#10: How To Profit From A Recession

Lesson 10

In today’s training, I want to share how you can profit from a recession because at this time the S&P 500 has dropped by 20%.

How to profit from a recession

Many investors and traders are worried whether the COVID-19 virus will affect the whole world.

Is this just a pullback or is there more to come?

Here's the thing, we’ll never know ahead of time whether it's going to be a pullback or a recession. If we can predict that, we will all be filthy rich.

Whatever the case is, whether it's going to be a recession or not, this video here will prepare you for it.

If it's a recession, great. Then you can use the techniques and concepts that I'm about to share with you to profit from a recession.

If it's just a pullback, you can also use this information to your advantage.

The truth about recession nobody tells you

There’s a lot of gloom and doom out there: businesses closing, shops and other things are not going well.

But amid this crisis period of uncertainty, there is a money-making opportunity (if you can spot it).

How to time the market during a recession

How do you know when is a good time to buy stocks in the markets?

You buy a stock and the stock continues to drop further, should you average into your losses?

How do you know when is the right time to buy?

I’ll show you my technique of how I time the market.

How to know what stocks to buy during a recession

What if you buy the wrong stock and the stock goes to zero?

What if the stock goes bankrupt because the economy is not doing well?

How do you pick the right stock that has the greatest chance of surviving a recession?

When to sell your winners for maximum profits

How do you know when to sell your winners for maximum profits? You don’t want to just sell it at 10%, 20% profit when you managed to get your stocks in a recession.

Since you’re getting them during this fire-sale, you want to hold for maximum profits. And I want to share with you when is the right time to sell your holdings.

All these and more in today’s training.

Let's get started.

The stock market is in a long-term uptrend

The first thing that I want you to know about recession is that in the long run, stock markets are generally in a long-term uptrend.

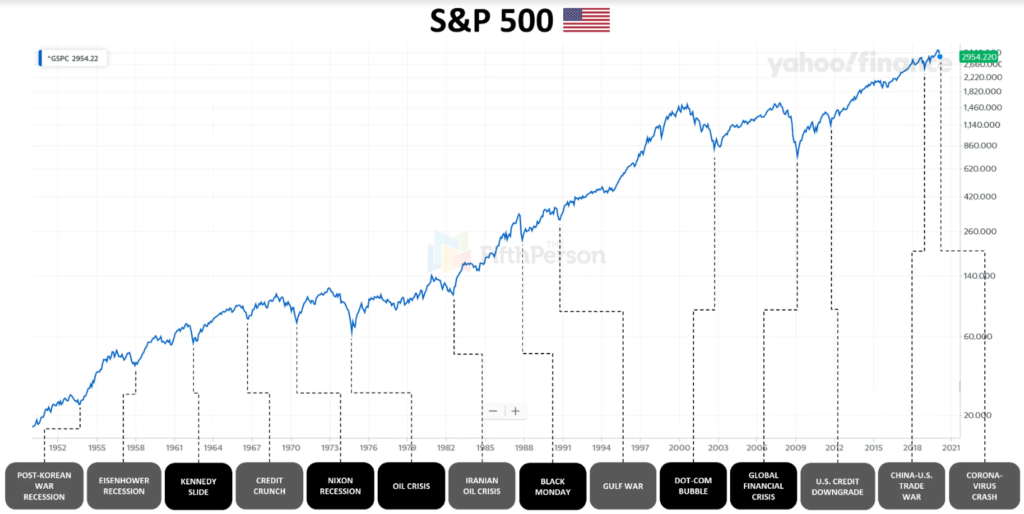

Here’s a chart of the S&P 500 over the years:

We have pullbacks that you see on the chart, we call this retracement.

But when you are experiencing this in real-time, some would say this is a recession where the market corrects 40-50% or even more.

But one thing we can agree to is that whenever the pullback or recession ends, the stock market tends to continue higher, it tends to break out of the previous high.

Bear this in mind that in the long run, the stock market is in an uptrend.

This will give you the conviction and say, “Hey, this is something that I want to be buying when prices are low.”

I’ll talk about when to buy later on. But the message that I want to bring up to you here is that the recession will be over. Eventually, the markets will go back up and continue its uptrend.

Bear markets are short-lived

If you look at the bear markets, how long have they last?

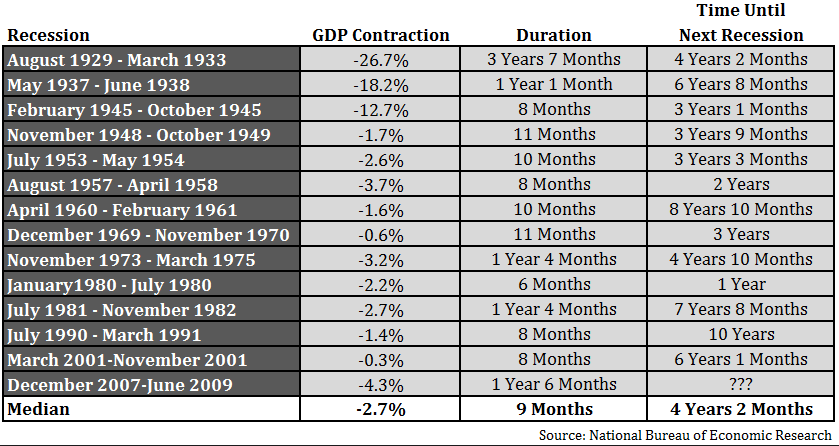

You can look at this column over here:

Generally, you can agree that most bear markets are less than two years of duration.

For example, the 2008-2009 financial crisis, lasted for 18 months. The dot-com bubble lasted for around 8 months. Generally, most of them are less than 2 years, although the great recession is slightly longer, almost 4 years.

But we can agree that bear markets are short-lived. This should make sense intuitively because if we look at the previous chart, you'll see that the retracements are much shorter compared to the trending move.

Remember bear market won’t last forever, they’re usually less than 2 years.

The returns are good

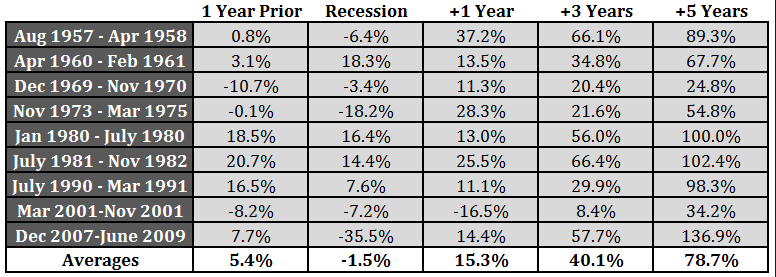

The returns after a bear market are good. Looking at the chart here:

What happens after the recession?

If you look at the numbers after 3 years or after 5 years, you get insane returns after the market had a recession.

This should tell you that when the market is in a recession when a market has corrected 30-50% this is where the money-making opportunity lies.

This is where you want to buy some stocks.

For example:

The S&P 500 let's say previously it's trading at $100 and drops down to $50. At this point, the S&P 500 has lost 50% of its value.

For it to go back up to $100 from $50, how much is the gain?

If you do the math, the gain is not 50%, the gain is 100%. When something loses half in value, you need to regain 100% just to breakeven.

The best part is this:

if the S&P 500 drops 50%, most stocks out there won't drop just 50%, they’ll drop 70%, 80% even 90% of their value. They tend to drop more than the S&P 500 because they have a larger beta.

So if a stock dropped from $100 to $20, it has dropped by 80%. It means that it needs to go up by 500% to go back to breakeven.

This means that the greater the stock price drops, the greater the opportunity lies ahead. So the returns after a bear market are pretty favourable.

How to time the markets

How do you know when is the right time to buy a stock?

Here is a technique I use…

I look at the historical chart and see how much the market has dropped previously.

For the S&P 500 previously in the dotcom bubble, it dropped about 50% from the highs. Then in the 2008-2009 financial crisis, it dropped about 55%.

Right now, it’s a question mark on how much it can potentially drop.

One thing we can agree to is that this market could drop 40%-50% or more.

This tells you that if you want to prepare for a recession, you don't want to buy just because the market has dropped 10-20% because there's a good chance it could drop further to 40-50%.

My game plan moving forward is this, you can do it in what they call trenches:

- If the index drops 40%, use half of your allocated capital to buy stocks

- If the index drops 50%, then use the remaining half to buy stocks

Because you've seen historically when the S&P 500 drops 50-55%, it's almost near the bottom, but you can’t guarantee it.

The reason why I buy when the S&P drops 40% is that sometimes it may not pullback 50%. Maybe it pulls back by 40%, then rallies and never looks back.

And you are just waiting at the 50% or 60% mark, you may not get filled and you might miss the opportunity of the decade.

So be flexible, you don't have to nail the exact bottom to make money.

What stocks to buy

There are many stocks out there in the US, there are like thousands of stocks.

Here are a few techniques I'll share with you:

Technique #1: Google “[Investor] holding”

You can just Google into the investor holdings.

What is the investor? You can follow the most famous investor of all time, Warren Buffett.

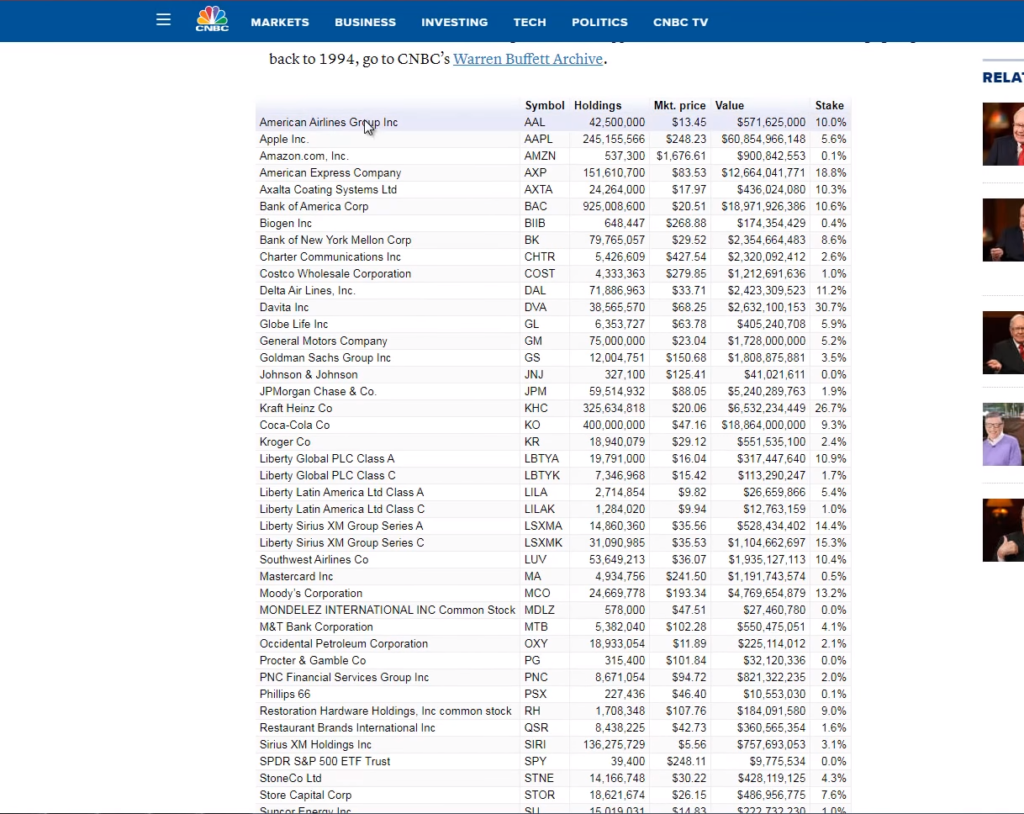

Just Google Warren Buffett holdings, and you will see something like this over here

It shows me pretty much all the holdings that Warren buffet is currently holding. It says that he holds the American Airline Group, with a 10% stake, etc.

You can see his stakes in all these different companies that he's holding it. And as you know, Warren Buffet is the greatest investor of all time.

He has probably done his research, the fundamental of the companies, the management, etc. You can take advantage of all the hard work that he has done.

This is one way to pick quality stocks that have been done for you by the world's greatest investor.

Pay attention to the stake that he has in each company. The greater the stake, the greater the conviction he has in the company.

Technique #2: Buy stocks you believe in

You can start to buy stocks that you believe in. What do I mean by believe in?

How stocks work is that in the long run, if the company makes money the stock price will reflect according to it. So, it's a barometer to how well a company is being run and how profitable it is.

I believe in Google because 5 years from now search engine will still be there. They are the biggest player in the search engine market. I believe in Google.

I believe in Amazon, I buy things from them regularly, I believe they’ll be here for the next 5 years. If you like eating McDonald's, that's another company that you might believe in.

What other stocks do you know that you have come across or maybe things that you use? Think of those stocks.

Do you believe in those stocks? Do you believe that there'll be there over the next five years? Do you think that they will survive the crisis?

If you think it's a yes, then maybe those are some stocks that you want to consider.

Technique #3: Stocks from your country’s index

I’m from Singapore, I can just look up the STI and see which are the top 30 stocks and see I believe will still be around after this crisis. It could be bank stocks.

Just look through the large-cap stocks in your countries and see whether those stocks are something that you believe in. You might want to consider buying.

How many stocks to buy

Let's say you have $100,000 of allocated capital that you want to buy in this recession.

Remember I said if the index drops 40%, you’ll use half of it to buy the first batch of stock.

With $50,000 you can start buying some stock like maybe, Amazon, Tesla, Google, Apple, whatever you want. Till the $50,000 is used up.

If the index drops to 50% mark, you can fire off the remaining $50,000 in buying the remaining stocks that you want.

Maybe the similar stocks that you have bought previously, but now at a better price or it might be some other new stocks that you know you didn't manage to buy earlier.

Again, it's all up to you.

My suggestion is to try to make things easier if you have a $100,000 of capital, and let’s say you want to buy 10 stock, then simply put $10,000 in each stock.

You can get fancy, overweight certain sectors and buy more stocks within that sector or buy more heavily towards that stock.

But that’s where the idiosyncratic risk comes, where you never know what the management of the company's doing behind the scenes. You don't have such information.

My suggestion is just kind of like spread out your bets, you won’t know what happens.

When to sell the stocks

I am not an investor at heart. I'm a trader at heart, I'm not going to devour research papers, fundamental news of the company to see when it’s a good time to buy.

Here are some guidelines on when to sell:

Sell 50% when it reaches near the previous highs

Let’s say Amazon before the crisis is trading at $1,000 and now prices drop to a low of $500 or $400.

When you buy it at that price it rallies near the previous high of about $1000, you can sell half of it and you keep the remaining half.

Sell the remaining 50% when the stock closes below the 200-week moving average

Because you have no idea how far this could go.

Maybe the economy is going to a long-term bull market. All stocks are being lifted along the way. You're now trailing your stop loss to ride the trend as long as possible.

What you can do is to sell the remaining 50% when a stock closes below the 200-week moving average.

This way you are giving a buffer to ride further to the upside.

But whatever the case is half of it is in the bank, you’ve already booked that profit. Technically it’s risk-free to you.

Again, I'm not a fundamental person, I'm not going to study a research paper nor read the quarterly earnings. I'm just going to follow a simple technical analysis and ride the stock till the weekly candles close below the 200-week moving average.

Final advice

Here are some things to take note of:

1. Don’t invest with money you can’t afford to lose

I have no idea whether this is going to be a recession, whether you know you will be buying stocks over the next few weeks or the next few months.

The most important thing here is that you don't invest with money you can afford to lose.

If you have bills to pay, you have a mortgage payment, you have to put food on the table, don't borrow money to invest. Don't borrow money to trade.

Just because I share with you how I'm going to time the market doesn't mean that the market will bottom-out at 50%.

It might go in further to 60-80%, I have no idea.

If that's the case, if you're investing on margin, you’re going to get a margin call and sell all these quality companies at a time that you don't want to be selling because you're dealing or you're investing with money you can’t afford to lose.

So don’t do that.

2. Don’t sell too quickly

I know it can be tempting because in bear markets the rally is very quick and many investors buy at a really good price and the price goes up at 20%, they sell everything. They say, “Oh, wow, look at the amount of paper profits that I have, I'm so tempted to sell.”

And when they sell at 20% guess what? The stock goes up another 200%.

Don't let that happen to you, don't sell too quickly.

The guidelines that I've shared with you earlier, are meant to allow you to hold those winning stocks for as long as possible.

If you sell too quickly, then why go through all the emotional trauma just to earn 10-20%. It doesn't make sense.

3. You don't have to nail the bottom

You don’t have to nail the exact bottom to make money. Many investors are always trying to pick the exact bottom to make money.

But as I've shared with you earlier, even if you don't enter at the absolute bottom, you can enter at 10-20% around the bottom.

When a stocks rebound, the returns are still highly favourable. Don’t focus on nailing the exact bottom that you miss the entire move. Don't focus on the trees that you miss the entire forest.

Recap

- The stock markets are in a long-term uptrend

- Bear markets are short-lived, and it offers lucrative investing opportunities

- Look to buy when the index drops 40% or more

- Buy fundamentally sound companies

- Look to sell half when the price is near the previous highs and trail the remaining with 200-week moving average

- Don’t invest with money you can’t afford to lose, don’t sell too quickly, and you don’t have to nail the bottom