#1: What Are Stocks And How Does It Work

Lesson 1

Welcome to the ultimate stock trading course for beginners!

So…

Who is this course for?

Who is this course for?

If you are someone who is totally new to the financial markets and you want to learn more, then this course is for you.

If you’re a trader who trades Forex and Crypto but no idea what a stock is, then this course is for you.

Perhaps you're someone who wants to use the stock markets to help you generate a source of income to help you beat inflation or to just grow your wealth over time…

Then this course is for you as well.

Before I get started…

Who am I?

My name is Rayner.

I am the founder of tradingwithrayner

I suggest you subscribe to my youtube channel, this way, whenever I publish a new video…

You'll always stay up to date and never miss another training from me.

Sounds good?

Then let’s begin…

What is a stock?

Have a look at this…

This is apple with a $731 billion market capitalization.

The stock market goes up and down, so the data shown may be outdated as you read this.

So what does it mean to buy a share of Apple?

Whatever company it is, buying a stock/share of a company means that you're a part owner of the company.

Ownership in a company

You might be thinking, “What? I’m an owner?!”

Yes!

You're an owner but just a very small or a minor owner.

Let me explain further…

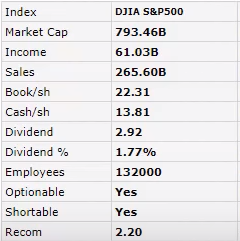

If you go to Finviz right now, Apple’s market cap is around $793.46 Billion...

Again, the market capitalization is the value of Apple itself, and right now, the price is about $165.25 per share…

If you wish to buy 1 share of Apple, then you have to fork out $165.25, right?

So if you buy 1 share of Apple and divide it into its market cap (which is in billions)

Then you’ll realize just how small your stake is in Apple.

Does it make sense?

But let's say you're a really rich individual that wants to buy $7.93 billion dollars’ worth of shares in Apple…

Right now you own 10% of Apple shares.

That's what I mean by being a part owner of the company as you buy a stock.

You can check out Finviz for other financial data, but for now, let's move on…

A stock is traded on an exchange

There are multiple stock exchanges in the world where you can buy stocks:

- New York Stock Exchange (NYSE)

- Singapore Exchange (SGX)

- Philippine Stock Exchange (PSE)

- And so on…

Depending on where you're from…

Usually, your own country would have an exchange dedicated to trading stocks.

Next…

Different Types of Stock (Sector)

So one thing to note is that there are many types of stocks out there.

There are stocks that focus on…

- Energy

- Materials

- Industrials

- Consumer discretionary

- Consumer staples

- Health care

- Financials

- Information technology

- Telecommunication

- Utilities

- Real estate

As you can see, there are about 11 different sectors that you can look at when trading stocks.

But within the sectors, you can still further break up the different types of stocks which of course we will not go in depth with it

What you just need to know is that stocks are traded across the different sectors.

Now…

This isn't the only way how you can classify stocks because you can also break them down according

to their market capitalization…

Different Types of Stock (Market Capitalization)

You can rank stocks according to how much they are worth as you can see below…

- Mega Cap = Over $300 Billion

- Large Cap = Over $10 Billion

- Mid Cap = $2 Billion to $10 Billion

- Small Cap = $300 Million to $2 Billion

- Micro Cap = $50 Million to $300 Million

- Nano Cap = Below $50 Million

A while ago, you saw that Apple has a $700 billion dollar market cap.

Which means, that Apple is a mega cap.

There’s another type of stock that I did not edit here.

It's called a penny stock, which is a stock trading below $5 a share as they are usually Nano to small-cap stocks.

Now, the question is…

Why do you want to trade stocks?

There are many reasons why you may want to trade stocks:

- You want to beat inflation

- You want to grow your wealth

- Earn a second income

Where I'm from, Singapore’s inflation is about 3% to 4% a year.

And if I earn more than 4% a year trading stocks, then hey, I’m beating inflation!

I'm protecting and growing my wealth!

And if you are trading stocks on a shorter-term timeframe, you could be making anywhere from 2% - 5% a month, so it’s also possible to trade stocks for a living.

There are many reasons why you want to trade stocks.

But you really have to ask yourself what is the purpose of trading stocks before you dive deeper.

Because as you study later in the course…

You’ll realize that there are different methods to trade stocks, and different methods have their own pros and cons to it.

But we'll get to that later.

Moving on…

How to buy a stock

As mentioned a while ago, stocks are traded on an exchange.

It’s not like Forex where it’s over-the-counter or forwards where you and the broker are trading within one another.

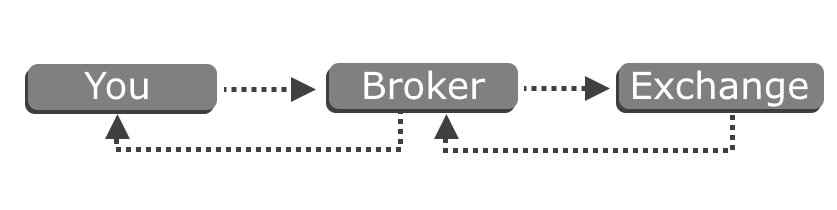

When you trade or buy stocks, you go through your broker, and your broker will then link to an exchange as shown here…

So, whenever you want to buy a stock, it goes to your broker and your broker routes your order to the exchange.

Within a few seconds, the exchange will know let you know whether your order is filled or not.

Once the order is confirmed, the exchange sends the message back to your broker and then your broker will instantaneously notify you on your trading platform that your trade is filled…

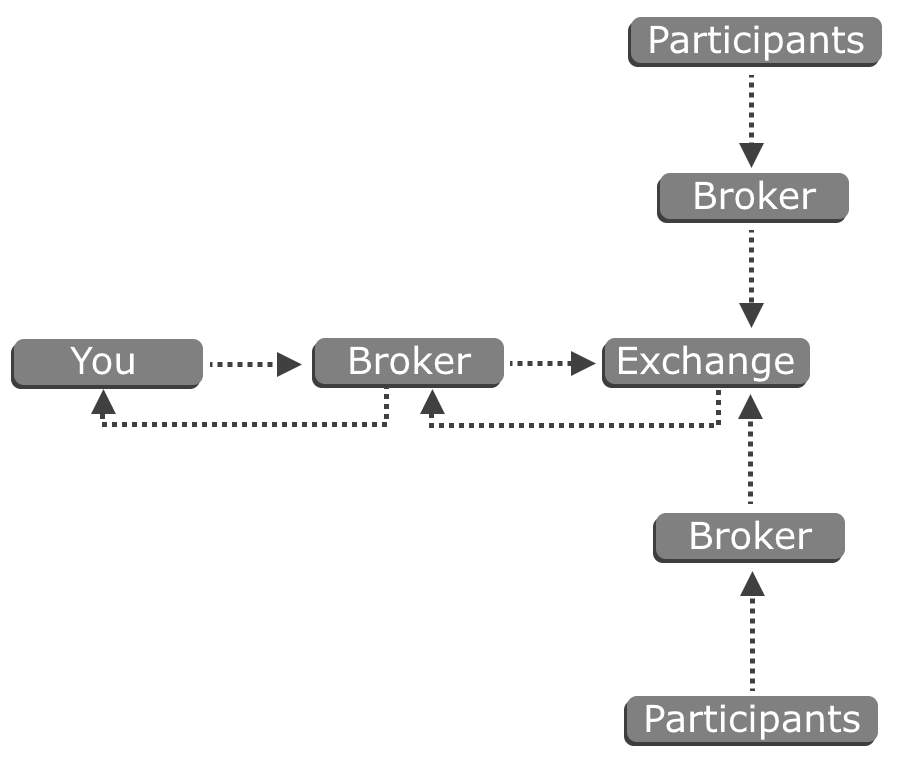

Now, there are many different brokers and participants around the world.

Such as a lot of brokers, and a lot of retail and institutional traders and investors…

This little mind map could expand endlessly, and that’s how the stock market works.

Of course, there are times where certain people have the privilege to get their order into the exchange directly.

But most of you reading this lesson right now, it's unlikely that you know you will fall under the category as that’s usually for the institution.

With that said, let’s do a quick summary…

Summary

- A stock represents ownership in a company

- A stock is traded on an exchange

- There are different types of stocks (by sector and market cap)

- You can buy stocks through a broker