Now I’ll be honest with you…

I can’t help you with your money problems.

I can’t turn you into a millionaire trader.

I can’t help you turn $1000 into $100,000 in 2 weeks.

You might be wondering…

“So why the heck should I listen to you?”

Well, I could improve your trading results.

This means…

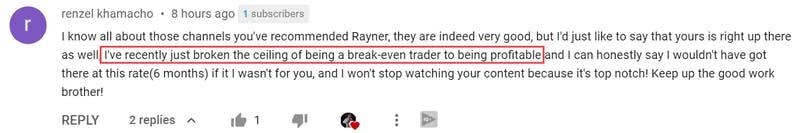

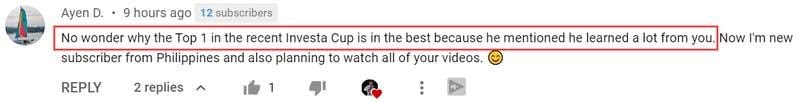

If you’re a losing trader, I could help you stop the bleeding.

If you’re a breakeven trader, I could help you get to profitability.

If you’re a profitable trader, then what are you doing here?

But, don’t take my word for it.

Here are what other traders have to say…

Anyway…

Today’s email isn’t about me.

Rather it’s about you, and how you can avoid the top 4 mistakes that almost all new traders make.

So, let’s get started…

#1: You listen to opinions

In 2009, I started trading in the financial markets.

I was new to this business so I did what most traders do…

Lurked around a stock trading forum with the hopes of gaining some tips and insights.

Every morning, I’ll read the forum to catch up on the things I’ve missed from the night before.

But today was different.

I noticed there’s a new thread in the forum.

In that thread, a guru did some technical analysis on a stock called, China Sports.

He drew an upward trendline on the stock price and was bullish on it.

I thought to myself…

“Wow, he seems to know what he’s doing.”

So, what did I do?

I bought China Sports, of course!

The next day, the stock rallied and I said to myself…

“Damn, trendline works like magic!”

However, over the next few days, the price of the stock declined and started moving lower.

It went back to my entry price and eventually, put me in the red.

I wondered what’s happening to the stock.

So, I quickly went back to the forum and check out the latest analysis on the stock.

Then something caught my attention.

The upward trendline I saw previously was “shifted lower”.

I didn’t think too much about it as the guru was still bullish on the stock—so I held on.

Over the next week, the price of the stock collapsed even more—I was down 30% from my entry price.

And every day, I was at the forum checking out the latest analysis of the guru.

Then I realized one thing…

His upward trendline was “shifting lower” as the days go by.

Eventually, the stock price tanked so much that his upward trendline became almost flat.

I had no choice but to cut my loss and call it quits.

The lesson?

Never trust the opinion of others—it puts you in a position of weakness.

#2: You "play" with indicators without knowing what it means

Here’s the truth:

Indicators are derived from price.

This means the values on your indicator are “created” by applying a mathematical formula from the price on your charts.

You’re probably wondering:

“What’s the problem?”

It’s this…

Indicators are “manipulated” to form bullish or bearish signals.

Let me ask you…

Have you noticed that your RSI indicator shows a bearish signal, but your MACD shows a bullish signal — at the same time?

So, which indicator do you trust?

Well, you’re stuck because now you have conflicting signals.

So, what’s my point?

Stop toying with indicators, it doesn’t give you an objective view of the markets.

Without an objective view of the markets, you can’t make the right trading decisions.

Without the right trading decisions, you’ll find yourself losing consistently in the markets.

Now don’t get me wrong.

I’m not saying indicators are bad and you can't use them. But they shouldn’t be the basis of your analysis.

#3: You rely on fundamentals to make your trading decisions

Here’s a fact:

The market can go up on bearish news and it can go down on bullish news.

And often, by the time the news is out… it’s probably too late to enter.

Now you might be thinking:

“You should combine both fundamental and technical analysis.”

Okay.

But what if your technical is bullish and fundamental is bearish.

Now you’re stuck, AGAIN.

So, what now?

Well, here’s a secret for you…

Often, when the fundamentals are bullish, it would be reflected in the price.

This means the market is in an uptrend when the fundamentals are bullish (and in a downtrend when the fundamentals are bearish).

Here’s an example:

As you can see, NZD/USD is in a downtrend even before the central bank cuts interest rate.

So, does it mean technical analysis is better?

Yes, at least in my opinion.

Because when you’re wrong, you have your stops in place to cut your losses.

But if you rely on fundamentals…

By the time the “bad news” is out, the market had collapsed and you’d lost a huge chunk of capital.

So here’s the deal:

If fundamentals can’t accurately predict what the markets will do and it’s a horrible risk management tool, then what use is there?

#4: You subscribe to a signal service

Now here are 3 reasons why I don’t believe in signal service and I never will…

1. 99.9% of these systems don’t work at all

Here’s the deal…

The “amazing” results you see from these systems are curve-fitted.

This means it finds the best parameters to fit the historical data so you get a nice-looking equity curve.

Now, it looks good on hindsight.

But it’s a disaster when applied to the real world of trading.

2. The market is always changing

Now… perhaps you might be lucky enough to chance upon a signal service that works.

But here’s the thing:

The markets are always changing.

It moves from low volatility to high volatility, from range market to trending market, etc.

So…

Your signal service might work for a while.

But when the market conditions change—it's game over.

3. You’re not in control of your trading

Now when these systems fail, it’s easy to point the blame at others.

And it’s the last thing you want to do because…

If you blame others, it means you’re not taking 100% responsibility.

If you don’t take 100% responsibility, you are giving up your power to change.

If you give up the power to change, you’ll never improve for the better.

So the bottom line is this…

Indicators, news, and opinions will not make you a consistently profitable trader.

So, what should you do?

I'll tell you more in my next email...

Certainly!

I can’t wait for the next email

You’re most welcome, Fred!

Always keep it in mind, Wayne!

Thank you for your appreciation!

Our goal is to deliver trading education that is practical, purposeful, and positive.

Enjoy the journey!

Cheers!

I want to learn how to do forex trading from starting to ending i have no idea about it which of your course should I take

Hey there, Adama!

Jarin here from TradingwithRayner Support Team.

If you are a beginner in trading, I highly suggest you start with our Academy.

Here is the link:

https://www.tradingwithrayner.com/academy/

Cheers!

Thank you for sharing, Ayabonga!

Thank you! We’re glad that you feel that way, Jude!

Hi, Matthew!

You can check this link regarding How to Overcome trading losses and losing streak:

https://www.youtube.com/watch?v=mPzxtXtwFzM

Hope it helps!

Thanks for your kind words, Silas!

Hey Sadashiv!

Here is a link on how to tell when Support/Resistance will break!

https://www.youtube.com/watch?v=K5dnTdg7Lz8

Hope it helps!

You are right with all your explaination based on your past experiences. In a situation like this what do i do? Because am a victim of what you have just disussed.

Hey Tim!

So sorry to hear that! You can check this link on how to identify Trend Reversal:

https://www.youtube.com/watch?v=aWN5oeVWA2A

Hope it helps!

Cheers!

It’s our pleasure, Abdel!

Thank you for your kind words, Eswar!

It is our pleasure to help!

Thank you sir i agree with your opinions

Thanks, Bob!

You’re most welcome, Ruth!

We’re glad you learn something from our materials!

Cheers!

You’re welcome!

We’re glad to help, Bishwanath!

You’re very welcome, Red!

Super

Amazing. Thanks for always sharing honest insights. This piece to me is being very honest. Most people would sell you signals to just get themselves some reward but Rayner would rather have you do the work. Thanks a lot bro.

You’re most welcome, David!

Hope to listen again in depth from you.. Thanks and keep guiding us…

You’re genuinely welcome, Harshal!

I’m unable to download your moving average guide pdf. Please share. Thank you ❤️

Hi, Kunal!

Kindly email at support@tradingwithrayner.com for assistance.

Cheers!

Thanks so much. I was just on a crossroads of technical, fundamental , indicators and the signal. Now I know what to do. ” MY HOMEWORK” no lazyness

You’re most welcome, Michelle!

Very true Rainer,

I learned a lot

Great!

Let’s keep in mind and try to avoid the top 4 mistakes that almost all new traders make.

Cheers!

Okay tell me

Great work man….The efforts you make to help other traders is a thing appreciate. You are a perfect example of a concent creator and a helpful human being!

Thank you for your kind words, Shaik.

Cheers!

Always clear

Thanks!

Thank you very much Rayner, for sharing your honest insight and the hard works! Your kind works is keep awakening me to see the light in front.

Thank you for your appreciation, Loke!

We’re delighted we could help you.

Cheers!

you are a master of price action . you r genius.

Great information sir

Thanks, Odega!

Eye opener

Cheers, Richard!

Have been trying to trade but my trades are all disabled

Hi, Yekini!

Here is a simple strategy but effective trading strategy which allows you to profit in bull and bear markets, You can check this link:

https://www.tradingwithrayner.com/only-trading-strategy-you-will-need/

Hope it may help you in your trading career!

Cheers!

Thanks for the insight

You’re most welcome, Agboola!

Thanks RT.

Thank you very much I’m greatful for this write up

It’s our pleasure to help you, Cyril!

You are teaching and have taught me alot, i wish for a 1 on 1 course with you,even if its paid:)

Thanks so much.

With pleasure!

Rayner thanks so much for touching some of our lives.question: Rayner please what is the best way of getting bias ?So that one will the direction of the market with precision?

Hi, Alex!

Here is the link on how to identify the trend:

https://www.youtube.com/watch?v=EbFUuSmuhVs

Hope that helps!

Great

Amazing. Kassim from Tanzania

We really appreciate it, Kassim!

Nice sir

Beyond greatful!

So what to do?

This is awesome

Cheers!

I have pass a lot of problem of losing market.

But there is one thing that I told myself

The mission has start no going back and it must be complete

Thank you for sharing, Clinton!!

Great insight as always and u make me read everything as always… U not just understand the technical of Market but Psychology of retailer trader as well

Happy to help, Tanaji!

Trading is also a mental sport so we have to control our emotions too!

Cheers!

wow super

Thanks, German!

Thank you Sir for sharing the secrets of Market.

You’re truly welcome, Vikash!

please recommend a broker for me am in africa (ghana)

Thank you Rayner for sharing your trading experiences to me. Much appreciated. My question is how do I predict the trend in two days time then I can make profit from some trading techniques.

Hey, Robin!

Here is a link on How to Identify Trends like a Pro: https://www.youtube.com/watch?v=OXCnFHp1EsI

Hope that helps!

Profound

Thank you for your teaching Reyner, the more I learn from you the more I become confident in my tradings, I’m still on demo but I can see tremendous improvement and can’t wait to put it into use on a real acc..

Hey Peter!

You’re most welcome! Demo trading can set you up for long-term success if you develop good trading habits before you start trading live.

Cheers!

Damn

Thank you for your good work Rayner

You’re most welcome, Abdulhakim!

Very good one

Thanks!

Pliz send Price Action trading stratgies , I will be waited your email

Hi, Mukhtar!

For your concerns, Please email us at support@tradingwithrayner.com

Cheers!

thank you to share precious knowledge with us.

We’re happy to help, Upendra!

I agreed with your opinions about News fundamantles and indicator ; you are always write

Cheers! Glad you find our material useful!

It will never stop teaching and never stop learning thanks teo this helps me to focus on the things that I don’t know

You’re most welcome, Madhan!

Cheers!

You just make it a clear view to me on RSI and MACD .. I also want to know , which place should check on this website!! On your trade prediction?.

Don’t leave us hanging!

Do you have any webinars that’s not a good time for California time

Thanks for the nice lesson,I wish again to gain more knowledge from you

You’re truly welcome, William!

Follow us on our verified account so you will be notified and updated when we have a new post!

Facebook: https://www.facebook.com/raynerlovesyou

Youtube: https://www.youtube.com/user/tradingwithrayner

Twitter: https://twitter.com/Rayner_Teo

Telegram: https://t.me/tradingwithrayner

Tiktok: https://www.tiktok.com/@raynerteo?

Cheers!

Waiting on your next mail.

Your advice is very useful. Thanks for this email

It’s our pleasure, Gerlyn!

Thank you for helping us Guro

We’re glad to help, Jhet!

i appreciate for your efforts you are putting to make people understand reality about share market.

Thank you for your appreciation, Hemant!

Your the best dude!!

Interesting and will wait for the next mail

Nice

Thank you Rayner, you have no idea how much you have helped me. I trade crypto for a living using your basic principles. God bless you

You’re most welcome, David!

We wish you all the best! Cheers!

I am brand new to this, still learning a lot. Good insight…waiting for you next email….

Hey Monica!

If you are a beginner in trading, you might wanna check our free course in our Academy. This will help you big time! Here is the link:

https://www.tradingwithrayner.com/academy/

Cheers!

Super Rayner… There’s a special place for guys like you. Honest, true and worthy. Profitable from knowing nothing. God bless you. Thanks.

Thank you for your kind words, Jo!

Cheers!

What is the best indicator to use on backtesting

Hi, Stanley!

Here’s how Rayner backtested his strategy!

https://www.tradingwithrayner.com/how-to-backtest-a-trading-strategy/

Hope that helps!

i wasnt expecting this email to be honest wow thanks. i wish i can learn this asap i really need to make profit not loss

Hi, Chris!

Here is a link that may help you on how to minimize your losses:

https://www.youtube.com/watch?v=1ohBdvp8CoU

Hope that helps!

Your views are awesome as always…very realistic. Waiting for next email as you have left us desperate to know what to do next

Since I have started trading from last six months and incurred huge losses till date. I tried many tactics but didn’t works. Eventually by my luck I came to your YouTube channel and found it’s content very knowledgeable and useful. Today’s mail also makes sense. Thanks a lot. Looking forward for your valuable guidance.

We’re so glad to hear that Rajendra!

Glad you find our materials useful!

Cheers!

I am waiting for the update emails.

Thank you for the support, Ahmad!

Cheers!

Started trading in July and made HUGE LOSSES already. Can’t wait for your useful guidance

Hi, Jeronimo!

Kindly check this link about Why your Losses are larger and what can you do about it!

https://www.tradingwithrayner.com/why-your-losses-are-larger-than-your-winners/

Hope that helps!

Thank you so much man,I started trading few months ago and blew my account twice,after watching your videos on YouTube,I improved.so many things I didn’t know but because of you,I know a little.thank you man.

We’re happy to hear that, Vambos!

Cheers!

I can’t wait to hear it all, thanks man

Thank you so much for useful knowledge

Thank you for all your insightful information, I’m learning so much from watching your videos on YouTube and receiving your emails..very much appreciated

Don’t mention it! It was the least we could do, Aubrey!

Thanks for the support.

Cheers!

Thank you, it was a good lecture.

It’s our pleasure, Moua!

Really nice piece sir

I’ve seen some of the things I’ve been doing wrong which greatly affected my trading in this article right here…

Thank you

I look forward to the next mail

It’s our pleasure to help, Joshua!

Cheers!

Oh thank you for my help you lovely and my good vishsh to you so anjay lang life GOOD

Thanks, Ashiq!

Thank you… Eagerly waiting

It’s our pleasure!

Thank you for this advice Rayner, i really find it helpful. I can’t wait for the next email.

So glad you find our materials really helpful, Clara!

You’re most welcome!

I’m lucky to find your channel Rayner. Your NFP strategy work like magic i made $987 today during NFP release

I’m new in forex trading, ThankGod I’m learning from the best. Waiting for the next email

Congratulations!

We’re so glad to hear that.

Cheers!

you need to go to a trading school. learn all basics stuff. then do the practical. sure you fall but mistakes made and learnt make you stable. emotional stability will be needed to prevent further falls. you do become profitable overnight.

So how can we accurately trade

Very helpful info to I as a beginner

Indeed! You might wanna check our free courses in our Academy!

It is very helpful too for a beginner. Here is the link: https://www.tradingwithrayner.com/academy/

Cheers!

I’m excited to your next email!

Eagerly waiting for next email. Learn a lot from you and started to build confidence. Thankyou boss

Good for you, Eshwar!

Let’s do it consistently! We wish you the best!

Cheers!

Yes Sir You are cent percent right that indicators, news and opinions will not make one a consistently profitable trader

But I think opinions depends on who gives the opinion I mean his knowledge, experience and intention

News have definitely effect but temporary

And about indicators I believe it definitely help in trading but it all depends on the knowledge and experience of person of the indicator he/she uses.

And I also strongly believe market i e price action discounts everything and news comes afterwords

You have given very nice example of NZD/USD chart.

So as you say Always trade with Trends and Enter and exit with Candlestick pattern with support and resistance And yes with plan of Stop loss and Target

Thank you so much Rayner for your all support to become us a consistently profitable trader

Thank you for sharing, Suresh!

We wish you good luck and good trading!

Cheers!

Thank you Sir, finish reading the book Price Action Trading Secrets and it gave me a lot of confidence and knowledge. keep up the good work, god bless.

Glad you like our PATS book, Agerico!

We wish you good luck and good trading.

Cheers!

I love that…… you’re one hundred percent correct ♥️♥️

Wow true can’t wait for the next email was really learning

Hey there, Owach!

Jarin here from TradingwithRayner Support Team.

I am glad to know you find it informative.

Cheers!

I will wait my fren.

thank you Rayner

Rayner, I am very new to the trading industry, Still working with a demo version ,as I don’t know yet what Broker to invest in. But listening and coming to you via YouTube and listening to you really encourage Me.

Hey there, Ananias!

Jarin here from TradingwithRayner Support Team.

Thank you for your support. If you are new to trading, I highly recommend you to use our Academy. This will also help you in your trading journey.

Here is the link:

https://www.tradingwithrayner.com/academy/

Cheers!

Thank u for using simple words which is easy to understand. Before reading your books on Candlestick and Trending lines, I was blank. You gave me the confidence to trade. Cheers

Hey there, Roy!

Jarin here from TradingwithRayner Support Team.

I am so happy to hear you’ve learned from Rayner’s books! Believe in yourself!

I wish you good luck and good trading.

Cheers!

Extremely knowledgeable love you

I’ve learnt something today again

I am glad to hear that, Ebenezer!

THANK YOU

SIR i LEARNED MUCH FROM YOU.

You’re welcome, Aileen!

I really enjoy your writing, I believe it will improve my trading by next year, because I have been losing money since I started trading fx market. Please write on time .

Hey there, Raphael,

Jarin here from TradingwithRayner Support Team.

You can backtest your strategy to have an additional edge in the market. Here is a link on How to backtest your trading strategy:

https://www.youtube.com/watch?v=nXKzcP1t8gU

Cheers!

Thank you

Its so helpful for me rayner

It’s our pleasure, Bikram!

Looking forward to your next email Rayner.

Amazing

Thanks, Alexandra!

Wow, thank you for those wonderful words of advice, can’t wait for your next mail.

Thank you.

It’s our pleasure!

Thanks bro, i can’t wait to read your next email.

Thank you very much. Your experience of trading is really helpful to improve our knowledge regarding the market.

Very educational!

I can’t wait for the next e-mail.

Hey there, Michael.

Jarin here from TradingwithRayner Support Team.

I am glad you find Tradingwithrayner’s blog informative.

Cheers!

Rayner, coming in contact with your YouTube teachings have really made to have hope that it is possible to be a profitable trader on forex. I am consistent improving in my trading skills especially using the price analysis you have been teaching. Thank you.

Hey there, Sylvanus!

Jarin here from TradingwithRayner Support Team.

I am glad to hear that good news. Just keep on practicing your strategy to master it.

Wishing you the best in Trading.

Cheers!

That was so me, plunging due to reliability on fundamentals. Awaits yer next email..

Thanks, Terence!

Hello sir I am a student and I have joined the course for trading 2 months ago and am currently practicing on price action. But I got more to learn from your videos than courses. Thank you so much sir..

Hey there!

Jarin here from TradingwithRayner Support Team.

You’re most welcome! Just keep on learning and practice your strategy first in a Demo account. Once you get a consistently positive result, you can try to hop on in your live account.

Wish you all the best!

Cheers!

That advice there has changed my perception

Thanks

It’s nice to hear that, Evans!

I want to learn how to start the trade from beginning to end because I’m seen this as a magic because I find it difficult to understand it

Hey there, James!

Jarin here from TradingwithRayner Support Team.

If you are new to trading, I highly recommend you check our Academy. This will help you big time in your trading career.

Here is the link: https://www.tradingwithrayner.com/academy/

Cheers!

thank you sir.

You’re welcome, Kitchie!

I’m ready for the next email. I have tried all of these methods and everything you stated is true.

Thanks, Kassa! I am glad to know you find Rayner’s blogs informative.

Cheers!

Thanks so much sir

Very much welcome, Cornelius!

Thank you Rayner

I’m still learning

Keep on learning, Lawal!

Cheers!

Can’t wait

I want to join your course

Hey there, Indrajit!

Jarin here from TradingwithRayner Support Team.

If you wanna join our course, feel free to check this out:

https://www.tradingwithrayner.com/courses/

Cheers!

What then

hello, I can not wait for your next mail.

can’t wait.

I can’t wait for the next mail