I’m guessing you’re interested in trading because you want to break the shackles of your 9 to 6 job.

Or maybe you want to generate another source of income so you can be financially secure.

Whatever the case is, trading gives you hope.

The hope that you can be financially free and better provide the needs of your family.

However…

Hope isn’t enough if you don’t know what you’re dealing with.

So, are you ready to learn the truth about trading and hopefully, make it work for you?

Then read on…

Trading is a get-rich-slow scheme

This will not win the hearts of many, but it needs to be said:

Trading is a get-rich-slow scheme.

You’re probably wondering:

“But Rayner, I’ve heard of traders trading a small account and turning it to 7-figures.”

Now, that could be possible but the odds of you pulling it off are slim to none.

Here’s why…

The only way for you to make a huge sum of money quickly is to take a huge risk on your trades.

If you get lucky, you could generate 6 or 7-figures on your account.

But here’s the deal:

99.99% of traders who attempt it will blow up their account. Only a lucky few could get away with it (and it’s nothing to do with skill, but luck).

But hey, don’t take my word for it. Here’s what Warren Buffet has to say about his wealth…

“My wealth has come from a combination of living in America, some lucky genes and compound interest.” – Warren Buffet

The keyword here is compound interest.

In other words, Warren Buffet became the richest investor in the world by being the best at what he does and, compounding his returns.

This is not achieved over a few weeks or months—rather, it’s compounded over 50+ years.

So, if you’re looking at trading as a get-rich-quick scheme, then guess what? You are the scheme.

“Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.” – Albert Einstein

You need money to make money in trading (even if you have the “holy grail”)

This is one of the biggest trading myths which have fooled most traders…

“If you have a winning trading strategy, you can use it to make millions of dollars from the markets.”

That’s B.S.

I’ll explain…

Yes, you can have a winning strategy but, it doesn’t mean you can make millions of dollars.

Why?

Because the size of your account matters!

Let me give you an example…

Let’s say you have a trading strategy that makes 20% a year.

On a $1,000 account, that’s $200/year.

On a $10,000 account, that’s $2,000/year.

On a $1m account, that’s $200,000/year.

As you can see, your trading strategy is one part of the equation, the other equally important aspect is the size of your account.

And this is the same reason why hedge funds raise millions, if not billions of dollars—they need money to make money in trading.

Next…

Trading is one of the worst ways to earn a regular income

Here’s the deal:

Many traders get into trading because they want to generate another source of income.

That’s because they want to quit their 9 to 6 job and have the freedom to do the things you love.

Now, if that sounds like you then here’s a warning to you…

Trading is one of the worst ways to earn a regular source of income.

Why?

Because the markets are always changing!

A trading strategy that makes money this week might go into a drawdown the next.

Now, it doesn’t mean you can’t trade the strategy anymore but, it’ll take time for market conditions to revert to your favour—and it could take a few weeks or months.

This means you shouldn’t expect to make profits every single day, week or month.

You only take what the markets give, and nothing more.

You’re always a student of the markets

Here’s my learning curve as a trader:

I started with indicators, then price action trading.

And for a few years, I thought that’s all I needed because after all, the price is king and that’s all I needed to be a profitable trader.

But that hurts my growth because I tuned everything else out (and limited myself only to price action trading).

When I realized my folly, I quickly went back to being a student of the markets.

So I asked myself:

“What are other winning traders doing to profit from the markets?”

That’s when I got exposed to trend following, systems trading, mean reversion trading, etc.

The outcome?

Today, I trade multiple trading strategies across different markets—which results in a smoother equity curve of my portfolio.

So the lesson is this:

You might be a profitable trader but, it doesn’t mean your learning curve is over because you’re always a student of the market.

The market is always changing

Here’s a true story:

Around 2006 to 2012, the Nikkei futures were heavily traded among proprietary traders in Singapore.

That’s because the Nikkei is traded across multiple exchanges like SGX, OSE, and CME—and this offers arbitraging opportunities.

Let me explain this works…

Let’s say you can buy 1 Nikkei contract for $100 on SGX, then you quickly sell it on CME for $101—earning you a risk-free profit of $1.

Now, when you trade many contracts and do these many times a day, it’s possible to earn 6-figures a day.

So, many proprietary traders exploited this inefficiency and made good money for several years.

Then, something happened…

Algorithms entered the market to profit from this inefficiency.

As you know, machines are faster than humans and slowly, the market became efficient and the “easy money” days were over.

In the end, most traders couldn’t adapt to it and eventually, quit trading altogether.

So here’s the lesson:

There’s no guarantee in trading.

Just because something has worked in the past doesn’t mean it’ll work in the future.

That’s why you must remain a student of the markets so you can adapt to ever-changing market conditions.

Pro Tip:

Focus on trading strategies that exploit behavioural biases because we are prone to making poor decisions based on our emotions—which makes the strategy likely to continue working.

So, how do you become a winning trader when the odds are against you?

At this point:

You’ve discovered that trading isn’t as easy as it seems. So, what can you do about it?

Well, here are my suggestions…

1. Don’t reinvent the wheel

Here’s the deal:

You can figure things out on your own which will cost you time and money or, simply follow what works.

You’re probably wondering:

“How do I know what works?”

Well, the key thing is to look for trading books which contain specific trading rules with backtested results.

Here are some books worth checking out:

- Following the Trend – Andreas Clenow

- Unholy Grails – Nick Radge

- Buy the Fear, Sell the Greed – Larry Connors

This way, you don’t have to re-invent the wheel and can simply tweak their trading strategy to your needs.

If you want to learn more, then go download The Essential Guide to Systems Trading.

Next…

2. Don’t quit your full-time job, yet

If trading is your only source of income, you’re putting yourself at a disadvantage psychologically.

Why?

Because you will have the need to make money every month.

This causes you to make poor trading decisions like widening your stop loss, averaging into losers, trading too large, etc.

And that’s why many professional traders do not rely on trading as their only source of income.

For example:

- Mark Minervini, a Stock Market Wizard, offers a master trader program that cost $5,000

- Most hedge funds (even the best ones) charge a management fee every year —even if it’s a losing year

To put things in perspective, if you run a billion-dollar hedge fund and take a 2% management fee, it means you get $20m a year — guaranteed.

As you can see, professional traders and hedge funds structure their trading in a way that it’s not their only source of income.

This means if you have a job, you have a source of income every month no matter what. This allows you to focus on your trading without having to worry whether you can pay the bills this month, or not.

3. Embrace the 9th wonder of the world

Albert Einstein once said, “Compound interest is the 8th wonder of the world.”

But I’m going to take things a step further and introduce to you, the 9th wonder of the world.

So, what is the 9th wonder about?

It’s this… adding funds regularly and compounding your returns.

Let me explain…

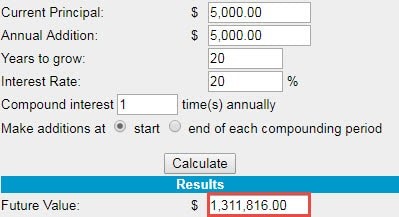

If you make an average of 20% a year with a $5,000 account, after 20 years it will be worth… $191,688.

Not too bad.

But, what if you add another $5000 to your account each year and compound your returns?

After 20 years it will be worth… $1,311,816

Can you see how powerful this is?

So, if you want to build serious wealth that’s sustainable, then you must embrace the 9th wonder of the world (and forget about the get-rich-quick schemes).

Conclusion

So here’s what you’ve learned:

- Trading is a get-rich-slow scheme. If anyone promises you “fast profits”, run far away.

- The best trading strategy won’t earn you a cent if you have zero capital—you need money to make money in trading.

- The market is always changing which makes it one of the worst ways to earn a regular income from trading. If you want a consistent income, get a job—not trading.

- No matter how much money you’ve made, you’re always a student of the markets.

- If you want to be a winning trader:

1) Follow what works

2) Don’t quit your full-time job, yet

3) Embrace the 9th wonder of the world

Now here’s what I’d like to know…

What’s the biggest takeaway you had?

Leave a comment below and share your thoughts with me.

True pearls of wisdom. The randomness of price action many don’t accept, but you have a system around it. Great work

Hi Hanks,

Thank you!

Every word u said is practical…..however difficult to identify that one trading strategy best suited to you

Hi Shilpa,

You are most welcome!

I am also really impressed sir

🙂

நீங்கள் ஒரு சிறந்த வழிகாட்டி Sir :)(:

Hi Archunan,

You are most welcome!

Cheers.

Very insightful. Thanks Rayner.

Hi Williams,

You re most welcome!

Cheers

Great and inspiring writeup.

Thanks Ray

You’re welcome, Clement!

THANK YOU SO MUCH….ITS GREAT INFORMATION

Awesome to hear that, Unmesh!

Yes, very powerful. Thankyou Rayner.

From this, I’ve learnt compounding

Great to hear that, cheers Johns!

Thank you for the truth!! Most people feed of the hype and never take into consideration what it takes to get where you want to go. There is a reason why 95% of traders quit and only 5% continue to make trading a part of their lives. The 5% know it is hard work and a very serious personal lifetime commitment. Thanks again and all the best!!

You’re most welcome, Robert! Cheers!

Don’t quit your day job, money to make money, always a student,,,,, all good advice for the new and good reminder for the experienced.

Hi Shark,

I’m glad to hear that!

A very appropriate and sound advice for beginners….Cheers Rayner

Hi Gunalan,

You are most welcome!

You are 100% right rayner without investing you can not be rich and trading is the way to hell… Now question is how to invest money and where to invest??

Rayner I can’t thank you enough. You have this “gift” a good teacher has. I guess it’s natural and a product of the education system in Singapore. I’m impressed. Thank you.

Im very surprised that you are so different from adam k***! You won me as your loyal fan and supporter! After reading this! I finally see why you stand out as the most unique and special one! So happy to know you are in Singapore and enhancing our country’s name! I watch alot of adam’s videos and I felt somewhat uncomfortable with his messages claiming all his students succeeded… You are down to earth and not here to promote riches n glory to potential students. You are here to teach solid philosophy and solid TECHNICAL ANALYSIS SKILLS. You won me with this post!

You stayed true to doing good deeds for free to educate the masses. God bless you

Awesome, Lili!

The book Price action trading secrets is really wonderful and praiseworthy. Thanks RAYNER!!!

We’re happy to help, Raju!