#6: How to Trade NFP

Lesson 6

So one of the most common questions I get is this:

“Hey Rayner, how to trade NFP?”

“How do I trade the news?”

“How do I profit from FOMC?”

Now…

One thing that I want you to know is:

If you're trading high impact news, the market is rigged against you.

You’re not playing on a level field – you’re at a strong disadvantage.

Let me explain why.

The market is rigged against you

During high impact news release, the market is in a low liquidity environment.

Low liquidity leads to a wider spread

Prior to the news release, traders will pull out their orders away from the market.

So when orders are pulled from the market, the spread in the market will widen.

There’re many pockets of gaps in the market now since there are no bids and offers anymore.

So when the spread widens in the futures market…

What happens to the spot market that you're trading?

Your broker will also widen the spread because they need to protect themselves.

If not, arbitrages will come in and it’ll hurt their trading business.

So when currency futures’ spread widens, its spot market’s spread will also widen.

In fact, your broker tends to widen the spread even more than the spread on the futures market.

Because they want to protect themselves.

So what happens next?

Low liquidity leads to price spikes

In a low liquidity environment, all you need is just a few orders to come in and the price will go crazy.

It'll spike up and down.

With just a few orders, you can push the market around.

So when the price spikes up and down, what happens?

Price spikes lead to you getting stopped out

You’ll get stopped out if you trade during this market environment.

Let me explain what I mean.

Example:

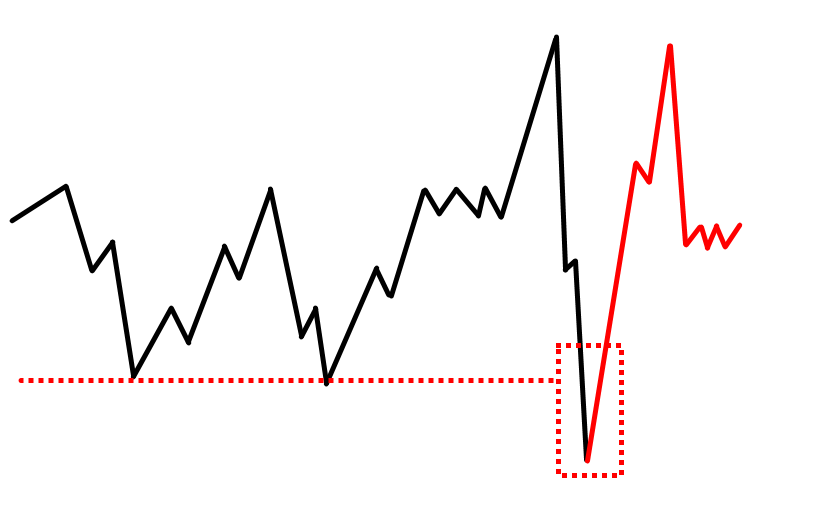

As you can see on this EUR/USD 5-min chart, this is when the NFP news is released:

You can see that price spikes down, then it spikes up and it comes back down.

So imagine traders who trade the news.

Trading before the news is released

Maybe prior to the news, they go long with a stop-loss at the lows.

What happens?

When price spikes down lower, they get stopped out.

Or maybe traders who are short prior to the news, their stop-loss is above this high:

What happens?

When price spikes up higher, they get stopped out as well.

Trading after the news is released

Or maybe, some traders wait for news to come out with the numbers before they trade the direction of the breakout.

Well, what happens?

You can see that price broke down broke below the swing low and then the market comes down.

However…

If you're not fast, the market quickly reverses back higher and you’ll get stopped out as well.

Then you look at the chart and say:

“Okay, maybe this time around the breakout is real.”

Price this time round breaks above this high:

“Look at how bullish the candle is.”

“This time the breakout has to be real.”

Then what happens?

Price collapses and you get stopped out again:

So this is what I mean by the market is rigged against you.

During this low liquidity period, the spread widens, price spikes – and you get stopped out.

And not only that…

You lose even if you're right

What do I mean by this?

I'm sure you’ve seen these many times…

The price goes up on bad news.

BUT the price goes down on good news.

Why is that?

Because news trading is NOT as simple as:

“Hey, it’s good news – time to buy.”

“Hey, bad news – time to short.”

It's not like that.

Because as you've seen…

Price can go up on bad news and go down on good news.

So in reality, news trading is this:

You're trading the expectations of the news release.

You're trading what people would react to the news release.

So if the news is bad, but the expectation of the crowd is bullish, the price will go up.

And you need to trade that expectations of the people who are bullish that the price will go up.

But as you can see here, trading the expectations of the news release – is near impossible.

Heck, I don't even know what I'm going to eat for lunch tomorrow.

How can I even predict how people will react to a piece of news that's going to come out?

I would say it's near impossible to trade the expectations of the news release.

Given these two points:

- The market is rigged against you

- You lose even if you're right

I suggest that if you don't know what you're doing…

Don't trade the news.

Don’t trade NFP.

But for those of you who still want to do it…

How to trade news

Here are some tips that I have for you on how to trade the news:

- Know how the price moves

- Ignore the first move

- Wait at market structure

- Trade the reversal

I’ll explain.

1. Know how the price moves

Generally whenever a piece of news releases…

The market whips up and down and then it goes quiet a little bit.

There are many variations to it.

It could also spike down and then go up before it goes quiet.

So whenever high impact news releases, the price tends to do a few whips before it goes back to its normal market condition.

Bear this in mind because you’ll see this a few times later on.

2. Ignore the first move

So whenever the news just comes out, there's usually the first move.

The market is either going to break out higher or breakdown lower.

I want you to ignore the first move.

I’ve got two reasons why.

Firstly, because the spread is usually pretty wide.

If you look at your trading terminal, your spread is usually wide during this period.

You don't want to be trading when the spread is wide.

Because you're immediately down 20 to 30 pips the moment you hit the buy or the sell order.

So it's not favourable to you.

Secondly, the first move is usually a fake move.

So don't get suckered in by the huge momentum candles – because it's usually the fake move.

3. Wait at market structure

Don't just chase the markets.

Instead, be patient and let the price come to you.

What I mean by waiting at the market structure is this…

Let's say prior to the news release, the price forms an area of support.

Then that is a market structure where you’ll look for buy opportunities.

Because it’s a frame of reference which you can use to establish your position and enter your trade.

So when price swings to that market structure after news release, you can look to go long.

So this is what I mean by waiting at the market structure.

It can be a trendline, support/resistance and etc.

You want to plan all these levels before the news release.

Don't do it when news is out because it's too late already.

Your levels have to be there prior to the news release.

4. Trade the reversal

During news release, it's better to trade the reversal and not the breakout.

Because the breakout tends to be fake.

Moving on…

Walkthrough on how to trade the NFP

So now, let's have a look at a few examples.

Example #1:

This is EUR/USD on 1st February 2019 on the 5-min chart:

At 9.30pm (+8 GMT), the NFP came out.

Remember what I shared with you – ignore the first move.

This is a fake move.

Secondly, you want to be waiting at the market structure.

This is a possible reversal set up for you to go long on the next candle open.

As you can see from a risk to reward standpoint, there’s not even a 1 to 1 for this trading setup.

However…

That’s not the only setup that you might have.

The market is at this high it broke out of, and then it reverses lower over here:

You can consider entering short once the price reverses.

I don't want to go too much into trade management and stuff like that.

It's not possible to cover every aspect of It here.

But these are a couple of things for you to consider:

- Where you want to set your stop loss

- Where you want to consider taking profit before the opposing pressure comes

So that is one example of how you can trade the news release.

Next…

Example #2:

Let's have a look at EUR/USD on 8th March 2019, 9.30pm (+8 GMT) on the 5-min chart.

Remember to ignore the first move:

At one point in time, that was actually a huge ass bullish candle.

So if you ignored this first move, you wouldn't be caught on the wrong side of this trade.

Traders were buying till the absolute highs until it collapsed lower.

Secondly, wait for the price to come to the market structure.

In this case, there wasn't a market structure that the price came into.

Maybe this is a possible one:

That was where price come into the swing low.

Now for the opposite side…

It would be this swing high over here:

You can look for short entries over here as well.

So these are a couple of levels that you can look for trading opportunities.

With that said, here’s a quick summary on what you’ve learnt…

Summary

- Don’t trade the news if you don’t know what you’re doing

- Know how the price moves

- Ignore the first move

- Wait at market structure

- Trade the reversal