#10: Stock Trading Tips That Work

Lesson 10

We have come a long way in this stock trading course.

Before I end…

I just want to share with you a few stock trading tips to get you started in your stock trading career.

Stock trading tips

The first thing that I have for you is…

Don't “chase” the markets

It doesn't matter whether you're trading Stocks, Forex, or Futures.

As a new trader, there is always this “urge” to chase the market where the market breaks up higher and the candle is so big and bullish that you can’t resist to buy it.

Because you’re thinking, “Man, this is going to go up forever, if only I can just catch a piece of the move!”

That's what you are probably thinking.

But trust me…

Whenever you see this type of price action where the market or the candle is hugely bullish…

That’s usually the worst time to enter the trade.

That’s what I mean by not trying to chase the markets.

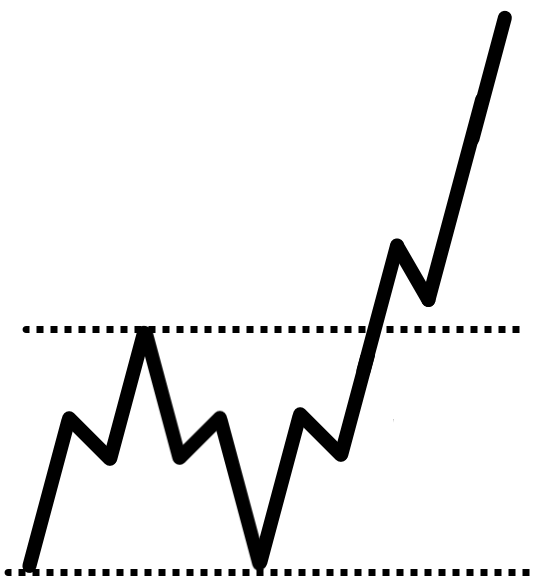

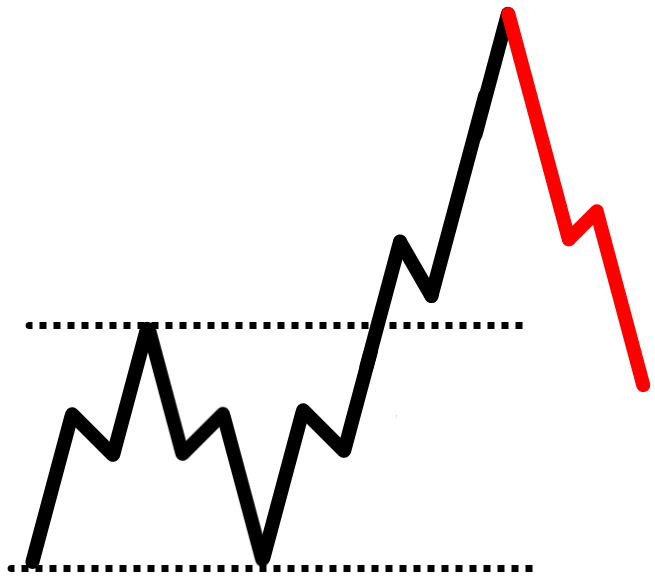

If you want me to give you a visual, illustration it would be something like this…

The market is in a range and breaks out higher as you’re tempted to buy the highs.

And when you buy at the highs, that's usually when the market collapses…

The second thing that I have for you is to…

Start Small

If you have $50,000 to speculate in the markets…

My suggestion is to not risk that whole $50,000.

There are many brokers already out there that’s letting you buy 1 or 2 shares (beyond the usual minimum board lot) and lets you trade commission free!

So you can start small like $10,000 or even just $5000 at the moment.

Because as a starting trader, you’ll make a ton of mistakes.

So start really small and make as many mistakes as possible which is totally fine.

Why do you want to you know pay for example $10,000 for a painful trading lesson when you can actually learn that same lesson for a $300 or $400 account?

So start small so your tuition fees are kept small as well.

Later on, you can scale up your account when you're confident and when you're ready.

Third thing…

Risk Management First

As you start in your training journey, you will be overwhelmed.

I’d be lying to you if I say that trading is simple.

No.

You will be overwhelmed.

There is a lot of information out there and you’ll probably hop from one trading system to the next.

Maybe you have already tried swing trading, position trading, mean reversion trading, trend-following, momentum and so on.

But the one thing that you must not neglect is your risk management.

If you think about this right…

If you have proper risk management in place and no matter what trading strategies you trade…

Even if flops or fails, you will not blow up your trading account.

Because each trade that you risk is only 1% or smaller, it’s not something that would destroy you.

So feel free to explore other methods but never ever forget your risk management.

The last thing on the share is…

Look at what the index is doing

For example, if you are trading stocks in the S&P 500…

Then it would make sense to track what is the trend on the S&P 500 to kind of to serve as a trend filter for to know whether you should be buying or you should be staying in cash.

If the stock index is in an uptrend, chances are stocks will be in an uptrend.

If the stock index is in a downtrend or is in a recession, more often than not, more stocks will be in a downtrend.

One way to improve your trading is to trade along the path of least resistance.

One tip that I have for you is…

- If the S&P 500 is above the 200-day moving average, then look to be a buyer

- If the S&P 500 is below the 200-day moving average, then you stay on cash or don’t buy stocks at all

So these are the four of the most important ones that I hope you can take away from this entire stock trading course.

I wish you good luck and good trading and I'll talk to you soon.