#9: What Are The Different Types of Trading Style

Lesson 9

In this section, we'll be discussing the different types of trading methods as a stock trader.

There are different ways to skin a cat, you can be a:

- Day Trader

- Swing Trader

- Position Trader

In this section, we'll be discussing the different types of trading methods as a stock trader.

There are different ways to skin a cat, you can be a:

Day Trading

With Day Trading, you’re usually trading below the 1-hour timeframe.

Possibly even 5 or 15-minute timeframe.

And your goal as a day trader is to capture the intraday volatility.

Most stocks pretty much move about 1% to 3% a day.

So as a day trader, you are trying to capture this intraday move of the stock and exit your positions by the end of the day.

Pros:

The pros of a day trader are that you can actually be profitable on most months if you’re good at it.

Cons:

The downside is that Day Trading is stressful as it requires a lot of screen time, and the opportunity cost is really high because if you have a bad day…

You could possibly be better off working elsewhere full-time job elsewhere with a fixed income.

Moving on…

Swing Trading

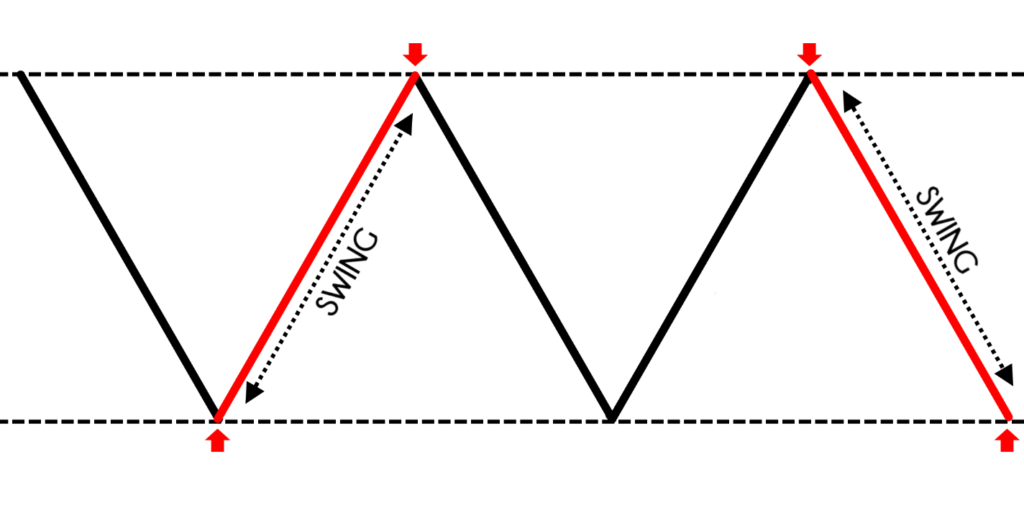

Typically, you would be operating between the 1-hour and the Daily timeframe.

As a swing trader, you buy near the lows of the range exit before the price hits resistance if the market is ranging.

Similarly, if the market is trending, you just have to capture that one wave.

Pros:

It’s less stressful and you don't need much screen time because you are trading off the higher time frames.

Cons:

But the downside to it is that swing trading has a less frequency of trades.

Which means, you won't make money on most months.

If you're good, you can make money in most quarters.

Another downside is that you will not be able to ride trends because as a swing trader, you're just capturing one move in the market.

And finally…

Position Trading

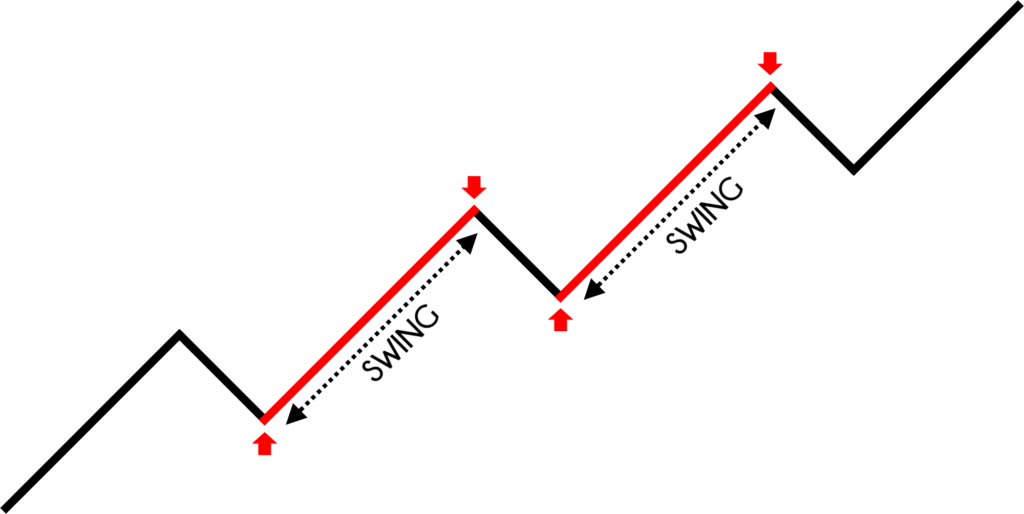

Position Trading is the longest form of trading.

This is where you are trading off the daily and the weekly timeframe.

Your goal as a position trader is to ride trends in the market or to capture the “meat” of the trend as you can see here…

Pros:

It is the least stressful and does not require much screen time because you’re trading the higher timeframes.

Cons:

You need patience.

In fact, you need a lot of patience, because it takes time to see results.

Position Trading would have the least number of trades because trading opportunities don't always come.

So with that said, let's do a quick summary…

Summary

- For Day Trading, you’re looking to capture the intraday trend, operating below the 1-hour time frame.

- For swing trading, you operate between the 1-hour and the daily timeframe. Your trades usually last a few days to a few weeks

- For Position Trading, you operate on a daily timeframe and higher. Your trades will last usually from weeks to even years.