#8: Proven Forex Trading Strategies That Work

Lesson 8

Hey, hey, what's up my friend?

Here's the thing, I know there are many trading strategies out there, and it can be overwhelming for you as a trader.

Which strategies should you trade? Which ones do you focus on? Which strategies are best for you? What are the pros and cons of all these different strategies? There are a lot of questions in your head and I understand.

That's why in today's lesson, I want to share with you the 4 main types of Forex trading strategies out there.

I'll walk you through what is it, how it works, the pros and cons, and how to decide which strategy is best suited for you.

So let's get started...

Day trading

As a day trader, your goal is to capture the intraday volatility. What do I mean by it?

For different markets, they move by different amounts every day. For example, the EUR/USD tends to move about 55 pips a day. For blue-chip stocks, it tends to move about 1% to 2% a day. So various markets have their own intraday volatility.

As a day trader of those markets, your job is to capture the volatility of the day. If EUR/USD moves about 55 pips a day then as a day trader, maybe you're just trying to capture 25 out of 55 pips on average on a single day.

That's what I mean by capturing the intraday volatility. And you do that by usually getting your bias on the higher timeframe. I'll explain this one a little bit.

As a day trader, you typically trade off the 30-Minutes timeframe and below.

And because of the fact that you’re trading on the lower timeframe, markets tend to move faster because every candle is painted once every 30 minutes for the 30-Minutes timeframe, once every 5 minutes for the 5-Minutes timeframe.

It's not possible to be trading 40, 50 markets. That's why as a day trader, you typically focus anywhere between 3 to 7 markets. That's about it. That's pretty much the most that you can handle at any one time

Let me explain to you how capturing the intraday volatility by getting your bias on the higher timeframe works.

Example:

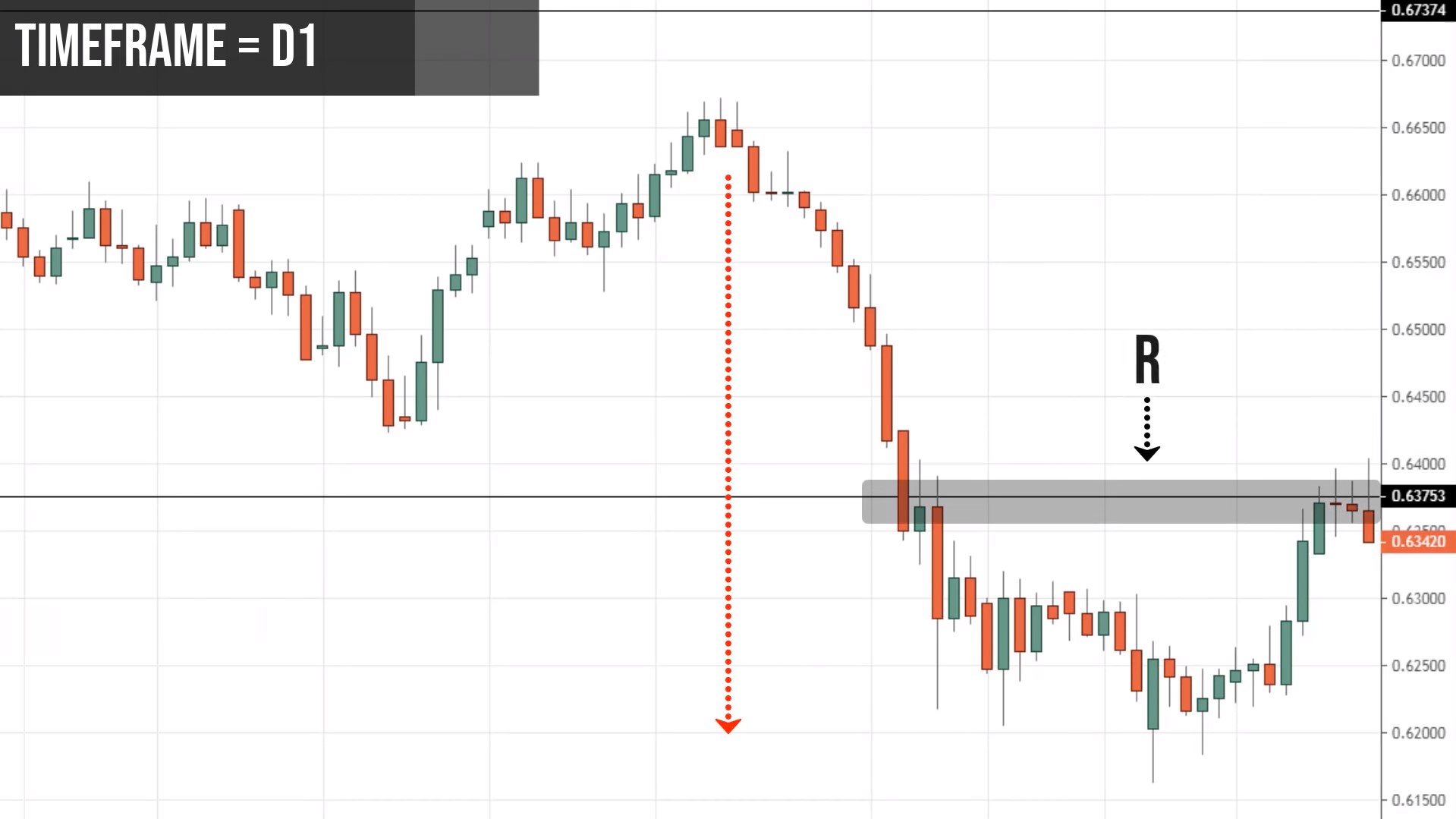

For example, you noticed the NZD/CHF on the Daily timeframe, the higher timeframe, is in a downtrend. The market is at this area of resistance (grey area), and you have multiple price rejection in this area of resistance:

This gives you a bias as a day trader, so you don't want to be long at this point in time. Because in the higher timeframe, the price is at resistance and the market is in a downtrend.

On top of it now, the market has given you clues that it’s rejecting higher prices. Look at the upper wicks over here:

Using this information that you have, you want to short the markets. You'll go down to a lower timeframe to look for an entry.

The multiple price rejections you saw earlier in the higher timeframe, is pretty much this whole section over here:

As a day trader, you’ll notice this market is now forming a build-up in this area of support:

You could be thinking a higher timeframe is in a downtrend, price is at resistance, this area of support is likely to break down, let me look for shorting opportunities. Maybe you could look to short the breakdown of that swing low.

Or maybe you can look for a retest of previous support turned resistance:

This could be another opportunity to short. Hopefully, this gives you an idea of how intraday traders work. They usually get their bias on a higher timeframe, then get their entries on the lower timeframe.

And they usually get out their trade before the session ends for the day.

This is what intraday trading is about, for the Forex markets at least.

Pros:

If you’re good, you can make money in most months.

Because as a day trader, you have ample trading opportunities and you can be trading anywhere between 50 to 100 times a month. And if you have an edge in the markets 50 to 100 trades will be enough for your edge to play out over time.

This is why you can make money in most months.

You’ll not have overnight risk because you exit all your positions before the day ends.

Cons:

The downside is that day trading can be stressful. It is stressful because you're watching the markets all the time, you're glued to the screen.

You're always having to be aware of any potential news coming out, anything that could affect your trades, when it's the next trading set up coming in, etc.

And another thing to consider is that there are high opportunity costs in day trading.

This is something that a lot of day traders neglect. For example, let's say you have a $100,000 trading account. You make 5% a month, on average a year. That's about $60,000.

But you could have also been working elsewhere full-time, making about $6,000 a month, that's almost $60,000 a year, similar to your day trading endeavor. And chances are you're working fewer hours and it's less stressful.

This is the opportunity cost that you have as a day trader. Because if you're a day trading, you would forego the opportunity of working elsewhere or making an income via some other methods.

Don't forget to take into consideration the opportunity cost as well.

Moving on

Swing trading

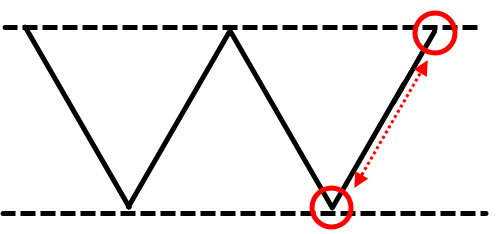

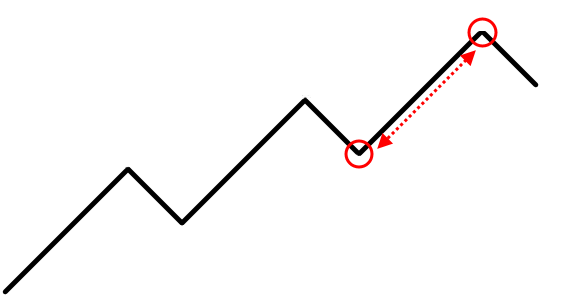

As a swing trader, what you're trying to do is to capture one swing in the market.

Let me illustrate to you what is one swing. For example, the market is in the range. One swing could be buying near the lows, and when the market moves up one swing higher, you’ll exit near the highs.

Alternatively, the market could be in a trend with higher highs and higher lows. So one swing in the market could be buying near the lows and exiting near the highs.

Now, some of you might be thinking…

“Rayner how I know when this trending movement might end?”

Well, I'll share with you a technique to predict the highs in a trending market later on.

As a swing trader, you typically trade off the 1-Hour timeframe and above, maybe the 2-Hour or even 4-Hour timeframe.

Since you're trading off this higher timeframe, you can trade more markets because the charts are only painted once every 4 hours on a 4-Hour timeframe. You can trade anywhere between 20-40 markets, it's possible.

Now, let me share with you, how swing trading looks like on the chart and how you actually “predict” the end of the trending move in a trending market.

Example (trending market):

Let's have a look at this the 10-Year T-Note Futures.

If you pull out the 50 MA, you’ll see this market is in a healthy uptrend where the market tends to pull back towards the 50 MA and it also tends to pull back to a previous resistance turned support, and then reverse from there.

As a swing trader, your goal is just to capture that one swing in this trending market:

Your goal is just to capture that one swing. And the beauty of swing trading is that you don't have to endure the retracement that comes along with it.

Now, how do you know ahead of time when this trending move is about to reverse?

Let me share with you a technique…

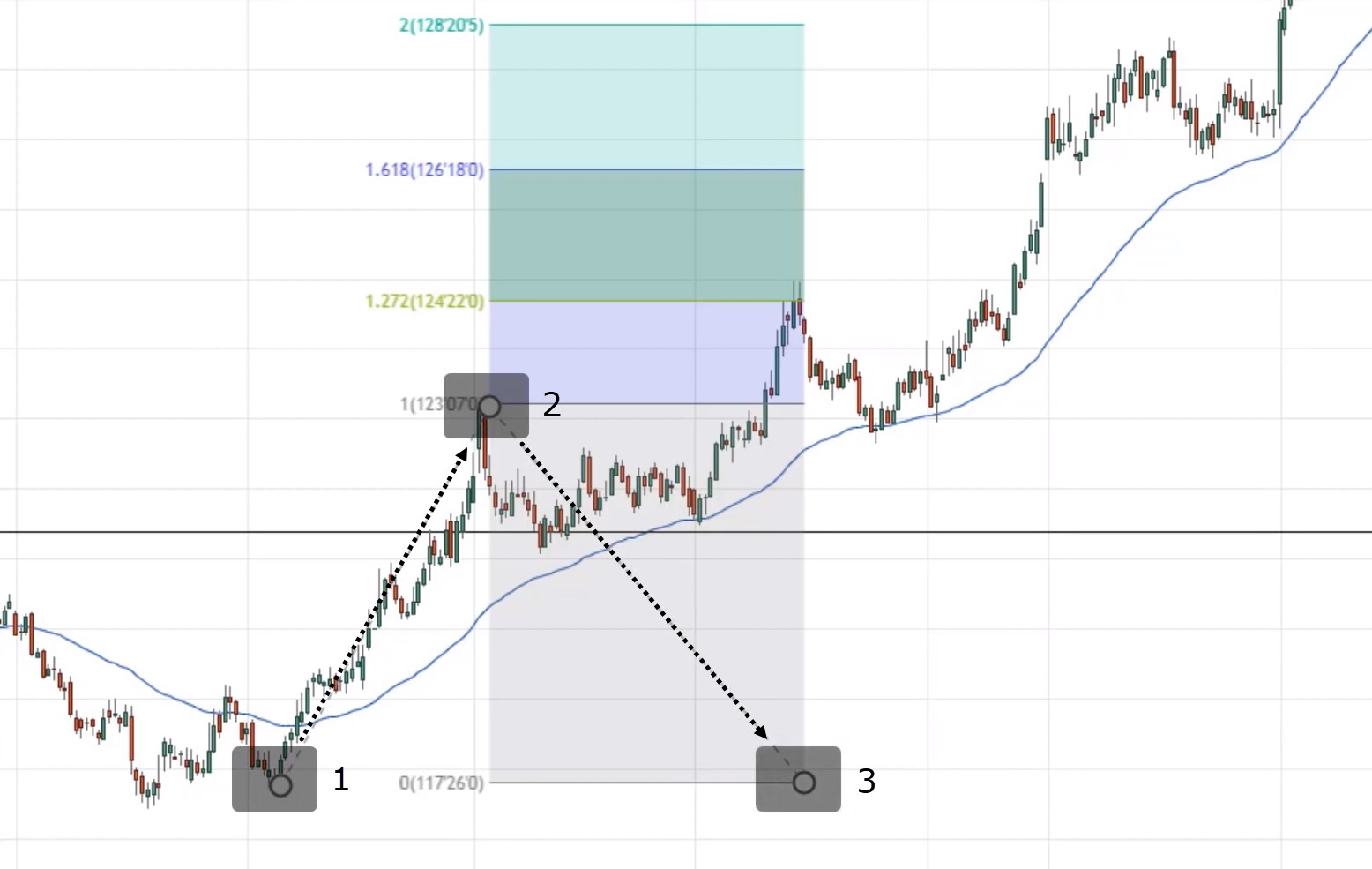

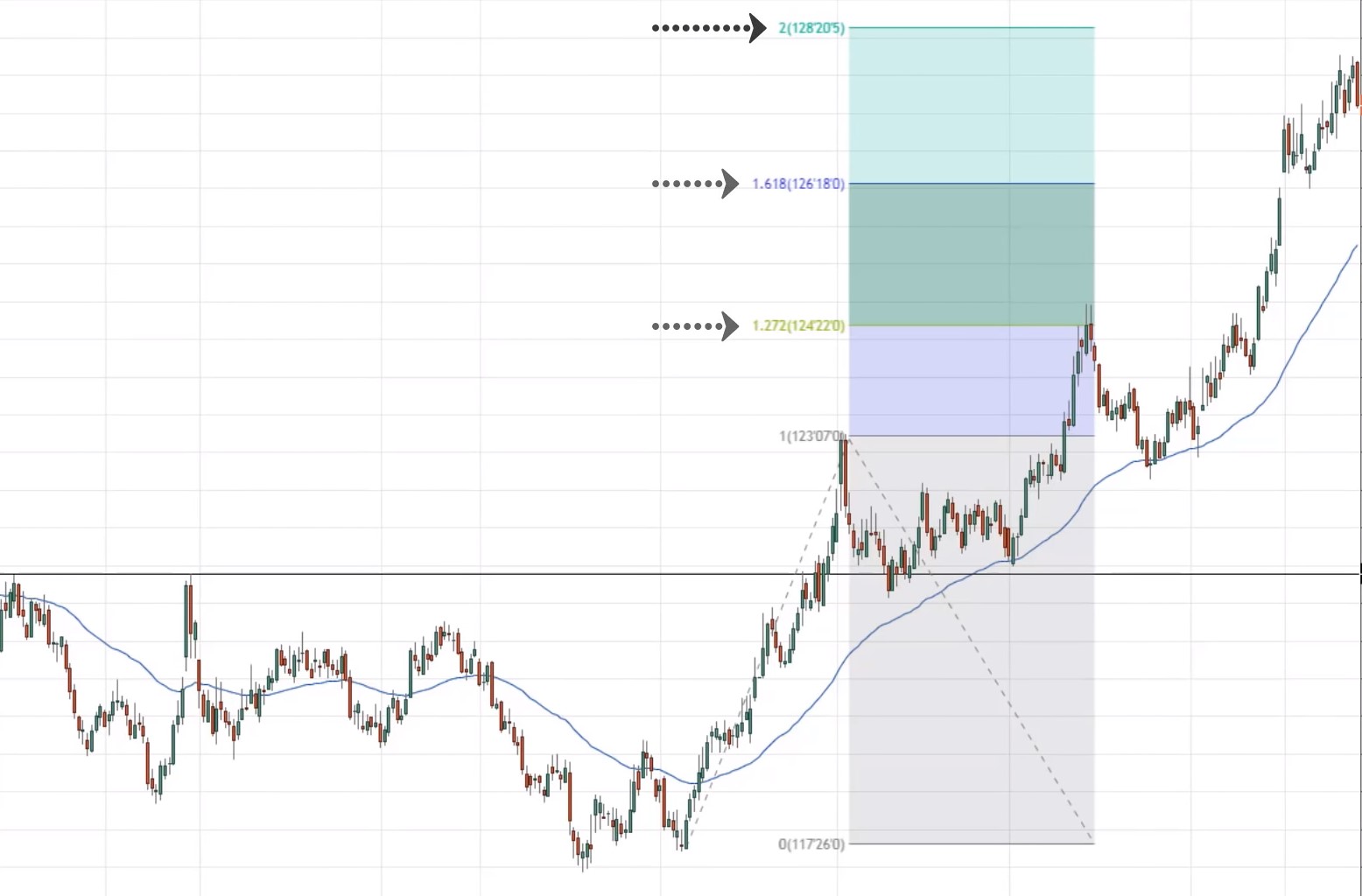

You’ll use a tool called Fibonacci Extension. So in an uptrend, plot the Fibonacci Extension from the swing low (1) to the swing high (2), and pull it back down to the swing low (3).

Once you've done it, you’ll notice that there are three levels of price projections to look at – the 1.27, 1.618 and 2.0 levels.

Let me explain to you how these numbers come about. This tool calculates the distance

from the swing low to swing high and let’s say this distance is 10cm. You’ll just take 10 cm, multiply by 1.27 and you’ll get this figure over here:

Same goes for the 1.618 and 2.0 levels. That's how you get your figures at those levels to get these different price projections.

Now here's the thing…

Which level do you pay attention to? To be conservative and to have a higher chance of getting out with a profit, you want to look to target the 1.27 extension. That's the most conservative measure.

And if you want to give your trade, a little bit more room to run, 1.618 is another possibility. This are a couple of techniques that you can use to give you an idea to where the trending move might potentially end.

Let's say now you bought at this lows over here near the bounce of the 50 MA:

You’ll take the Fibonacci Extension tool, plot from swing low to swing high, pull it back to the swing low. And in this case, the price actually did even retest back to the 2.0 level:

But again, there's no way to tell whether it's going to reverse from the 1.27, the 1.62 or the 2.0 level. Generally, the more conservative approach is between 1.27 and 1.62. This is a technique to give you an idea of where to exit the trade for maximum profit potential.

Example (range market):

You’ll notice that this market is somewhat in a range, between these highs and lows, and then market came down to this area of support:

Let's say you have an opportunity to go long. As a swing trader, where do you exit the trade? Well, this is a little bit different because now it's no longer a trending market. It's more of a range market.

In a range market as a swing trader, you want to exit your trade before opposing pressure comes in. Now ask yourself, where will opposing pressure come in? Where would the sellers come in?

If you look at the chart, sellers could possibly come in within this area where previous support could become resistance:

This is a possible area to look to capture one swing in the market. In this case, this will be your one swing, buying from this low and exiting near this high:

So that’s what swing trading is all about.

Pros:

If you’re good, you can make money in most quarters. Why most quarters? Because compared to day trading, you don't get as many trading opportunities for swing trading.

You need time for your trades to play out. If you're good and you have an edge in the market, you can make money in most quarters. It's possible to trade part-time because you don't have to be glued to the screen all the time.

For example, if you trade off the 4-Hour timeframe, you can just check the charts once every 4 hours, and you can trade it part-time.

Cons:

You won't be able to ride trends because as a swing trader, you're just going to keep trading one swing. You're gonna exit the trade before the opposite pressure and the retracement comes in. This is why you'll never ride trends. You have to embrace it.

And you also have overnight risk where you might be affected by news’ impact and stuff like that. This is something to be aware of for swing trading.

Moving on…

Position trading

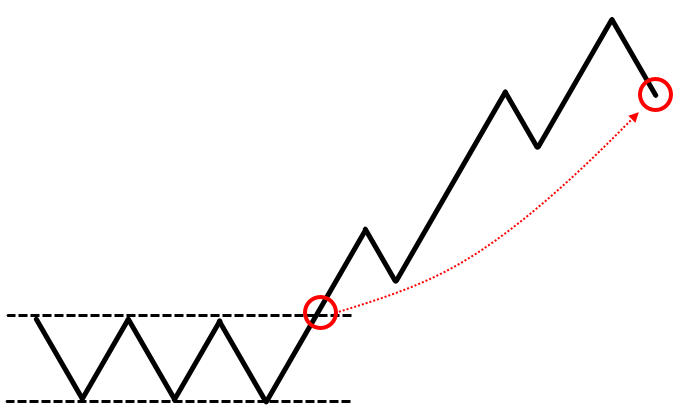

What is position trading? It's like trend-following, riding trends in the market.

Let’s say market breaks out of a range and goes into a trend, you’ll likely exit somewhere here after the market show signs of reversal and it has hit your trailing stop loss:

This is what position trading is all about. And as a position trader, the key is to trade many markets. You have to trade many markets because there are times when the markets are not going to trend.

If you just trade a few markets, you're going to get stuck in those few markets and suffer a lot of whipsaws. The more markets you trade, the odds of you capturing a trend is higher.

And your timeframe is Daily and above. You can do it on a daily timeframe or even a weekly timeframe.

Example:

One example is the USD/CNH. (This is a trending market actually, and I've done backtesting on it.)

This market had an accumulation stage where it pretty much broke out of this resistance and it started trending:

You can see that as a swing trader, it's unlikely you'll be exiting your trade at the highs on the right of the chart, and you’re likely to exit your trade somewhere lower.

But as a position trader, this is where you can capture a trend. And one way to go about it is to use a tool like the 20-period moving average, and you’ll exit the trade only if the price breaks below the 20 MA, which is somewhere here:

This is where a position trader can ride the entire huge move in the market. This is what position trading is all about.

Pros:

It can be done in less than an hour a day. Because you're trading off the higher timeframe like the Daily or even the Weekly. You don't need much time. It also probably doesn't interfere with your full-time job, so there's really not much stress.

It’s either there’s a trade or there's no trade, or you're just riding the trend. That's pretty much it.

Cons:

The downside is there's a low number of trades because you don't get trading setups often.

And you also have to be comfortable watching your winners become losers because the market could breakout. You're in the money and it does a sudden reversal, becomes a false break down to hit your trailing stop loss, and you get stopped out for a loss.

It's very common to have your winners become losers. And you’ve got to get comfortable with it. This is the truth. That’s position trading.

Transition trading

It's something that I hesitated to put in here because it’s more of advanced trading. For traders who have been trading for a while now, this trading style that you can consider is what I call transition trading.

The way transition trading works is that you get your bias on the higher timeframe, but you time your entries on the lower timeframe just like a day trader.

But if the trade or the market condition makes sense and the trade goes in your favor, you can manage your trades on a higher timeframe. I'll give you an example later.

For transition trading, you would typically focus only on a few markets and you’ll adopt a multiple timeframe perspective.

Example:

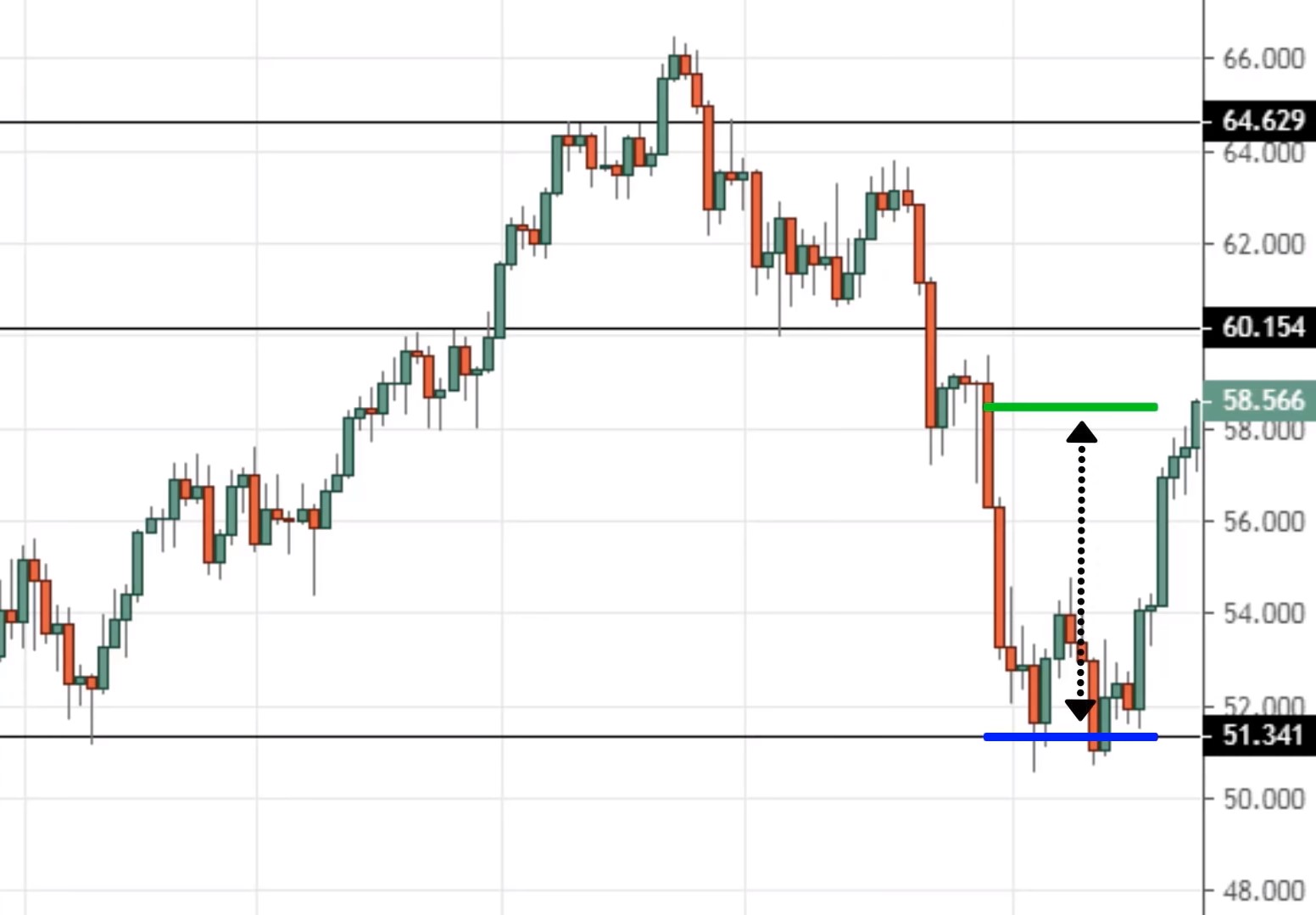

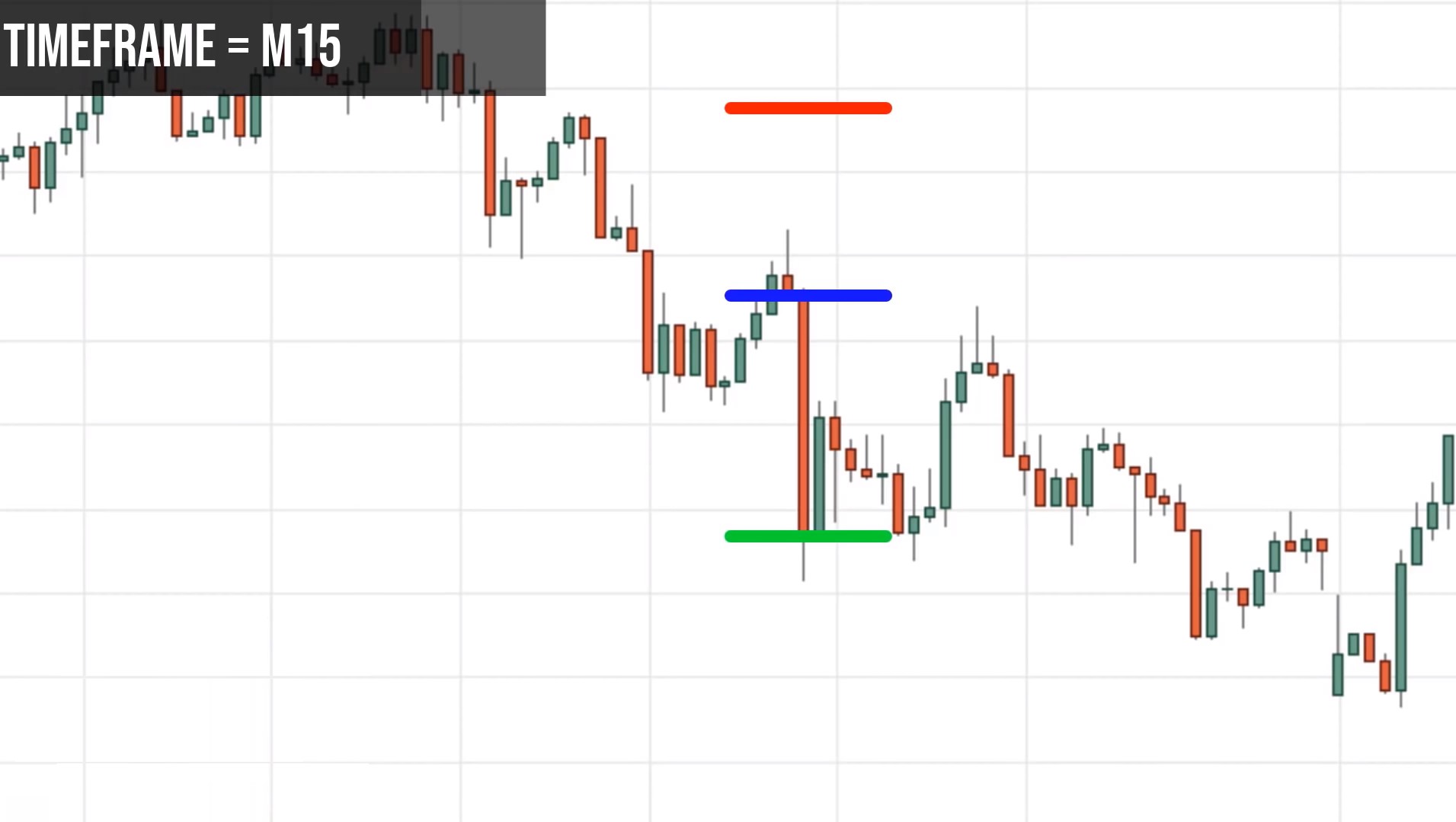

If you look at this NZD/USD, price is in a downtrend overall on the Daily timeframe, at resistance with multiple price rejection over here:

Let's say you got an entry on the lower timeframe, like the 15-Minute timeframe.

Let's say you had a shorting opportunity at this previous support now turned resistance, so you went short on this price reject:

Bear in mind that since you're entering your trades on the lower timeframe, your stops are also based on the lower timeframe.

Let's say you went short over here with stop loss 1 ATR from the recent high:

Your stop loss is like 10 to 12 pips. And at the same time, on a higher timeframe, the market is in a downtrend, and it’s at resistance showing multiple price rejection.

This could be a move that could play out really well.

In this case, the market pretty much went in your favor and it went all the way down. But at the same time, you’ll have to be able to swallow this move against you. Most probably a lot of traders will not be able to do swallow that retracement.

One tip to share with you is that as a transition trader, let's say you short 1 lot, you don't want to hold onto that 1 lot and watch your equity curve go up and down for that full 1 lot, because it's going to be a roller coaster ride.

You can imagine at this point, maybe you're up like 2 or 3 R on the trade and once the market reverses, you’re back to break even.

This is why when the market moves in your favor, one-to-one risk-reward ratio, you would exit a third or half your position. The remaining half is technically “risk-free” trade. You’ll let the remaining half ride for as long as possible using higher timeframe analysis.

For example, let's say you went short at this point and you have a one-to-one risk-to-reward trade:

You have the remaining half riding. And this remaining half, you could be trailing it or managing it on a higher timeframe. Like for example, on the higher timeframe, price is approaching this swing low over here where you can take profit on the last remaining half:

Can you see how transition trading works? You time your entries on the lower timeframe and if conditions permit, market moves in your favor, you can use the higher timeframe to take profits.

This gives you a very favorable risk-to-reward on your trade. And that's what transition trading is all about. It’s basically timing your entries on the lower timeframe and managing your trades on the higher timeframe.

Pros:

You can achieve insane risk-reward on your trade, possibly 1 to 10 or more. And the reason being is your stop loss is tight because you’re timing your entry on the lower timeframe.

Cons:

The downside is that most trades will amount to nothing. You hit your one-to-one, take profit on half of the position but the remaining half will just get stopped out at breakeven or for a loss.

Most trades are like scratch trades, with small wins and small losses amounting to nothing. But there are those few trades which will really make a huge difference to your bottom line.

And another thing is that it's mainly for experienced traders because you can see that you are utilizing multiple timeframes analysis.

For example, this is combining day trading and swing trading together to give you this transition trading.

Which is the right trading strategy for you

The first question to ask yourself is:

1. Do you want to grow your wealth or do you want to make an income from trading?

There's a difference. When I talk about growing your wealth from the markets, it means making 10%, 15% or X% a year.

But when you're talking about making an income from trading, it means you're looking to make like 3% to 4% a month or maybe 5% to 6% every quarter, you're looking for some consistency.

If you want to grow your wealth in the markets you can adopt a swing or position trading approach.

But if you want to make an income that's where you need to look at day trading or transition trading.

2. How much time can you devote to trading?

If you just graduated and you’re going to do this full-time, then clearly day trading is for you. But if you’re having a full-time job, you don't want to do this full-time, then you've got to look at swing trading or position trading.

If you want the least amount of time, position trading.

If you want more action in the market but at the same time, you don't want to be glued to the screen, then swing trading. If you want to do it full-time, then day trading is for you.

3. Does the strategy suit you?

For example, in position trading, it's awesome to ride big trends. But maybe you're not suited to ride trends because you're not comfortable watching your winners become losers, you feel a lot of pain when winners become losers.

And if you feel a lot of pain, then you might consider swing trading where you just look to capture one swing in the markets.

Ask yourself, does the strategy suit you? Do you exert a lot of mental capital? Do you feel a lot of pain psychologically when you execute a strategy?

If it doesn't really hurt you, if there's really not much pain, then that strategy probably is for you. But if you feel a lot of pain, that strategy clearly isn't for you. Simple.

As a quick recap…

Recap

- Day Trading – capturing intraday volatility

- Swing Trading – capturing a swing in the markets

- Position Trading – riding trends in the market

- Transition Trading – a combination of multiple trading styles