#14: What is a sell stop order

Lesson 14

What is a sell stop order

A Sell Stop Order is an order placed below the current market price.

The order gets triggered if the price were to reach that level.

(The exact opposite is a Buy Stop Order.)

Now…

I’ll explain how a Sell Stop Order works.

Forex Example:

Let’s say you want to short EUR/USD

And EUR/USD is now 1.12345

Assuming you want to enter short only when the price makes new lows.

You’ll place a Sell Stop Order at a price lower than 1.12345.

For example, at 1.12200.

The Sell Stop Order will be triggered if EUR/USD hits 1.12200 or lower.

Stock Example:

Let’s say you want to short Amazon shares.

But you’re waiting for fundamental catalysts to confirm the selling pressure.

And you’ll want that to be reflected on the share price as well.

If Amazon share price is $1,900, you’ll short only if it goes lower.

What you can do is to place a Sell Stop Order at $1,800.

So you’ll be in the trade when its share price falls to $1,800 or lower.

Next…

Why you should use a sell stop order

A Sell Stop Order is a tool to make your trading simpler.

Let me explain.

You’re trading using a breakdown strategy

You’re expecting the price to go much lower if it breaks the support level.

But here’s the thing:

A breakdown of support could happen within seconds.

And you could miss a shorting opportunity.

So by placing a Sell Stop Order ahead of a breakdown, you’ll always be in the trade.

Improves your trading psychology

By using a Sell Stop Order…

- You’re less likely to miss a trade.

- You don’t have to chase the price when it gets overstretched.

- You’ll be able to plan ahead and short at a better risk to reward.

- You don’t have to watch the chart the entire day waiting for that breakdown to happen.

- You’ll become less emotional in trading – saving your account from going bust.

Next…

The downside of using a sell stop order

As convenient as a Sell Stop Order is, it doesn’t guarantee you a profitable trade.

Because your Sell Stop Order might get triggered on a false breakdown.

What happens next?

The price hits your Sell Stop Order.

But instead of continuing lower…

The price reverses and rallies till you get stopped out.

And now you wonder:

“Why am I even shorting at the breakdown?”

Don’t worry...

Let me share with you how to properly use the Sell Stop Order for your breakdown strategy.

How to use the sell stop order to ride the breakdown

I’ve broken the process down to 3 simple steps:

- Identify a support level

- Wait for a build up to form at support level

- Place Sell Stop Order slightly below the support level

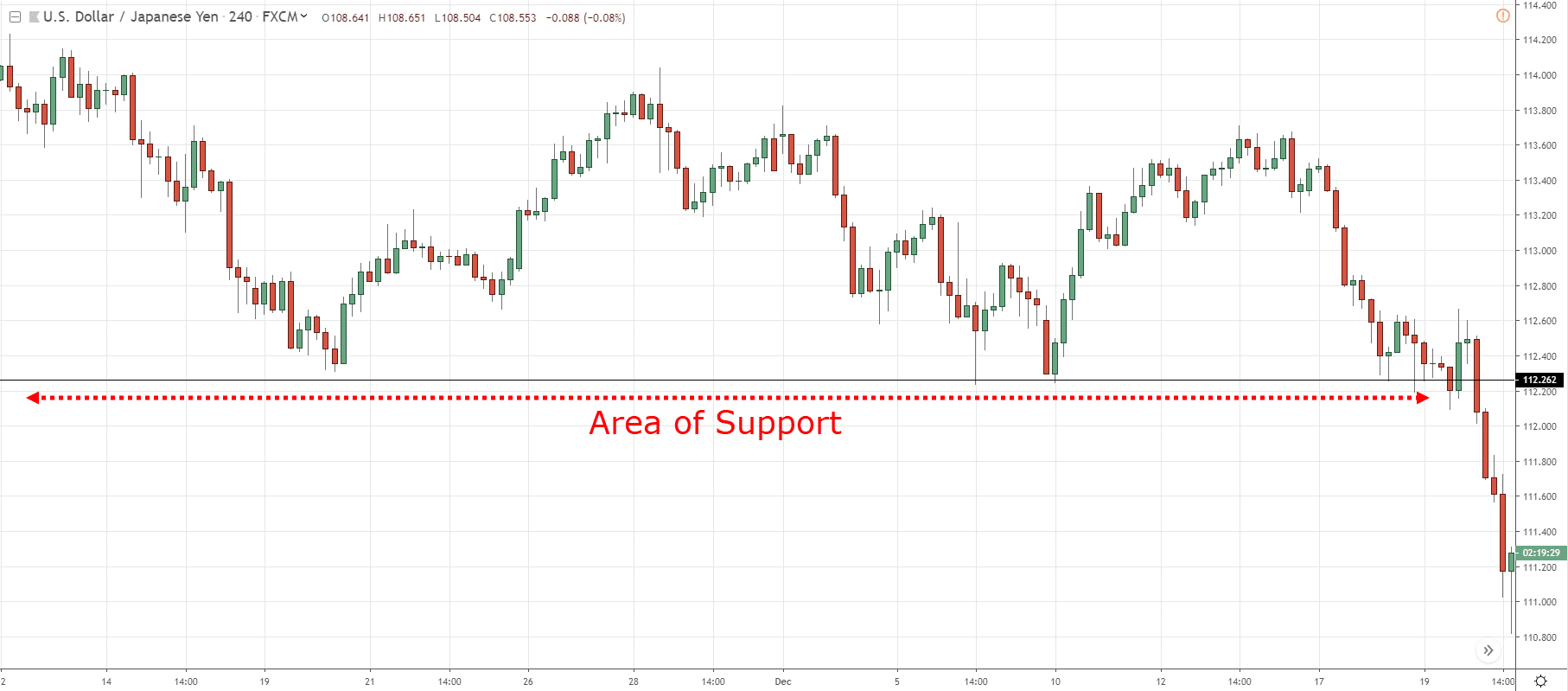

Step 1: Identify a support level

You’ll use the previous swing lows as your support level.

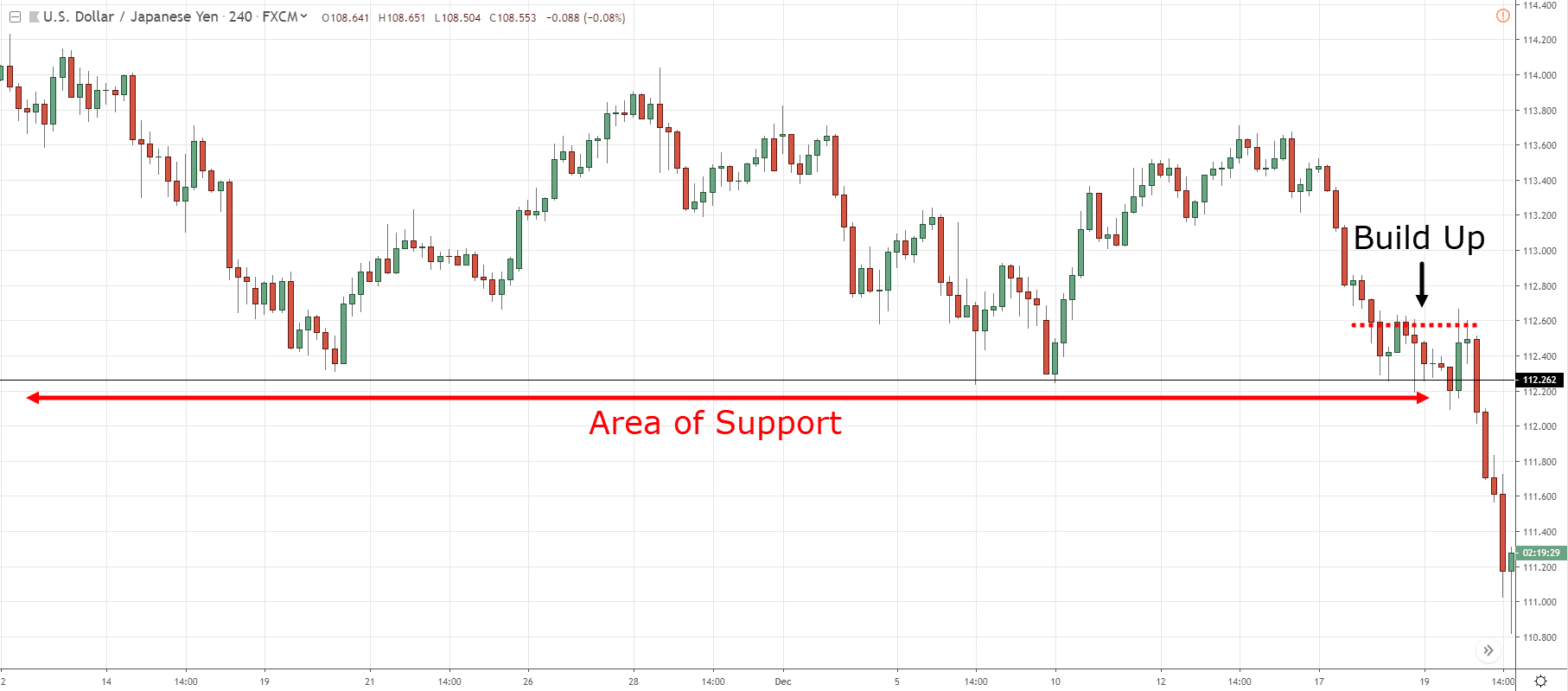

Step 2: Wait for a build up to form at support level

After the support has been formed, don’t place a Sell Stop Order yet.

Instead, wait for the price to form a build up near support level.

Here’s what I mean:

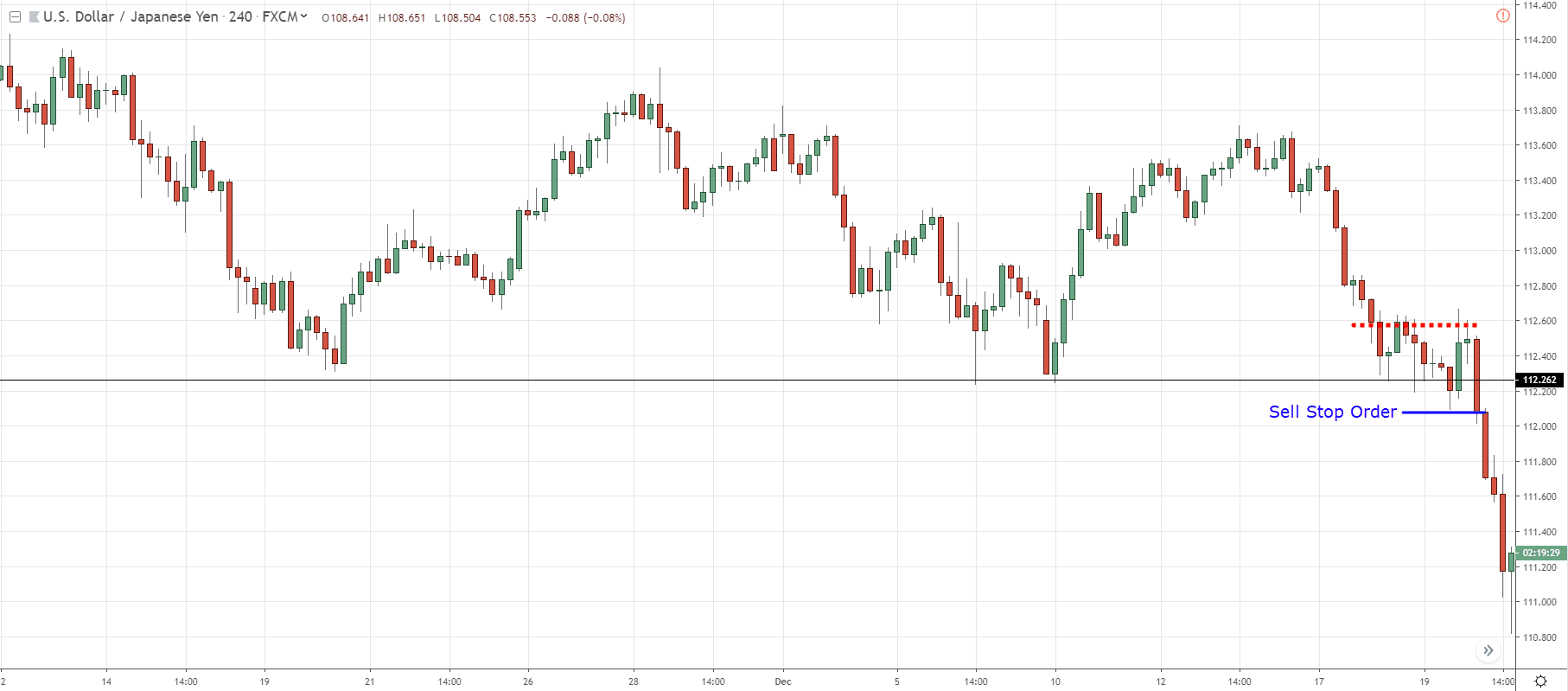

Step 3: Place Sell Stop Order slightly below the support level

Now…

You don’t want to be placing your Sell Stop Order on the support level itself.

Because you’re likely to get stopped out from a false breakdown.

Do this instead:

Place the Sell Stop Order slightly below support.

Fairly simple, right?

If you want to find out more about high probability breakout trades, check out The Complete Guide to Breakout Trading.