This post is written by Jet Toyco, a trader and trading coach.

Imagine this…

You’re having a good day in trading and you’re currently on a winning streak.

You’ve even tripled your money!

So, with that high confidence…

You decided to enter a “high risk-high reward” trade.

But as time went by, it kept declining…

And declining…

You’re probably thinking:

“What the *beep* is going on?!”

“Should I exit this trade?

But you’ve gone this far!

So with your big ego, you add to your losing position and become an “investor”

But then what happens?

That’s right, it kept getting lower and lower…

At this point…

You’ve accepted defeat and don’t want the trade to eat into the profits you’ve made.

So you exit the trade…

Now, can you tell me what happens when you exit your trade?

That’s right, it often goes back in your favor but without you!

Dammit!

So, has this ever happened to you?

If so, then what’s the problem?

Well, chances are—you are trading in a sideways market.

And believe me, this is a recurring pattern I see happen to me!

That’s why in this trading guide…

Based on what I experienced, you’ll learn:

- The REAL truth about trading sideways markets and when to exactly know that you’re trading in one

- This one trick to instantly fix most of your trading mistakes when trading sideways markets

- The right and simple way to trade the range market

Sounds good?

You bet as this guide’s packed!

So with that said, let’s get started…

What are sideways markets (and why they are hard to trade)

Now…

I don’t doubt your knowledge when it comes to sideways markets.

But let’s have a refresher, shall we?

So as the name suggests…

Ranging or sideways markets are low volatility market conditions:

It’s the type of market condition where buyers and sellers are fighting each other out!

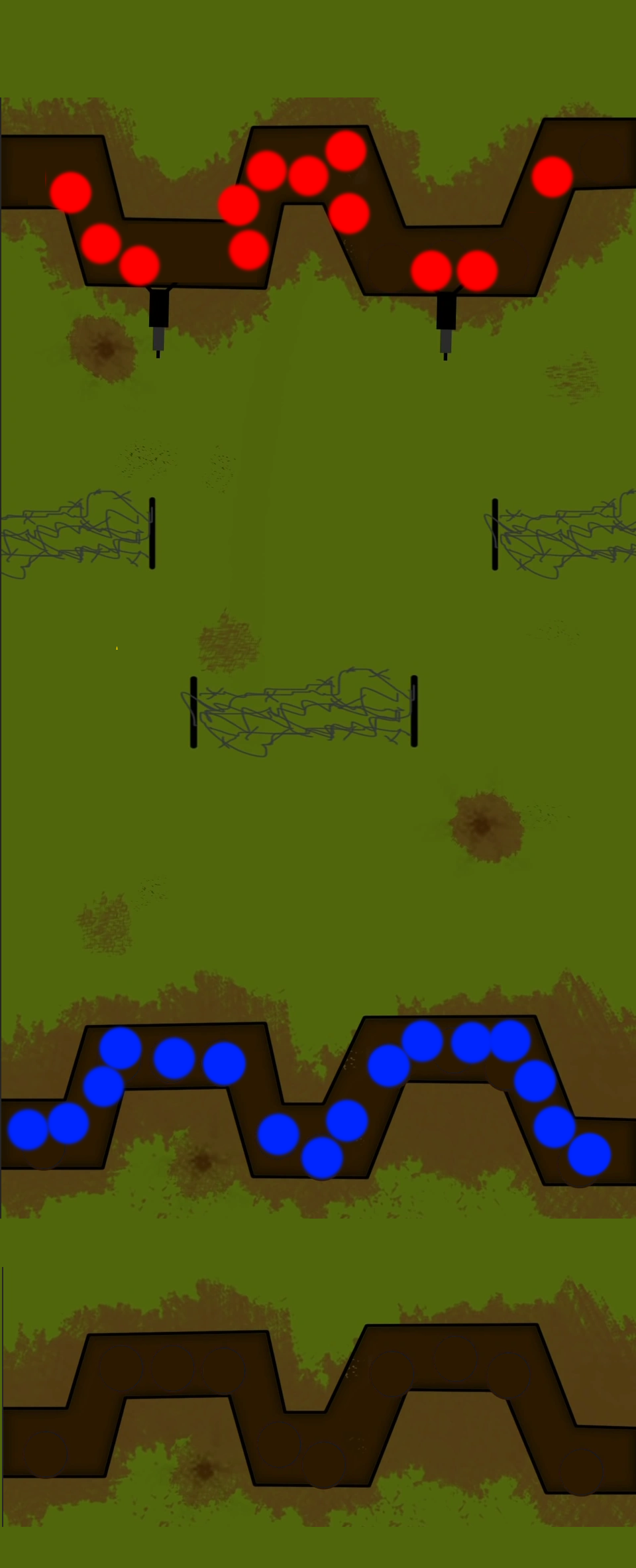

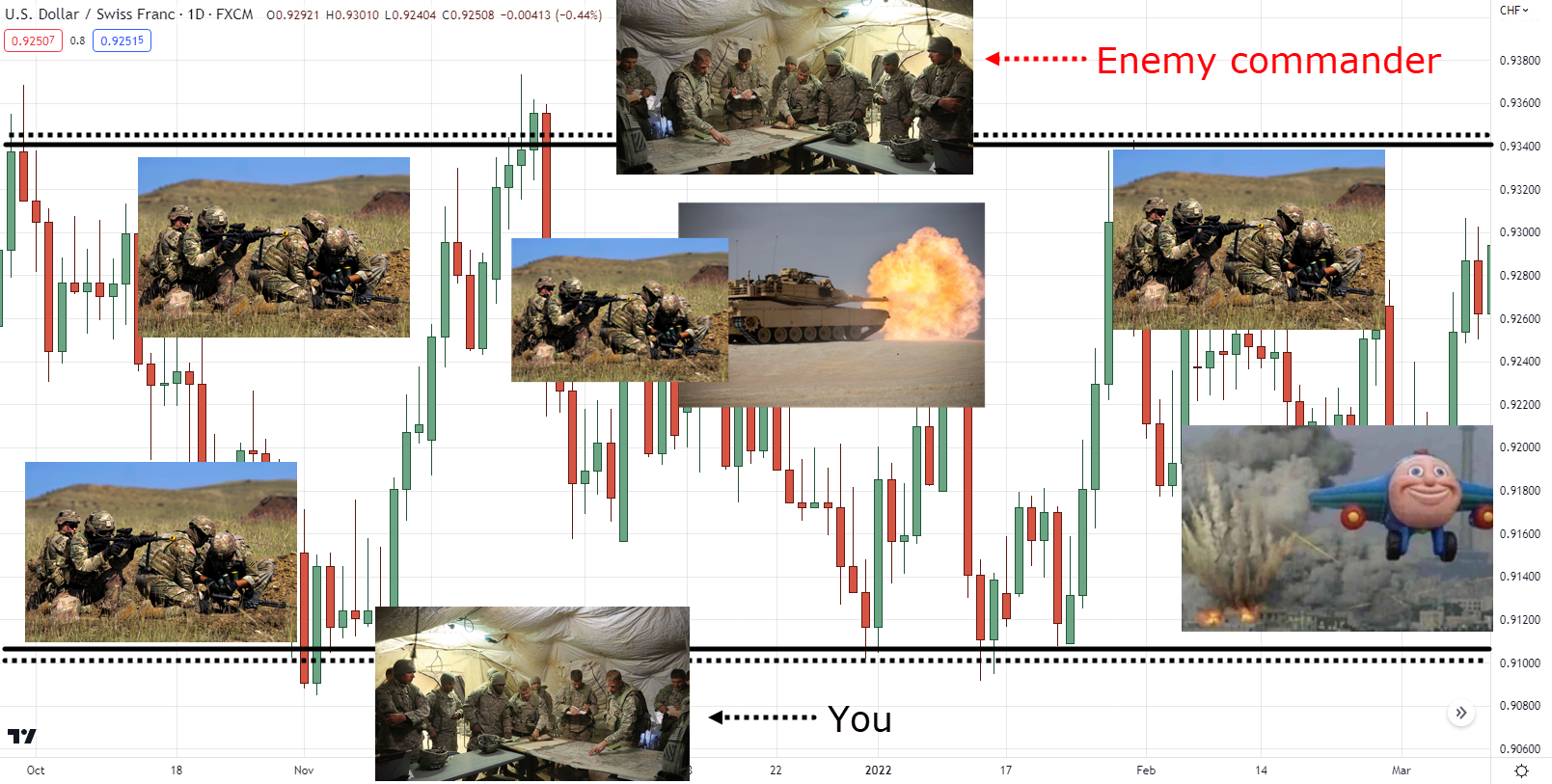

You can imagine sideways markets similar to trench warfare back in world war 1.

Where two opposing countries are at a standstill!

From time to time, the army would charge into the other side gaining a few inches of land!

But as the defenders make a counterattack, they would return to where they were.

This my friend, is similar to the market’s sideways markets.

Where there is no clear indication of who’s winning!

Buyers and sellers are constantly battling each other out!

That’s why this is often the hardest market condition to trade…

Now you might be wondering…

When are range markets exactly valid?

For this part…

You must focus on where the price is rather than where the price was!

That means you trade what you see and not what you think!

Now, when is a market considered a sideways market?

Simple.

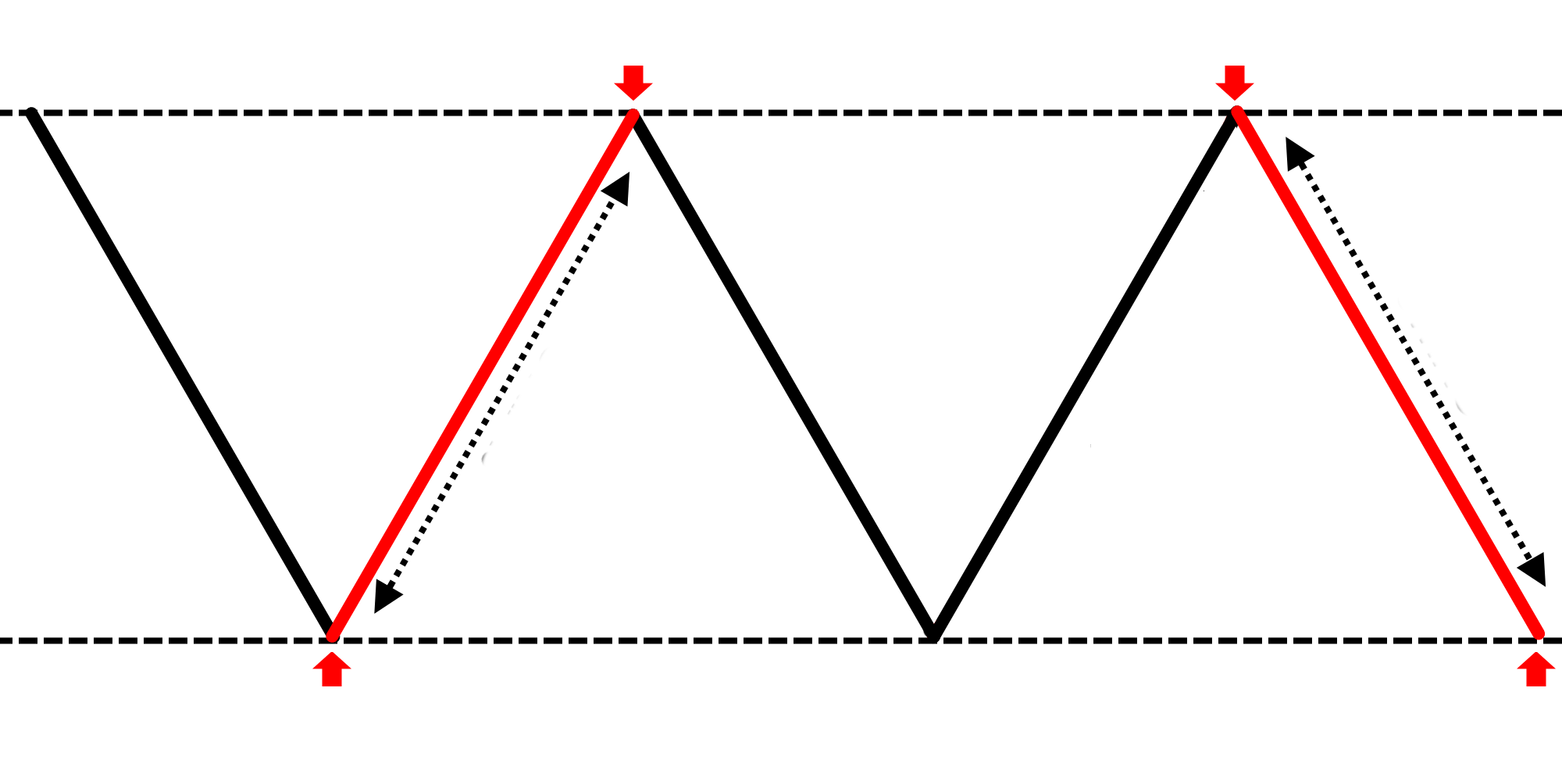

It starts with a clear market structure of a previous market high and low such as this:

But we’re not yet in a range market!

The moment it makes a clear reversal “away” from the previous low (or vice versa if price touches the highs and reverses from it):

You now have a valid sideways market!

Why?

Because the current price is now in the middle of the range!

Makes sense?

With that said…

Here’s an important thing that you should know about sideways markets.

The truth about trading sideways markets that you should know

Sideways markets are hard to trade not only for their environment…

But also because of the possibility that sideways markets can:

- Expand

- Contract

Let me explain…

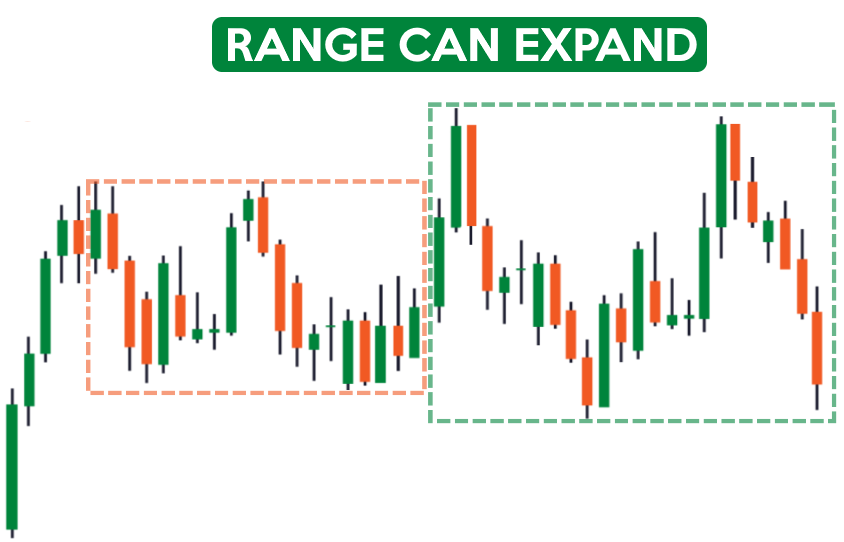

Range expansion

Whenever you look at trading textbooks what do you normally see?

That’s right!

A perfect flat sideways markets

Of course, such simple schematics are important to grasp its concept.

But in the real markets…

It’s like a whole new beast!

It’s a market that’s not often flat but can expand!

In the later sections, I’ll teach you how to tame such markets.

In the meantime, sideways markets can also have…

Range contractions

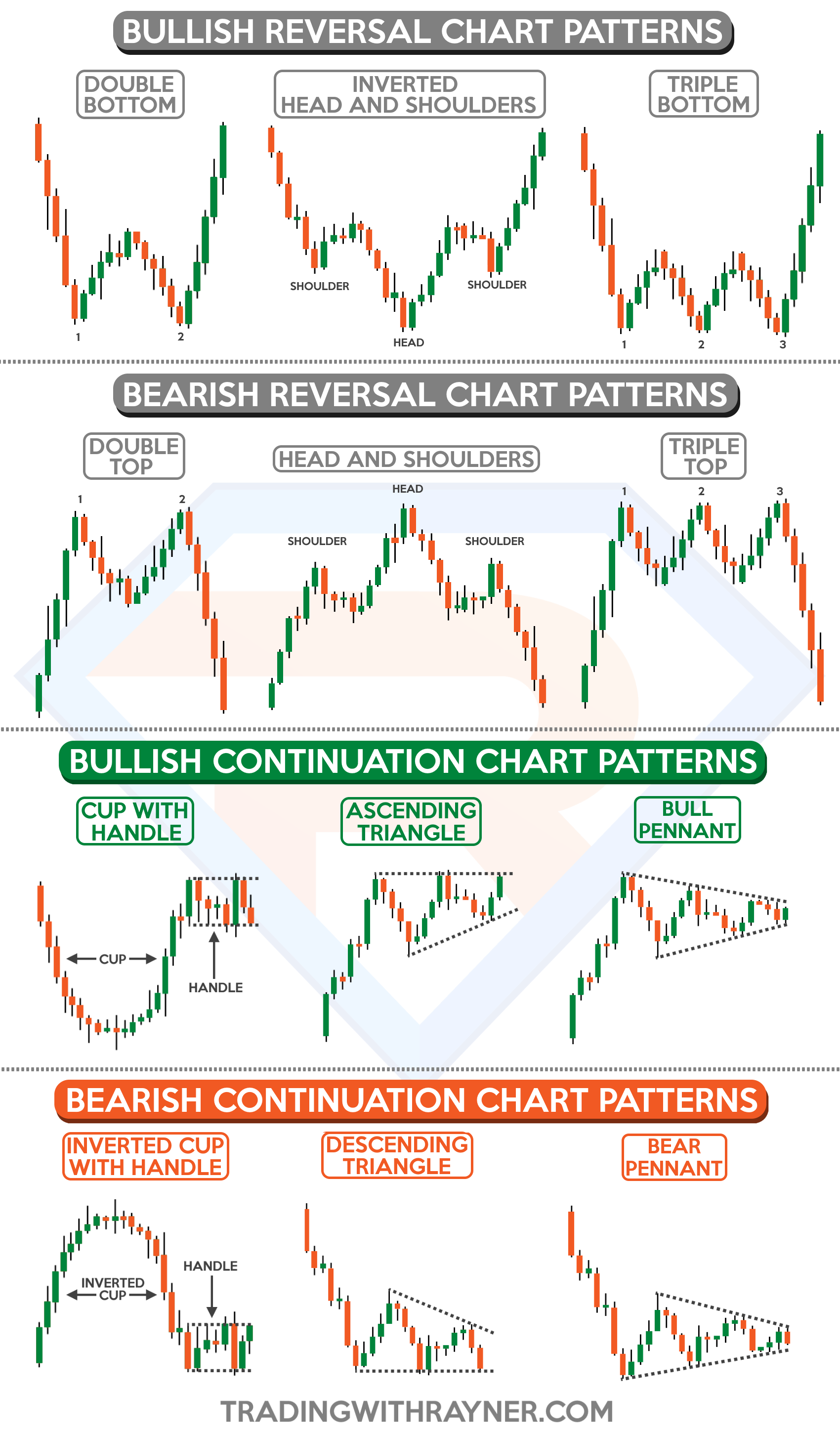

It’s very similar to other chart patterns which you might have seen before.

They are just different forms of range contractions!

Except of course…

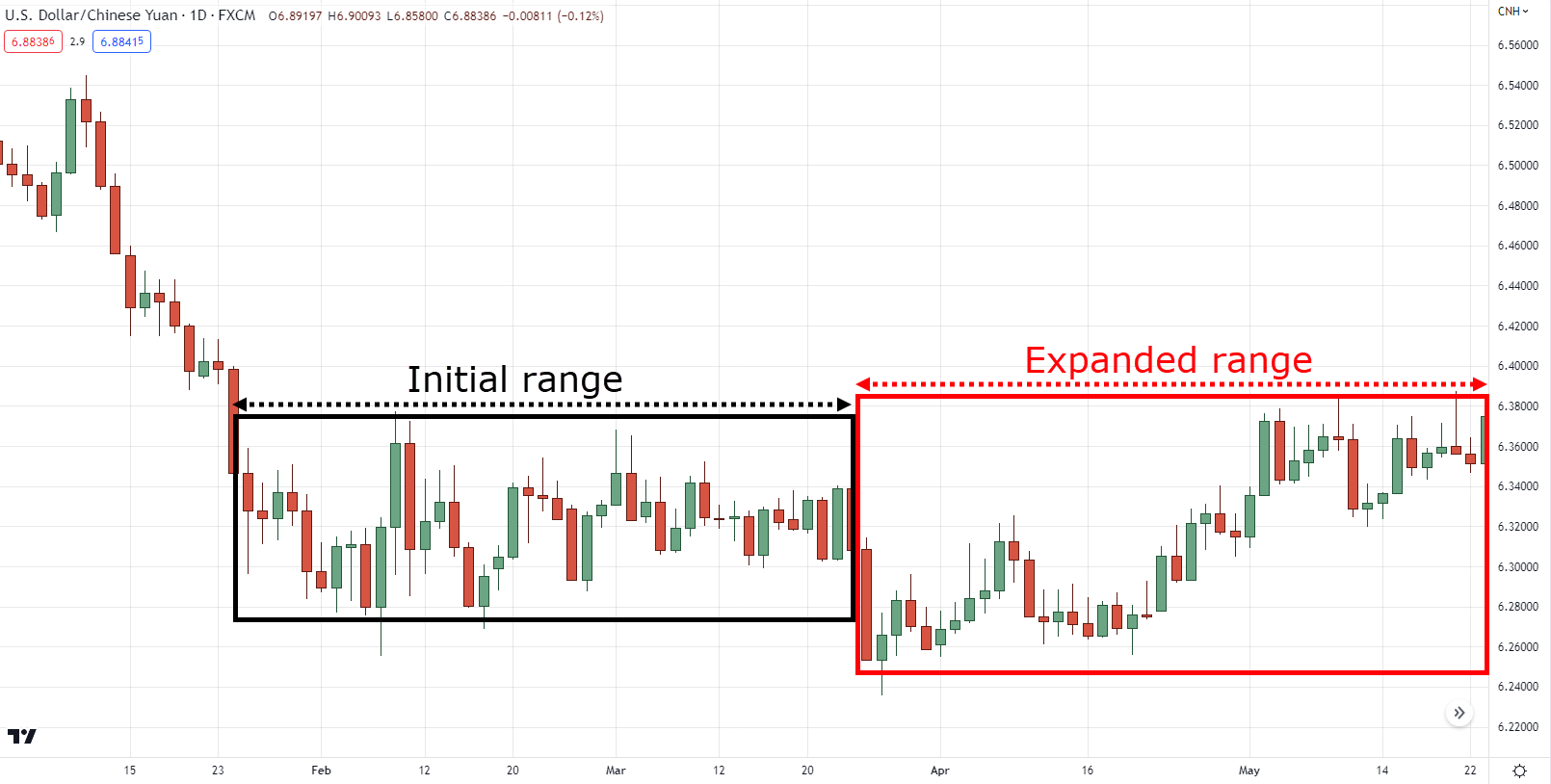

Sometimes they can happen from a span of a couple of months to years:

And it’s these monster sideways markets that we’re going to focus on today!

Makes sense?

Now if you want to learn more about chart patterns, you can check this out:

The Essential Guide to Chart Patterns

But in the meantime…

Let me show you how exactly to trade the sideways market.

Because what use is there to know all these if you can’t use them to make money in the markets, right?

So let’s move on to the next section…

Do this ONE trick to instantly improve trading sideways markets

If you want to trade sideways markets, you must act like a commander.

Let me explain…

As a commander, you tactically give orders to your battalions!

You get to deploy assets like tanks!

Heck even airstrikes!

While you, the commander…

Stay on the sidelines to command your army.

And that’s the trick to trading sideways markets!

To be a commander on the sidelines while you let the buyers and sellers battle it out.

Avoid trading the middle and only the top and bottom of the range!

And by the time the price reaches the top or bottom of the range…

What should you do?

Yes, a confirmation!

But what do I mean by confirmation?

Let me show you in the next section…

Simple trading sideways markets strategy

Let’s have a quick checklist…

The price is in a sideways market?

Check.

Market is at the area of support or resistance and not in the middle of the range?

Check.

Confirmation and entry?

Well, one way to go about it is through…

False breaks

Remember when I said that ranges can expand?

Good.

Because false breaks are all about taking advantage of this phenomenon!

Now, I know I shared with you what a false break looks like when trading sideways markets above.

But I want you to listen closely as it can be tricky to trade!

So, assuming that the price is at the area of resistance (and of course it must be a valid range).

You need two things to happen.

First, is for you to wait for the price to close within or beyond the area of support.

That’s right!

You want the price to overextend within or below the range and not do anything yet!

Don’t chase the price!

So, at this point…

If the price continues moving downward then we skip the trade.

But if it snaps back into the range like this?

Then boom!

You have a valid false breakout!

Of course, you can consider entering at the next candle open with stop loss just a room below the lows…

Since you are entering a sideways market, you’d want to take your profits before the buying pressure hits:

Yes, you’d never want to be too greedy to set targets directly at support!

Because remember…

A range can contract.

So just a recap on how to go about trading sideways market with a false break setup:

- Wait for the price to close within or beyond an area of support/resistance

- Then wait for the price to close back into the range and enter the next candle open

- Finally, take profits before opposing pressure comes in

Trading false breaks strikes a good balance between being risky and conservative when trading sideways markets.

This is why it can be a very flexible setup to trade as it can work in most timeframes.

Sounds good?

So with that said, let’s have a quick recap of what you’ve learned today!

Conclusion

Trading sideways markets can be challenging at times.

But once you know how to navigate or know when and when not to “pounce” on a market opportunity…

Such market conditions can be profitable as well.

Nonetheless…

Here’s what you’ve learned for today:

- Range markets are challenging market conditions where buyers and sellers are in equilibrium, and it’s valid when the price is stuck between the highs and lows

- Trading sideways markets means that you have to keep in mind that ranges can both expand and contract

- Using a versatile setup such as waiting for a false break (range expansion) can help you profit from range markets

There you go!

A simple guide to trading sideways markets!

So this time, I want to hear from you…

Is it often very challenging for you to trade sideways markets?

Have you ever experienced being stopped out on a range market then the price moves back in your favor?

Let me know your story below!

Thank you for this opportunity, yes I have been stopped so many times. I am new trader what you have explained in your guide in side way trading structure will help me. I now have a better understanding. Thank you very much.

Great to hear that Malvin, you’re welcome!

yes really it happens alot with me but as i read your this whole strategy i am impressed teo sir you are awesom man now i trade range bounds with some tactics hopefully it will help me alot

It definitely will help you a lot, Rana, make sure to keep your risk management in check!

I have always wondered on how I can trade ranging markets. Most importantly making entries and exits ( the timing) has been a big question. Now that I have read this piece, then I will

Trade them but of course with cotion. Thanks.

Hey great to hear that Timothy, feel free to refer back to this article anytime!

Your teachings are the best

Thank you for the kind words, Cecile!