#5: Head and Shoulders Chart Pattern

Lesson 5

In this video, you'll learn how to trade the head and shoulders chart pattern.

Specifically, you'll learn:

- What is it and how does it work.

- The biggest mistake that traders make when trading the head and shoulders chart pattern.

- I'm going to share with you three little-known techniques to trade the head and shoulders chart pattern consistently and profitably.

Are you ready? Then let's begin.

What is the Head and Shoulder Pattern

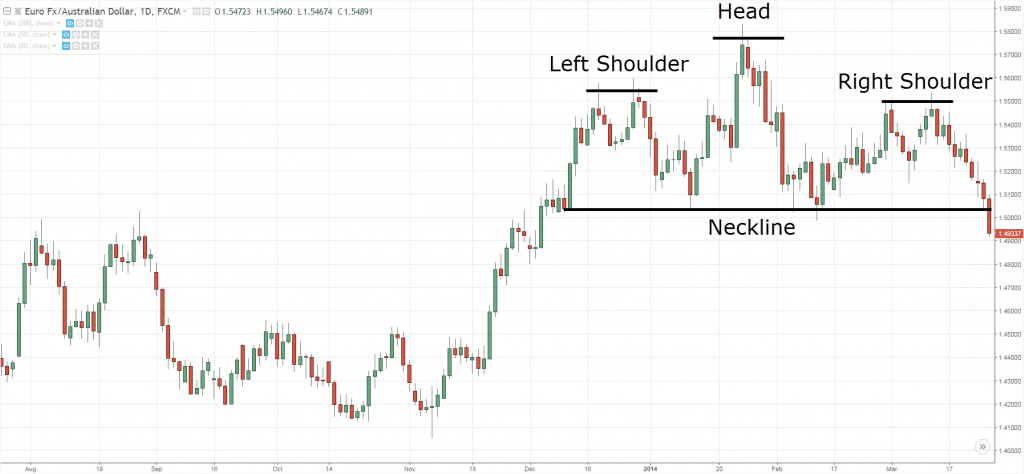

For those of you who are unaware, the Head and Shoulders Pattern is a trend reversal pattern that looks something like this:

It has a left shoulder.

Then it forms the head, which is basically a higher high.

And then the right shoulder is basically a lower high.

So, at this point, you have something that we call a neckline that basically connects the two low.

And when the market breaks below the neckline, we conclude that this prevailing trend has reversed and the market could possibly head down lower.

So, this is basically the general idea behind the head and shoulders chart pattern!

Now…

What I want to share with you is the biggest mistake that traders make when trading this pattern.

And it's none other than this…

It's that they think an uptrend will reverse just because they spot a head and shoulders pattern.

Let's say for example, you have a trend that's going up higher and higher.

And then, just because you spot a head and shoulders pattern it does not mean that the trend will reverse!

You have to take into consideration the strength and the duration of the trend.

Because if the trend has been going on for six months and your pattern took three weeks to form...

What are the odds of this three-week pattern overcoming this six to seven-month trend?

The odds are unlikely...

So, you want to be aware of trading every head and shoulders chart pattern you see.

Because chances are they are usually against the trend.

And if the trend is very strong, this pattern more often than not will fail.

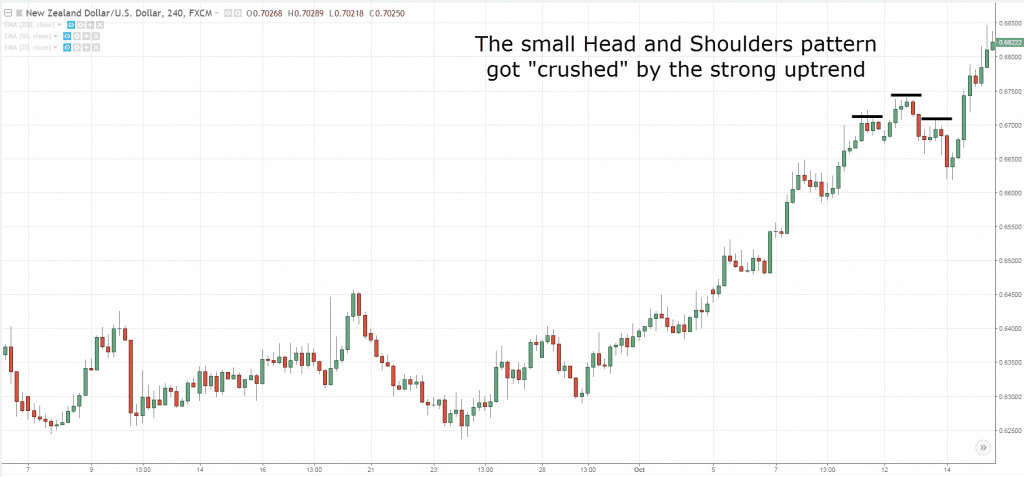

So, here's an example:

You can see over here, this is a strong trend, notice how long it has been persisting.

This is in the 4-hour time frame, but you can see the number of bars is so much more than the head and shoulders pattern that has formed!

When you see this head and shoulders pattern going against this strong trend of longer duration.

You want to avoid shorting it because chances are you will get stopped out.

So, in this case, the market did continue trading higher.

This is one thing to take note of.

The preceding trend before the head and shoulders pattern.

If you can pay attention to this one thing, you would be able to identify and filter much higher probability Head and Shoulders chart pattern setups.

Okay?

Moving on…

How not to trade the Head and Shoulders Pattern

Not that it's wrong, but I find that there are better ways to trade it.

Often when traders identify the head and shoulders pattern, they will go short on the break of the neckline.

And where would they put their stop loss?

They would say, “Oh, the pattern will be invalidated if the price re-tests back above the head over here.”

So, their stop loss is basically above the head, and their entry is at the break of the neckline.

The issue with this is that your stop loss can be really large!

If you're trading on the daily time frame, the weekly time frame, this is way too large of a stop loss.

Because it will take weeks or even months just for the market to give you a profit of one hour.

To basically move off a similar magnitude down lower, It would take weeks or even months.

So, I don't really recommend shorting over the neckline and then putting your stop loss above the head.

Because this is a pretty darn wide stop loss.

Moving on…

Three little-known techniques to enter a Head and Shoulders Pattern

These following techniques could actually give you a more favorable risk to reward and a better higher probability trade on this chart pattern.

1. The buildup

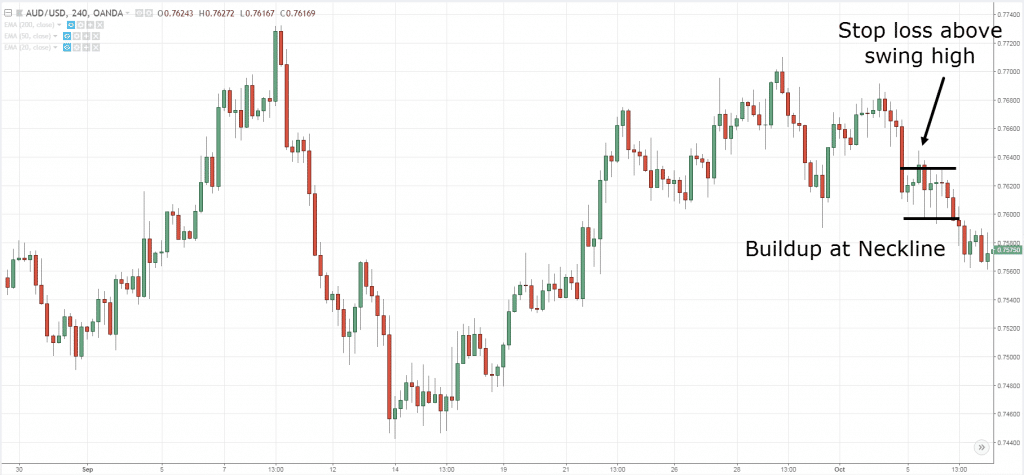

It looks something like this:

When you see a Head and Shoulders pattern, we're not going to short immediately on the break of this neckline.

We are looking for a buildup.

A buildup is basically a tight consolidation.

If you get a buildup, your risk to reward is more favorable instead of putting your stop loss at the buildup.

There are few variations to it.

Alternatively, the buildup could look something like the right shoulder itself, which is simply a buildup, and you can just reference it to set your stop loss.

And one thing about buildup is that this is when the volatility of the market is low.

And you know that from a period of low volatility will lead to high volatility.

So, if the market does break down, volatility is likely to expand!

And this means that from a risk to reward perspective, it will be favorable for you!

If the volatility picks up and moves in your favor, we can see that you can earn multiple R on your trades.

Basically, here's an example of what I just mentioned:

So, you can see that a risk to reward standpoint on how much the size of your stop loss would be smaller, which allows you to put on a larger position size!

This is what I mean by the build-up technique.

Okay?

Moving on…

2. The first pullback

Often, the Head and Shoulders pattern may break down without forming a buildup.

And if you don't go short on this low, you would have technically missed the move!

So, you might be wondering, "hey Rayner, I don't want to miss the move. What can I do to hop on the back and catch a piece of the move?"

What you can do is what I call the first pullback.

When the market breaks out, rarely does it just go in one straight line without doing any form of a pullback because the market needs to take a rest!

So, what you want to look for is what I call the first pullback where the market starts to retrace.

Ideally, you want to see small-bodied candle retracing higher.

Somewhat looking like a bearish flag.

And then continue to short this market when the market breaks below the swing low.

Again, you can reference your stop loss from the swing high of the bearish flag and you have a tighter stop loss.

Instead of setting back above the head which is so large to get.

So, this is what I mean by the first pullback and here's an example:

Notice this head and shoulders pattern...

The market broke below.

Didn't give traders much of an opportunity to catch on-board the trade.

But hey!

All is not lost, because if you look for the first pullback, where the market is retracing a little.

It gives you an opportunity to catch on-board trade when it breaks below the low.

And again, your stop loss can just reference it from the swing high.

So, this is what I mean by the first pullback, giving traders a chance to catch a piece of the move, even after it has broken out.

The last technique I want to share with you is what I call the...

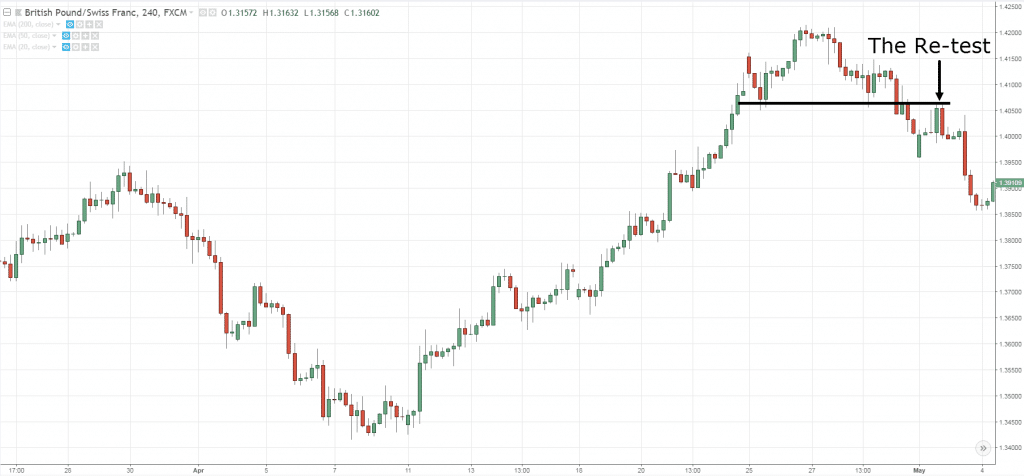

3. The Re-test

This is the head and shoulders pattern, and sometimes it does break out and it pulls back.

But it pulls back so deep and you wonder “hey, why is the pullback so deep? I'm looking to short and it keeps pulling back!”

What you want to pay attention to is to this previous support that could act as resistance.

because this is a prime level to consider placing a short trade.

Because you're now shorting back at the level where the market did break out earlier.

Basically, a re-test of the neckline.

The re-test of previous support turned resistance...

If the market comes into this area and it gets rejected, this now is a favorable trade location to look for short trading setups.

And again, your stops can just go above the swing high.

Okay?

So, here's an example:

We can see that this market, a head and shoulders pattern.

It broke down from a re-test and then it continued trading lower.

So, in this scenario, if you ask me, there are two ways you can go about it.

You can either look to trade the breakout of the swing low or the re-test of the neckline.

One thing to point out is the Head and Shoulders pattern is actually against the relatively strong trend.

So again, if you see the trend is so strong, you don't want to just straight away go short on a breakdown.

Because it could just as well continue trading higher!

The re-test is sort of like a confirmation signaling to you that this market could possibly continue trading lower.

Okay?

This is another way to look at it, on how these techniques I've shared with you kind of increase the odds of this pattern working out.

With that said, let's do a quick recap of what you have learned today...

Recap

- Head and Shoulders is a trend reversal pattern.

- Don't short this pattern just because you see that there's a head and shoulders pattern.

- You can trade the Head and Shoulders pattern with buildup, basically a tight consolidation.

- You can trade the Head and Shoulders pattern on the first pullback.

- You can trade the Head and Shoulders pattern on the re-test, basically on the re-test of the neckline, on the re-test of the previous support to resistance.