#16: What is bid vs ask

Lesson 16

What is a bid vs ask

What does Bid and Ask mean for Forex traders like you?

In the Forex markets:

- Ask price – the price you buy at to go long

- Bid price – the price you sell at to go short

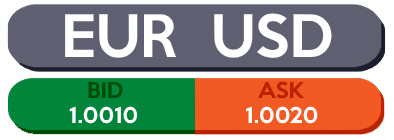

Here’s an example of what Bid and Ask price looks like in Forex:

So what does it mean?

When you want to go long, you’ve got to buy at the Ask price.

When you go short, you’ve got to sell at the Bid price.

Now the difference between Bid and Ask price is also known as the Spread.

For example…

Let’s say EUR/USD = 1.0010/20

- Ask price = 1.0010

- Bid price = 1.0020

- Spread = 10 pips

If you go long EUR/USD, you’ll buy at 1.0020

If you go short EUR/USD, you’ll sell at 1.0010

The spread of 10 pips is part of the transaction cost of the trade you take.

How the Bid-Ask Spread impacts your trading

A huge Bid-Ask spread erodes your profits and worsens your losses.

But what’s worse is not realising that it actually happens.

So let me explain…

Bid vs Ask is large

Let’s say you buy 1 lot of EUR/USD on a 10 pip stop loss and a 10-pip target profit.

If the Spread is 3 pips, then that’s 30% of your profit potential, or 30% of your stop loss.

This means that your trade only has 7 pips to move before you get stopped out.

And if you win the trade, your profit is only 7 pips.

Bid vs Ask is small

Now…

Imagine you buy 1 lot of EUR/USD with 10 pip stop loss and 10 pip target profit.

If the Spread is 1 pip, that’s only 10% of your target profit or 10% of your stop loss.

Your trade has 9 pips to move before getting stopped out.

And your profit is now worth 9 pips (instead of 7 earlier).

So with a tighter Spread:

- You don’t get stopped out as easily

- You keep the bulk of your profits

How to overcome the wide bid ask Spread

You can’t avoid paying the Spread in Forex.

But you can work around the bid ask Spread.

And here are 2 ways to do it:

- Focus on major currency pairs

- Trade on a higher timeframe

I’ll explain…

1. Focus on major currency pairs

Trade the major currency pairs (those with USD in it) like EUR/USD or GBP/USD instead.

Major currency pairs have higher trading volume and liquidity.

This means that their Spread is much lower.

Avoid trading exotic currency pairs from developing countries like Mexico, Turkey, etc.

Because they have larger Spreads to compensate for the lower volume and liquidity.

2. Trade on a higher timeframe

By trading on higher timeframes, you’ll place wider stop loss and profit target.

And the thing is…

As your stop loss is wider, the bid ask Spread matters less.

Here’s how it works:

Let’s say you buy 1 lot of EUR/USD on the 5-minute timeframe.

You place 10 pips of stop loss.

The spread of 3 pips is 30% of your stop loss.

However…

Let’s say you buy 1 lot of EUR/USD on the Daily timeframe.

And you place 100 pips of stop loss.

The spread of 3 pips is only 3% of your stop loss.

So if you trade on the higher timeframe with a wider stop loss…

The percentage of transaction costs on the trade decreases.

Now, there’s other advantages to trading the higher timeframes.

If you want to find out more…

Then check out The Truth About Trading Daily Timeframe Nobody Tells You.