#6: Swing Trading Strategies

Lesson 6

Hey hey, what's up my friends!

In today's video, I'll share with you three swing trading strategies that you can use to profit in the financial markets.

Doesn't matter whether you're trading FOREX, stocks, or whatever.

These strategies can be applied the same.

So, are you ready?

Then let's begin.

What is swing trading

Before I begin, I want to explain to you what is swing trading.

Because some of you are wondering, “Hey Rayner what is swing trading?”

Let me explain to you quickly...

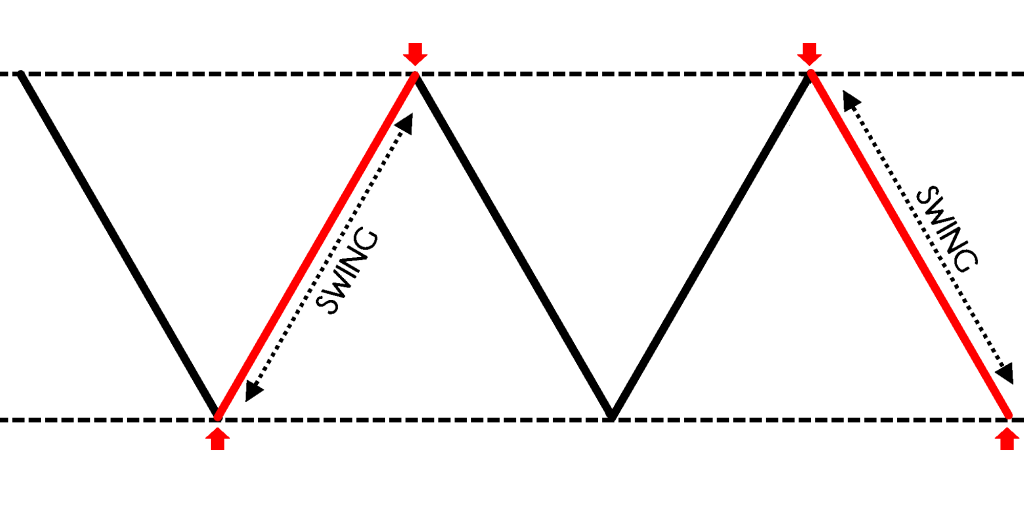

Swing trading is the idea is just to capture one swing in the market.

Here's an example:

This market is in a range.

Let's say you are a swing trader and you buy at the area of support.

Where will you exit your trade?

Well, as a swing trader, you typically exit your trade before the opposing pressure comes in.

Let me repeat that once again…

As a swing trader, you usually exit your trade before the opposing pressure comes in!

So, if you're long, where is the opposing pressure?

The opposing pressure is traders who are looking to sell!

Where will traders be looking to sell?

If you look at this, chances are traders will be looking to sell at the resistance or swing high.

You want to exit your long trades before this opposing pressure kicks in.

This means that you go long near the lows and you try to capture one swing, exiting your trade before the area of resistance.

Likewise, if you are short in the markets at this resistance, you want to exit your trades before the area of support.

This is the core idea behind swing trading.

Moving on, I want to share with you…

Three swing trading strategies that you can use to profit in the markets

The first one is what I call…

Stuck in a box

Where the price is pretty much stuck in a range.

Stuck in a box.

Similar to what you've seen earlier:

The core idea here is that the market is in a range.

You want to buy low and sell high, so how you would go about doing it is to let the price come into an area of support and let the price reject the lower prices.

This, as you can see, is rejecting lower prices over here:

The market, at one point in time, was trading lower and lower and lower.

And then suddenly the buyers step in and push price all the way up higher.

Finally closing near the highs:

So, this is a swing trading setup for you to actually go long.

When you see a price rejection of the lows of support…

You can look to get long on the next candle and look to set your stop loss at a distance away from the lows:

Because you don't want to set it at the precise low as it's very common for the price just take out the previous lows.

So, what I would suggest is that give it some distance, some buffer.

Now…

Your goal as a swing trader is to capture one swing.

The question is…

Where is the opposing pressure likely to come in?

If you ask me, chances are it would come in the resistance area.

If you look left, there is a resistance area.

You want to take your profit somewhere about here:

As you can see in this example, clearly the market didn't reach far enough before it reversed back into the area of support.

And then finally, at the second attempt, it hit resistance:

Depending on how you manage your trade, this could be a break-even trade, a small winner, or even a loser.

I'm not going too much detail into trade management, because that will be a video for another time.

But I just want to share with you the core concepts of swing trading.

The other one is what I call…

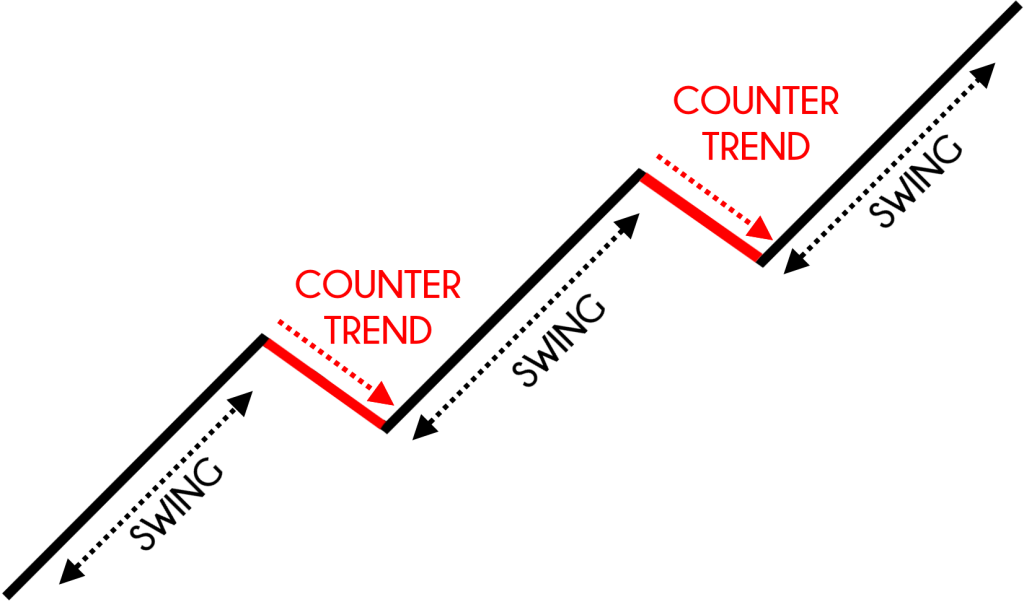

Catch the wave

This is used when the market is in an uptrend.

When the market is trending, you are trying to time your entry and capture just one swing in an uptrend.

One thing to point out is that in an uptrend, there are multiple swings.

As a swing trader, if you ask me, your best chance of riding a swing is to capture the swings that are in-line with the trend:

You can see that the moves that are in line with the trend are usually stronger.

Usually, you want to trade with the move that is in line with the trend.

I call this the trending move!

How we can go about doing it is using the 50-period moving average:

In an uptrend, if it's in a healthy uptrend…

The market tends to bounce off the 50 EMA which is shown as a blue line.

What you can do is to wait for the price to come to an area of value, which is this 50-period moving average.

Again, look for a form of a price which actually can be a hammer.

It can be what you call a bullish engulfing pattern, and etc.

In this case, you've got somewhat of a bullish engulfing pattern:

Notice the price came in.

At one point in time, it was near the 50-period moving average.

And then the buyer stepped in and finally pushed the price higher, closing near the highs.

As a swing trader, you can look to get long.

Again, for stop loss, give some buffer below the lows, and entry over here:

Then you can look to exit your trade just before the swing high:

Again, we mentioned exiting your trade before the opposing pressure kicks in.

This is the second strategy, catch the wave.

The final strategy that I want to share with you is I would say more aggressive.

But it still offers a favorable risk to reward on your trade if you execute it correctly.

It's what I call…

Fade the move

This is actually a counter-trend trade.

Because when the market is trending, and it has traveled quite a distance towards the swing high towards resistance…

There is actually an opportunity for you to take a counter-trend trade.

But I'll share with you a little bit on how to manage this type of trade.

Because if you are not careful, the price can actually reverse quickly against you.

In this case, you can see that this market is in an uptrend and price came and retests back towards the swing high over here:

Notice it traveled quite a bit from the swing low all the way up into this swing high, and then the next candle…

It got rejected with a bearish engulfing pattern as it collapses lower.

But prior to this, as the market was breaking out higher, there are traders who went long on the break of these highs!

Because they are thinking…

"Hey, the market is breaking. All right, man, I better go long. The trend is up. I want to long the breakout. I want to catch the next move up higher. I don't want to miss the trade."

And then what happened?

Well, the next candle did a 180-degree reversal towards the downside.

That's why you have the bearish engulfing pattern in the example.

And now the group of traders who went long earlier on the breakout are now trapped!

Now…

Where will these group of traders put their stop loss?

Chances are, their stop loss is possibly somewhere here:

What happens is that as the price hits lower, you will actually hit this cluster of stop loss from the breakout traders, and that will fuel their selling pressure.

That's the logic behind this trade.

What you can do is that when you see this pattern where the price did a false break, you can go short on the next candle open.

Again, stop loss.

You can set it a distance away, from this high, in anticipation that you can capture one swing down back towards this swing low over here:

Just a quick one swing down.

As I mentioned, this trade is a counter-trend trade.

It's slightly more aggressive than the earlier ones because you are trading against the trend.

So, for trade management, what I suggest in this instance is that you don't want to hold your trades for too long.

What usually I do is that if the price breaks and close above the previous candle high (when short), I will exit the trade.

Because I know I'm trading against the trend.

I don't want to overstay.

If it shows signs of reversal, chances are the pullback might end and the trend would continue itself.

So, this is where my trade management comes in.

It will be more conservative where my trailing stop loss will be tighter in this case.

This is what I call fade the move.

For the earlier trades like catching the wave strategy, you can give your trade more room to breathe for the stop loss.

Because after all, you are trading with the trend, so there are a few ways you can go about it.

First, is you can use market structure.

As long as the lower high remains intact, you can hold onto the trade till the price hits your target profit:

Or you can also use a trailing stop loss approach until the price closes below the 50MA.

Because after all, you are trading with the trend.

Whereas using the fade the move strategy, you don't want to over welcome your stay.

You are trading against the trend.

With that said, let's do a super quick recap on what you have learned today…

Recap

- We talked about “stuck in a box” where the market is in a range and you will buy low and sell high.

- We talked about “catch the wave” for a trending market on how to capture a swing.

- Finally, this a counter-trend trading strategy “fade the move” where the market makes a strong rally into a key resistance or key level and then got rejected.