#4: Inside Bar Trading Strategy

Lesson 4

Hello hello, my friends!

In today's video, you will learn what is an inside bar!

And after which, you will learn how you can actually use it as a trading strategy that lets you capture the trend and momentum in the markets!

With...

Low risk!

What is an Inside Bar

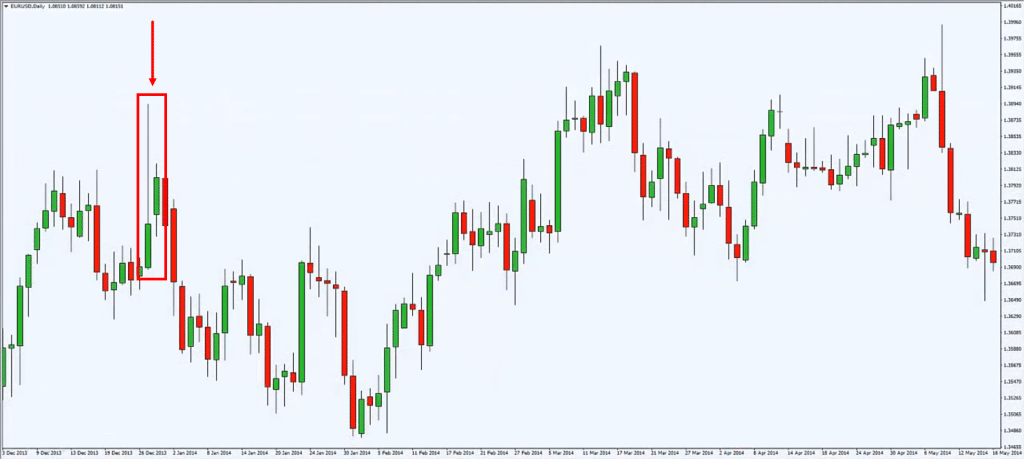

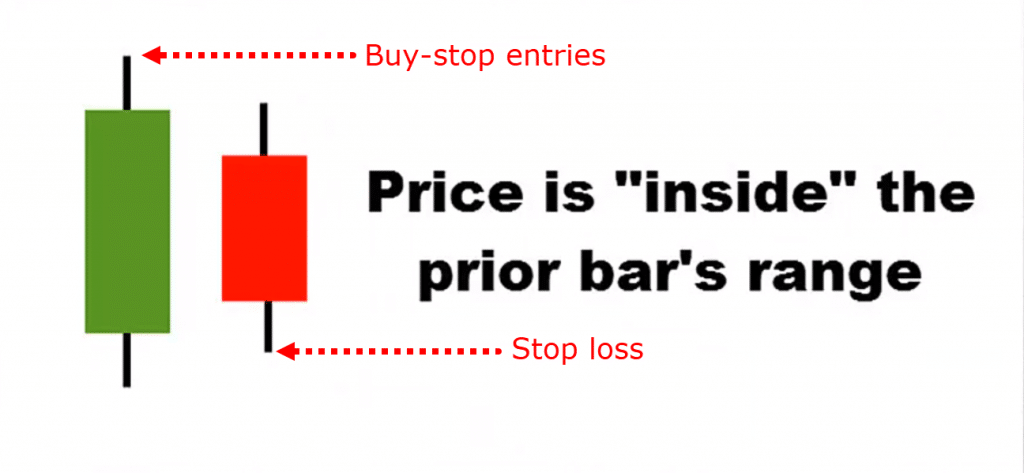

According to the textbook definition, an inside bar looks something like this:

It's when the price is inside the prior bar's range.

So, we can see that this red candle over here is an inside bar.

Why is that?

Because it is within the range of the previous bar highs and lows.

It's contained within the previous bar's range.

According to the textbook definition, this is an inside bar.

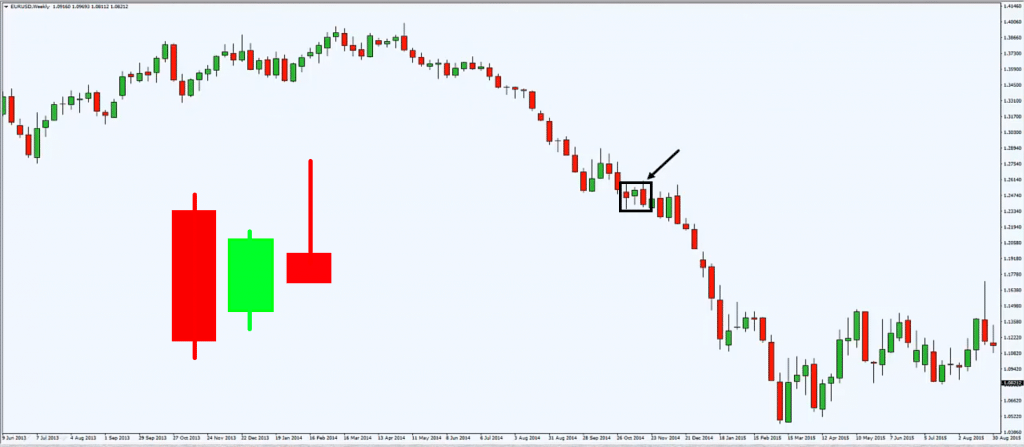

So, an example of how an inside bar would look like on your chart is something like this:

Do you see this candle over here?

This is an inside bar.

Why is that?

Because it's contained within the range of the previous candle high and low.

So, it's really in the range, it's an inside bar.

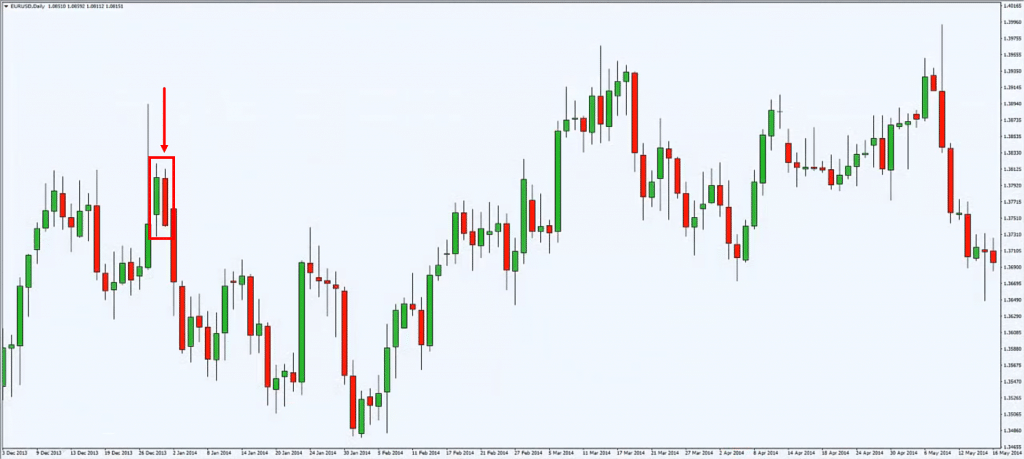

Look at this candle as well:

Is this an inside bar?

Yes, it is!

Because it's contained within the range of the previous bar highs and lows.

Now you have an idea of what an inside bar looks like, let me share with you on how you can actually go about entering a trade on an inside bar.

How to enter a trade with the Inside Bar

To be honest, there are many ways you can enter the trade.

There is no right or wrong.

Ultimately you have to find something that suits you!

So, I'm going to share with you how I enter the inside bar trade.

You don't have to follow me, you can trade a variation of it, it’s entirely up to you.

But I just want to share with you how I would look to trade it.

How I look to trade it, is that if I have a long bias, I would see the highs of the previous bar, this is where my buy-stop order will be.

And I put my stop-loss below the low of the inside bar:

So, this is what I'll do...

Place a buy stop order above the highs of the larger bar.

And my stop loss will be below the low of the inside bar.

And vice-versa for shorts.

If I want to go short, my sell stop will be below the low of the larger bar.

And my stops will be above the high of the inside bar.

I look to sell below the low, and stop loss above the high of the inside bar.

So, this is how I go about trading it!

There are many ways you can do it.

Other traders would do it differently, but ultimately, this entry itself is not going to be profitable in the long run.

It boils down to your risk management, your consistency, and everything else.

this is just how I go about entering a trade on an inside bar.

let me share with you right now on how not to trade the inside bar setup…

How not to trade the inside bar

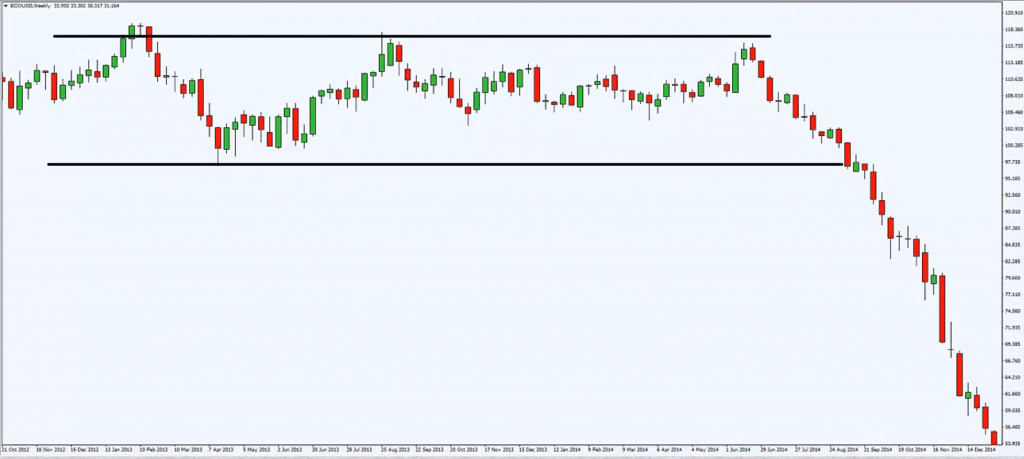

The key thing is that you don't want to be trading it when the market is in a range.

Because think about this…

I explained earlier that an inside bar represents indecision...

Am I right?

If you're going to trade an inside bar, and the market is in a range, what are you going to do?

Well, if you ask me, I would say that you're not going to get very favorable results.

Let me share with you a few setups that would occur when the inside bar is in a range:

In the example, we can see inside bars.

Then what happens is you get choppy price action.

Price gets lower, and then it trades higher.

This should not come as a surprise, because after all...

You are trading in a range where the price action is choppy.

It is undecided on where it wants to go as of now!

My take on this is not to trade the inside bar when the market is ranging.

Now you're probably wondering, “Okay Rayner, I shouldn't trade this in a range. When should I trade it?”

And this brings me to my next point.

You should trade the inside bar based on these two market conditions.

This is something that I find to be reliable and useful.

Let me share it with you:

- When the market breaks out of consolidation.

- When the price is "respecting" the 10-period moving average.

Think about this...

When a market breaks out of consolidation, what is the price action telling you?

Because the market has been consolidating for a while...

What it's telling you is that there is potential energy being stored.

And when it breaks out, there is momentum towards the downside!

This is where, if you apply the inside bar approach, it greatly increases the odds of your trade working out!

Because you have momentum at the back of your trade!

The second is when the price is respecting the 10-period moving average.

Think about this...

When will price respect the 10-period moving average?

Because this is a pretty small moving average number.

If the price is respecting the 10-period moving average, then chances are it's in a very strong trend.

If price can respect the 10-period moving average, it's telling you that the momentum is very strong.

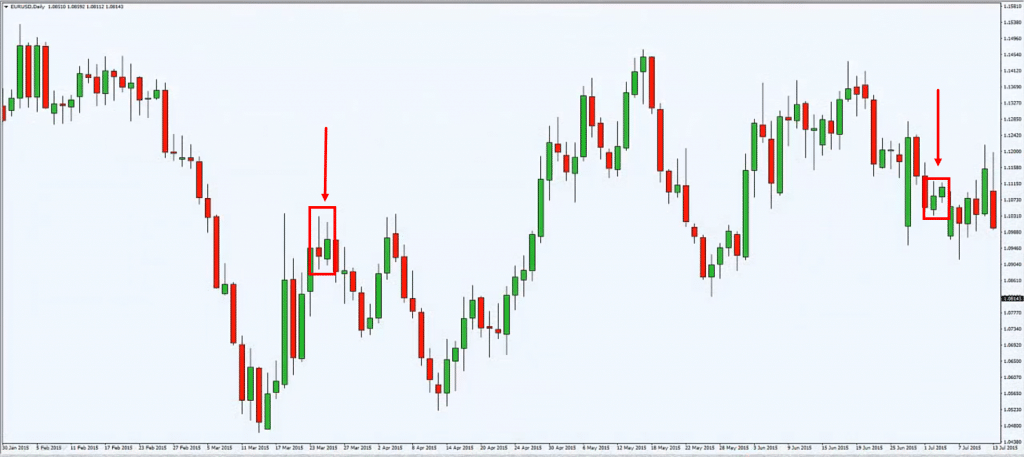

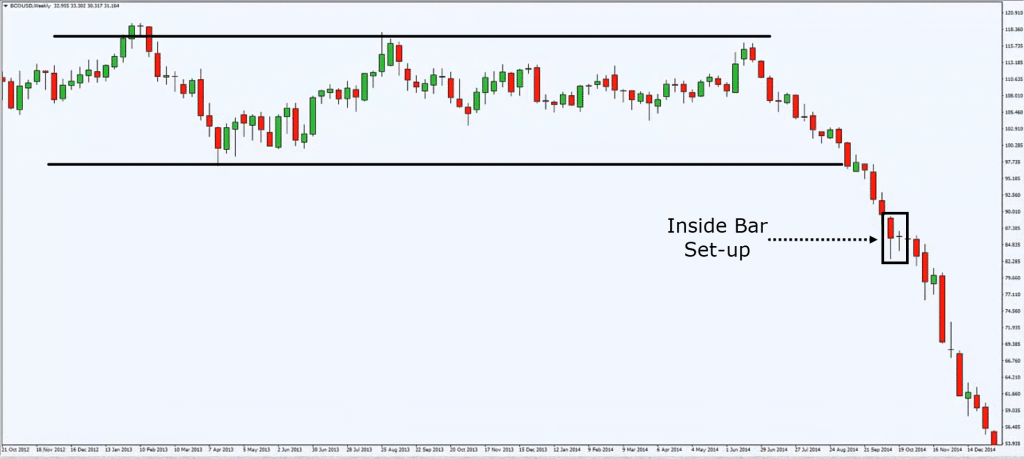

Let’s have a look at a few examples, to illustrate my point:

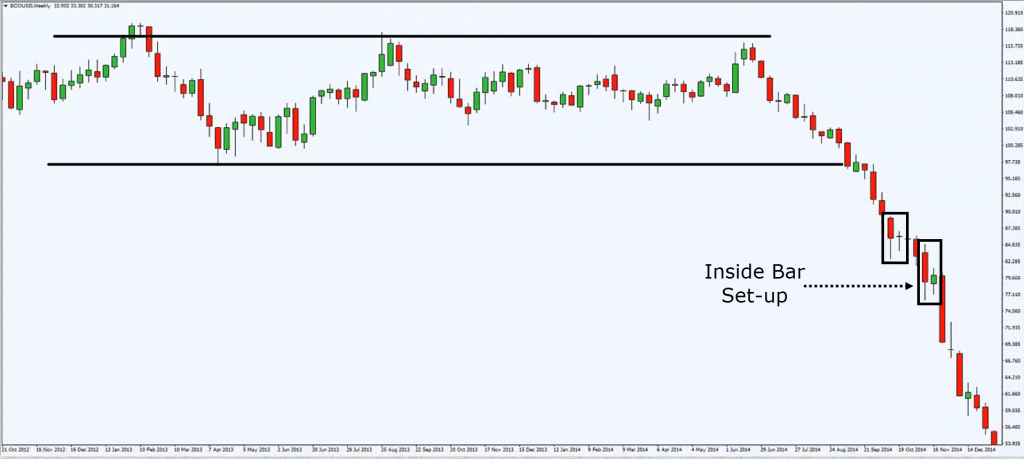

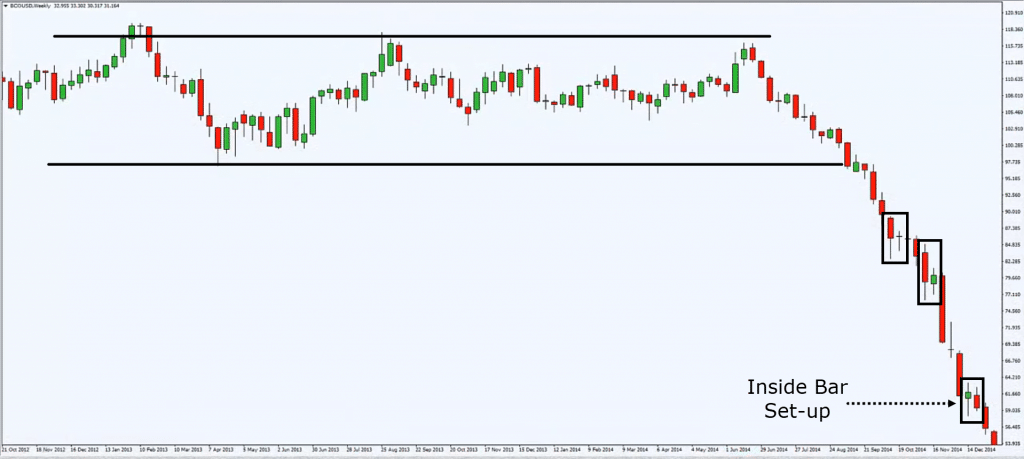

We can see over here that this is clearly in a range.

And when price breaks out of the range, this is where the market has signaled to you that it wants to trade lower.

If you trade the Inside Bar in this scenario, you know that you have the trend in the back of you.

You have the momentum with you.

This will be the first inside bar set up over here, and this is an Inside Bar:

You can look to short and have a sell stop order on the lows, and stop loss above the high of the first bar.

Another Inside Bar here:

You can look to place a sell stop on the lows, and a stop loss above the Inside Bar high.

This is another Inside Bar:

It's being contained within the previous bar highs and lows.

Place a sell stop below the low, stops above the inside bar high.

So, we've got sort of specific entries and exits, or entries and stop loss.

There are a few ways you can go about it!

And, you have to find something that suits you...

I'm just sharing with you what works for me, but it may or may not be suitable for you.

Because you may not be comfortable with the way the trade is being executed, or the way your stop loss is being placed!

You have to find something that suits you.

But ultimately the concept is still the same or the principle behind why it works.

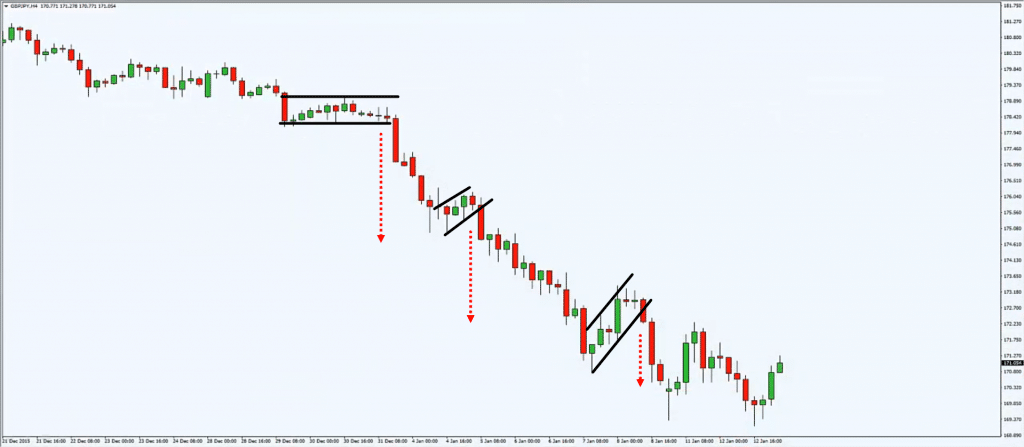

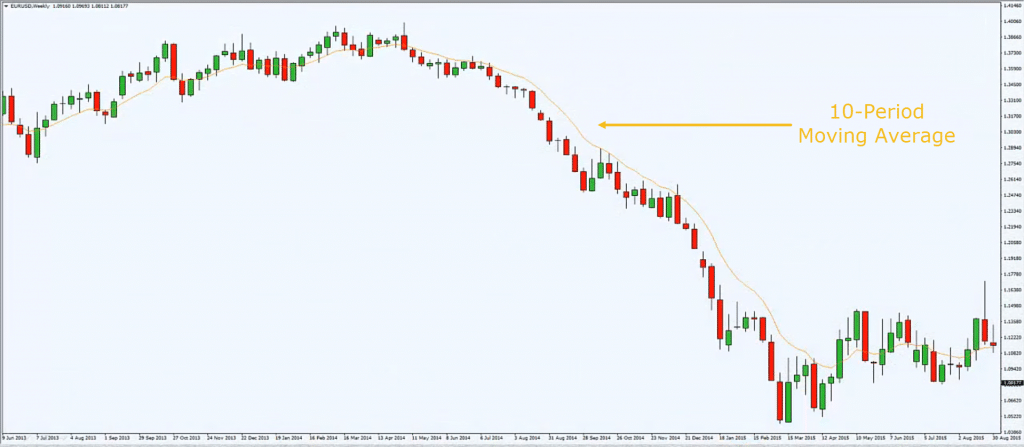

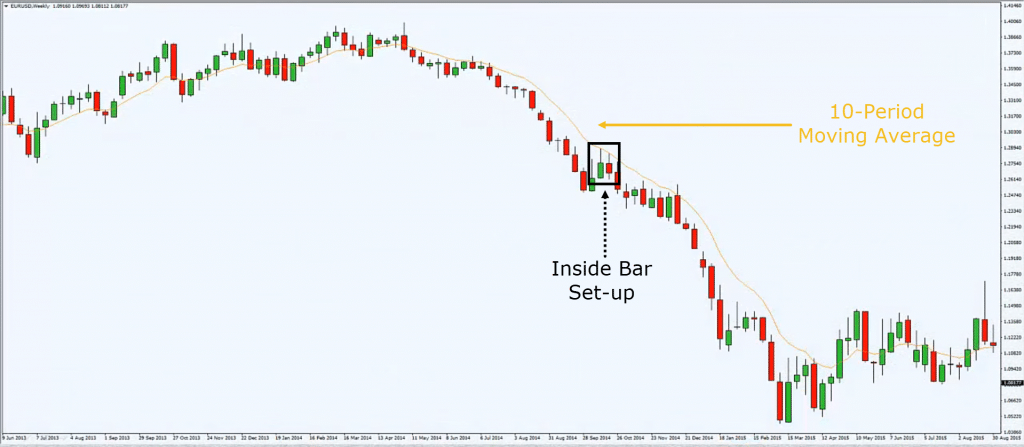

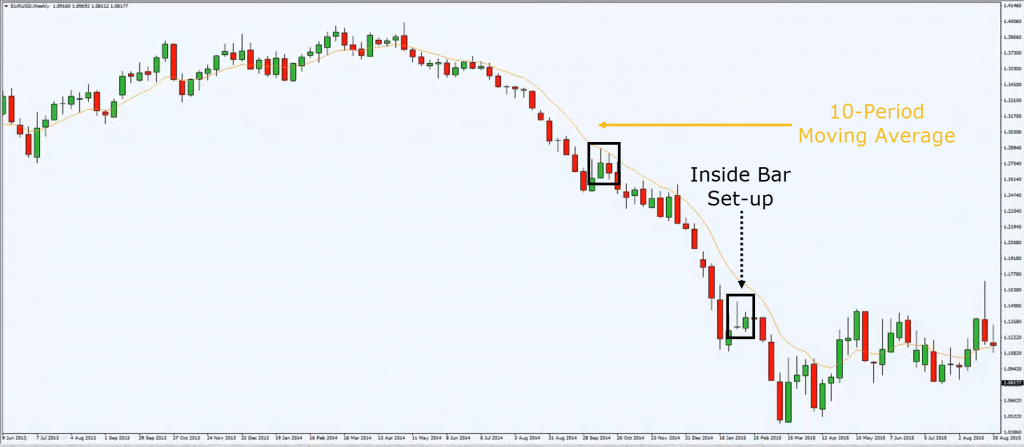

An example of how you can use it with the 10-period moving average:

This orange line over here is the 10-period moving average.

You can see that when the price is respecting it, it's telling you that there is momentum in this market.

And this is why you cannot break above the 10-period moving average.

So this is another inside bar over here:

It's contained between the highs and lows of the previous bar.

You can look to place a sell stop on it and eventually, price traded lower.

You have another Inside Bar over here:

Within the lows and highs of the previous bar.

And then you can see right there is momentum at the back of your trade.

Now…

I want you to think about this.

I would say that a slight disadvantage if you were to trade an inside bar in isolation, is that you may not get many trading setups!

Because you are looking for something really specific in the market.

So, what we're going to do is educate you, the thought process, the price action, why inside bar works!

You understand that if there is momentum behind it, a trend behind the inside bar entry signal.

It really increases the odds of your trade.

An inside bar is just basically indecision in the markets.

Moving on…

Other variations of the Inside Bar - Fakey

Another variation of Inside Bar that you can look for is what I call the "Fakey."

I did not come up with this term.

It's credited to Nial Fuller from learn to trade the markets

He came up with the term the Fakey setup.

And, other variations are the continuation patterns like the flag pattern, pennant, triangle, etc.

These are all variation of continuation patterns in a market.

All these patterns signal that there is a potential for the move to continue in your direction!

Let me share with you a few more examples:

What are Fakey setups?

For example, you have an Inside Bar.

And then you have a candle that looks something like a pin bar.

Price opens, trades higher, comes down lower and closes inside the Inside Bar.

So, this is called a Fakey setup.

Basically, you have a false breakout higher before price closes lower back into the range of the Inside Bar!

You can trade it in a similar way, a Sell Stop below the low of the larger candle, and stop loss above the high.

This is how the Fakey setup works.

You are actually taking advantage of traders who are "trapped" from the long breakout.

They are now trapped because there was a false breakout!

And if the price trades lower, chances are you will see that their stops will get triggered along the way.

So, you can see in the example that there is a Fakey setup.

You can see that this is an inside bar.

Price opened, traded higher, and came down and closed back the lows.

You can take advantage of this setup, just place a sell stop order above the high.

And you can see what happens next!

So, this basically, knows the concept of how the Fakey setup works.

On top of it, continuation patterns…

Other variations of the Inside Bar – Continuation Patterns

Sometimes you don't see a Fakey, sometimes you don't see an Inside Bar.

But, you see continuation patterns.

Classical continuation patterns like the flat pattern, the pennant, the triangle, they are all continuation patterns in a market.

And they all tell you the same thing as the Inside Bar.

They are all slight indecision in markets.

And then when it breaks out, it trades lower. That's indecision.

Because as you can see:

The bars are getting smaller.

And then it breaks out lower, another flag pattern, and then it breaks out lower.

If you ask me, the Inside Bar is like a continuation pattern when you have the trend and momentum behind you.

Sometimes you don't get an inside bar pattern that you are looking for.

Then understand that there are other variations of it.

Don't be too fixated at the inside bar.

Because if you do so, you're going to miss a lot of trading opportunities!

Right?

Don't go and memorize patterns.

Understand the price action behind it, and trade it.

Okay?

Let's do a recap of what you have learned today...

Recap

- I shared with you how I trade the Inside Bar, how I look to enter it and place my stop loss.

- Then I shared with you how not to trade an Inside Bar. The worst time to trade it is when a market is in a range.

- We talked about how to actually trade the Inside Bar. To trade an inside bar is when price breaks out of consolidation.

- I shared with you a variation of the Inside Bar, like the Fakey setup, the flag patterns, the pennant, et cetera. Instead of just memorizing the inside bar trading setup.