#10: The Different Types of Forex Trading Strategies

Lesson 10

Different types of Forex trading strategies

In this video...

You will learn what are the different types of Forex trading strategies that you can use.

I've broken them down into three different categories:

- Position trading

- Swing trading

- Day trading

Let me explain them in more detail…

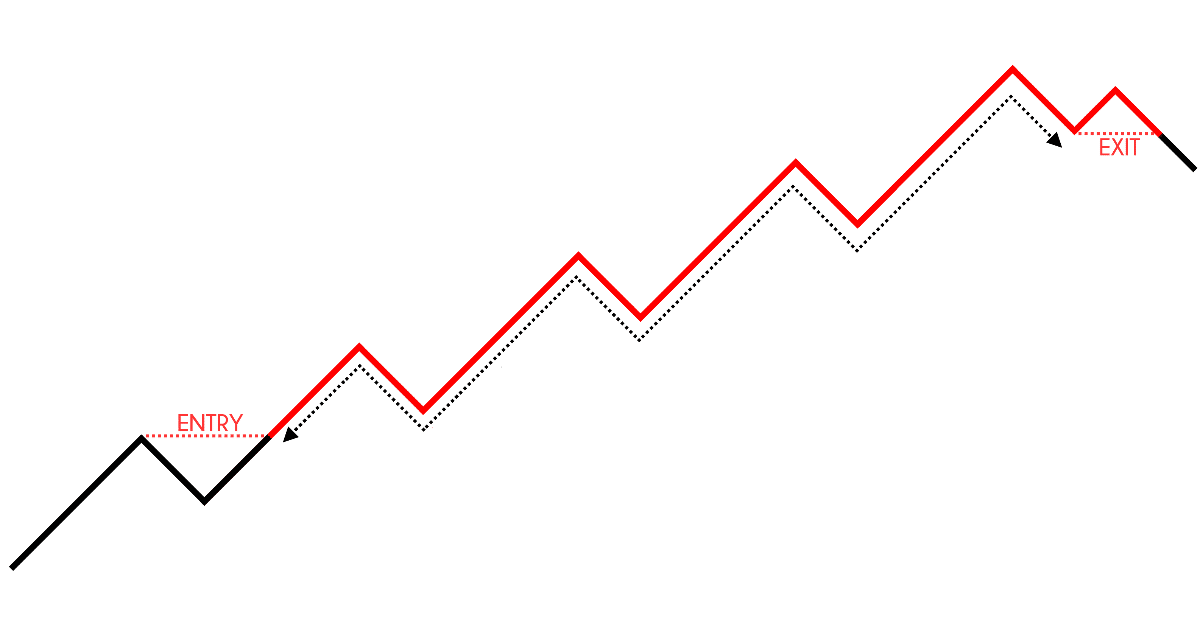

Position Trading

Position trading is a long-term type of trading.

You are usually trading off the 4-hour time frame and above:

What you're trying to do is to ride the long-term trend.

For example, the market is trending.

Then it starts to show signs of reversal.

As a position trader, you can either long at the breakout or the pullback, but you can never exit at the absolute highest.

It's not possible to consistently predict where the market will reverse.

Your goal as a position trader is to capture this meat of the move.

Basically, the chunk where the market trends the most to capture the meat of the move and you would only exit your trade when the market shows signs of reversal.

May it be having a trailing stop loss or a break of a support structure.

This type of trading approach would suit those with a full-time job because you can't watch the markets every hour, every minute.

Position trading would suit you because you don't need to spend a lot of time in front of your monitor.

I would say about 30 minutes to an hour a day is enough.

Because you are usually trading off the higher time frame like the 4-hour and daily.

Moving on…

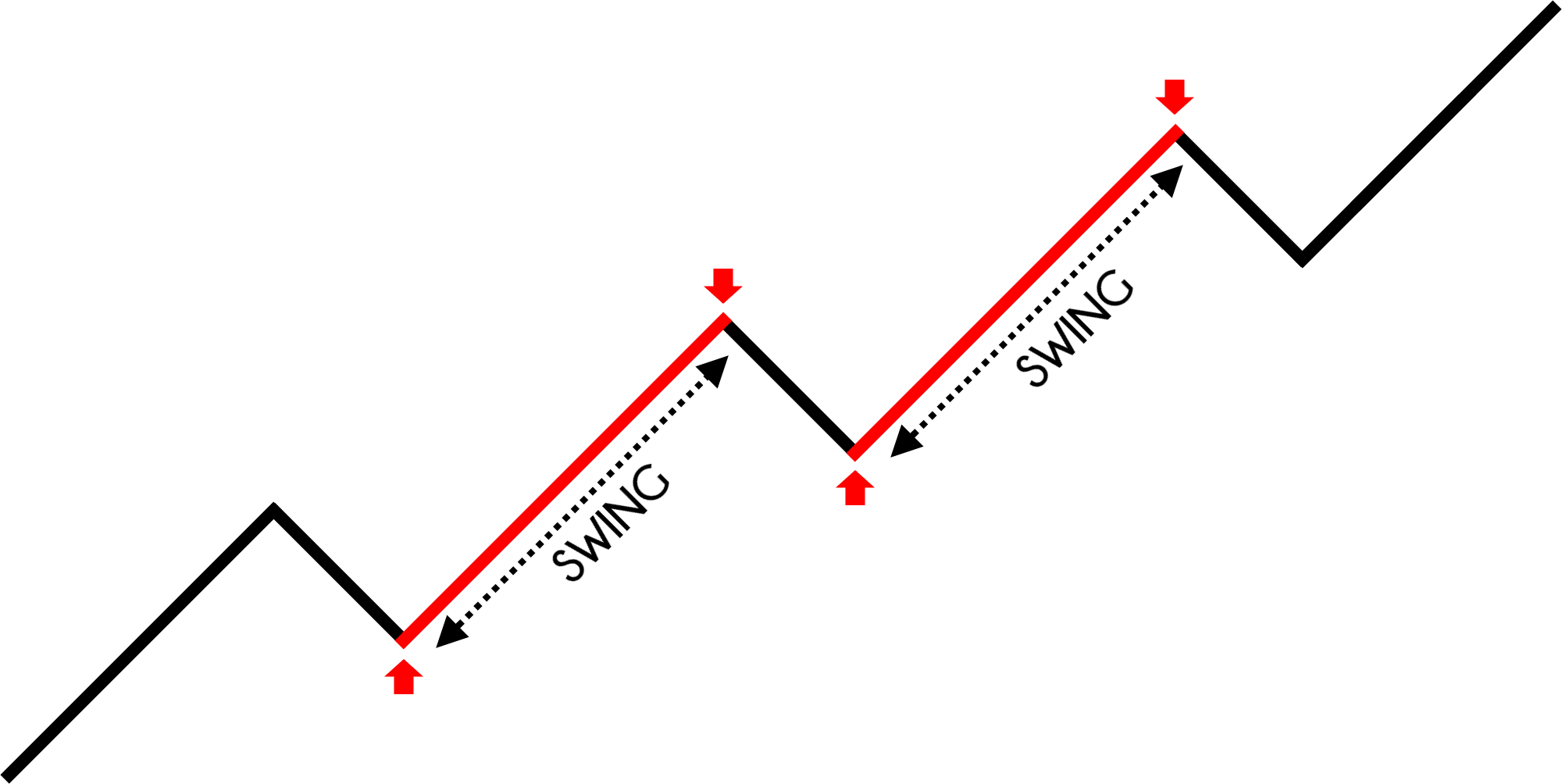

Swing Trading

As a swing trader, you're typically entering your trades between the 1 and the 4-hour time frame.

What you're trying to accomplish is to capture a swing in the market.

What is a swing?

Let me explain:

If the market is in a range and it comes down, it is called one swing.

And if the market reverses back higher again, it is called another swing.

Needless to say, as a swing trader, you're just trying to capture one move (swing) in the market.

Similarly, if the market is trending higher, you can look to go long on the pullback.

And exit when the market swings higher and possibly exiting near the previous swing high.

This is what swing trading is all about.

And usually, the time frame you are entering your trades on is on the 1 and 4-hour time frame.

Another question again, who is swing trading for?

Swing trading is for those of you with full-time jobs, but you still want more action in the markets if you have a little bit more time.

You'll typically spend anywhere between one to two hours a day trading the markets.

And usually scanning the charts between the 1 and 4-hour time frame.

And lastly…

Day Trading

This is something that I think most of you are probably familiar with.

As a day trader, the time frames that you are on is usually below the 1-hour time frame.

You have to understand that day trading is pretty much a full-time job in and itself.

And the difference between day and swing trading is just simply the time frame you are trading.

In terms of the approach, the technique, the entries, and exits, day and swing trading are pretty much similar.

So, if you want trading to be your only source of income, then day trading is something for you.

Because it provides the most trading opportunities compared to swing or position trading because you're trading on such a low time frame.

Recap

- Position trading is for those of you who have a full-time job. You typically can look to make like x% a year.

- Swing trading is for those with a full-time job and you still want more action in the market. You’re looking at x% every three or four months instead of waiting for a full year.

- Day trading is for those of you who want to have a full-time trading career in trading itself.