#15: Swing Trading Secrets You’re Not Supposed To Know

Lesson 15

In today's training, it's all about swing trading.

You’ll learn swing trading secrets – profitable trading strategies and techniques to profit in bull and bear markets.

What is swing trading?

Swing trading is about capturing just one move in the market.

What is one move?

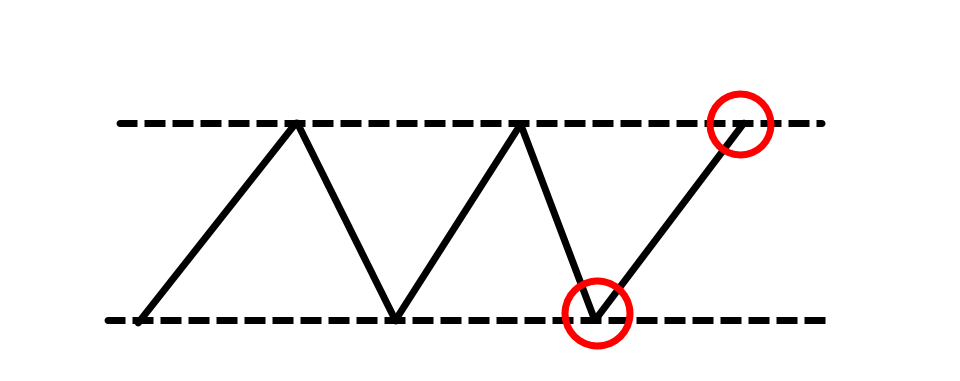

Let's say the market is in a range, and it swings up and down. As a swing trader, what you're trying to do is to buy the lows of the range and sell at the highs of the range.

In essence, you're just trying to capture this one swing.

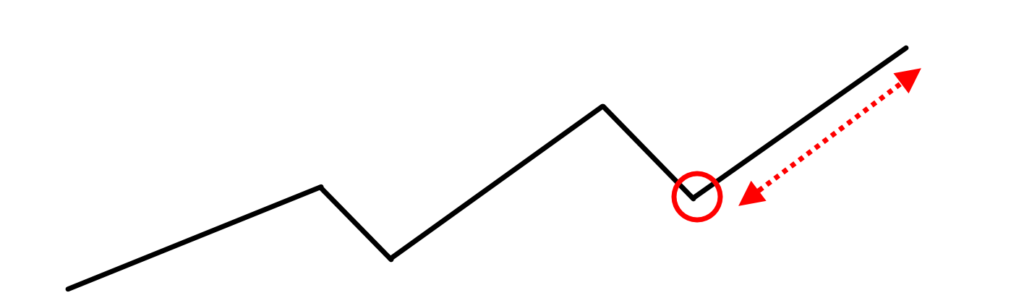

Alternatively, the market could be trending and you can also capture swings in an uptrend.

For example:

You can look to buy the dips and sell the rally. In essence, you are just capturing one swing. So hopefully this gives you a good idea to what swing trading is about.

Best market conditions for swing trading

It's best to trade the swing when the market is in a range or a weak trend. This is something that you should be familiar with.

What is a weak trend?

In an uptrend, you have a series of higher highs and higher lows. For a weak trend, it has a deeper pullback than usual.

If you use Fibonacci retracement, for example, you realize that the price usually retraces to a minimum of 61.8%. That's the bare minimum for a weak trend.

If you overlay the 200-period moving average, the price tends to retest the 200-period moving average as well.

An example:

The market is in a downtrend, and it's a weak one. Pay attention to the pullbacks, they’re pretty deep from the lows up to these highs.

So pull out a Fibonacci retracement tool and pull it from the swing high to swing low.

This retracement went up to about 61.8%. We can see that when the market is in a weak trend the retracement is pretty deep.

Alternatively, for those of you who are familiar with moving average, you can pull out your 200-period moving average.

You'll notice that price tends to retest the 200-period moving average.

There are a couple of tips to share with you on how to identify a weak trend, but this isn't the main point of today's training.

Next…

How to time your entries for a swing trade?

There are a couple of entry techniques that you can use.

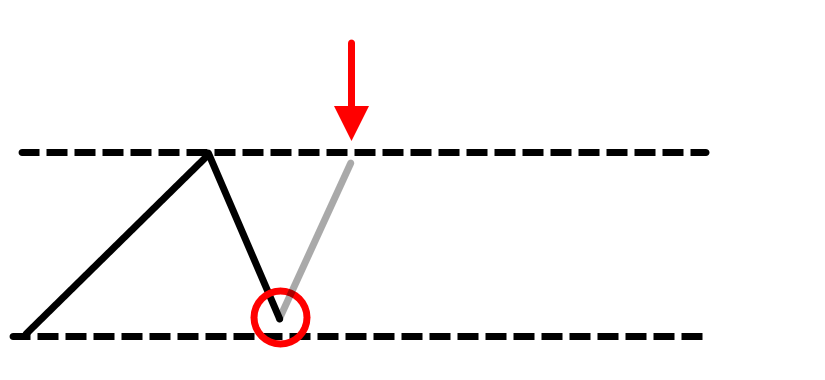

1. False break

Here’s an example…

The price came down into the lows. This is a significant level because if you look left, the market tested the level four times.

And it took out the lows of support by a few ticks and then rallies higher, breaks and closes above the previous day high.

This is what I call a false break set up. Where the market has a false breakdown.

This is an entry technique you can use in swing trading.

2. Break of structure

This is another technique you can use and it's on the lower timeframe.

An example:

This market is in an area of support. The price broke above these highs, breaks out and then retests back this breakout level.

Now it’s a previous resistance turned support. Besides the false break, you can also look for a break of structure.

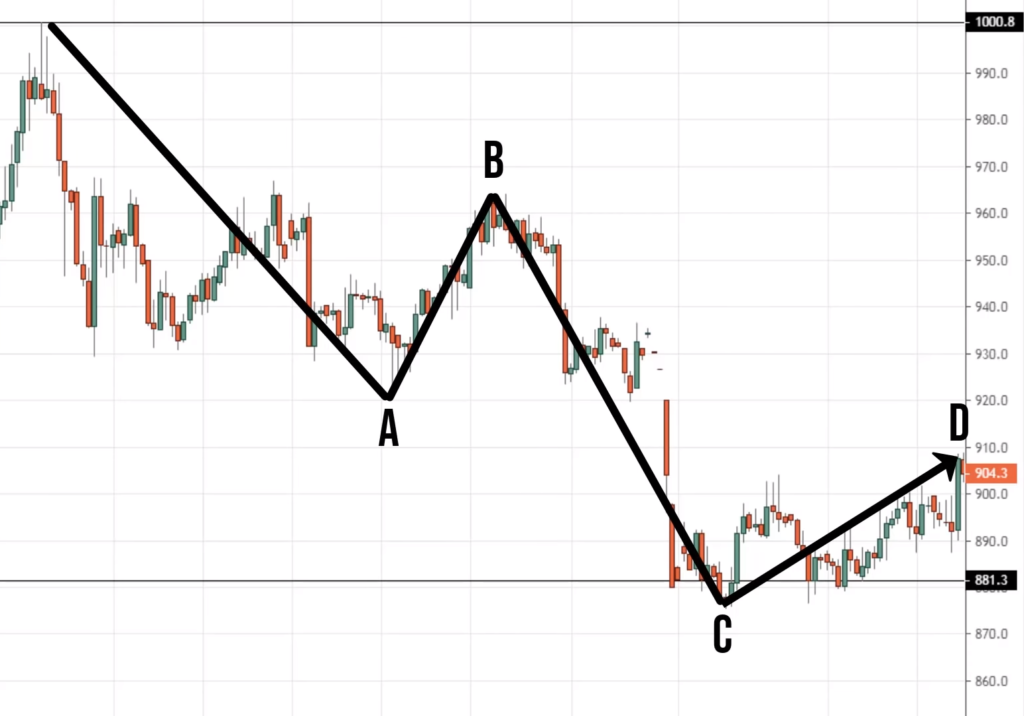

If you look at this move over here:

This looks like an ABCD pattern.

On the lower time frame, you will see that the chart will look like a downtrend with a series of lower lows and lower highs.

This entire move is the ABCD pattern that you saw earlier on the daily timeframe.

When we talk about the break of structure, what we are looking for, is for the market to invalidate this existing market structure.

This existing market structure is a series of lower highs and lower lows.

What we are looking for is a series of higher highs and higher lows, telling you that the buyers are coming in and ready to take the price up higher.

At this point, you have the resistance, and a series of higher lows and higher highs.

This tells you that now there is a break of structure.

It has invalidated this series of lower highs and lower lows, by forming a new break of the structure where you have a higher low and higher high.

This is another entry technique you can use and I call this the break of structure.

We don't trade these entry techniques in isolation, we will combine this with several factors to identify the swing trading opportunities (I will get to that point later).

For now, we'll go through it step by step, so at the end of this training, when I piece all the puzzles together, you would be like, “Ah, that is what Rayner is talking about.”

Moving on…

How do you exit your trades as a swing trader?

Recall, swing trading is all about capturing one swing in the markets. And logically, when you exit your trades, you want to exit your trades before opposing pressure comes in.

As a swing trader, you're not trying to ride trends in the markets and endure the retracements that come along the way. As a swing trader, you’re just interested in capturing that one move in the market.

So you’ll want to exit your trade before the opposing pressure steps in.

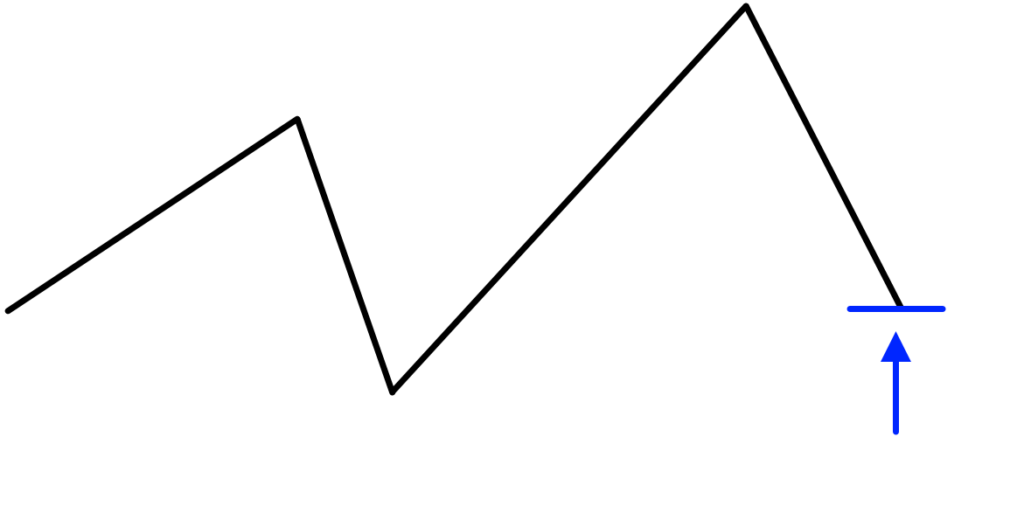

Here’s a simple example:

If you buy the lows of support, where do you want to sell? Where will opposing pressure come in?

If you look at this right, clearly the opposing pressure will likely come in at resistance, where people are looking to sell at resistance and take profits at that level.

This is where opposing pressure will step in.

Alternatively, if we talk about a weak trend, we have a deep pullback comes in and makes another deep pullback, you buy near the lows of this pullback.

Where do you want to sell? Where will opposing pressure come in? Likely they would come in near these highs over here:

You want to be selling just before the highs, at this swing high over here. This is what I mean by identifying levels where opposing pressure will come in.

This is important, so let me walk you through a few simple exercises to train your eyes to this.

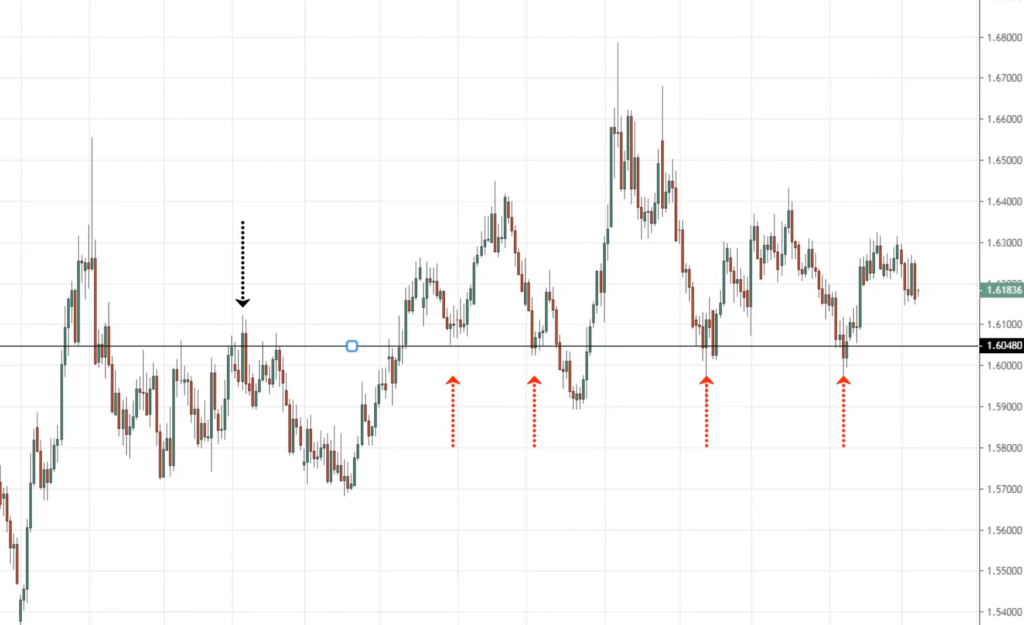

This is EUR/AUD on the daily timeframe:

Let’s imagine that you are short, you just sold off at these lows.

Where is a logical place to take profits? Where on the chart would opposing pressure tend to come in?

This is a level you want to be paying attention to possibly take profits.

You will notice that the market has respected that level several times. You can see that the 1.60 area is a significant level.

If you are short in the market, this is an area you are to exit the market and take your profit, by just capturing one swing in the market.

You are not trying to ride the entire move down.

This is how you exit your trade-in swing trading. In essence, you are just asking yourself, where would opposing pressure come in?

You want to exit your trade right before opposing pressure comes in.

How to set profit targets

One thing to share with you is that you don't want to get greedy in setting profit targets.

In setting profit targets. I know what some traders will do is they will set their targets at the absolute lows over here trying to squeeze the market out of every pip.

That's not a good idea. Why is that?

Remember, you're dealing with areas on your chart. The market may not get to this low and reverse, it may just come to this area and then reverse it.

If you have your target right at these greedy levels, you will not exit with a winner, but as a loser, as the market will reverse and hit your stop loss.

Don't be greedy with your targets or give the market some buffer to take you out of the trade. Don’t aim for the absolute highs or lows.

Best time to enter a trade

When is the best time to enter a trade?

Let’s have a look.

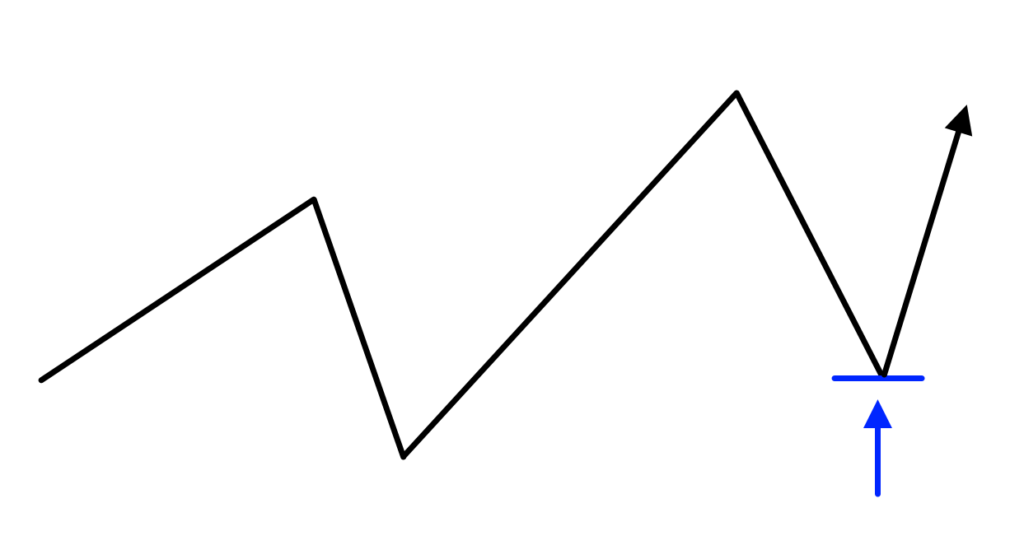

An example:

The market is in a weak trend. Let’s say you are looking to short this market in a downtrend and capture just one swing.

Your entry point, let’s say you use the market order. And where do you set your stop-loss?

Would you want to set your stop loss at these highs of resistance?

No, because you know that this is an area of resistance.

Also, if you pull out your 200MA, you would see that the market is finding resistance at 200 periods moving average.

This is an area of resistance and it doesn't make sense to be setting your stop loss at this area of resistance.

Because the market would come up higher, hit your stop loss at resistance and the collapse lower.

To set a proper stop loss, you want to set it at a level where if the price rejects it, you will invalidate your trading setup.

One technique I can share with you is to use the ATR indicator and just add on 1 ATR towards the highs of resistance.

I usually use 20-period ATR and I go with SMA.

What you want to do is find out what's the current ATR value. The current ATR values about 40 pips right now.

What you would do is to add 40 pips to the highest resistance. And set your stop loss at that price level.

Next, where do you want to exit your trade?

As you know, swing trading you want to exit your trade before the opposing pressure comes in. So you’ll shift your target to somewhere here:

IF you look at this potential trading setup, you're in essence risking $1 to make $0.34.

How do I know that?

The red area is your risk and the green area is your potential reward.

If you look at this tool, it tells you the risk-reward ratio is 0.34. This is not a trade I want to be taking, I don't want to be risking $1 to make potential $0.34 on the trade.

What should we do?

This is where patience is important. You want to let the market come to you. Let's say instead of chasing the markets lower, we trade it from a favourable trade location.

We will be camping and waiting in this area of resistance. By being patient, we have dramatically turned the table.

Now we have a potential risk to reward of 2.22. This means that you risking $1 to potentially make $2.22. See the difference?

By trading from an area of value, you’re putting yourself in a more favourable risk to reward trade. This is powerful stuff. It doesn't matter whether you're a swing trader or a day trader.

This concept can be applied at the same rate, basically measuring your potential risk on the trade to your potential reward.

And the best time to be timing your entries is when you are near the area of value because that's where your stops can go beyond that area slightly.

This is powerful stuff, don't neglect this.

Bonus tip: How to manage your trades

There are a couple of ways you can manage your trades. In this case, let's say you have your entry, stops, and target.

There are a couple of methods.

1. Set a fixed profit target

You set your entry, your stops and target, you let the market do what it needs to do.

But the downside of having a set a fixed target approach is that sometimes the market could reverse before hitting the target.

And if you have a set a fixed target approach, it's all or nothing; it’s either it hits your target or hits your stop loss.

Sometimes if you are more active, you have more time to watch the markets, you don't want to see your open profits get eroded just like that

One way you can go about it is that you can use an active trade management approach.

2. Active trade management – trailing stop loss

Yes, you have your entry stops in target, but at the same time, you are in a way protecting your open profits if the market moves in your favour.

For example:

Let’s say you are looking for a target at these lows. You can see that the market is showing signs of reversal.

But how much room should you give the trade to breathe? Because what if the price reverses up higher and then break out, then you get stopped out?

Is there a protective mechanism that you can use for your swing trading to protect your open profits?

One useful technique is to trail your stop loss using a higher timeframe.

In this case, assuming you went short on a daily timeframe, you can go up to the weekly timeframe, and exit your trade only if the price breaks and close above the previous week high.

You can see that the green candle has broken the previous week high, so this is where you can manually exit the trade.

At this point, you have protected your downside as the market hits your trailing stop loss. The reason why you want to go up one timeframe higher is to give it more breathing room.

You can do it on the same timeframe as your entry. But if you do that, you’ll often get out of the trade prematurely before the price even hits your target.

What I like to do is to trail it one timeframe higher and to see if the market hit the higher timeframe trailing stop loss first or the profit target I’ve set.

Recap

- Range and weak trend markets are ideal for swing trading

- Entry techniques: false break and break of structure

- You want to exit your trade before opposing pressure steps in

- Your risk to reward is improved when you enter near the area of value