In the previous video, we talked about how you should not go about finding an edge.

We talked about trading psychology and risk management not being the solution.

Because you can have the best risk management and the best trading psychology out there, but without an edge, you’re still going to lose money in the long run.

Then we talked about fundamental analysis. Why a trader like you shouldn’t be focusing on fundamental analysis to tell you whether to buy or sell.

Because, when good news comes out, the price can go down. When bad news comes up, the price can go up. So, there’s this discrepancy here.

The good news doesn’t mean the price will go up for sure, because we talked about expectations. The price goes up because of their expectations towards the news, not whether the news is good or bad.

Trust me, I do not know of anyone who can predict people’s expectations towards the news. You would be a god if you can do that. Fundamental analysis isn’t a solution.

Finally, we talk about, using the same tools the same way. If you’re going to use the tools like how 99% of traders use them, then you’re asking for trouble. Because you know, most traders, lose money in the long run.

So now the question is…

What does the 1% do differently?

What do the 1% of winning traders do differently? Here’s the secret. They trade with a proven trading system consistently.

Now you might be wondering…

What’s a proven trading system and how do I get there?

So, there are a few ways to it. In my opinion, the best way to go about it is to be a system trader or get involved in systems trading.

With systems trading, you don’t have to spend all day watching the markets. You just need to follow the rules, which I’ll talk about later.

And that’s how you can find your edge in the market.

Our systems trading is simply trading with a fixed set of rules without discretion or subjectivity.

For example, in system trading, whenever the price breaks out of the 200-day high, you go long.

That’s an example of entry based on systems trading because the rules are very clear cut.

Unlike drawing support and resistance on your chart which is more subjective because how do you draw support resistance? From one person to the other, the levels might be different. It depends on how you interpret the charts.

Whereas systems trading is black and white. If the price breaks above the 200-day high, you buy. No subjectivity. You can get 200 traders to do this and they all going to get similar entry points.

But if you ask 200 traders to draw their support resistance on their charts, you’re going to get very different levels.

So, we can see that one is subjective, one is discretionary. The best way forward is to trade with a proven trading system is to go with the systems trading approach.

Let me share with you a few secrets about systems trading…

Secret #1: You don’t need to code to be a systems trader

I know most of you are thinking:

“Rayner, I don’t have any programming knowledge. I can’t code, how can I be a system trader?’’

Maybe in the eighties and nineties, you need to learn how to code to program your system.

But in today’s day and age, with the technology we have right now, you don’t need to know how to code to be a systems trader.

Let me share with you an analogy. When you switch on the light. Do you need to know where electricity comes from? Do you need to know what is a filament? Do you need to know who is Thomas Edison? Probably not.

You just go through the light switch and switch it on.

The light is on and it’s the same for systems trading. All you need to do is follow the rules and let your edge play out in the long run.

The first secret is you don’t need to know how to code to be a systems trader. If you know how to, then that’s good for you. But if you don’t, you are not losing out, trust me. I’ll share with you later on how this is possible.

Secret #2: Saves you thousands of dollars and years of trial and error

You can validate your trading strategy in minutes or even seconds if it’s a simple strategy. This would help you save thousands of dollars and years of trial and error. Unlike someone who is going with a discretionary approach, how would they validate their trading system?

They need to backtest and how do they backtest? They need to manually look through their charts. For example, let’s say they are trading a breakout, then they’ll look through all the past breakouts and identify times that they would buy the breakout.

And if they buy the breakout, they need to calculate what is the result of that trade. Is it a winner or a loser and they need to write it down on a paper or excel the result of their simulated test.

You can do this for one market, depending on how much data the market has. Maybe let’s say 10 years of data. It would take 5 hours just for one market across 10 years of data. But what if you are trading 50 markets across 10 years of data?

You can see how manual backtesting is going to cost you a lot of time and effort. That’s not all when you do manual backtesting, there is always this bias in you. You’re more prone to making a decision that would make you have good backtesting results.

Imagine you spend so much time backtesting a strategy, but subconsciously, you want a strategy to work because if it doesn’t work, you are wasting all your time and effort on this backtesting procedure.

How does this bias come in?

For example, as you scroll through the chart, if the market is in an uptrend, your mind tells you to let’s buy breakouts because you know what’s going to happen next.

It’s going to be an uptrend so let’s look to buy and let’s avoid shorts’ signals because the market is going to be in an uptrend. Whatever we short are going to lose money. You can see that this bias in your head would skew your backtest results to be better than reality.

This is why if you’re going to do manual backtesting, you will be prone to biases and errors which is going to cost you hundreds of hours to just backtest 10 years of data across 40-50 markets.

But if you go down with the systems trading approach, you can just backtest a strategy in minutes.

Secret #3: You can beat the markets with less than 30 minutes a day

You may be wondering,

“Hey Rayner, how is that possible? 30 minutes a day isn’t systems trading, trading on a lower timeframe isn’t it high-frequency trading?’’

No. High-frequency trading and systems trading are two different things. High-frequency trading refers to trading on the lower timeframe, maybe the 1-minute, 5-minute charts.

Systems trading on the other hand simply means that you are trading systematically with a very clearly defined, fixed set of rules. And the system trading that I advocate is trading on a higher timeframe, daily timeframe, and the weekly timeframe, or even a monthly timeframe frame.

If you think about this when you’re trading on a daily timeframe. How much time do you need to run a system? All you need to do is check the charts once per day. If there’s a valid trading setup, you take it. If there isn’t, you move on.

Let’s say your portfolio of markets is 20 markets. How long does it take for you to look through 20 charts on a daily timeframe to know whether there’s a valid trading setup?

I don’t know about you, but for me, if I were to do it, I can do it in 10 minutes. Maybe if you’re entirely new to trading, then 20 minutes.

But you can see that if you trade off the higher timeframe, like the daily or weekly timeframe, you can beat the market in less than 30 minutes a day.

If it’s the weekly timeframe or the monthly timeframe, you just need to check the charts once per week or even once per month. So this gives you the freedom to do the things you love.

This is the power of systems trading. You can beat the markets and still have time to do the things you love. You don’t have to stare at a screen all day long monitoring the markets, whether your position hit stop loss or not.

You can instead just put on your trades, move on, get a life, come back and see whether you’ve made money or not.

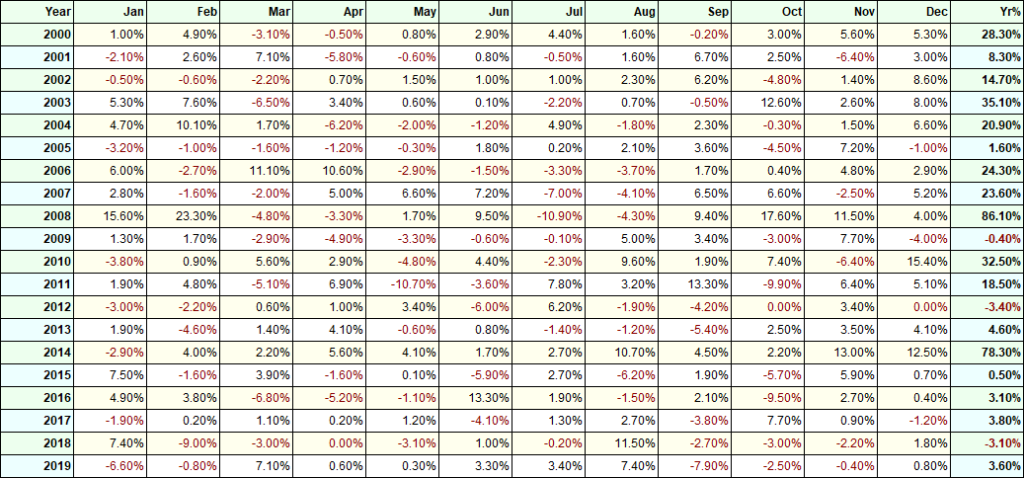

I just want to share with you this system over here. This is the daily system trading across a portfolio of about 40 markets. It doesn’t take much time.

It’s a daily timeframe system. If you do it manually, I would say no less than 30 minutes a day, you can run this system over here.

This is just to share with you, how a daily system work, what kind of results you can expect. It’s based on a backtest from 2002-2018 which is about 19 years of backtesting on this system.

Secret #4: You become a consistently profitable trader in record-breaking time

Let me explain why. When most traders get into trading, they have the mindset of:

“Let me go all in. Let me quit my job and trade full-time.”

The problem with that is most traders tend to fail when they go with the all-in approach, the all-in mentality. Why is that? Because when you go all-in trading you leave all the safety net behind you. Trading becomes your only source of income.

Let’s say maybe you do have a strategy that has an edge in a market but you’re relying on trading to put food on the table.

Maybe in April, your trading strategy is losing money. You’re having losses, and you know you need profits to put food on the table, to pay the bills, etc. Imagine when you have losses in your trading account, what will you do?

Chances are you will widen your stop loss because you don’t want to take the loss. If you take the loss, then there are no profits. So, you might widen your stop loss or you might double down.

These actions lead to destruction. You can get away with it once or twice, but if you do it in the long run, your account is going burst.

Why is that?

It’s because you went all in and you have the need-to-make-money syndrome. And if you do go all in and trading with no safety net, you are putting yourself in an unfavourable environment.

If you want to be consistently profitable in record-breaking time, go with a systematic trading approach. You need less than 30 minutes a day, if you are slow you take an hour there.

And if you have a full-time job you’re no longer relying on trading because your full-time job can pay the bills. This means you can focus solely on executing your edge in the markets with no distraction, bias or negative emotions that cause you to break your rules, etc.

All you need to do is focus on your trading because you know that the bills are taken care of by your full-time job. As a system trader, you can become consistently profitable in record-breaking time because you are not 100% reliant on your trading profits.

Trading is to supplement your lifestyle, not become your lifestyle – a big difference.

Secret #5: The richest traders in the world are systematic traders

Let me share this with you. David Harding, he’s a founder of Winton capital, he has a personal fortune of $1.5 billion at the age of 55.

John Henry bought the Boston Red Sox for $700 million.

Jim Simons, founder of Renaissance technologies has a net worth of about $20 billion as of 2018.

The secret is that the richest traders in a world are not discretionary traders, but systematic traders. There’re not day traders or scalpers, they are all systems traders.

This should give you a signal that the best in this business use systems to extract profits from the market consistently. The best traders, the most profitable traders in a world, the fund managers, they are all systems traders.

Secret #6: You can build massive wealth even if you have a small trading capital

How is this possible?

Remember, in systems trading, you don’t need much time. You only need less than an hour a day. And after we have time to do our full-time job.

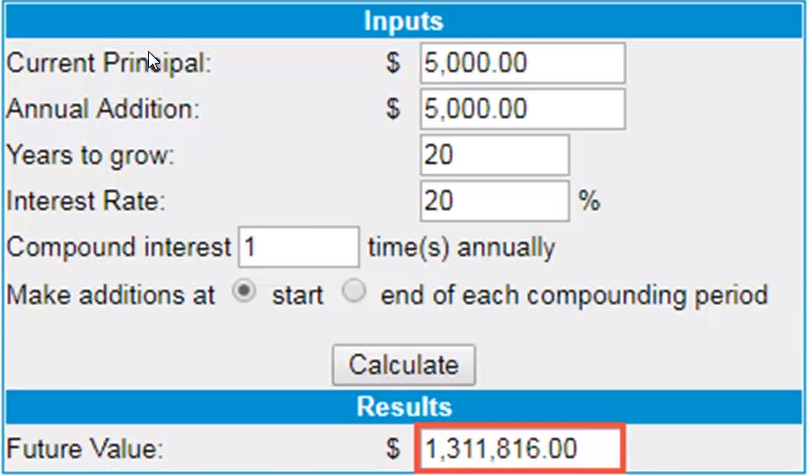

Let’s say you have a starting account of $5,000. You have a full-time job and have some savings, you can afford to put in another $5,000 to your trading account every year. That’s like $400 monthly savings.

Let’s say you take 20 years to grow, with a 20% annual return. With systems trading, you can make anywhere from your 10-30% per year consistently, depending on your risk management, but 20% is doable.

Let’s say you compound it once per year, after 20 years, with all these factors accounted for, you would end up with about $1.3 million. Is it enough for you to live on? I don’t know.

It depends on your expenditure, but you can see that with a small trading account, adding funds consistently to trade your system with an edge, you can snowball that money into something substantial, even seven figures over here.

The secret here is that you can achieve massive wealth even if you have a small trading account.

Systems trading allows it because you have the flexibility, the time to get a full-time job to supplement your trading and let that account grew consistently over time.

Recap

- You don’t need to code to be a system trader

- You can validate your strategy in minutes

- You can beat the markets with less than 30 minutes a day

- You can become a consistently profitable trader in record-breaking time

- The richest traders of the world are systems trader

- You can build massive wealth even if you have a small trading capital

For now, here’s what I would like to know:

What does successful trading mean to you?

Leave a comment below, share your thoughts with me because I’ll read every single comment.

what is system trading?

Hey Rakesh,

Check out this post…

https://www.tradingwithrayner.com/essential-guide-to-systems-trading/

Hah Hah he just told you

I not sure about beat the markets, how about going with the flow?

Please do you have a video of how to trade the market in a system way

Hey Kenneth,

Check out this post…

https://www.tradingwithrayner.com/essential-guide-to-systems-trading/

do you offer systems trading among your portfolio of programs?

thank you for this topic, can we say system trading is trading with robot.is it anything one will install in mt4 or…..

What is system trading , will be helpful if u can elaborate on this

Hey there,

Check this post out…

https://www.tradingwithrayner.com/essential-guide-to-systems-trading/

To me it means being able to someday use what I have worked for to work for me with little help and time from me or my days

Hey Winston,

I’m glad to hear that!

Larger profits then losses.

Successful trading for me means irrespective of my losses my gains should be at least 10-15% of my capital employed.

I presently run a manufacturing business so I am looking at this as a passive income. But I hope that in AT LEAST 2years time I should be able to trade much better and increase my gains to at least 25-30% of capital employed.

In 5years time I want trading to be my full time passion on which I will be wholly dependent . From passive income it will become my main and only income.

Congrats and all the best sunil. Dr Subhas Babu

How do I start systems trading?

Hi Arnold,

Check this post out…

https://www.tradingwithrayner.com/essential-guide-to-systems-trading/

It was a great experience listening to you rayner

Hi Mandisi,

You are most welcome!

Good stuff

Cheers

Hi Kit,

Thank you!

As a nurse working in a different country. A successful trading means to me is when i follow my Trading plan or system. But a successful trader means to me is when I retire and go back to ky home country and still get constant income on my trading

Rayner Sir, Is Trading Charts Patterns and CandlePattern is also Systematic Trading ??

Hi Darshan,

Check this post out…

https://www.tradingwithrayner.com/essential-guide-to-systems-trading/

need to master the art of being system trader and ability to trade with an edge

Hello Rayner,

This is a very useful information. I was just thinking of how to get an edge on my trading with all I know but still having loses when I saw your mail on : ” What do 1% of traders do differently “. It is an eye opener!

Thanks

Simon

Hi Simon,

I’m glad to hear that!

Thanks for your great revelation on system trading. all will back test with demo account and watch the unfoldings result.

Hi Pius,

You are most welcome!

I’ve Been aFx Trader for Years ,, STILL Struggling , , Win some lose some,,,BUT Never Breaking into

Positive Goal , to Achieve that Freedom of Success !

Hi Jack,

Don’t give up!

Cheers.

Successful trader to me means someone that followed the rules and norms of trading.

sucessfull trading mean working and have a lot of time for family

whats the next video ?

Thank you Rayner! Very interesting!

Hi Alexis,

You are most welcome!

A successful trader is someone who has good financial intelligence and know how to handle his or her emotions well.

for a beginner like me, successful trading provides cash consistently and enough satisfaction to carry on and improve your strategy & results

Successful Trading is profitable trading, you may lose some money a lot of the time, but make profit at the end

Hi Hassan,

I’m glad to hear that!

Successful trading to me is to make profits on a monthly basis using systems trading

Good information, how to get that system

A logical pre-targeted return on capital employed consistently over a considerable length of time.

Correct analysis and all the best

Hi Dr,

I’m glad to hear that!

i guess it depends on your objective

though you have talked about not relying on it to pay bills, you still have a life.

so for me successful trading is having financial freedom, iam not looking to accumulate wealth in 20 YRS, I want to be able live comfortably today, Iam 60 yrs i cant satrt to look for wealth for 20 yrs when iam in want for today

Good education

HI Mokgethwa,

Thank you!

playing your edge ryt

They can take lose, and willing to take less per cent reward.

I really want to abe to provide for my family and help the poor .Successful trading is making $500 a week and limiting my losses to bel li w 2%.

Successful trading is earning profit consistently. I’m looking forward to here from you the systematic trading rules.

Regards,

Subramanyam.

Mr Rayner teo thank you sir, I really appreciate the knowledge.

Hi Matthew,

You are welcome!

I think a successful trader is the one that makes the pip, keep the pip n repeats the strategy.

Hi Uwakwe,

I’m glad to hear that!

Thank you .I got know how can I become profitable trader.

Hi Vinayaka,

I’m so glad to hear that!

Successful trading, being able to grow your trading account to a point where $500, $1000, $2000 per week seems trivial because you have developed a system or method of trading that gives consistent results. This then protects your way of life and allows you to achieve.

Hie Rayner. Hope you can read my message. I do understand what you have been saying in this video.Honestly it makes sense. However ,i am from Africa (and its not an excuse). To be honest most of the jobs we have do not pay us “enough” to start a trading account with $5000. If you are to look at the stats, $5000 is even more than the average ANNUAL salary we get here. Personally would love to start an account with $5000 and let it compound. However In that case how can we leverage your knowledge or (systems trading) so that we can start with X amount and let the account grow without waiting for 50 years to enjoy the fruits of trading

I was thinking of the same thing

Successful trading means financial freedom. It’s great to make money from everywhere in the world without having any customers.

Successful trading leads to freedom

This program looks very intriguing. I am forever hearing gurus say to develop your own system. But how do I know if it works consistently? How does one backtest efficiently? I am not a tech geek. I work full time and am looking for a system that trades the daily chart that has been backtested to be consistently profitable in the forex market. I understand and practice proper money management and trading psychology. I would ultimately like to trade for a prop firm full time. I am looking forward to knowing more about this program!

thanks for everything

Hi Dela,

It’s my pleasure!

Successful trading means making profits consistently- need npt be heavy profits.

Hi GR,

I’m glad to hear that!

Alot depends on when you start using a trading system….looking at the spreadsheet above, would you have continued using the method if you started trading in January 2012 and traded for a whole year and lost 3.4 %……. or started trading in January 2009 and lost .4 % after trading for a whole year…..Imagine trading for a whole year and losing money !! Also what if you started trading in March 2020 and watched the market collapse due to the virus …would you have stayed in the market or got out of your positions at a tremendous loss and quit trading forever ? Something to think about !

can’t wait to see your next video, so far its very good and help full.

Hi Harold,

Thank you!

System trading

This is really an eye-opener

but do you think it is a bad idea to be a scalper to grow your account before becoming a systems trader ( from my end $5,000 isn’t exactly a small trading capital).

Thanks man like you said l think successful trading means to understand the edge and to follow the strategy

Hi Takalani,

You are most welcome!

so ? what do you offer_?

Is this will work for intraday trader Rayner?

Means i can trust the business and myself around it that when i envest mu capital im growing financial and spiritual as well as mindset that was successful trading mean for me and be stable for my generation to come❤❤

I want to grow my (losing) account so that I can teach my children how to formulate winning trades.

Hi Al,

Successful traders are made and not born.

Keep learning and practicing.

Good luck!

For me successfull. Trader is who has more winning ratio, risk management.

Hi Shivkumar,

I’m glad to hear that!

Rayner, you’re an inspiration. I’m learning trading since Covid and redundancy, and you are helping me quite a bit. You are very kind to share your experience.

Successful trading, to me, means quite simply achieving financial independence. Making my own money when I need to. That’s it.

Thanks for sharing your knowledge!

Hi Dave,

I’m glad to hear that!

Cheers…

Successful trading means to me that I have more wins than losses and my average win is greater than my average loss.

Hi Andy,

I’m glad to get your contribution…

Cheers.

Hi Rayner, thank you for sharing this video. I have been developing my own system, but my system is dependent upon the same indicators that everyone else uses. My parameters may vary incrementally, But is that really enough to give me an edge? My track record is very good with winning percentage and ROI, but it’s only been running for a few months, so has not been tested yet by the bear. Either way, I am still looking for improvements.

Being a good successful trader would be , being able to replace my daily income from my day job when i retire, so i will have something to fall back on.

Hi Mike,

Thanks for your opinion.

Cheers.

First time I heard about this Systems Trading Strategy. Sounds great and resonable.

Hi Enrique,

I’m glad to hear that!

Cheers.

reasonable. Thought at first you will be talking abou intraday trading.

Its funny you know I have been trying different ways to trade for a long time now and I have just began to trade exactly how Raynor explains in this video and guess what its working really well so far.I trade the daily time frame instead of the 3,5,15, or even the one hour time frame.I used to sit up for hours trading, being in Australia probably didn’t help but finally went to the longer time frame and used a set of rules and no guess work or emotions and so far so good.Anyway fingers crossed oh hang on NO GUESSWORK ONLY SET RULES LOL.

Hi Philip,

I’m glad to hear that!

Cheers.

I love your teaching methods. You simply make it easy to understand the act of trading forex. If one can still to your principles, I guess financial success would be achieved seamlessly.

Hi Efoghor,

I’m glad to hear that!

Cheers.

Amazing a relief and ray of hope from Ray, my

Thank you, Trupts!

Sir please I want to ask if u can don a video on how to understand muse more, how to know an understand the (adge) an also the (system) I am new in trading with ziro experience but with the help of ur teaching I am be able to know muse better. how the trade is all about because I am leaning it so fast sir please do a video

Hi Jerry,

Check out this post.

https://www.tradingwithrayner.com/profitable-trader/

Cheers.