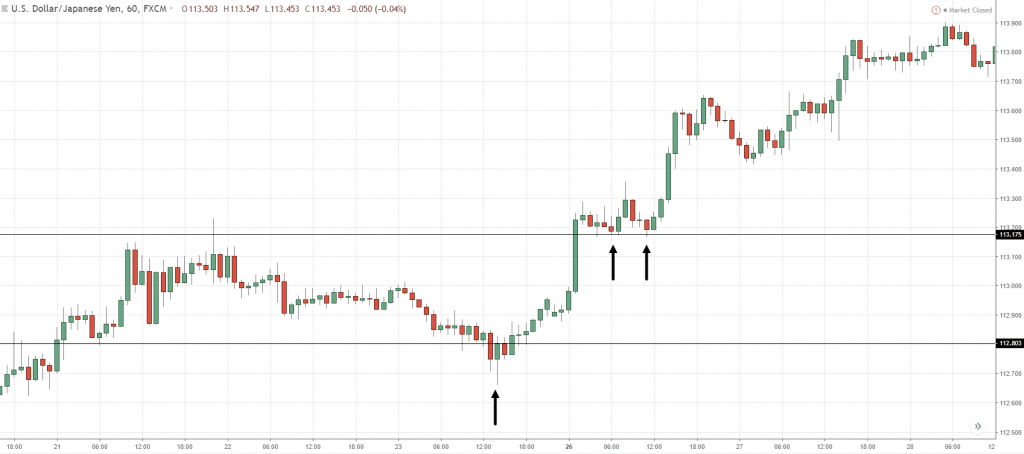

An example below from price action in forex:

A solution to this problem would be to place your stop loss away from support & resistance.

An approach you can consider is to use the ATR indicator to gauge how far away your stop loss should be.

This way if you do get stopped out, it’s a good indication the support & resistance has failed to hold up.

Now here comes the best part, quantifying high probability patterns…

4) Size of reversal candlestick

Candlestick reversal patterns serve as confirmation of whether a level is holding up.

Candlesticks like the Pinbar and Engulfing pattern comes in all shape and sizes. But are they created equal?

Not necessarily. The larger the Pinbar or Engulfing pattern, the stronger the price rejection.

What if you get a small looking Pinbar that lacks conviction, would you still trade it?

How do you quantify the size of the Pinbar to trade?

One way to overcome this issue is to use the ATR indicator to gauge the volatility of the market and compare it with the range of the Pinbar.

You can look for the Pinbar to have a range of at least 2 times the ATR.

The larger the range compared to the ATR, the more conviction of the underlying move.

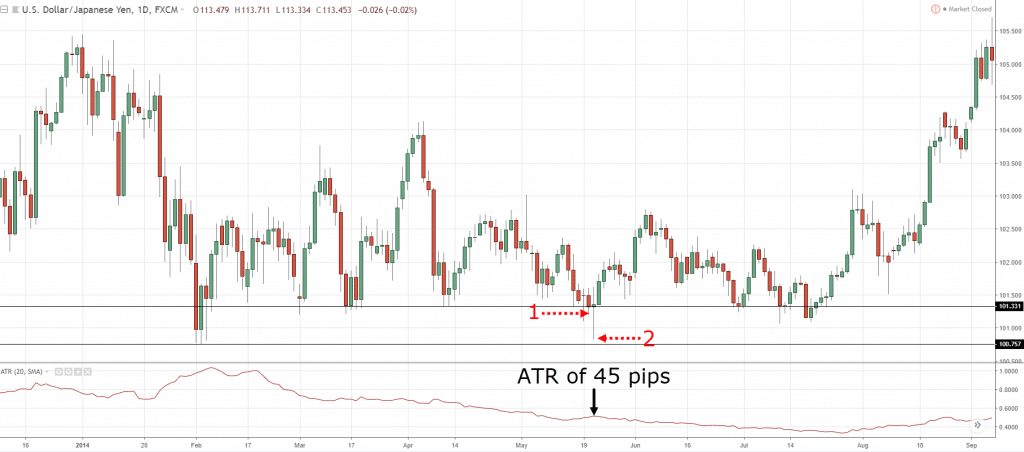

Looking at the chart below, the given ATR for that period is 45 pips.

Notice the range of Pinbar 1 is 45 pips, I would skip this Pinbar as it is not 2 times the ATR.

Next, Pinbar 2 has a range of 95 pips. It is more than 2 times the ATR and tells me that there is conviction behind the move. I would choose this Pinbar to trade instead.

This method would allow you to identify Pinbar or Engulfing patterns that have a higher probability of working out.

Frequently asked questions

#1: If you went short at resistance without confirmation, do you close that position early if the candle closes above resistance but have yet to hit your stop loss?

One thing to point out is that I don’t sell blindly at resistance. As part of my price action trading strategies, I’ll usually wait for a price action pattern like a shooting star or an engulfing pattern to decide if I want to enter a trade.

If you were to trade without confirmation, the key question to ask is this, is your resistance area invalidated?

The candle might close above resistance, but it doesn’t mean that the area of resistance has been invalidated. Because resistance is an area on your chart, not a line. So if that area is still intact, then you shouldn’t close your trade.

But if the candle breaks and closes above your area of resistance, and it invalidates that area, then yes, you should exit the trade.

#2: Do you use a stop loss order or do you keep “mental” stop loss orders? I think if I had used “mental” stop loss orders, a lot of the previous losses might have been avoided as the market eventually goes up higher as per my initial intention.

I use stop loss orders, I don’t use mental stop loss orders.

If you use mental stop loss orders, and you find that your results improve, then feel free to experiment with it.

But the downside about mental stop loss order is that often traders don’t have the mental capacity to exit the trade when it’s time for them to exit the trade. Instead, they hold onto it longer and their losses end up being bigger than intended.

If you have the discipline to execute your mental stop loss order, then give it a go and see if it helps with your trading results.

Conclusion

You’ve just seen how to overcome the 4 biggest problems with price action trading.

I hope this helps to improve your price action trading strategies and results!

Great article Rayner, thanks, that is a nice point about the ATR and candle range. It makes complete sense for filtering entry candles strength. If you are entering levels without confirmation and a 2ATR based stop do you ever close a trade before hitting your 2ATR stop. For example if you enter a short trade at a resistance level would you ever close a loss early if the daily candle closes above the resistance area? or do you think that is a bad idea… this would create some losses that are less than 1R or 1% ..thanks

Hey Shane!

Thank you and i’m glad you liked it.

When i have my stops in place, i never adjust it anymore even if a candle has closed against me. I will let it hit my stops and take me out of the trade.

Rayner

What period ATR would you use to measure the strength of pinbar or rather candles?

Hi Bob,

I use 20 period for my ATR, but the default settings would do just fine.

Rayner

can someone realy trade with $60.00 acc

Hi Dexter,

Check this video out.

https://youtu.be/tvZ9UH7FcHA

Thanks for sharing and i have the same problems as what you have listed and yes, these methods i have tried in the past had made forex and easy game not until my impatience and GAMBLING attitude took over. Kudoes to your post!

Hey Zac,

You are most welcome, yes these problems are very frustrating and I hope it helps the price action traders out there.

Rayner

Hello Rayner.

The devil is within the detail. This are common problems witch every trader must solve individual. Because every one has his own mentality. The challenge is now, to find out witch trading style suits to your mindset. Frustration is a very bad energy who can kill your acount regardles if the trading system are usefull or not.

Your suggestions are very usefull skills with no doubt. A trader must find his system that suits for him and do not jump from system to system and switch or bend their rules to often when they are bored and frustrated by trading. A little change in your envirnonment or your trading rules can change a system totaly when it is fit to your mindset.

I compare and discus setups often with other traders and we re often match. But i’m the one who feel comortable with more trades, but small losses. other one say “Hey Alex do you ever think about Overtrading? :)” and at the end he had +1% and i am +0.5% but with lower risk than him. Because i apply the rules witch i feel komfortable with.

It is always a two sided sword.

Hi Alex,

Yes you are absolutely right. Trading is alot to do with psychology, the decisions you make on a day to day basis reflects the mindset you have.

That is why i believe that a trader has to develop his own trading system and not simply copies someone else’s. Because they would have no conviction behind it if they simply copy someone else’s trading system. And during periods of draw down, they will likely abandon it and look for another trading system.

Also risk and return are 2 side of the same coin like you mention, however it isn’t objective to base a trading performance on hardcore percentages. Rather the return to risk would make much more sense. E.g. a trading making 50% return on 10% risk against a trader making 20% on a 1% risk.

I would choose the later any day and time.

It’s always great to have you around Alex 🙂

Rayner

Trading strategies can be totaly different. But in risk- and money- management we have definitely the same opinion.

I allways appreciate your blog.

Enjoy the weekend and i wish you a successfull february.

Thank you Alex, and the same to you 🙂

Rayner

Hi David,

I believe we have a slight difference in definition of price action trading, and it will be my bad. I should have re-name the article ‘4 problems of trading candlestick patterns at support resistance’

1) Regards to confirmation, in my trading I find confirmation doesn’t increase my winning %, but reduce my frequency of trades. So if my winning % remains the same, and frequency increases, my expected value will increase.

2) I can’t agree i am risking a higher margin by placing my stops away from support resistance area. My position size will decrease relative to the size of my stops. However this would depend on your money management style, whether you risk a fix size or fix %.

3) I have no comments here, this is something to each his own.

Nonetheless thank you for your comments, I enjoy such discussions 🙂

Rayner

Hi Rayner, could you advise how much or the bare minimum capital in USD to be able to to feasibly trade the various instruments or markets . Thanks.

Regards

Ryan

Hi Ryan,

It all depends on the amount of leverage your broker offers and how many % of your account you are risking per trade.

You can start with 1k and trade micro lots if you want.

Rayner

HI Rayner,

What is ATR? How do we use it and calulate in our trade?

Thanks

Hi Angus,

ATR stands for average true range and it is an indicator on MT4.

You can check out this video here where I talk more about ATR.

Rayner

Hi Rayner:

Concerning the first rule: I like to switch to other time frames to find confirmation.

If I don’t have confirmation in 1H, I would go to 5M o 15M, and usually might find a decent ping bar o engulfing bar.

Sometimes it might work even in higher time frame: no confirmation in 1H, but pin bar in 4H.

And, your last rule and first one seems to be contradictory: If we don’t need confirmation (first rule), why should we need a pin bar of 2ATR (fourth rule)?

Eugene

Hey Eugene,

Yes your approach is sound. However be consistent in the time frames you are drilling down to find your trades E.g. if you only drill down to 5 mins, stick to 5 mins.

You’re right that it contradicts. But other traders may not face all of these 4 problems. Some may face problem 1, some problem 2 etc.

But if they face problem 1 & 4, then they need to ask themselves which matter more.

Rayner

Hi Rayner, thanks for the tips above. On the first point,

“…One way to overcome this problem is to not wait for confirmation. That’s right, don’t wait for confirmation.

What you can do is identify your levels as per normal, and trade without price confirming at your levels.

Try this on demo, then compare it with your own actual trading. See if there’s any difference in your frequency of trades and profitability. You may be surprised at the results.

Alternatively, you can look to trade more markets like exotic currency pairs, equities and futures.” I would appreciate in your future video postings show some trades to illustrate. I am not very clear on this. Thank you for the generosity of your time. Regards, Ryan

Hi Ryan,

What I meant was instead of waiting for price action confirmation in the form of pinbar or engulfing pattern etc.

You can consider just shorting at resistance without confirmation.

Rayner

Hi Rayner,

My late trading setup is likely a combination to that 3 & 4 i am also using it to breakouts because sometimes breakouts may fail. I was really surprised when i recalled all my stops level where exactly just below that bottom and it is really frustrating when price came back rallying again.

And my other problem is, i am impatient i tend to jump to another stocks even if it doesn’t hit yet to my stops or just when i feel something different about it or i envy to other stocks that soared up then i exit and buy the other only to get whipped then shifted to the other edge and i just found out i was really running in circles and my port got beaten down to 70%. It is really deadly habit.

Thank you very much for this. This is a really big help for me.

Reynaldo

Hi Reynaldo,

I understand how you feel.

The best way to go about it is to understand price action itself and develop a trading plan on your own and trade it solely.

Chasing after the price is never a good thing to do and usually results in poor performance.

Keep me updated on how you’re doing, I’ll be glad to help.

Rayner

Hi Rayner,

According to you which is more accurate technical indicater ?

Hi Zainu,

There isn’t a more accurate technical indicator out there.

Rather, you need to find the ones that suit your trading style.

Hi Rayner,

I’ve seen you don’t trade stocks, so not sure if this problem affects currencies, commodities, futures, etc as well.

What I’ve noticed is that if I put my stop at a certain level, a lot of times I’m selling at the very bottom of the candle. Then it reverses and goes higher from there (without me). I’m not putting my stops directly below a support/resistance area, they’re in random places (at a certain % to control my risk). My doubt is, do you submit your orders to the market? or do you keep mental orders?

At the moment I’m submitting them to the market because I cannot monitor it whilst I’m working, but I’m thinking that if I keep mental orders in place, a lot of the previous losses might have been avoided, as the stocks recovered quickly.

What is your experience about the subject pls?

Hi Michael,

I submit my order to the broker platform.

Perhaps this post can help with your stops…

https://www.tradingwithrayner.com/set-stoploss/

very helpful in day trading and to identify potential support level in ready /trading long positions.

Hiii…. Rayner i am biggest fan of you..i gain my knowledge by reading your blog and videos .

i am intraday trader in equity market..i am use 15min timeframe. so it’s Good for me or not give me your suggestions. what i learn from your blog and video its apply on 15min candle timeframe or Not..Thanks..Love from India 🙂