#11: The Different Types of Forex Brokers

Lesson 11

What are the different types of Forex brokers

In this lesson, you'll learn what are the different types of Forex brokers.

They generally fall into one of two types of category:

- Dealing Desk Broker

- Non-Dealing Desk Broker

Let me explain what this all mean…

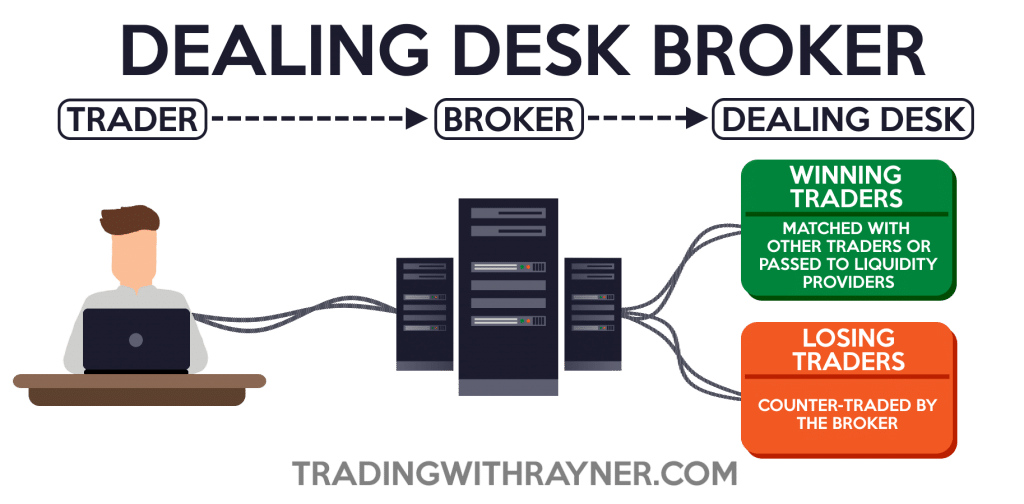

Dealing Desk Broker

A dealing desk broker is basically a market maker.

And yes, they take the opposite side of your trade…

There will be many of you who will have alarms ringing and ask “Oh what? they take the opposite side of my trade? So, that means if I lose they'll gain!”

Yes, if they take the opposite side of your trade, and they don't hedge it.

Your loss is their gain, and their gain is your loss.

Although it sounds pretty gloomy, there are upsides to trading with market maker:

- Fixed Spread

- Likely to trade Nano lots.

First, is their spread tends to be fixed, it doesn't really fluctuate too much because after all, they're trading against you!

Second, you are likely to be able to trade in Nano lots.

If you recall in the earlier lessons...

You have studied mini, micro lot, and even nano lots.

This means that you can trade really small size.

With a nano lot, it is possible to trade with a $500 account and still adopt proper risk management.

So, this is the beauty of trading with the market marker.

Although they take the opposite side of your trade, it's not an illegal thing.

This is just the way they run their business, and there are a couple of advantages to trading with a market maker and otherwise known as the dealing desk.

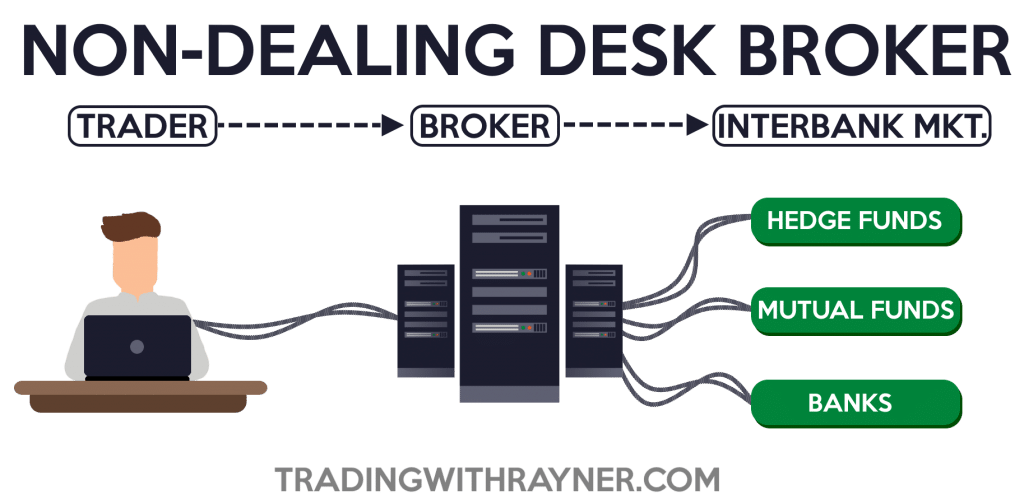

Non-Dealing Desk Broker

Non-Dealing Desks fall into two categories:

- Straight through Processing (STP)

- Electronic Communication Networks (ECN)

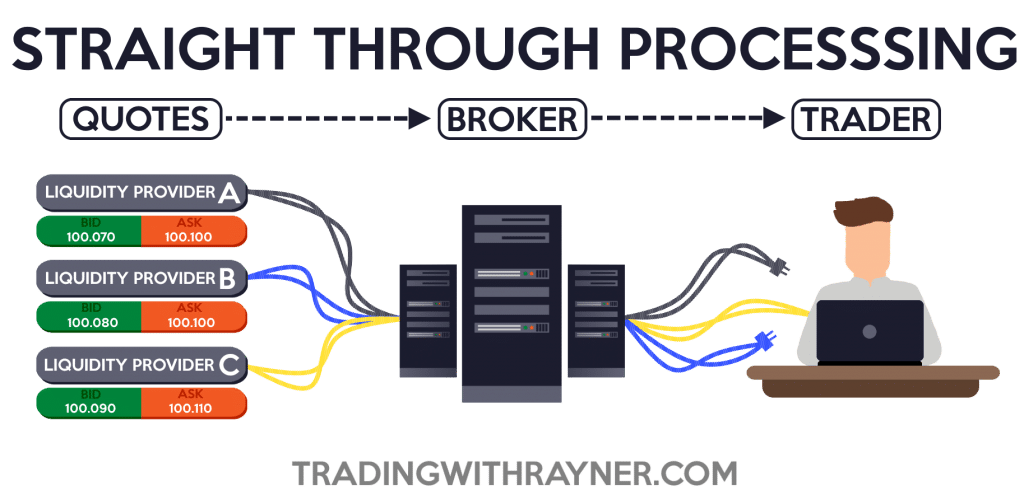

For Straight through processing:

Let's say, this is you, the trader in the image (right).

The broker will link my order to a liquidity provider like banks, hedge funds, and other brokers.

Basically, the broker will take my order, and route it to a liquidity provider.

How your broker will earn in this instance, is that they will mark up the spread.

So, let's say it's trading at a bid price of 100.070, and ask is 100.100 (Provider A).

What your broker will do is that they’re not going to give me a better spread as being offered on the liquidity providers.

What he will show on my screen is 100.090 Bid and 100.110 Ask.

You can see that the spread is higher than the original price.

What the broker will do is to mark up the spread.

In real life, they won't usually mark up too much, I'm just trying to give you an illustration.

You tend to have variable spreads when there is major news releases.

Because you know traders are taking away liquidity in the market.

Another thing about Straight through processing is that you're unlikely to trade in Nano lots.

So, it's unlikely that you can trade with Nano lots if you're going through Straight through processing broker.

Another one is what we call it Electronic communication network.

So, the difference between this and STP is that an Electronic communication network gives you direct interaction with the liquidity providers and other ECN participants.

Let's say this is you (left), and this is your broker (center).

The broker gives me the ability to trade within the other liquidity providers.

Instead of marking up the spread of my order, they typically charge a commission on your trades.

So, the ECN approach is where you can have a direct interaction with the other liquidity providers.

What type of Forex broker should I choose?

Should you go to the STP, ECN or market maker?

Well, here's my take on it…

For the market maker, otherwise known as dealing desk.

I would suggest new traders go for it.

Why new traders?

Because, for new traders, you want to be able to adopt proper risk management.

You want to be able to trade in Nano lots.

And only a market maker would offer you this privilege because they're simply not making a market for you.

As for Non-Dealing Desks, I would suggest this for day traders where you're trying to fight for every pip in the market.

Going for Non-Dealing Desk broker will give you better spreads.

So, going for a Non-Dealing Desk broker will charge you a commission every trade.

But you will be offered with the tightest spread possible.

Okay. So, with that said, let's do a quick recap...

Recap

- Dealing Desk Brokers are typically trading with market makers, they typically offer you a fixed spread and allow you to trade in nano lots.

- Non-Dealing Desk Brokers consists of STP and ECN. It gives you tight spreads, but you have to trade a larger minimum size.