In this video, I’m going to show you what you can do to develop proven trading systems that work even if you do not know a single line. This is the framework that I use to develop my trading systems.

How to “steal’’ proven trading systems that work

A couple of ways you can do it:

- Systematic/quantitative trading books (Amazon)

- Research Papers (SSRN)

On Amazon, there’re a lot of trading books out there, and you want to focus on trading books that talk about systematic trading, quantitative trading.

Because these are the books that reveal trading systems that you can use. I’m not referring to books like technical analysis, chart patterns, etc.

They have their purpose, but it’s not what we are doing over here. What we are doing over here is quantitative, backed by data and statistics.

So, the books that you want to focus on should be systematic trading books. Once you get your hands on them, you can look through those systems.

They’ll tell you the exact entries and exit, markets traded and everything.

From there it makes your life much easier.

The second approach is reading up academic research papers.

You can go down to www.ssrn.com.

There’s a huge database there, where academics publish their research on this free portal. You can just download a research paper, look at whatever topics that interest you.

Like momentum and value investing, whatever it is, there’s a wide array of topics.

Download the research paper, and read it. They break down and share the “experiments” that they did.

You can copy the experiment and their system that was tested on to see if you’ve got similar results as to what they have shared in the report.

It wouldn’t be 100% perfect because sometimes they are prone to making errors.

But the Amazon and the SSRN has systematic trading books and academic research papers which are very good starting places to steal proven trading systems that work.

Trading books and research papers

Here are some trading books and research papers that come with trading systems which you can consider using:

Books

- Mean Reversion Trading Systems by Howard Bandy

- Short-term trading strategies that work by Larry and Cesar

- Building Reliable Trading Systems by Keith Fischer

Research Papers

- Does Trend Following work on Stocks by Cole Wilcox

- Two centuries of Trend Following by M. Potters Etal

- Analysis of Trend Following Systems by Jose Cruset

Do you start trading immediately?

So, once you’ve got the system, do you immediately start trading? No.

Remember the 1%, what do they do? They validate a proven trading system and trade it consistently.

At this point, you have trading systems that you have learned from. The pioneers, the veterans who were earlier in this business before you.

That does not mean that those systems work. They could be wrong. They could be an error in their testing. This is why you always must validate whatever stuff that you have come across.

How to validate a trading system?

So how do you validate a trading system?

By backtesting I don’t mean manual backtesting where you look at the charts, you identify the setup and you record in your excel spreadsheet.

That is manual testing. And I don’t advocate that over here because it’s cumbersome. It’s prone to human errors.

And it’s going to take you a long time. So to backtest systematically, and you need three things…

- Platform

- Market data

- Code for your trading system

Let’s look at these in more detail.

1. Platform

There are many different backtesting platforms out there and these are the more popular ones used by professional traders:

- AmiBroker

- RightEdge

- Tradestation

- MultiCharts

So for me, I have used AmiBroker. But it’s up to your preferences what you want to do with your backtesting.

Some of these platforms have called pros and cons, so it depends on what you want in your backtesting.

But none of them is the best. They all pretty much have their usefulness for backtesting. And it’s up to you to decide which one is best for you.

I filtered down to these four, so you can make your life easier in choosing a backtesting platform.

2. Market Data

Once you have your platform, you need to put in data to test. You need to have data that you can work on, this is where you can get your data from:

- Norgate Data

- CSI Data

- TradeStation

- Not advisable to get free data.

There are backtesting platforms that come with data as well, otherwise, you can get your hands on all these data.

I don’t advise you to get free data like those from Yahoo etc.

Because free data is usually prone to errors and mistakes. If you’re dealing with stocks, the free data would not take into consideration, delisted stocks, dividends, etc.

If you want to do proper testing, get paid data. They have fewer errors and they’re more accurate to start with.

Imagine you test on the wrong data, you’re going to get wrong results, and you don’t want to be trading live with an unreliable result. So, data is important.

3. Code for your trading system

- Do it yourself

- Outsource: Google and Upwork

- (X platform) programmers

You need to code your trading system. For those of you who can code C++, python, etc.

You can do it yourself. But what if you’re like me? I can’t code from that. What I did is that I outsourced to others whom I know are more proficient in it.

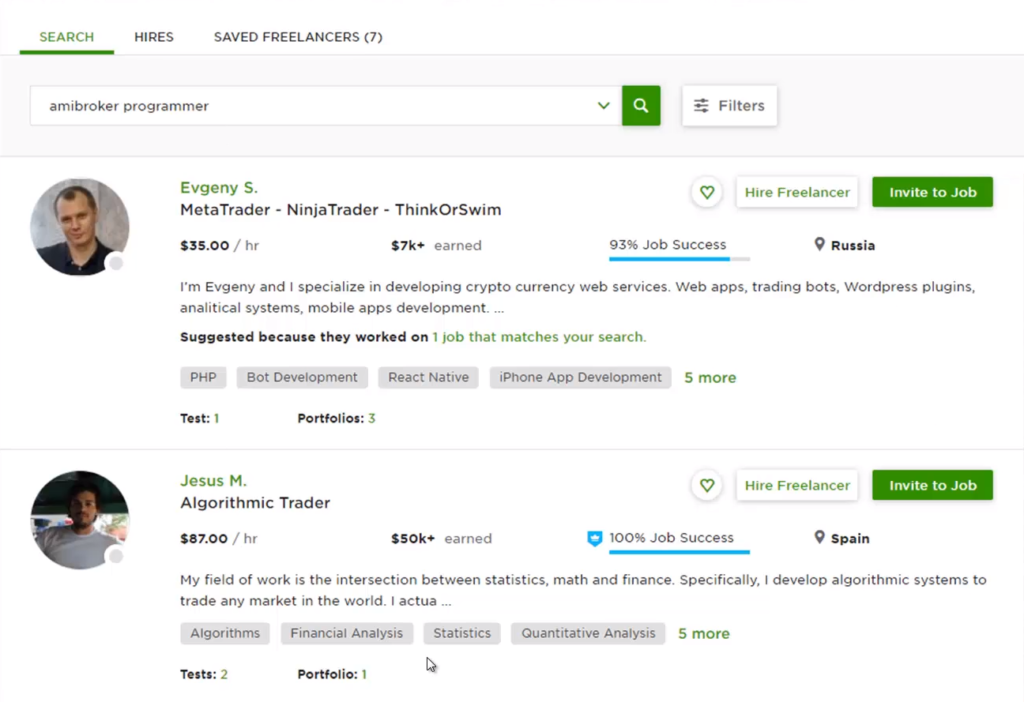

You can go to Google or Upwork, which is a marketplace where there’re a lot of professional freelancers. You can look for the programmers there as well.

Let’s say, for example, you want to go with AmiBroker.

What you do is just put the bracket X platform, for instance, AmiBroker programmer. You can just search it on Google or Upwork.

It will give you a list of people with the skill you need. Maybe you want to go with the TradeStation, just search TradeStation programmers, you will find results from it.

Let me just share with you a couple of examples.

I’m on Upwork over here. You can see that I search for “AmiBroker programmer’’, they’ll give you a list of people who can use AmiBroker.

You will find them and they will help you code your system.

You already have the system in place. Maybe you learned from books or the research papers, all you need now is someone to help you code the system into the backtesting platform.

It’s pretty easy. It’s just a matter of whether you want to do it or not.

Let’s put it to the test…

- Trading system

- The tools (data, platform, code)

Let’s say, I’ve read several trading books and I come across a trend following system. This is an idea that I got from the book Following The Trend by Andreas Clenow, which he shared a trend following system.

Let’s test the trend following system, not the exact rules, but a variation of their rules.

The tools I used to get data is Norgate data, the platform is AmiBroker and for the coding, I outsourced it to someone on Upwork.

So, these are the rules I learned from the book. This is not the exact rules but a variation of it. But it’s not important.

What is important is at least gives me an idea to know where to start with.

The rules (long)

- Go long when the price closes the highest over the last 200 days

- 3 ATR is your trailing stop loss

- You risk 1% on each trade

The rules (short)

- Go short when price closes the lowest over the last 200 days

- 3 ATR is your trailing stop loss

- 1% risk per trade

Since this is a trend following system, we want to trade it across a portfolio of markets.

Markets traded

I just randomly picked 20 different markets.

- Gold, Copper, Silver, Palladium, Platinum

- S&P 500, EUR/JPY, EUR/USD, Mexican Peso, British Pound

- US T-bond, BOBL, BUXL, BTP, 10-year Canadian Bond

- Heating Oil, Wheat, Corn, Lumber, Sugar

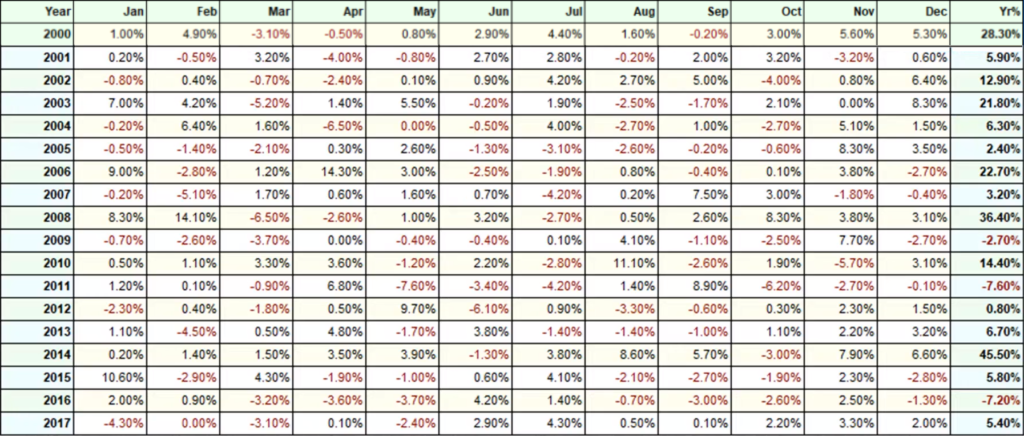

And this is the results that I’ve gotten over 18 years of backtesting.

You can see from the look of it, in the long run, this trading system makes money.

What’s interesting is I didn’t come up with the system. I just learned it from a book.

I did a little bit of tweaking, I understood how the system works, why it works, and did a little bit of tweaking and tested it out.

What I just shared with you is what I’ve done over here. And if you look at it, this system is pretty alright.

Not the best system in the world, but you can tell it gives you an edge in the market. You can make money in the long run, using this trading system.

In the 2008 financial crisis, remember the collapse of the Lehman Brothers. This system made about 36%, while the world collapsed, crumbled, and burnt.

In 2009, it lost 2.7% then recovered by making 14% then lost 7.6%.

Am I a genius? No, I’m not.

I just simply know where to find stuff that is likely to work. I validated and made sure that the results are pretty much in line.

This is why I said validation is so important.

Can you see how powerful this is?

- No need to code

- No need to start from scratch

- No need to waste years “figuring” things out

- Validate a trading system in minutes

I’ll be honest with you. I can’t put in a single line of code.

You don’t have to start from scratch. Learn from people who are ahead of you, the veterans and academics.

They are willing to share. It’s a matter of whether you want to find out or not.

The information is out there, I have given you resources to go find where these goodies are.

Go ahead and find out, you don’t have to start from scratch. Don’t waste years figuring things out, like where does a head and shoulders pattern work, etc.

People have already shared with you systems, techniques, methodologies that work. All you need to do is just take it.

Ask yourself, what is it, why it works?

If the logic makes sense to you, then take that system. If you want to tweak it, do some tweaks according to your trading style preference.

Go ahead, do it and validate it. You can do it. You can validate it in minutes. If you can program, you can do it in minutes.

The one I just shared with you is relatively simple and in 20 seconds, the machine will spit out over 18 years of backtesting and the results of one a month etc.

You can validate a trading system in minutes. There’s no guarantee that the system will work.

So, what do you do?

Go back to the framework again. Find a new trading system, validate it and see how it performs. You can see that this entire cycle should give you many trading ideas and concepts you can use in your trading.

You don’t have to spend a lot of time to trial and error, feeling helpless or don’t know what to do. I’ve given you this framework and it works.

So now some of you might be thinking:

“Man, I’m not convinced if I can do it right. I don’t want to hire a programmer to baptize my strategies.’’

“I don’t want to spend thousands of dollars trying to figure this whole thing out.’’

I’ll be honest. If you go down with this approach, you need to spend money if you can’t program. Needless to say, you have to pay someone to program for you. Nobody’s going to do it for free.

You have to spend a few thousand dollars, trying to do what I just shared with you.

But if you don’t want to spend thousands of dollars because there is always a possibility we spend a few thousand dollars but the trading system doesn’t work.

You need to find something else and have to get someone to reprogram it again, it’s going to cost you even more money. What you can do is that you can invest in something called the Ultimate Systems Trader.

The Ultimate Systems Trader

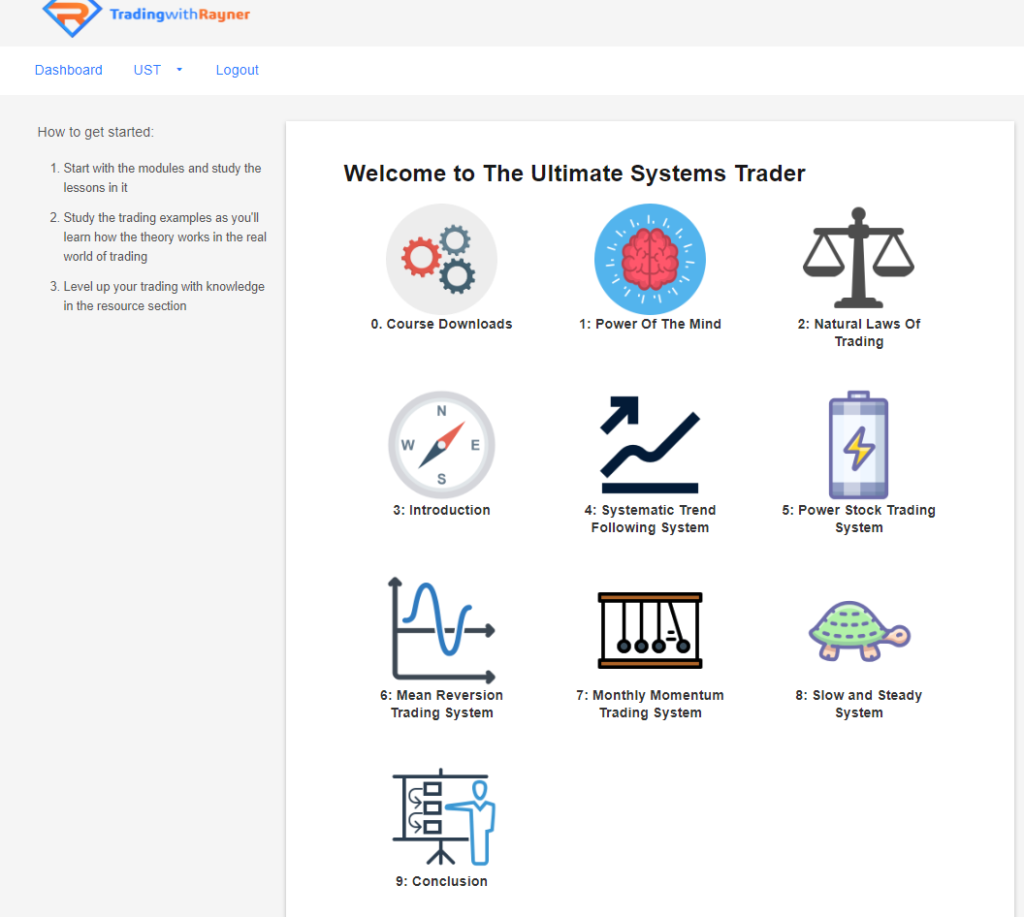

The Ultimate Systems Trader is an online trading program, that shares with you or teaches you step-by-step, proven trading systems that work.

This system has been backtested for at least 10 years or more. We’ve tested it in various markets, uptrend, downtrend, range market, and even during the financial crisis, the 2008-2009 financial crisis.

Only when it works and survives through this backtesting process, we add it to the Ultimate Systems Trader.

Let me bring you in, and share with you a sneak peek of what you’ll get in the Ultimate Systems Trader.

As you can see over here when you come into the member’s area of the Ultimate Systems Trader, we have several trading systems that you can trade.

Systematic Trend Following System

For example, the first one is called the Systematic Trend Following System. And it’s for those of you who want to trade the Forex and futures markets and apply a trend following system to it.

You can see that every system is broken down step-by-step. We talk about, what is this trading system, who is it for, the specific rules of this trading system, the results of the trading system.

For example, for the Systematic Trend Following system results, we break down the exact results over the last 18 years.

Then we’ll even walk you through step-by-step, how to implement this trading system.

Because it’s one thing to give you the system and it’s another thing to walk you through on how to execute the trading system.

We can see over here, how to execute this whole system, we have the video explanation plus all the screenshots, the step-by-step procedure to go about executing this system. We have broken it down into three different parts for this Systematic Trend Following.

If you have a question to ask, we have the Frequently Asked Questions where most of the common questions that I get are put over here in this FAQ section.

We can see over here this is for the Systematic Trend Following.

Power Stock Trading System

This is for traders who want to trade the US stock markets.

For example, maybe you’re a pretty busy individual, you only want to trade once a week, then this trading system is for you. It’s a once a week trading system.

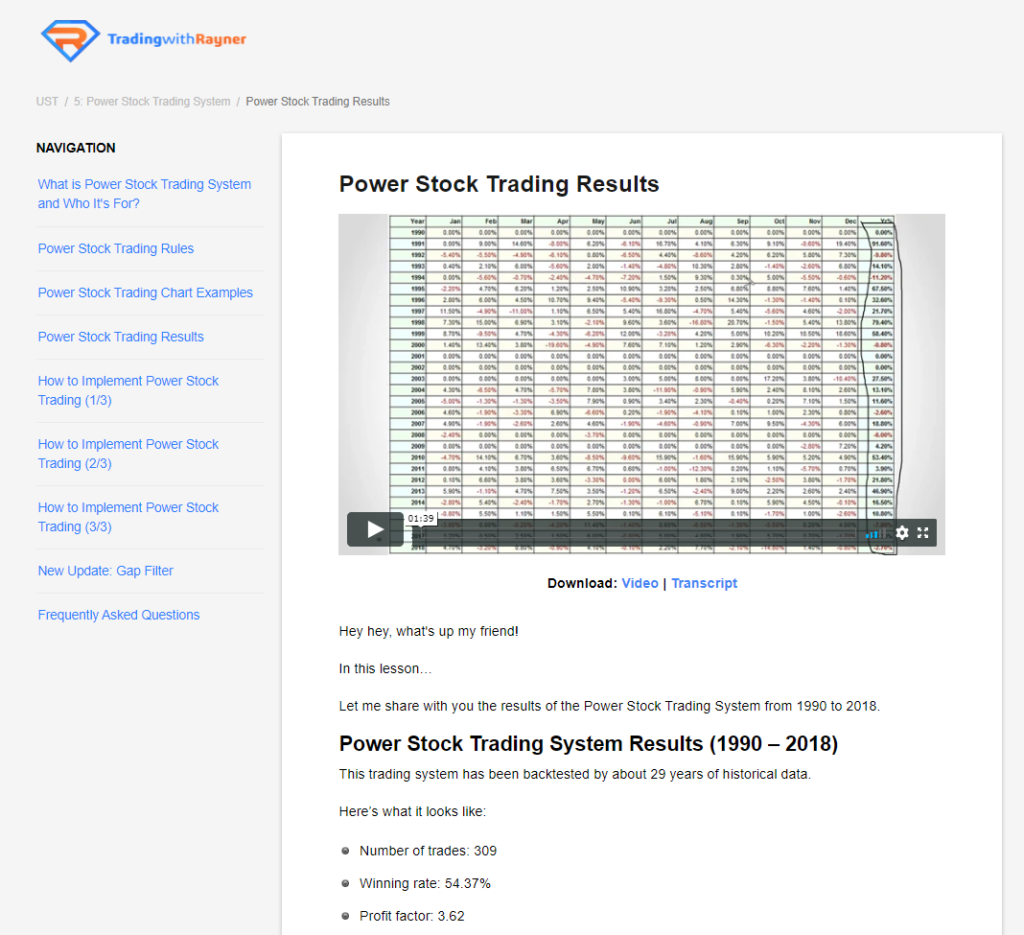

I’ll explain to you what Power Stock Trading is about, who it’s for, the specific rules, and the results. Again, I shared with you the results of all these different trading systems, and this one over here from 1990 to 2017 has been backtested.

Then we talk about the implementation of this Power Stock Trading System.

Again, I walked you through step-by-step, how to implement it, which platform to use, how to calculate position size, risk management, where to enter, where to exit, how to manage your trades, everything in detail.

So, no stone is left unturned, if you have any questions, you can always reach out to me or a trading coach and there’s a FAQ section which explains further in case you have any questions.

Monthly Momentum Trading System

This is an ETF trading system, and it’s for even traders who want to be as passive as possible.

This is a monthly trading system. You just enter your trades once a month and that’s it. You don’t do anything else for the rest of the month.

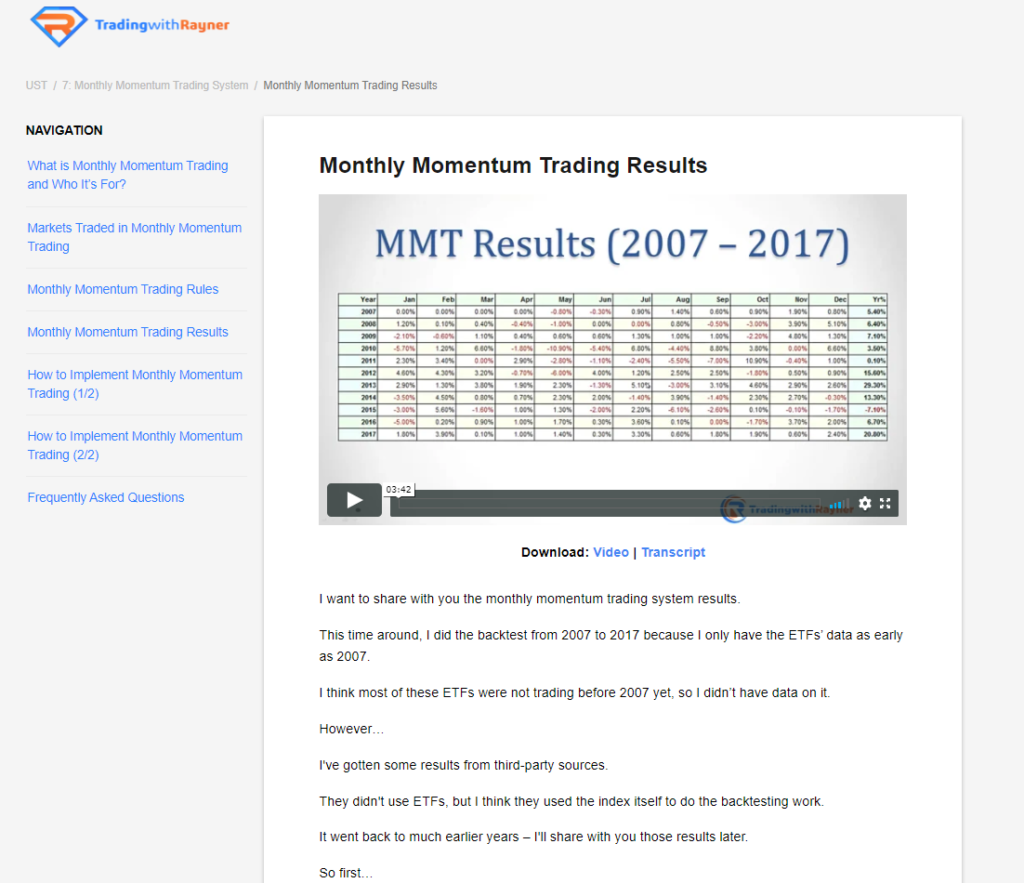

Again, expanding on what is it, who it’s for, the markets that you trade, the rules and the results.

This is the result of the Monthly Momentum Trading System.

You can see the results, and how to implement it step-by-step. You can choose to watch the videos or whether you want to read the texts.

It’s really up to you.

For those of you who prefer to watch the video, and for those of you who prefer texts.

This is a Monthly Momentum Trading. And one thing to note is that every system, especially the system that involves a few steps, I have this resource for you, like a simple checklist or flow chart so you know how to implement the system.

Slow and Steady Trading System

This is for traders who want to take this a bit slower. This is a yearly stock trading system. It’s not trading but more like an investment. Once a year, you’ll execute certain trades to help grow your wealth steadily over time.

I have this resource section for you in case you want to download the flow chart, the position sizing calculator, the webinar that we had. Everything is all in this resource section.

The Ultimate Systems Trader will be released over the next few days. If you’re interested, keep a lookout in your email. I’ll send you emails about the details on how you can invest in this program.

I’ll talk to you soon.

thanks Rayner I think I have a good road map to what I have work on for the next 5 years

Hey Gabriel,

I’m glad to hear that!

Is Ultimate Systems Trader a program that teaches trade systems that we need to enter and exit trades manually or it’s like quantitative trading that machine will control the trade entrance and exit?

Hey Joseph

You’ll have to input the trades on your own. Cheers

how do i know when the strategy is no longer working?

Hey hey hey! What’s up my friend.

Thank you Rayner, I can’t really thank you enough, since I have been following your video tutorials 3 months ago you hv’ my interest and confidence to trade forex grow more Gostronger, I really appreciate. This really another mind blowing course I must say, thanks a lot.

Hi Godswill,

I’m glad to hear that!

My hope is this won’t cost an arm and a leg to get in to.

look forward

Great info. Thank you

Hi Margit,

You are most welcome!

This program looks very intriguing. I am forever hearing gurus say to develop your own system. But how do I know if it works consistently? How does one backtest efficiently? I am not a tech geek. I work full time and am looking for a system that trades the daily chart that has been backtested to be consistently profitable in the forex market. I understand and practice proper money management and trading psychology. I would ultimately like to trade for a prop firm full time. I am looking forward to knowing more about this program!

Sound good. I am very much interested. Expecting your mail.

Hi Rayner,

Thanks for your usual tutorials. How affordable is it for one to key into this strategy?