In 2008, the S&P 500 plunged 37%, sending shockwaves across global markets.

However, while everyone else was selling their kidneys to cover margin calls, a small group of traders were quietly making a fortune:

- Mulvaney Capital gained 108% (while most fund managers were updating their resumes).

- Dunn Capital returned over +50%.

- Graham Capital finished the year up about +36%.

How did they do it?

They weren’t trying to call the bottom, predict the bailout, or outsmart the Fed.

Instead, they were simply following one timeless principle: ride the trend until it ends.

This approach is called Trend Following—and it has worked for decades. From the legendary Turtle Traders to billion-dollar hedge funds, Trend Following has consistently thrived in bull and bear markets, especially during a crisis.

That’s why in today’s post, you’ll discover…

- What is Trend Following and why does it work?

- 4 principles of Trend Following

- A complete Trend Following system that works (backed by 25 years of data)

- Pros and cons of Trend Following

- How to know if Trend Following is suitable for you?

By the end, you’ll understand why Trend Following is one of the most powerful strategies, and how you can apply it to your own trading.

Sound good?

Then let’s go…

Trend Following explained

Trend Following is all about profiting from sustained moves in the market (in both uptrend and downtrend). The idea behind it is simple: to ride the trend till it ends.

It originated from the commodities market and was made popular by Richard Dennis (and his Turtle Traders).

Today, Trend Following is still a popular trading approach and is even used by billion-dollar hedge funds (like Winton Group, Transtrend, etc.).

Why does Trend Following work?

There are three main reasons…

Behavioural biases

If you see the market goes up 5 days in a row, what’s your first reaction?

“It’s too high! I’m not buying that!”

But then it goes up another 3 days, and suddenly you’re hitting that buy button faster than I run when my wife says, “We need to talk!”

And when there’s fear? You sell faster than I run away from my kids when they need help with homework.

These behavioural biases cause the market to trend, and that’s how a Trend Follower can profit from it.

Information takes time to get priced in

Hedge funds and institutions move with size. Unlike a retail trader, they can’t just enter a position all at once because they will move the market (which means they get a poor entry price).

So, they will accumulate their positions over weeks and sometimes even months. This buying pressure will push the market higher, and by the time the “big money” completes their buying, the trend is well established, and a Trend Follower will profit from the move.

Trends are structural

Economic cycles lead to things like inflation, bubbles, crises, productivity, bull markets, bear markets, etc. These factors cause fear and greed in the market, which results in both uptrends and downtrends.

As long as these factors exist, you can expect markets to trend.

Now, before I give you the rules of a Trend Following system that works, you first need to understand the principles behind it so you can make it work for you.

4 principles of Trend Following

1. Buy high and sell higher (and vice versa)

The principle behind “buy high and sell higher” is that strength tends to beget more strength.

Unlike investors who “buy low and sell high”, Trend Following doesn’t care if something looks expensive or overbought. What matters is that the price is moving in the direction of the trend.

By buying strength, you align yourself with the market’s direction and avoid betting against the market. Think of it as going with the flow, not against it. Like when my wife says we’re going shopping and I just nod and prepare my credit card for the beating.

2. Use a trailing stop loss

After you enter a trade, when do you exit?

That’s where a trailing stop loss comes in. It’s a dynamic stop loss that follows the price like my kids follow me when I’m trying to eat ice cream. It is the key to cutting your losses and riding your winners.

Here’s an example…

- You buy a stock at $50 and have a 20% trailing stop loss.

- If the price drops to $40, you’ll exit the trade because it has hit your trailing stop loss (calculation $50 x 0.8 = $40).

- But if the price goes up to $60, your trailing stop loss will be at $48 (calculation $60 x 0.8 = $48).

- Now, if the price shoots up to $200 and hits your trailing stop loss (at $160), you’d have captured a big winner.

Now, if you used a fixed target profit, it’s unlikely you’ll ride such a trend because of emotions. Agree?

But with a trailing stop loss, you simply ride the trend till it ends—without guesswork.

3. Trade many different markets

Here’s the thing: trends don’t happen everywhere at once. By trading many markets, you always have “lottery tickets” spread out across different asset classes—like having multiple dating apps instead of just one.

Also, different asset classes trend at different times:

- Commodities move on supply/demand shocks.

- Bonds move with interest rate policies.

- Currencies move with capital flows.

- Indices move on growth and earnings.

By trading these different asset classes, you benefit from these different sources of trends.

Here’s a real-world case study:

During 2014, the US stock market was choppy. At the same time…

- USD had appreciated strongly against EUR and JPY.

- Crude oil collapsed from $100 to $40.

- Bonds had a major uptrend.

A Trend Follower would have made a killing while stock traders were struggling.

4. Keep losses small

Even though you trade many markets, you’ll still face frequent losses because most of these trades fail to develop into a trend. That’s why it’s important to cut your losses so you can live to fight another day—unlike my hairline, which fought the good fight but has now given up.

Trend Following is not about being right often. Rather, it’s about cutting your losses and riding your winners. This way, even with a 40% winning rate (which is common for a Trend Following system), you’re still profitable in the long run.

These four principles form the backbone of Trend Following. But principles alone aren’t enough— you need clear objective trading rules.

So now, I’ll teach you a Trend Following system that works (backed by data)…

A Trend Following system that works

Markets traded:

Currencies: GBP/USD, USD/JPY, AUD/USD, EUR/USD, USD/CNH

Metals: Gold, Copper, Silver, Palladium, Platinum

Commodities: Coffee, Euro-OAT, Corn, Soybean, Wheat

Bonds: Bund, US 5-year Note, Long Gilt, US T-Bond, Bobl

Timeframe:

Daily

Risk management:

2%

Trading rules (long)

- Go long when the price closes at the highest over the last 200 days.

- 6 ATR trailing stop loss.

Trading rules (short):

- Go short when the price closes at the lowest over the last 200 days.

- 6 ATR trailing stop loss.

Here’s an example…

Coffee (Daily timeframe)

On July 9, 2024, Coffee made the highest close over the last 200 days (as shown on the Donchian Channel) and gave you an entry trigger to go long.

In this case, the trade worked in our favour, and you held the position till the price hit your 6 ATR trailing stop loss on April 4, 2025. This would have netted you a gain of 39% on the trade.

Of course, this is a cherry-picked example. And because you are trading with an objective set of rules, you can backtest this Trend Following system and see how it has performed.

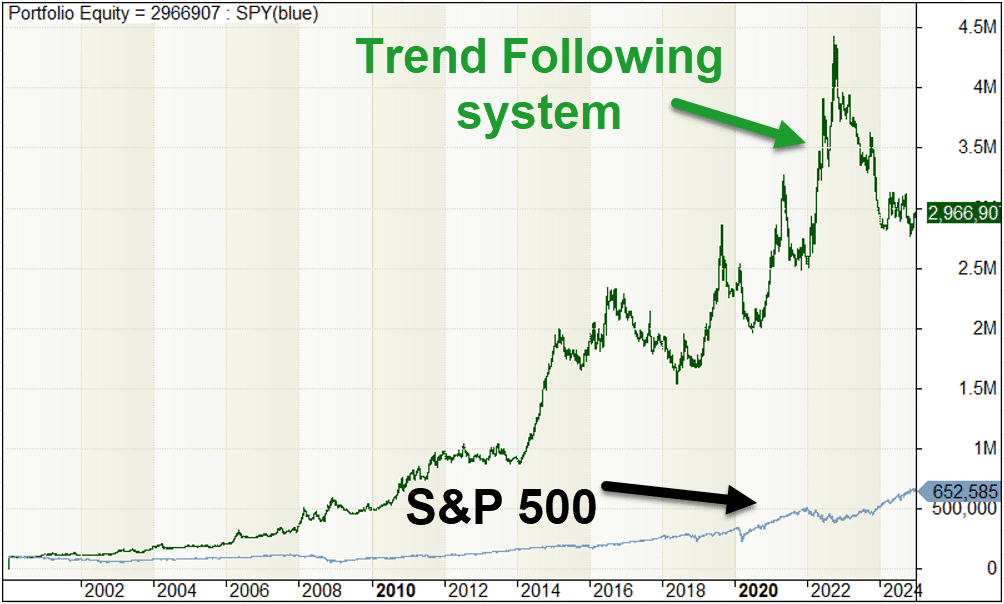

Backtest results: Trend Following system

Here’s the result over the last 25 years…

- Total return: 2866% (since 2000)

- Annual return: 14.51%

- Winning rate: 45.77%

- Losing rate: 54.23%

- Payoff ratio: 1.74

- Maximum drawdown: 37.7%

Here’s the equity curve of the trading system…

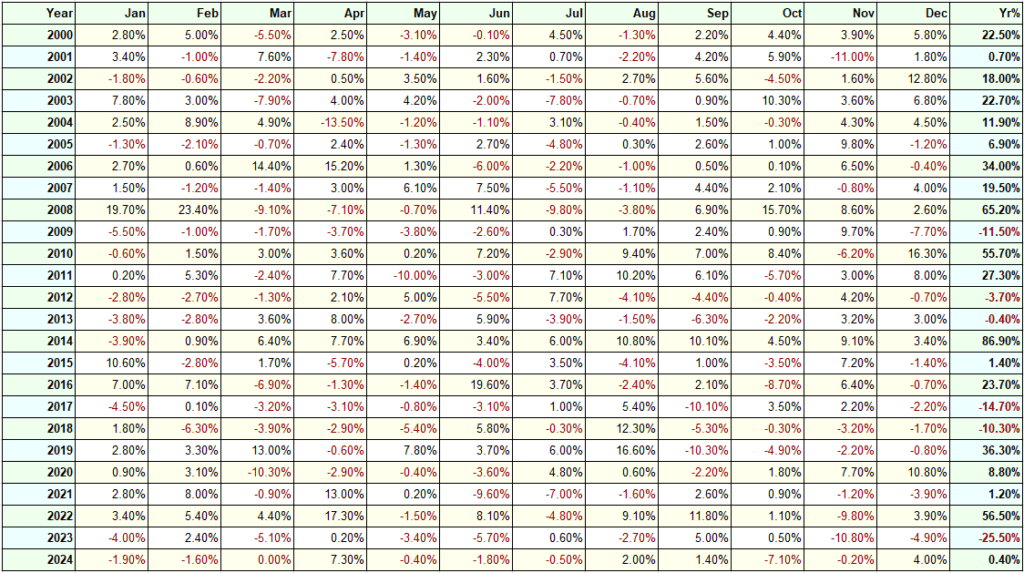

And the yearly returns…

Pay attention to the years 2000, 2008, 2019, and 2022.

What do you notice?

These were all crisis periods: the Dot Com Bubble, the Financial Crisis, COVID-19, and the Russia-Ukraine War.

While the stock market collapsed during this time, a Trend Following approach would have made a killing.

Here’s what one of my students, I Ang (from The Ultimate Systems Trader), has to say about Trend Following…

“As proven, it has worked well in bear markets and got me into trade before the big moves, like Crude Oil.” — I Ang

Now you might be wondering…

“Why does Trend Following work well during a crisis period?”

Herd mentality.

Let me explain…

Imagine you’re in a cinema watching a movie (Perhaps Avengers: End Game). Then, in front of the screen, you notice a flame getting larger as the seconds go by. And before you know it, BOOM, there’s a massive fire!

Now let me ask you: will you continue watching Avengers or dash out of the cinema? I guarantee you’ll run out of the cinema. Why? Because there’s a fear in you, the fear that you might get burned alive. And guess what? Everyone else has the same fear as you, otherwise known as the herd mentality.

You’re probably wondering:

“What has this got to do with Trend Following?”

Well, the same applies to the financial markets.

When there’s panic and fear in the markets, what happens? People sell their stocks and risky assets, which causes the price to go into a downtrend.

For many institutions (like pension funds), they can’t hold a ton of cash because of regulatory reasons. So, they would use their cash to buy up safer assets like bonds, gold, the US dollar, etc, which causes these markets to go into an uptrend.

If you recall, how does Trend Following profit? It seeks to profit from trends in the market! That’s why you often see Trend Following do exceptionally well during a crisis or a recession—it’s like owning a toilet paper company during COVID.

Moving on, let’s talk about the pros and cons of Trend Following…

Pros and cons of Trend Following

First, the advantages of Trend Following…

- Simple and robust

- Has worked for centuries

- Does well during a crisis

Trend Following has simple and robust rules. If you looked at the trading system I shared earlier, the entry & exit have only two trading rules. This makes it a robust trading approach, and it’s likely to continue working for decades to come (like how it has worked for the last few centuries). It’s the cockroach of trading strategies; it just won’t die.

Unlike most trading systems correlated to the stock market, Trend Following is not correlated. This gives you protection during a crisis and offers you better risk-adjusted returns on your portfolio.

This means you’ll sleep better at night knowing that even if shit hits the fan, you have a trading system that will perform well.

Next, the disadvantages of Trend Following…

- Low winning rate

- Long drawdowns

- Difficult to trade psychologically

Trend Following has a low winning rate, anywhere between 30 to 40%. This means you’ll lose frequently and have long drawdowns.

You might be thinking: “What is a drawdown?”

Here’s an example: let’s say your trading account reaches a high of $100,000 and then declines to $90,000. That’s a drawdown of 10%.

Now, the length of a drawdown refers to how long it takes for your account to reach a new equity high. If it took 1 month to go from $90,000 back to $100,000, then it’s a drawdown duration of 1 month.

However, for Trend Following, you can experience a drawdown duration for years, which makes this a difficult trading system to execute psychologically. After all, who likes to lose often and not see results for years?

And because this is a difficult system to trade, most traders will give up when the going gets tough.

(The good thing is that when more people give up, the strategy is less crowded, which means the edge will remain for disciplined traders.)

Next, let’s find out…

Is Trend Following suitable for you?

Here’s my take on it…

Trend Following is NOT for you if…

- You need to be right often because Trend Following has a low winning rate.

- This is your first trading system because it’s psychologically difficult to trade.

- You have a small trading account because it requires at least a 5-figure account.

Trend Following is FOR you if…

- You are long stocks and want to hedge yourself during a crisis.

- You want a trading strategy uncorrelated to the stock market.

- You have other trading systems and want to improve your portfolio’s adjusted returns.

Now, you have a good idea whether Trend Following suits your personality and goals.

Still, you might have a few questions. So let’s tackle some of the common ones I get from traders…

Frequently asked questions

How can I reduce the drawdown of a Trend Following system?

There are two things you can do:

- Increase the number of markets to trade.

- Adopt multiple trading systems, not just one.

That’s the reason why in The Ultimate Systems Trader (UST), we teach multiple trading systems so you can reduce your drawdown and profit almost every year regardless of market conditions.

Can Trend Following work on the Forex market?

Trend Following works best when you trade many different markets because it increases the odds of capturing a trend.

By reducing the number of markets, you reduce the odds of capturing a trend, drawdowns will be longer, and this makes it even more difficult to be a Trend Follower.

Can it work on stocks?

The concept of Trend Following can be applied to stocks, but with a few tweaks.

- Avoid shorting because the stock market has a bias to trend higher.

- Have a trend filter to stay in cash during a bear market.

Can this be traded on lower timeframes?

I’ve not tested this yet. But hypothetically, trends are shorter on the lower timeframe and transaction costs are higher (because you’re trading more often).

I would think it wouldn’t work as well (or not at all) on the lower timeframe.

How many markets can I apply Trend Following to?

As many as you can afford.

There are hedge funds that apply Trend Following to hundreds of markets for diversification purposes.

Conclusion

Trend Following is not about predicting the future. It’s about cutting losses small and letting winners run. It’s simple, robust, and it works. History has proven it, data has backed it, and billion-dollar hedge funds still rely on it today.

However, it’s psychologically tough to trade on its own. The frequent losses and long drawdowns can wear down even disciplined traders.

That’s why inside The Ultimate Systems Trader (UST), you’ll learn how to combine Trend Following, Mean Reversion, and Momentum—so you can profit in a bull market, a bear market, and even during a recession. The best part?

You only need 15 minutes a day. Details here.