#15: What is a stop loss order

Lesson 15

What is a stop loss order

A Stop Loss Order allows you to limit your losses on your trade.

Here’s how it works…

If you go long on a financial instrument:

A stop loss order is placed below entry price to close your position if the market price hits it.

If you go short on a financial instrument:

A stop loss order is placed above entry price to close your position if the market price hits it.

Simple?

Next…

Why you should use a stop loss order

When you use a Stop Loss Order, you’re essentially managing your risk.

It’s like having an insurance.

You hate to pay for it, but you’ll be glad you have it when shit hits the fan.

A Stop Loss Order:

- Limits your losses to feel like a pinch

- Prevents you from blowing up your trading account

- Allows you to live and “fight” another day

- Allows you to sleep in peace at night

Not to mention, a Stop Loss Order is FREE.

Moving on…

The downside of using a stop loss order

If your Stop Loss Order is too “tight”, you’ll keep getting stopped out of your trade.

And you’ve probably seen the price hit your Stop Loss Order…

Only for the market to go in your favour later on – a double whammy for your losing trade.

I know that stinks.

But the thing is…

A Stop Loss Order is necessary.

You’ll just need to learn how to use it the right way.

How to use a stop loss order properly

Here’s a simple guide for you to follow:

- Identify the market structure

- Set your stop loss order away from the market structure

Let me explain…

Step 1: Identify the market structure

Market structure refers to things like support and resistance, trendline, etc.

It behaves like a “barrier” that is hard for the price to get through.

This makes it difficult for the price to reach your Stop Loss Order.

Step 2: Set your stop loss order away from market structure

A Stop Loss Order is placed at where your trading setup will be invalid if price hits it.

So in order for you to not get stopped out easily, you’ve got to give it some “buffer”.

Here’s how…

- Find the current ATR value

- Place Stop Loss Order 1 ATR away from the market structure

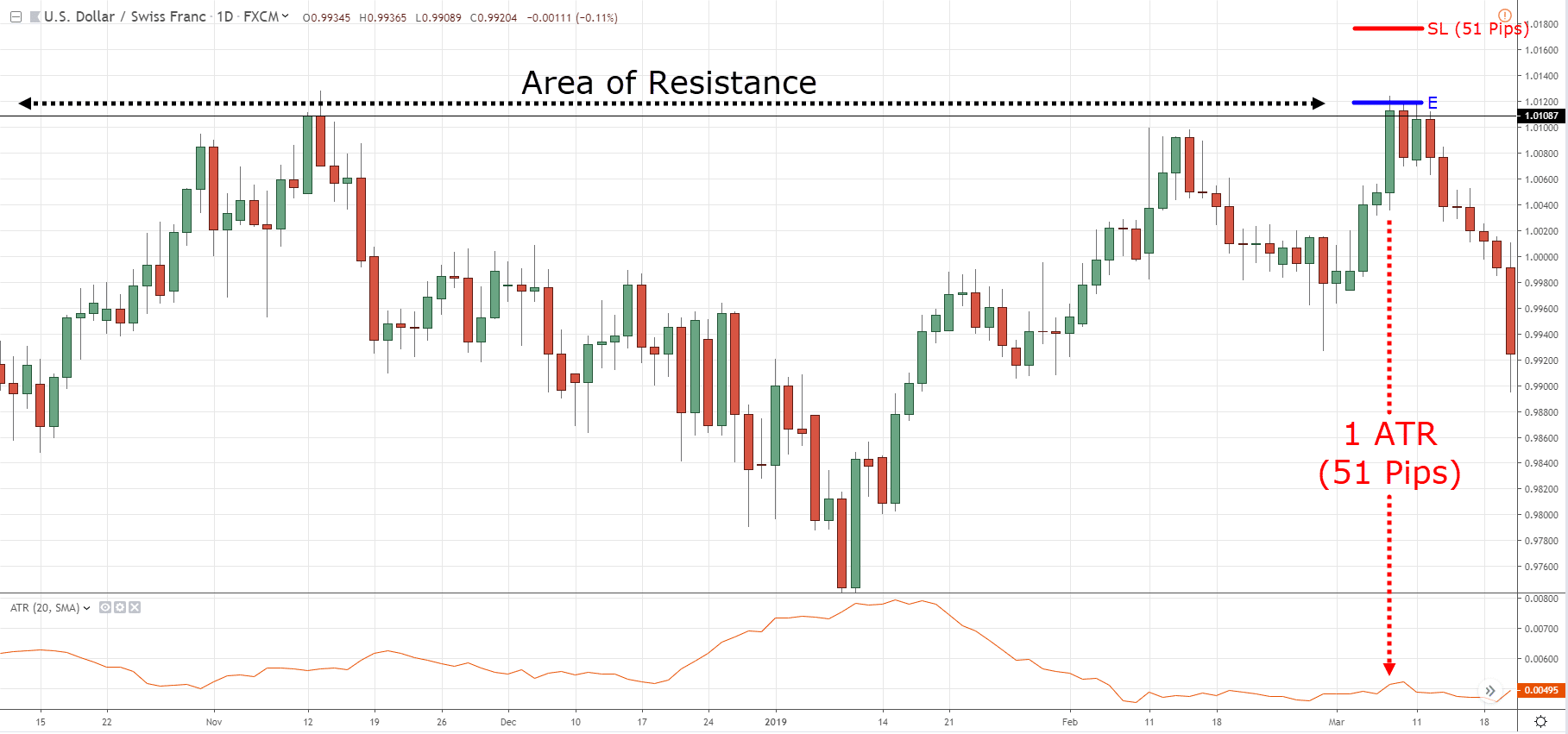

If you are looking to short, you’ll place Stop Loss Order 1 ATR value above resistance.

Entry at resistance in USD/CHF Daily:

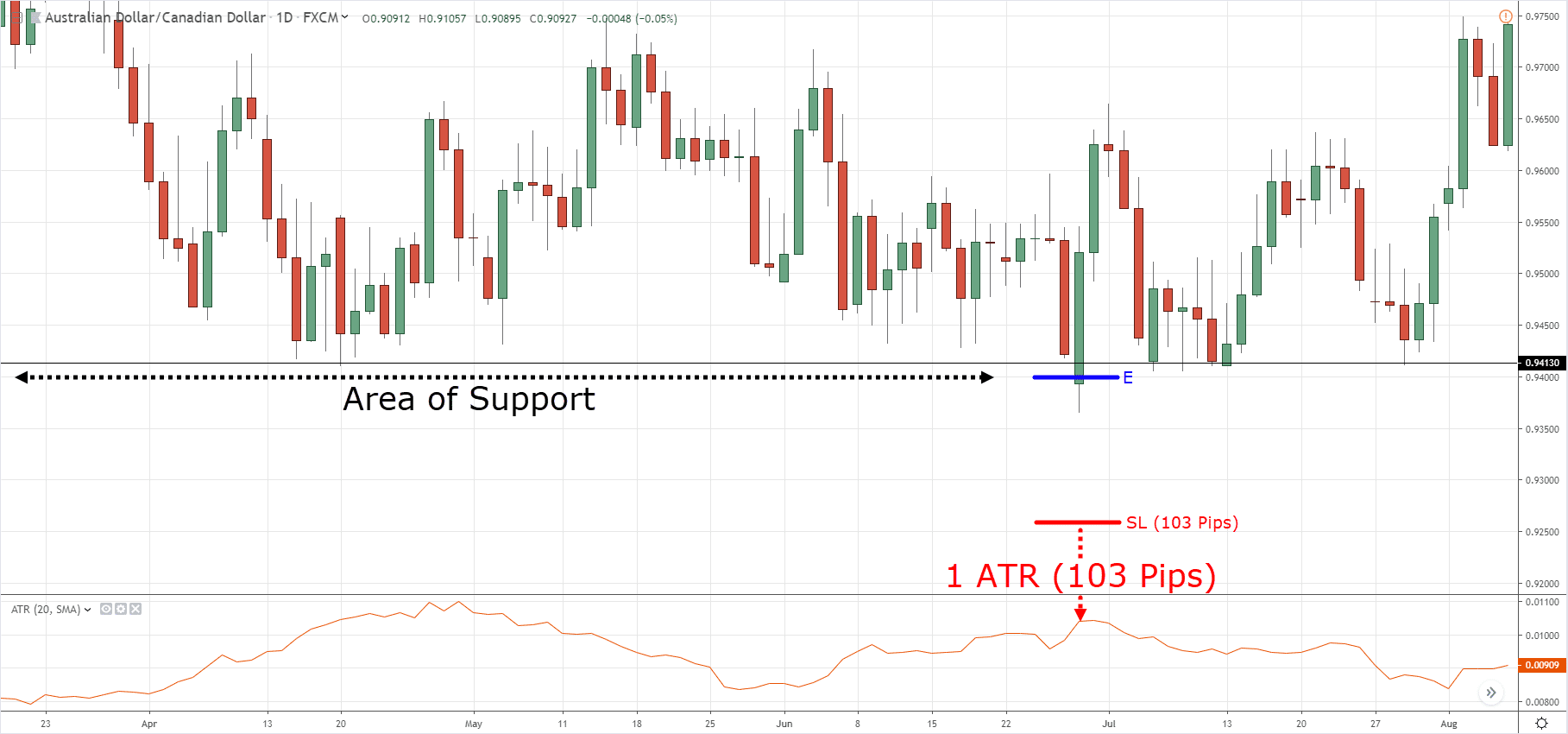

If you’re looking to long, you’ll place Stop Loss Order 1 ATR value below support.

Entry at support in AUD/CAD Daily:

Before you hit the buy order, always remember to place a Stop Loss Order first.

Now…

If you want to learn more about risk management and Stop Loss Order, then check these out:

• Forex Risk Management and Position Sizing (The Complete Guide)