Day trading gets all the attention.

It’s associated with things like financial freedom, ability to work from anywhere in the world, no boss to answer to, Lamborghinis, etc.

However, a group of researchers did a study on Brazillian day traders between 2013 and 2015.

They wanted to find out how many % of traders made money consistently.

And do you know what they found?

- 97% of them lost money

- 4% earned more than a bank teller (about $54 per day)

- The top trader earned $310 per day

Hmm.

It seems like day trading isn’t as hyped up as it seems to be.

Now, what about part-time trading?

Well, I don’t have any figures to back up the findings.

But, there are a few things that part-time trading offers that you won’t get as a day trader.

I’ll tell you more…

You increase your chance of becoming a profitable trader, here’s why…

Based on a survey I did with 500 traders, I realized that many of you faced these issues…

- Lack of trading capital

- The “need-to-make-money” syndrome

So, what can you do?

Consider a part-time trading approach. Here’s why…

You can keep your full-time job and grow your capital quickly

Part-time trading doesn’t require much of your time.

This means you can get a full-time job and use savings (from your job) to increase the capital of your trading account — and let the power of compounding work for you.

In my opinion… this is the secret to building serious wealth with low risk (which I’ll explain more later).

It removes the “need-to-make-money” syndrome

What is this syndrome?

This is where you break your trading rules (like shifting your stop losses, revenge trading, averaging your losers) just to avoid a loss.

Why?

Because you rely on your trading profits to pay the bills and you do whatever it takes to prevent a loss.

But if you have a job, things are different because you don’t rely on your trading profits to live.

Even if you have losing months, it’s not the end because your job will provide your living needs.

This means you can focus on learning how to trade and not worry about whether you can pay the bills.

Won’t this help you become a profitable trader in the fastest possible time?

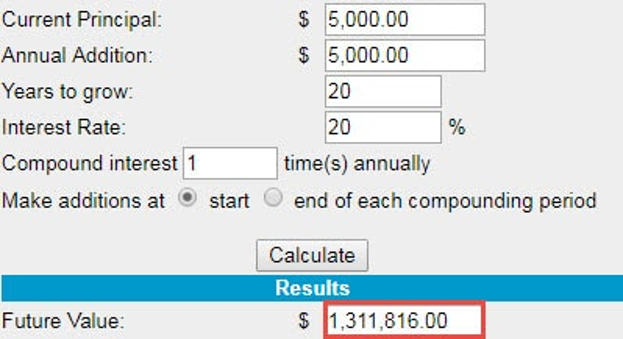

How to turn $5,000 into $1,311,816 without relying on a get-rich-quick scheme

Let me prove it to you…

If you make an average of 10% a year with a $5,000 account, after 20 years it will be worth…

…$33,637.

That’s probably not enough for you.

So let’s work on it…

Since you’re trading part-time, you have a job and can regularly add funds to your trading account.

Let’s contribute $5,000 to your trading account each year (which is less than $420 a month).

Again, the same rules apply.

You make an average of 10% a year with an initial sum of $5,000 and you add $5000 to your account each year.

After 20 years, it’ll be worth… $348,650.

Now, this looks much better.

But what if you can do 20% a year?

Again, the same rules apply.

You make an average of 20% a year with an initial sum of $5,000 and you contribute $5,000 to your account each year.

After 20 years, it will be worth… $1,311,816.

Now let me ask you…

Will $1.3m give you financial freedom?

Will $1.3m allow you to retire and have the freedom to do the things you love?

Will $1.3m give you peace of mind knowing you can better provide the needs of your family?

In other words…

If you have an initial capital of $5,000 and can add $5,000 to your account each year, then you have what it takes to build serious wealth.

But here’s the real kicker…

There is no limit to how much money you can make.

Instead of 20%, what if you make 25% each year?

Instead of 20 years, what if you compound your returns for 25, 30, or even 40 years?

Instead of $5,000, what if you add $10,000, $15,000 or even $20,000 to your account each year?

Now the question is…

…How much money do you want to make?

You have this ONE thing day traders will never experience

Let me share something with you…

After I graduated from university, I got a job as a proprietary trader and I work anywhere from 10–14 hours a day.

Here’s what a typical day looks like:

7:45am – 8:00am: Prepare for Nikkei’s open

8:00am – 10:30am: Trade Nikkei

10:30am – 11:30am: Tea break

11:30am – 2:00pm: Trade Nikkei

2:00pm – 3:00pm: Lunch break

3:00pm – 6:00pm: Trade London’s open

6:00pm – 8:00pm: Dinner break

8:00pm – 10:00pm: Trade London & New York overlap

Did I enjoy it?

You bet!

But here’s the thing…

This comes at the expense of my own time and freedom, so I had to make a choice…

Adapt to the higher timeframe or give up trading.

Fortunately, I adapted.

The best part?

Higher timeframe trading doesn’t require much screen time; this gives me the freedom to do the things I love (like spending time with my family, hanging out with friends, taking vacations, etc.).

Trading becomes more relaxed and less stressful

Imagine:

You’re a day trader on the 5 minutes timeframe and every 5 minutes, a new candle forms.

This means you’ve got to make a decision every 5 minutes.

“Do I buy?”

“Do I sell?”

“Do I stay out?”

“Do I scale in/out of my trades?”

“How many units do I buy?”

Can you see how stressful this can be?

And when you’re stressed, you make more mistakes which hurt your results.

But, what if you’re a part-time trader?

Well, you can trade off the higher timeframe like the Daily timeframe.

This means you’ll have 24 hours to make a decision. You’ve got 24 hours to think, plan, manage, and execute your trades.

The outcome?

You make better decisions, your results improve — and trading becomes more relaxed.

Transaction costs: How to put it in your favour

Now…

One of the biggest reasons why traders fail is because they don’t pay attention to the transaction cost.

And that can be a difference between a winning and losing trader.

Let me explain…

Imagine…

- You have a $10,000 account

- Transaction cost is $10 per trade (buy and sell)

- You place 500 trades per year (from day trading)

If you do the math, you need a return of 50% just to break even!

But what about trading the Daily timeframe?

Again…

- You have a $10,000 account

- Transaction cost is $10 per trade

- You place 50 trades per year (from part-time trading)

Now, you just need 5% to breakeven — it’s a big difference.

Can you see how transaction cost is a killer?

So if you want to put the odds in your favor, trade less — not more.

The downside of part-time trading (the truth)

At this point…

You’ve learned the benefits of part-time trading.

But, there’s a downside to it that you must know and it’s this…

It’s difficult to generate a consistent income from part-time trading.

That’s because you’re trading off the higher timeframes which offers less trading opportunities compared to a short-term trader.

This means it takes a longer for the law of large numbers to work in your favour.

Confused?

No worries, I’ll explain…

Imagine you have a special coin in your hand…

- If it comes up head, you win $2

- If it comes up tail, you lose $1

But here’s the catch, you can only toss your coin once a day.

Do you think you’ll make money every single day?

Of course not.

Why?

Because in the short run, your coin toss results are random — you could get tails many times in a row (and thus have many losing days in a row).

Now, what if you can toss your coin 1,000 times per day, how will the results change?

Well, you’ll get close to 50% heads and 50% tails after 1,000 tosses — which means you’re guaranteed to make money every day because your edge can play out within a short period of time.

And this concept is the same for trading!

If you have an edge in the markets and you have a higher frequency of trades, your edge can play out within a shorter period of time.

If you have a lower frequency of trades (in the case of part-time trading), it takes a longer time for your edge to play out.

Although this seems like a bad thing for a part-time trader, remember…

You’ll have the ability to compound your returns for a long time, have less stress, and have the freedom to do the things you love.

Is this worth it?

Only you can decide for yourself.

Conclusion

Here’s what you’ve learned today:

- Part-time trading allows you to keep your full-time job so you can focus on learning without having a “need-to-make-money” syndrome

- Part-time trading is less stressful, it gives you the freedom to do the things you love, and it compounds your returns for decades

- But if you want to generate a consistent income from trading, then part-time trading is not for you

Now, here’s what I’d like to know…

What’s your take on part-time trading?

Leave a comment below and share your thoughts with me.

Good read, thanks Rayner!

My pleasure, David!

I agree on everyone you say for the past 2 years. Except today’s article…you can make weekly income part time trading, because you can ‘flip the coin’ a few times a week using a weekly chart for trend, a daily chart for support and resistance and an hourly for entry and exit. As long as your entries and exits are per the total understanding of your price action guidelines on the chart, with the multitude of strategies available, and when entered without greed or emotion, but where good supply and demand exist, (your teachings), then a weekly income is possible.

Like the idea of part time trading, is it possible to do both, Scalping for shorter timeframes and swinging for longer timeframes.

Yup, that’s possible.

I think part time trading is the best thing anyone that loves freedom from tension and stress will go for.

Cheers

Part time trading sounds good especially for beginners who wants to try and see whether trading is for him or not.

Yes, makes perfect sense to me.

A part-time option seems reasonable because it also allows you to learn the basics. After that, new opportunities arise.

Thanks for sharing, Nixon!

Good and new fact i learened today.. Its helps me to realize my mistakes i am doing as of now.

It’s never too late!

Thanks. I’m currently listening to your videos “Forex Trading for Beginners”. I’m less than a week old and still learning the terms. You’ve been helpful. Thanks

Glad to help, Charles!

I think it sounds like a good idea, although to be a part time trader you need to be a good/profitable trader, and to be a profitable trader takes a lot of learning and experience I would presume would only come with a lot of trading – i.e. being a day trader or prop trader of some sort?

Would be interested to hear your thoughts!

Yes and no.

Yes, if you are a discretionary trader then more screentime would help, and that is something lower timeframe can offer.

No, because if you were to adopt a systematic trading approach, you can trade mechanically without knowing much about TA.

I always think time is the greatest factor in calculating returns … which a lot of casual trader has omitted it.

Hi Irene,

I’m glad to hear that!

Absolutely Greatly written also i never read this much lengthy blog without taking a min break.Also this is exactly what i was looking for.

Glad we could help, Abdul!