#13: What is a sell limit order

Lesson 13

What is a sell limit order

A Sell Limit Order is an order placed above the current market price.

That order will only trigger if the price were to reach that level.

The exact opposite is a Buy Limit Order.

So you might be wondering:

“How does a Sell Limit Order work?”

I’ll explain…

Forex Example:

Let’s say you want to go short on EUR/USD.

The exchange rate is now 1.1234.

But you think that you can short at a higher price later.

So, what do you do?

You’ll set a Sell Limit Order at a price higher than 1.1234.

Take for example 1.2200.

The Sell Limit Order will be triggered if EUR/USD reaches 1.1200 or higher.

Stock Example:

For instance, Facebook’s share price is $1,000.

But you think it’s not over-valued enough to short sell it now.

So you’ll set a Sell Limit Order at $1,100 and be in the trade when the share price rises a little.

Fairly simple, right?

Next…

Why you should use a sell limit order

When you use a Sell Limit Order, you make your trading easier.

Here’s why…

You’re able to short sell at a higher and precise price

And you’ll be guaranteed to go short at that price or higher.

If market gaps above the Sell Limit Order…

You’ll short sell at an even higher price!

Improvement in your trading psychology

You’ll realise trading is mostly about being patient and waiting for the right setups.

Now…

What’s a better way to stay patient than to use a Sell Limit Order, right?

By letting price come to the level you want, you’ll achieve:

- Better risk to reward

- Prevent yourself from chasing the market

- Makes you a more patient and less emotional trader

- Possibly reducing the chances of busting your account

Moving on...

The downside of using a sell limit order

Let’s face it, the Sell Limit Order isn’t foolproof.

And here’s the thing…

A Sell Limit Order is not guaranteed to be filled.

The market might not go higher to hit your Sell Limit Order.

So what happens next?

You’ll potentially miss out on trades that bring you huge bucks.

Or you might even forget about the Sell Limit Order you’ve placed.

Next…

An easy way to use sell limit order to ride the trend

You’ll want to use the Sell Limit Order to enter on pullbacks in a downtrend.

Don’t worry…

I’ve broken it down into these few steps for you:

- Identify a downtrend

- Wait for a breakdown of support

- Place the Sell Limit Order near that support turned resistance

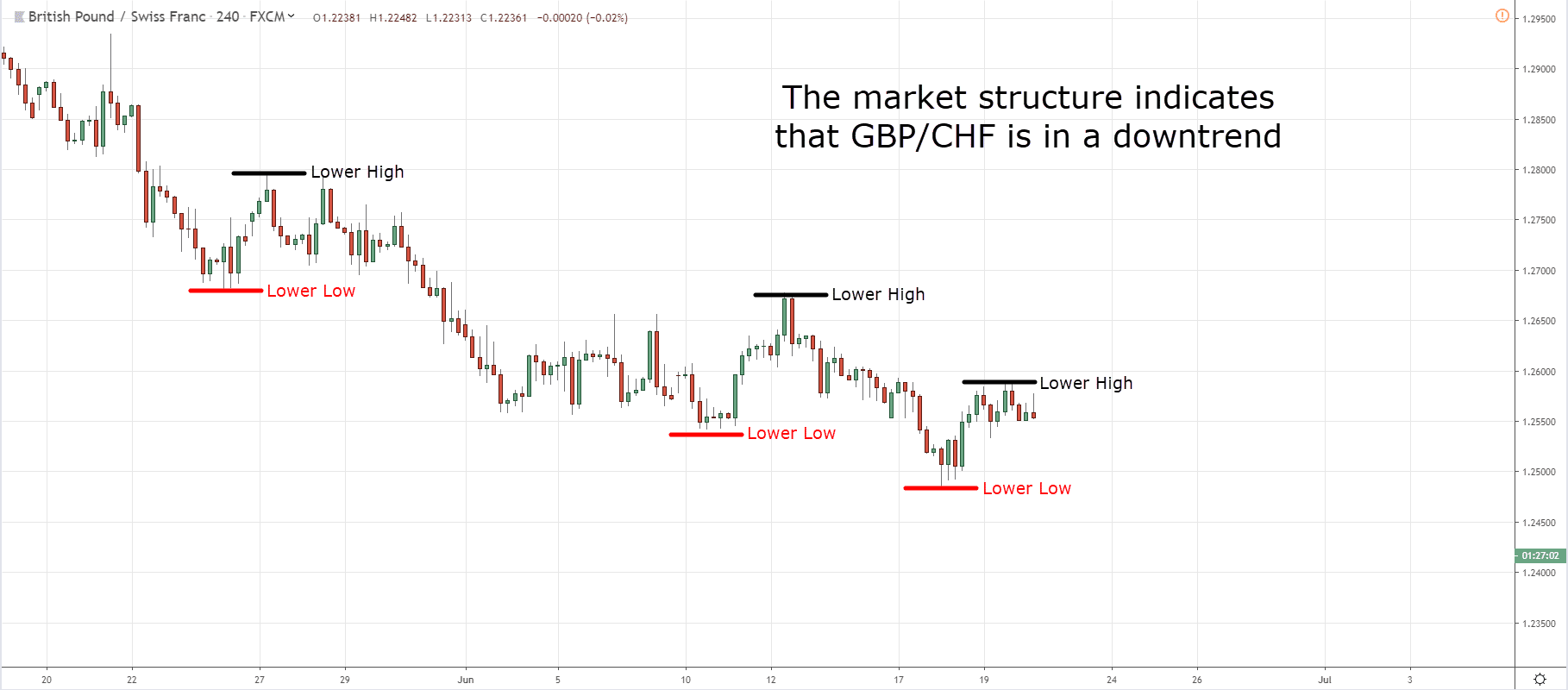

Step 1: Identify a downtrend

You’ll want to notice the price making lower highs and lower lows.

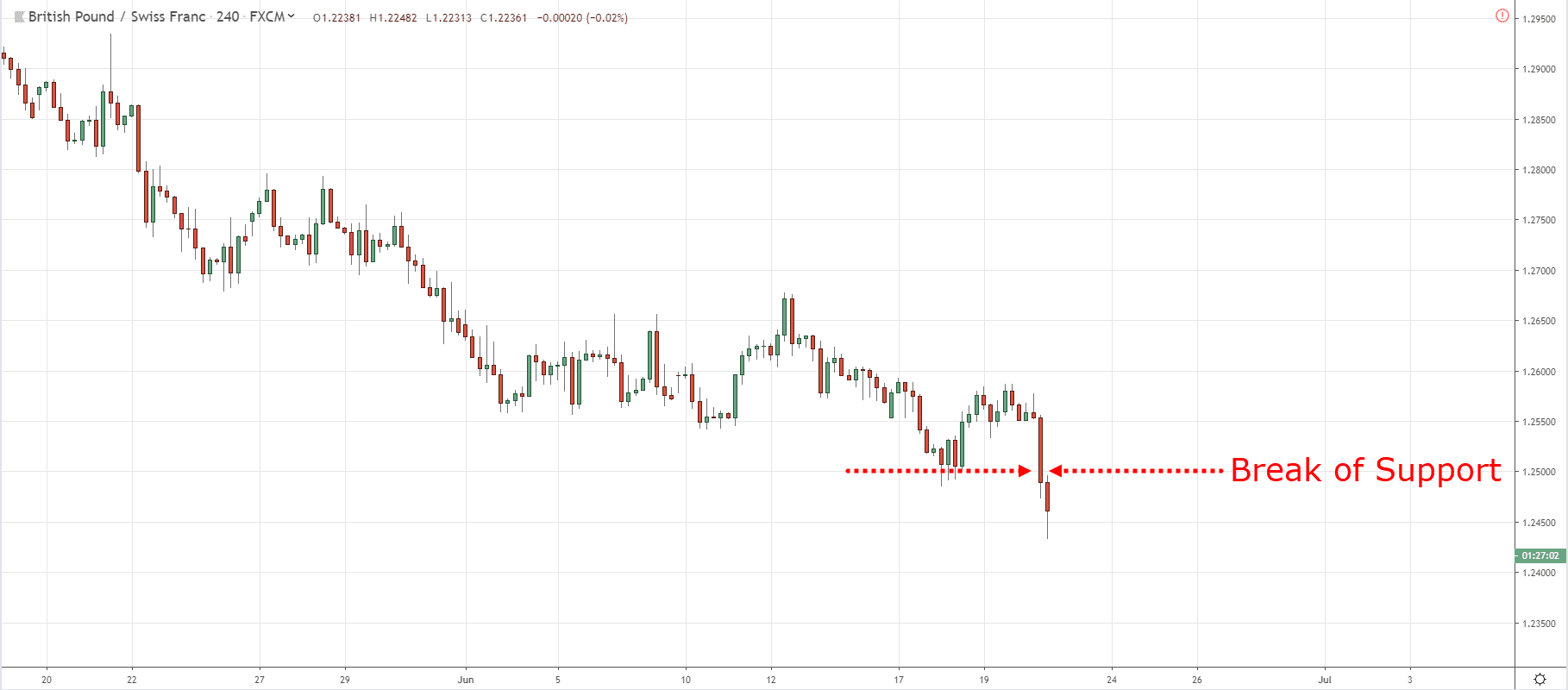

Step 2: Wait for a breakdown of support

Once price breaks down from support, you don’t want to jump straight into the trade.

You’ll end up short selling at the lowest price with lousy risk to reward.

Instead, you’ll want to:

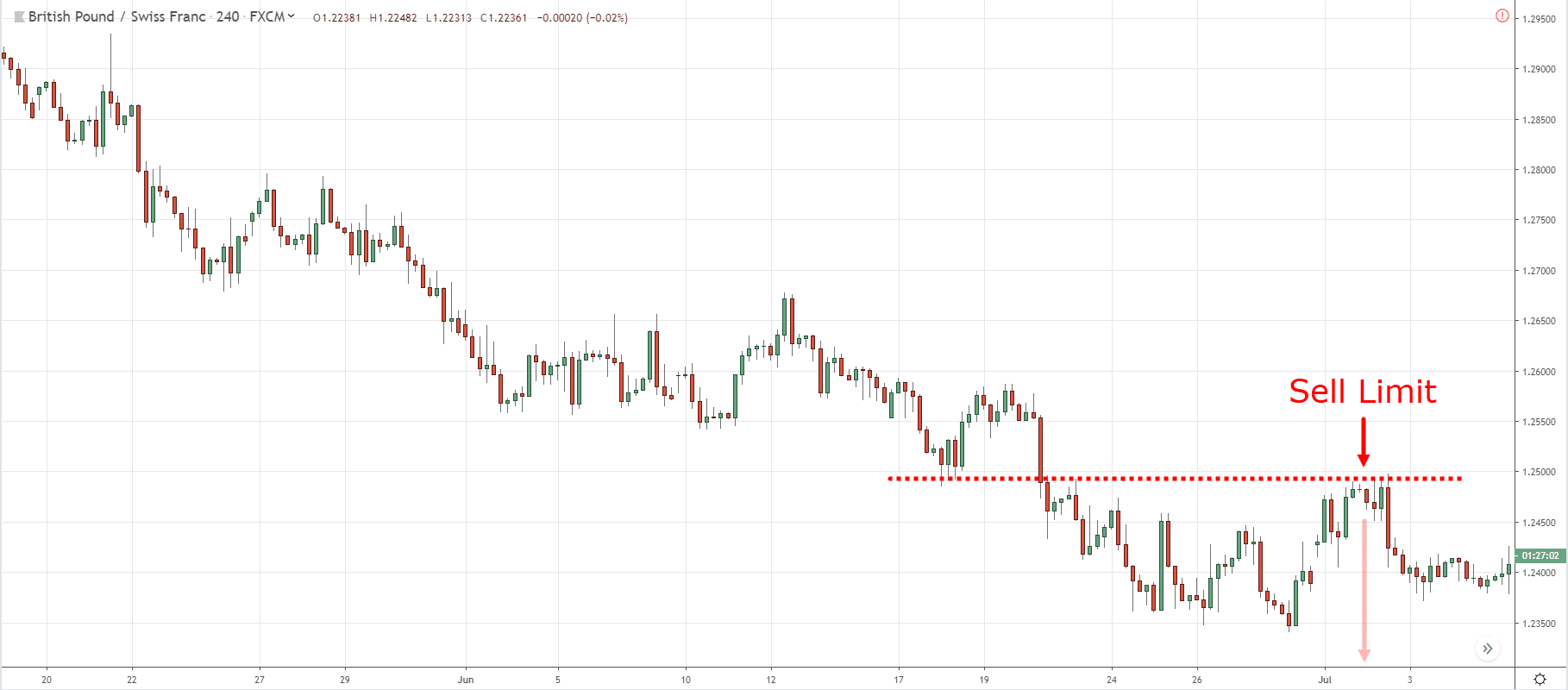

Step 3: Place the Sell Limit Order near that support turned resistance

Let the market come to you instead.

You’ll be better off with a more favourable risk to reward.

Now…

This is only one of the many ways to trade the trend.

If you want to learn more, check out The Trend Trading Strategy Guide.