Over the last few days, you’ve been on a wild ride to discover the TRUTH about what it takes to become a profitable trader.

If you missed my earlier posts, then you can read it below:

5 BIG Mistakes Losing Traders Make

The 3 SECRETS That Transformed My Trading

You’ve learned that most people approach trading the wrong way.

They trader on the wrong timeframes, don’t have the correct expectations, and simply don’t have an edge in the markets.

Moving on…

I’ll share with you a trading methodology that works and how it can overcome the issues that most traders faced.

Now you’re probably wondering:

“What is this trading method?”

It’s Trend Following.

A trading methodology that exploits trends around the world so you can achieve market-beating returns, without spending hours in front of the monitor.

You might be thinking…

“But why should I learn Trend Following when there are so many trading strategies out there?”

That’s a good question and here’s why…

You have the freedom to do the things you love

If you recall, many traders fail because they are trading the shorter timeframes.

They rush home after work and stay glued to their monitor, trying to scalp a few pips here and there.

Then they go to bed in the wee hours only to repeat the same thing the next day — sacrificing their time with family and friends.

So unlike short-term trading, Trend Following is traded on the Daily timeframe.

This means your entry, stop loss, and exits are done on the daily timeframe.

If you do it correctly, trading will take you less than 30 minutes a day.

And it gives you the freedom to do the things you love (like playing with your kids or having nights out with your friends).

So, gone are the days where you’re glued in front of your monitor — stressing yourself out for a few measly pips.

You have an edge in the markets so you can trade with confidence

Here’s the proof…

There are many research papers on Trend Following and it finds that Trend Following has an edge in the markets.

But one particular research stands out and it’s called “Two centuries of Trend Following”.

This research has found that Trend Following is proven to work over the last 200 years — and even till today.

You might be thinking:

“Sure, it looks good on theory. But what about the real world of trading?”

I’m glad you asked.

Because some of the biggest hedge funds in the world adopt a Trend Following approach, like Dunn Capital, Winton Capital, Mulvaney Capital, and Man AHL.

And even Market Wizards like Richard Dennis, John Henry, and Ed Seykota.

Clearly… Trend Following is proven to work by academic research, billion-dollar hedge funds, and — even Market Wizards.

You increase the odds of becoming a consistently profitable trader

Based on a survey I did with 500 traders, I realized that many of you faced these issues…

- Lack of trading capital

- The “need to make money” syndrome

My suggestion?

Adopt a Trend Following approach. Here’s why…

You can keep your full-time job and grow your capital quickly

By now, you know that Trend Following is a trading strategy that doesn’t require much of your time.

This means you can get a full-time job and use savings (from your job) to increase the capital of your trading account — and let the power of compounding work for you.

In my opinion… this is the secret to building SERIOUS wealth with low risk (which I’ll explain more later).

It removes the “need to make money” syndrome

What is this syndrome?

This is where you break your trading rules (like shifting your stop loss, revenge trading, averaging your losers) just to avoid a loss.

Why?

Because you rely on your trading profits to pay the bills and you do whatever it takes to prevent a loss.

But if you have a job, things are different because you don’t rely on your trading profits to live.

Even if you have losing months, it’s not the end because your job will provide your living needs.

This means you can focus on learning how to trade and not worry about whether you can pay the bills.

Won’t this help you become a profitable trader in the fastest possible time?

You can build SERIOUS WEALTH

Do you know the magic of compounding?

Most traders don’t realize it as they are looking for a get rich quick scheme.

But no, you’re different.

You know trading is a long-term endeavor and it can help you build SERIOUS WEALTH.

Let me prove it to you…

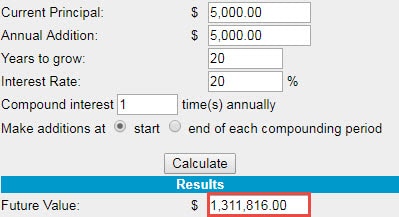

If you make an average of 10% a year with a $5,000 account, after 20 years it will be worth…

…$33,637.

That’s probably not enough for you.

So let’s work on it…

Since you have a job, you can take things a step further.

You can use a portion of your income to increase the size of your trading account.

Let’s contribute $5000 to your trading account each year (which is less than $420 a month).

Again, the same rules apply.

You make an average of 10% a year with an initial sum of $5,000 and you add $5000 to your account each year.

After 20 years, it’ll be worth… $348,650.

Now, this looks much better.

But, is this the best you can do?

Well, if you’re a Trend Follower, you can do better than 10% a year.

Because if you follow the system I teach in The Trend Following Mentorship Program, you can achieve 20% a year.

And let’s see what it can do for you…

Again, the same rules apply.

You make an average of 20% a year with an initial sum of $5,000 and you contribute $5000 to your account each year.

After 20 years, it will be worth… $1,311,816.

Now let me ask you…

Will $1.3m give you financial freedom?

Will $1.3m allow you to retire and have the freedom to do the things you love?

Will $1.3m give you a peace of mind knowing you can better provide the needs of your family?

In other words…

If you have an initial capital of $5,000 and can add $5000 to your account each year, then you have what it takes to build serious wealth.

But here’s the real kicker…

There is NO LIMIT to how much money you can make.

Instead of 20%, what if you make 25% each year?

Instead of 20 years, what if you compound your returns for 25, 30, or even 40 years?

Instead of $5000, what if you add $10,000, $15,000 or even $20,000 to your account each year?

Now the question is…

…How much money do you want to make?

You are hedged against a financial crisis

I’m sure you can agree that…

Whenever shit hits the fan, you’ll see the media talk about the collapse of stock markets, how bad the economy is and how many jobs are lost.

But here’s the thing:

Trading is a zero-sum game.

This means that for someone to lose, someone must win.

So the question is, who are these winners?

You probably guessed it… Trend Followers.

Here’s the proof…

1987 Black Monday stock crash

The S&P 500 lost 29.6%.

Dunn Capital gained 72.15%.

2002 Stock market downturn

The S&P 500 lost 23.27%.

Dunn Capital gained 52.23%.

2008 Financial Crisis

The S&P lost 38.5%.

Dunn Capital gained 55%.

Clearly…

Trend Following gives you a hedge during the worst of times.

When everything around you looks doom and gloom, you can expect Trend Following to provide stellar returns — and offer security during these dark times.

You have a peace of mind

If you’re day-trading, you must constantly watch the markets because a sudden news event could stop you out of your position.

It’s stressful and you are a “slave” to the markets.

Now unlike day-trading, Trend Following gives you a peace of mind.

Here’s why…

When the market is trending and a big news is about to be released, 1 of 3 things usually happens…

- The market continues trending

- The market does a pullback and continues trending

- The trend reverse

And more often than not, the market continues trending, or it does a pullback first, then continues trending.

So forget about NFP, FOMC, GDP, and etc.

Those are “noise” and have no long-term impact to on bottom-line.

You might wonder:

“But what if the trend reverses?”

Then you get stopped out.

No biggie because you live to fight another day.

And in the next section, I’m going to teach you a Trend Following strategy to profit in bull markets, bear markets, and even crisis periods.

Read on…

A Trend Following strategy that works

This is a False Break trading strategy that I teach in The Trend Following Mentorship Program.

The concept behind the False Break strategy is based on 5 things…

- The future market’s direction is likely to follow the long-term trend

- Support & Resistance offers an area of value to trade from

- Traders are likely to short the lows of Support and it gives you an opportunity to profit from their action

- You have no idea how far a market will trend, so you trail your stop loss accordingly

- You trade many markets to increase the odds of capturing a trend

Now, let’s break these down into a trading strategy you can use to profit in bull and bear markets.

Here’s how it works:

If the price is above the 200-day moving average, then wait for it to pullback to Support (trading with the long-term trend).

If the price pullbacks to Support, then wait for it to reject lower price and close higher (trading from an area of value).

If there’s a false breakout at Support (waiting for short traders to get “trapped” before entry), then go long on the next candle open with stop loss 1ATR below the low.

If the price moves in your favour, then look to trail your stop loss using the 50-day moving average (trail your stops as the market moves in your favor).

Markets Traded:

Trend Following works when trading across a variety of markets because it diversifies your risk and increases the odds of capturing a trend.

An example of an equal weighted market universe:

Forex – Eurusd, Gbpusd, Audusd, Nzdusd, Usdcad, Usdjpy, Eurjpy, Gbpjpy

Indices – S&P500, Nasdaq, Nikkei, Hang Seng, Asx200, DAX, Euro Stoxx 50, FTSE 100

Bonds – 30 Year Treasury, 10 Year Note, 5 Year Note, Bund, Bobl, Schatz, Eurodollar, Euroswiss

Agriculture – Corn, Wheat, Soybean, Soybean Oil, Oats, Rough Rice, Live Cattle, Lumber

Non-agriculture – Gold, Silver, Brent Crude Oil, Gasoline, Natural Gas, Palladium, Platinum, Copper

Risk management:

The nature of Trend Following is to have many small losses and monster winners when you do catch a trend. This will more than compensate for the little losses incurred along the way.

Thus, you want to risk a fraction of your trading capital (like 0.5% on each trade).

Here are some trading examples:

EUR/AUD Long:

US T-Note Short:

Soybean Oil Short:

And that’s all to it!

With this simple trading strategy, you can now ride massive trends across the markets and grow your wealth steadily over time.

It’s worked for me, it’s worked for my students, and it can work for you.

Of course, there’s much more you can do if you want to improve your trading skill, far more than I can fit into one blog post.

For example, you might have questions like…

How do I draw Support & Resistance correctly?

How do I trail my stop loss properly?

How to scan the markets quickly for trading setups?

If you’re interested in finding details, step-by-step answers to these questions, I’ve got good news.

The False Break trading strategy is only one small part of The Trend Following Mentorship Program (The TFMP).

It opens on 25th July, Wednesday, and is perfect for you if you want to trade part-time and make 10%, 20% — or even 30% a year.

So you have the freedom to do the things you love and better provide for the needs of your family.

If you want to join The TFMP, then keep a lookout for my next email.

But for now, leave a comment below and say…

“I’ll do whatever it takes to become a consistently profitable trader!”

Thank you Rayner for being one of the good guys!

I appreciate the kind words, Dylan.

Definitely great content and what is even better about it is you can keep going back to it plus the free guides.

Thank you Raynor you make so much sense.

very nice and informative article.just keep writing more trading article for us. thanks a lot

Thank you, Anish.

excellent blog Rayner!

Ryner you are my favourite teacher you explain we’ll and clear your blog is is the best thank you

Good information Rayner. Keep up the good work, god bless you

Thank you, Nkaule.

Hey Rayner,

For a change: a few critical notes:

1. Trend following on the daily TF is not for 68 year olds like me, you CAN follow trends on lower TF’s also.

2. If you follow trends a trader should also consider adding to exposure to speed up profitibility rather than trading (too many) markets.

3. Trading many markets should be done only if a trader is (very) familiar with Inter-Market relationships!

Otherwise you are a pearl in the ocean of trading hooligans

Thank you for sharing your thoughts, Peter.

best!

Hello Rayner

Can i use this strategy on lower timeframe? I dont want to be in a trade overnight.

Thanks.

Hi Lior

You can apply the concept to the lower timeframes but you might want to consider the “issues” of lower timeframe trading in my earlier post.

Good stuff Rayner! This is great advice for people new to the game.

Thank you, Paul!

Rayner keep it up!! ……very good Job

I am 71 and folowing you from Neuquen, Patagonia Argentina

Thank you, Dougall.

Cheers

Rayner,

Just a question: What’s in the word other strategy which are not trend following? Aren’t we by nature doing trading following the trend, buy when up & sell when down?

Do you know people who don’t follow the trend and get successful?

Thank you.

world

Trend Following is a more than just trading trends.

Here are a few things that Trend Followers do that other trend traders might not…

1. Trade a variety of markets

2. Trail your stops with no target profits

3. Risk a fraction of your capital per trade

You are a good teacher Mr Rayner. Thank you for your teachings and your unique teaching style.

You’ve been a savior for me, not only for me but for numerous traders like me, i guess. Keep inspiring brother.

I’m glad to be of help, Lekhdhoj.

Hey, Rayner

You emails have been helpful. Thank you.. So i have a random question. How long does it take for a trade to break even. Or how long does it take for you to cut losses and run?

Hey Eshiwani,

It depends on your entry timeframe and trailing stops buffer.

I would say if the trade goes in my favor, I can hold for months or even years.

For losing trades, I’ll be out in a few days or less.

Your write ups are always educational, informative and interesting. Indeed as they say the ‘trend is your friend’, trading the trend therefore, remains the traders delight.

I’m glad it resonates with you, Emeka.

“I’ll do whatever it takes to become a consistently profitable trader!”

Been following your YouTube and mailing list for a week now and give me more knowledge and perspective than the last year I’m trying to learn how to trade well.

Thanks Rayner

Awesome to hear that, Kiki!

Thank you Rayner, your emails are useful and highly readable!

Please continue your good work

I will, GB!

I am joining. Thank you a lot. My wife will be happy me spending less time in front of the screen when the working day is over:)

Never mess with the wife, hah.

I’ll do whatever it takes to become a consistently profitable trader

nice!

I’ll do whatever it takes to be a consistent profitable trader.

“I’ll do whatever it takes to become a consistently profitable trader!”

awesome!

Great article.

I’ll do whatever it takes to become a consistently profitable trader!

yeah!

it really depends on what’s your time frame that you are trading and what do you want to get out of the market. Do you want to get a income from trading? or you just want it to be an extra income. i can tell you that the time frame that you want to trade make trading a whole different games. if you are a good scalper , and you trading the 1 min time frame, i can assure you that there are at least 5-8 good trading opportunity per day. for a 5 mins time frame at least 2-4 good opportunities per day. as you move to a larger time frame the less trading opportunities because they are too slow. Now, back to the question, what is your goal? do you want to make trading as your primary source of income(which is difficult), that you can actually take money out to pay for bills? if yes, you have to trade a shorter time frame. And in a shorter time frame, most the the time the market is in an range. 20% of the time that market is trending. if you want to make trading your primary job and primary source of income, you have to learn to trade shorter time frame really well. Control your risk really good. Get in quick , Get out quick, and be consistent with your profit. You can’t be a scalper if you have a less than 70% of winning rate. you can try to trade the market in a longer time frame if you are looking to use trading as a side income. You trade small enough to make yourself comfortable with short term draw down and deep pull back, Hopefully, the market is in a strong trend and you ride it to paradise. But trading in a longer time frame probably won’t able to paid your bills and all your living expenses because the trading opportunity just don’t occur frequently enough. Imagine you waited for 3 days for a opportunities to appear then ended as a loser. then wait for 4 days again for another opportunity and ended as a break even. then waited for another opportunity for a trade to happen then the market start to consolidate. and your bills start to coming in and you have no income. that’s the fact and the truths.

Thank you for sharing, Andy!

Thanks Rayner!

I’ll do whatever it takes to become a consistently profitable trader!

Rock on bud!

Hi Rayner, thank you for the good work. “I’ll do whatever it takes to become a consistently profitable trader!” Kindly teach us inter-market relationship, seasonality in some market such as in soybean, etc. and how to avoid two markets that are positively correlated. Preferably, you can recommend books on the above mentioned topics. Thank again.

Hey David

A few ways…

1. Cut your risk when trading correlated markets

2. Reduce your overall risk per trade such that even if there are correlated markets, it will never blow up your account

3. Remove too many correlated markets in your portfolio

I m a professionnal trader in a bank

Im trading for myself only breakout head and shoulders

It world

cheers

Hey- The phrase is when the shit hits theFAN. It only happens your way when standing behind a cow.

Thank you, Don. I learned something new today.

sangat bagus bro

Cantik!

Nice work as always Rayner. But you don’t need to sell it so hard to the converted. I 100% agree with your methods and logic, I just need to tear myself away from my lazy habits and get with the program..!! Luck is a lady that’s hard to grasp so it’s time I tried something more systematic because I want to win the game.!

Hey Peter

The problem is I don’t know who’s the converted.

Thanks for dropping by!

Hello Rayner

Thank you so much for writing this article , its really going to help new traders (myself) out there.

Just a couple of questions I would like to clarify.

You stated:

If the price pullbacks to Support, then wait for it to reject lower price and close higher (trading from an area of value).

Could you kindly point me to either a previous article of yours or the term used to describe the above statement? I’m a little lost on that.

Thank you

Looking forward to the details of your mentor ship program.

Hey Persee

I’m not sure which article it might be, but you can try this… https://www.tradingwithrayner.com/support-and-resistance-trading-strategy/

Hi

I agree with all comments

Im almost a full time trader, I have different strategies for 5 min day gambles and strategies for longer time frame using Rayners teachings.

I personally also have an extra income after the markets close in UK which will back up any of my losses.

My goal is to create a business via my lap top, this way I can travel the world…

I say to any of the traders who feel they want to make this a LIVING…

HAVE 2 YEARS MONEY IN THE BANK TO PAY FOR YOUR BILLS FOOD ETC…..

Then start your new business ( trading the markets)with 10k MINIMUM and stop loss your deals at 1%

Think about this…..

If you were to start a new business what ever it may be, you would certainly calculate your

forcaste for profit and loss, mainly you cant open a new business with very little money

and the markets are NO different !!!

I hope this makes sense

Hey Martin,

Thank you for sharing, you’ve nailed it!

Hey Rayner,

I’ll do whatever it takes to become a consistently profitable trader!

Good article and strategy!

Thank you, Afiq.

I ‘ll do whatever it takes to become a consistently profitable trader!

nice!

I”ll do whatever it takes to become a consistently profitable trader.

That’s the spirit!

“I’ll do whatever it takes to become a consistently profitable trader!”

Once again a great article! Thank you for sharing your knowledge.

The pleasure is mine, Yam!

“I’ll do whatsoever it takes to become a consistently profitable trader !”

rock on

Hey Rayner again great information, thank you! If you speak about correlated market do you have it about a portfolio consisting forex indices bonds agriculture and non agriculture or a portfolio that diversifies within for example forex?

Cheers and thanks for your help

Hi Chris

I trade a portfolio across the different sectors as what I’ve shared in this post, not just forex. cheers

I”ll do whatever it takes to become a consistently profitable trader. Thanks again Rayner. I prefer to trade on a daily time frame while using the 4 hourly time frame to time the entries and identify the area of value(support/resistance) on a weekly time frame). I believe I will be profitable consistently very soon. The capital is one thing that one has to sort out.

Thanks again,

You are the best!

You’re welcome, Kagiso!

I’ll do whatever it takes to become a consistently profitable trader 10% per year would make a great contribution to my future pension!

Looking forward to your sharing.

Thx

Jan

Nice!

I’m glad you’ve got a realistic target set for yourself. cheers

I’ll do whatever it takes to become a consistently profitable trader!”

You are one of the best FX instructors online and the fact that you are doing it all for free is unheard of in the industry especially in a time where there are plenrty ripoffs. I say a very big thank you to you Rayner and more grease to your elbows.

I appreciate the kind words, Naiceuch.

cheers

good article but i still got to learn more. looking fwd to be a trend followers. tqvm

cheers Sam

Dunn Capital management REALLY?

You fail to post the drawdowns and how people stop following rules that are not “their own”. Trend following is a skill LEARNED and EARNED.

I wish all the luck in the world Rayner, you seem like a great guy. But please don’t mislead people with eye opening returns of over 10% per year CONSISTANTLY and not tell them about drawdowns.

Take care my friend.

Hi David

Yes, DUNN Capital has been in business for over the last 40+ years.

How am I misleading when I clearly state that a trader has to weather the ups and downs of trading, or else please don’t sign up.

Also, Trend Following has a much shallower drawdown than a traditional buy and hold on the S&P 500.

You can see it for yourself here… https://ctaperformance.com/

FYI, Warren Buffet, considered the best investor of all time, had drawdowns in excess of 50% in his career. And most Trend Following hedge funds doesn’t reach that kind of drawdown levels.

Just saying…

Hi Rayner,

Thanks for this. Only been trading for 2years now combined with a full time job whc is tough. But i must say that in addition to my personal decision to use larger time frames, you were the first person to comfirm in very simple terms exactly what I was noticing on my charts i.e confluence of support/resistance (Pp, MAs, Fibo) being areas of value and that helped refine my entry /exits and transformed my trading results.

Keep up the good work!

Ady

I’m glad to hear that, Ady!

cheers

Hello Rayner thank u for sharing your knowledge. I learnt to trade on forex and i just like the way you diversify your market. It seems logic.

You’re welcome bud!

“I’ll do whatever it takes to become a consistently profitable trader!”

nice!

“I’ll do whatever it takes to become a consistently profitable trader!”

Thank you so much Ryner! Looking forward to your next sharing. May GOD bless you more wisdom as you share it to the world. All the best.

You’re welcome, Wiz!

“I’ll do whatever it takes to become a consistently profitable trader!”

Nice!

I’ll do whatever it takes to become a consistently profitable trader.

I’m sure you will!

Rayner,

As someone above mentioned…. “thank you for being oneof the good guys”, so my thanks to you too.

Great articles you write as well as your video tutorials.!! Thanks a gazillion!

It’s my pleasure, Gavin!

“I’ll do whatever it takes to become a consistently profitable trader!

thank you Rayner

You’re welcome, Christine!

Hi Rayner,

I fully agree the Trend Following approach, avoiding the get rich quckly scheme and maintaining leverage low.

I think that the lack of capital is the key (supossed you have an edge to exploit).

Forex is great as you can adjust your position and therefore your risk (even by using micro contracts) but I realised that it does not trend like Indexes or Stocks in daily or higher timeframes. Also you must pay the carry (swaps) that can turn the small wins into small losses.

Considering Indexes or Stocks, you need enough capital to diversify. I only see two solutions: a) using CFD’s but I am not sure if it makes sense as you have to pay an interest for the position during the holding period; or b) using almost no leverage that implies reduced diversification and increased risk to get your transactional costs small enough so not only your broker wins while you take the risk. What do you think about trading SPY for example?

I will love to hear from you and thank you so much for your reply.

A part-time trader looking for consistency.

Hi JC

Yes, CFDs is an alternative but it will have swap charges.

What you can consider is trading forwards or futures. cheers

I’ll do whatever it takes to be a consistently profitable trader. Thanks Rayner for keeping us grounded to stick to the basics to win in this game. I have just under three year under my belt in trading part time, and i have made good money at times, with my strategy and ended up loosing it all, over one stupid risky trade once i get excited! im tired of that, it sucks, and for the 1st time after subscribing to your articles just over a month ago, I have a positive balance and have started growing my account. I have grown it for over 25% so far and going strong while keeping my risk to absolute minimum. Thanks a mil Rayner, your really tranforming our lives! Big up to you my brother, your simply awesome.

Awesome to hear that, Brian.

I’m glad to know it’s helping.

“I’ll do whatever it takes to become a consistently profitable trader!”

nice!

Hi Rayner,

I’ll do whatever it takes to become a consistently profitable trader!

jacques A.

Rock on!

“I’ll do whatever it takes to become a consistently profitable trader!”

Thanks for the great post, Rayner! I’m just starting out on trading and it seems like out of all the trading strategies that I saw, Trend Following seems to be aligned most with my personality. I think this is the trading system for me so I hope to learn more and master trend following/trading.

Thanks again, Rayner!

You’re welcome, Ninja.

cheers!

Hi rayner. Thank you for your fantastic articles. I would like to know your opinion on ichimoku cloud which is also a trend indicator and it’s cons and pros compared to moving averages.

Hi Hamed

I’ve not used it before, but I’ll look into it…

Mr Teo, will you please unsubscribe me? Thanking you in advance.

Hi SJ

At the bottom of my email, there’s an unsubscribe link.

Just click it and you’ll be unsubscribed.

Since following you Rayner, I am a big fan of the 4 hour time frame sometimes I will get on board on the 1 hr. I have to say even though I don’t get that many trades overall my trading skills and p/l have really improve.

Thank You

Bill

Great stuff, William!

Always a pleasure to hear from you bud.

Hi Rayner,

I’ll do whatever it takes to become a consistently profitable trader!

Awesome!

Thank Rayner for the blog..I learn a lot from you

I’m glad to be of help 🙂

I’ll do whatever it takes to become a consistently profitable trader!”

sweet!

I will do whatever it takes to be a consisitantly profitable trader

I’m sure you will!

“I’ll do whatever it takes to become a consistently profitable trader!”

I’m sure you will!

l’ll do whatever it takes to become a consistently profitable trader!

awesome!

Hey this is another good one by you

“I’ll do whatever it takes to become a consistently profitable trader!”

Thank you, Shahid.

Well said!

Hopefully could join your next mentoring program.

I’ll send the full details soon, cheers.

Excellent write up…A logical apptoach… I do want to be part of your program…

l’ll do whatever it takes to become a consistently profitable trader!

Thank you, Sachin.

cheers!

yes i do need to be a better trader than what i am today ,i hae seen only losses ,but i do need a tutor for a build up, on to improve my work and to to trade consistently,and to derive profits in the long run

Thank you for sharing, Suresh.

Thank you Rayner. Very Good and logical trading !

“I’ll do whatever it takes to become a consistently profitable trader!”

Best regards Ascenzio

Well said!

“I’ll do whatever it takes to become a consistently profitable trader!”

Thanks for the great post, Rayner! I’m just starting out on trading and it seems that I hear “Trend Following” everywhere I turn.

I hopped upon a trend recently, got burnt-lost my money…I think I need to learn the nitty-gritty about TF… Please Rayner could kindly point me to the books you sieve these valuable information’s from?

If exclusively from your trading experience then please kindly send me the links of detailed articles on;

1. Trend Following

2. Trading with time frame.

3. How to back test and forward test with indicators.

Keep up the good work!

Thanks and GB.

Here you go…

https://www.tradingwithrayner.com/best-trading-books-of-all-time/