#3: My 3 Favorite Forex Chart Patterns

Lesson 3

Three Favorite Chart Patterns

Hey hey, what's up my friends!

In this video, you'll learn three of my favorite chart patterns and how to actually trade them step-by-step.

I'll explain to you what are these patterns and why I love to trade them and how to trade them, talking about the entries, stop loss and exits!

The chart patterns that I'm about to share with you can be applied for the Forex market, stock markets, futures markets etc.

So, don't think it only works in certain markets because that is not the case!

With that said, let's move on to the first pattern.

The first one is what I call the…

1. False Break pattern

The concept is very simple.

When the market makes a swing high.

Rallies back up higher, breaking above the highs.

And then suddenly the market does 180-degree reversal and smashes lower and close near the lows of the candle.

What happens is that, traders who actually long on the break of the highs are now trapped, because the market did a 180-degree reversal!

They're in the red right now.

They're now so-called "trapped."

This is what I call the False Break pattern.

Where the market breaks above a significant high and then does a sudden reversal, closing lower.

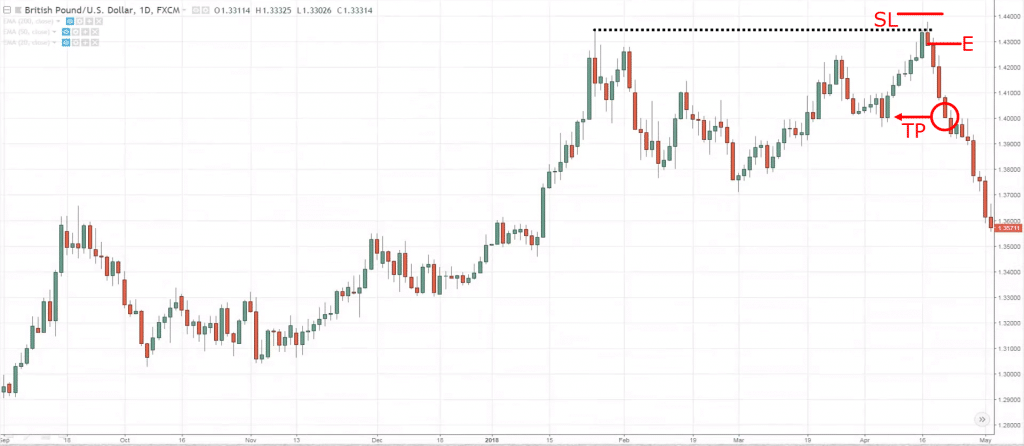

If you want to see how it looks like, this is an example of a False Break:

You can see that the market breaks above the high and then does a reversal closing near the lows of the candle.

The traders, if they are long on the breakout, they are now trapped because the market has turned against them!

You can actually go short on this pattern on the next candle open.

For your stop loss, you want to set it a distance away from the highs because you want to give your trade more room to breathe room.

Because what can happen is the market trades higher, trigger above the highs and then continue trading lower.

Okay, so give your stop loss more breathing room.

Set it a buffer above these highs until your trade on the next candle opens below.

For targets, if you note this…

The False Break pattern is always trading against the current momentum.

The current momentum is toward the upside and you're trading against it.

I wouldn't recommend being very aggressive with your targets trying to capture the entire trend to ride the entire reversal move towards the downside!

Instead, there are two options...

Consider taking profits at obvious swing highs or lows

In this case, you are short.

Consider taking profits just before this swing low over here:

That's the first option.

The second option is…

You can trail your stop loss but trail it ... closely

Don't give it too much wiggle room because the market can suddenly reverse and continue this uptrend.

So, trail your stop loss closely, and what you can do is to trail it using the previous candle high or low.

In this case, if you are short, you can trail your stop loss on this previous candle high.

If the market breaks and closes above the previous candle high, you'll exit the trade.

Using this second technique, you can see that you actually manage to ride down this swing down lower.

Because all the way, the market did not break and close above the previous day high, or previous candle high depending on the timeframe you're looking.

This is a false break setup that I want to share with you.

And it's a very simple setup and the logic is very clear.

You're just simply profiting right from traders who long the breakout and are now trapped.

The second pattern down I share with you is what I call the…

2. Volatility Contraction Pattern

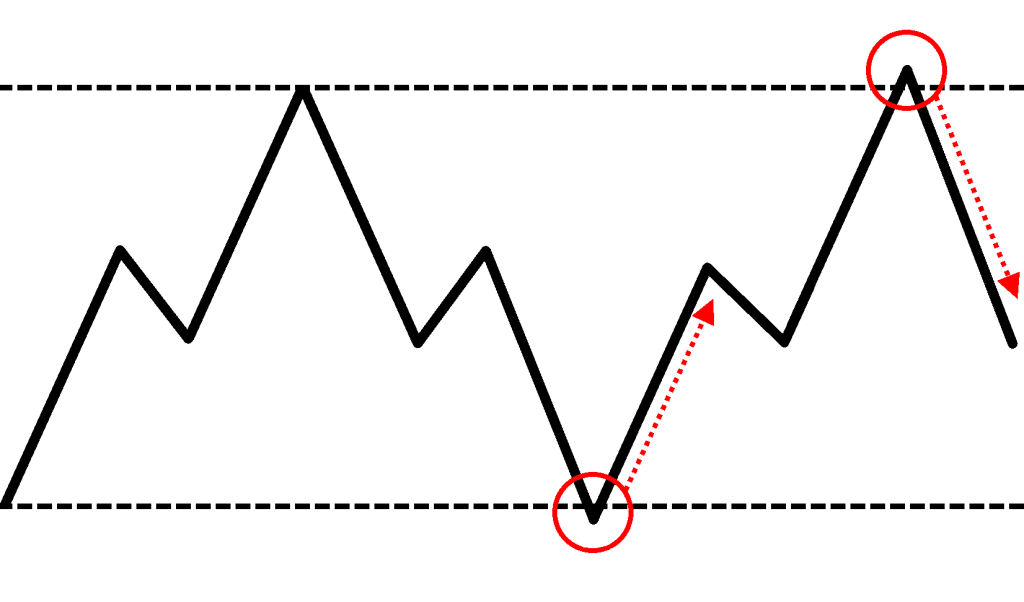

It looks something like this:

If you have traded for a while now, you know that volatility is always changing.

It moves from a period of low volatility to a period of high volatility.

For example...

The market is very volatile, then it gets quiet, then volatility can pick up again, and then it gets quiet, it can pick up again, gets quiet ...

You can see that volatility in the markets is always changing from a period of low volatility to high volatility.

Using this concept, you can actually trade this particular pattern in anticipation that the volatility could expand in your favor.

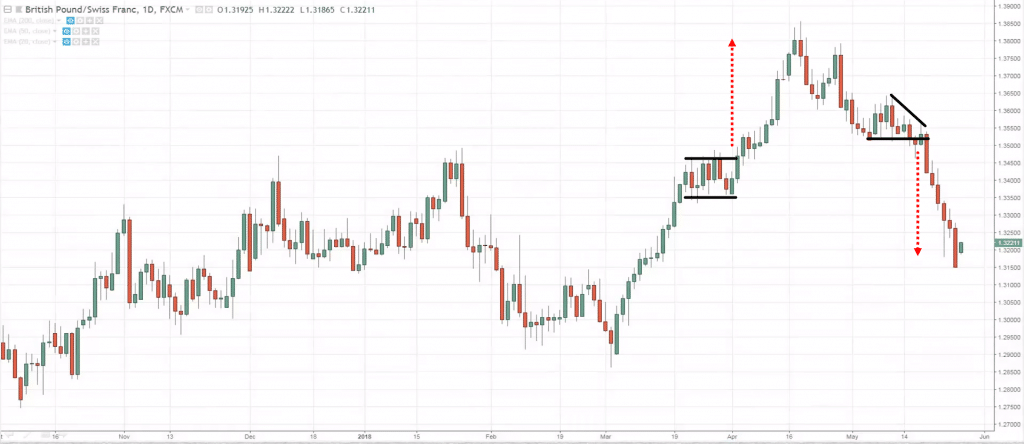

Just to share with you just a few examples:

You can see that the market volatility is pretty low, alright? nice and low.

The range of the candles is getting tighter and tighter.

And then, a volatility expansion.

Then you have a reduction in volatility and then volatility expanded lower.

So, how can you trade the Volatility Contraction pattern?

Well, it's actually quite simple.

This is more towards trading the breakout.

So, what it can do is wait for the market to break above the highs and enter your trade and you can set your stop loss referencing from the low of the range that is formed by the volatility contraction.

Sometimes it's not possible to have a target area to reference your take profits.

Because there are times where there are no support/resistance levels to set a reference to set your target profit.

What you can do is use a simple tool like a 20-period moving average and trail your stop loss and see how far this burst of momentum can go!

If the market breaks and close below the 20-period moving average then you exit the trade.

This is how you can actually enter a Volatility Contraction pattern.

Setting your stop loss just beyond the lows, and then trailing it with moving average like the 20-period moving average.

Moving on…

The last pattern that I want to share with you is what I call the…

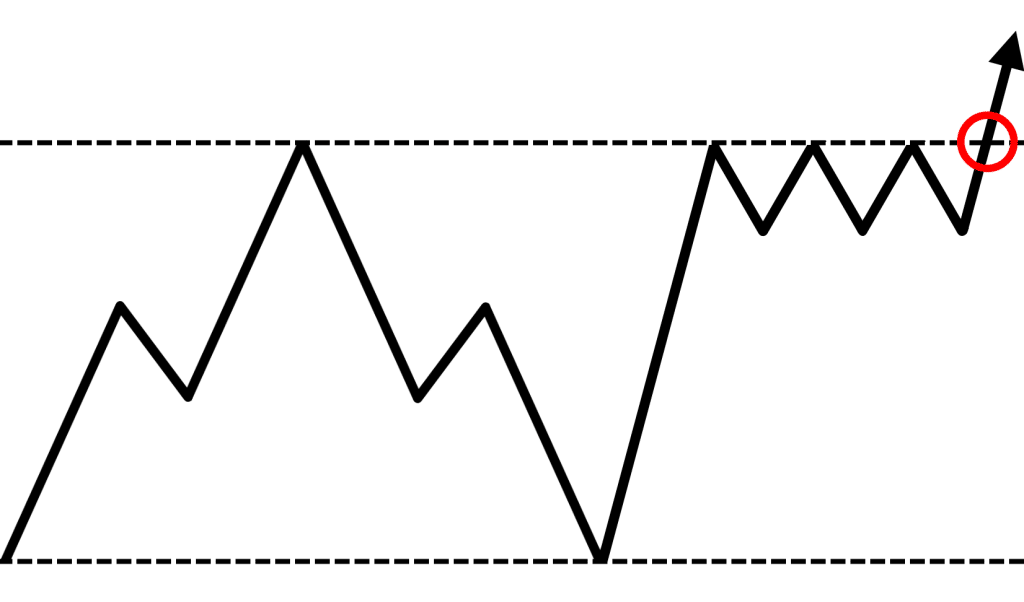

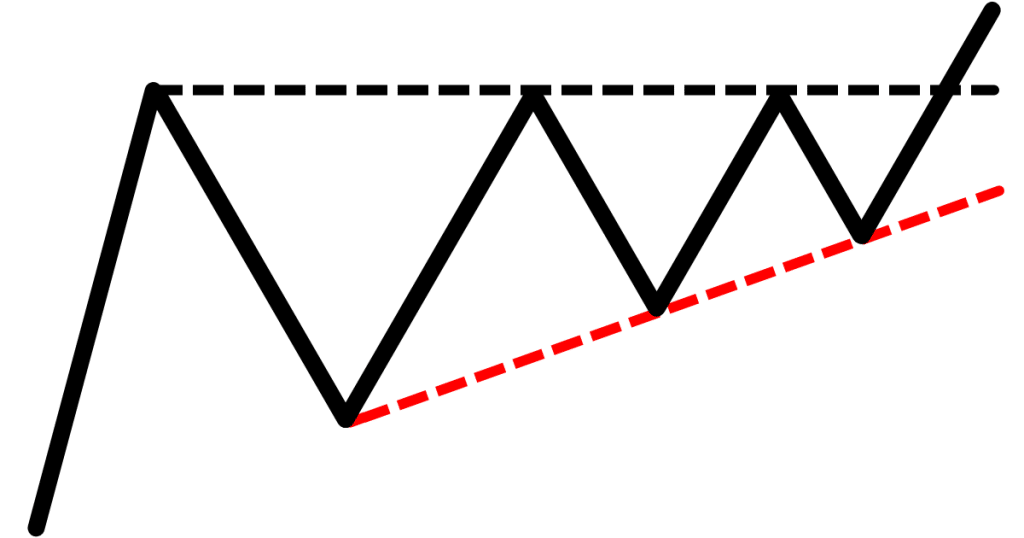

3. Ascending Triangle pattern

It looks something like this:

You can see that this pattern is a sign of strength...

Buyers are willing to buy at higher prices as the market makes another higher low!

It's telling you that buyers are willing to step in and buy at these higher prices.

And you can be sure that there are traders who will go short just because the market is at resistance.

They’ll go short and where would they put their stop loss?

Chances are above the highs.

Because that is what the textbook says, right?

Set your stop loss above resistance!

What happens is that the market will have buyers who are willing to buy at higher prices.

And you have a cluster of stop loss just above the area of resistance.

Well, if the market trades above the highs, you can expect that this cluster of stop-loss would become buy orders.

Because if you are short and the market hits your stop loss, that would transfer into a buy order and that would fuel further price advance.

This is why the Ascending Triangle is a sign of strength whenever you see it.

It looks like is something like this:

This is the chart of ETH/USD where I can see higher lows coming into this area of resistance.

Market breaks above it, and how you can trade it is that you go long on the break of the highs.

And when you are setting your stop loss, again, give it some room for a trade to breathe.

This one over here:

You might want to set your stops below the swing low, because if you set your stop loss within the range...

Technically the pattern is not invalidated yet.

This ascending triangle pattern still holds.

So, you want to set your stops where this ascending triangle pattern is so-called "destroyed."

At which level should you set your stop loss is where this pattern will get destroyed?

Because if you set your stop loss below the swing low, you know that the upward trend line is broken.

The swing low is broken as well.

For entries, just go long when the price breaks above the highs.

And as for target profits, again, similar to the Volatility Contraction pattern.

Sometimes when you look left, there is nothing on the left.

So, how can you set a target?

What you can do is use a simple tool like the moving average to trail your stop loss depending on the type of trend you want to capture...

If you want to capture a shorter-term trend you can use a 20-period moving average.

If you want to capture a medium-term trend, you can go with a 50-period moving average!

Or if you're in a longer-term trend, you can go with a 100 or 200-period moving average!

With that said, here’s a quick recap…

Recap

- The first pattern is the False Break where you profit from traders who long the break-up and got trapped when the market does a sudden reversal.

- The second pattern that I like to trade is the Volatility Contraction. It moves from a period of low volatility to high volatility.

- The last pattern is the Ascending Triangle. This is a sign of strength because there are traders who are short resistance and their stop-loss tends to cluster at the highs.