#14: How to Read Candlestick Patterns like a Pro

Lesson 14

Three things you must know

This is possibly one of the most important videos of this candlestick training series.

Because up to this point…

You have learned the different types of candlestick patterns.

But to be honest, you don't really need to memorize any candlestick pattern!

As long as you understand these three things that I'm about to share with you.

Once you understand the three things, you can forget about all the candlestick patterns that you have learned earlier.

Because you can still read what the market is trying to tell you.

This is powerful stuff.

With that, the first thing that you must know is…

1. The body

The length of the body shows you who's in control.

If you have a longer body, let's say, a bigger bullish candle with a larger body...

It's telling you that the buyers are, obviously, in control!

The second thing is…

2. The length of the wick

The length of the wick shows you price rejection.

Where the price get rejected at the highs, where they get rejected at the lows.

The third thing you have to look at is…

3. The ratio of the wick to the body

You need to know the ratio of the wick to the bod to get the complete picture.

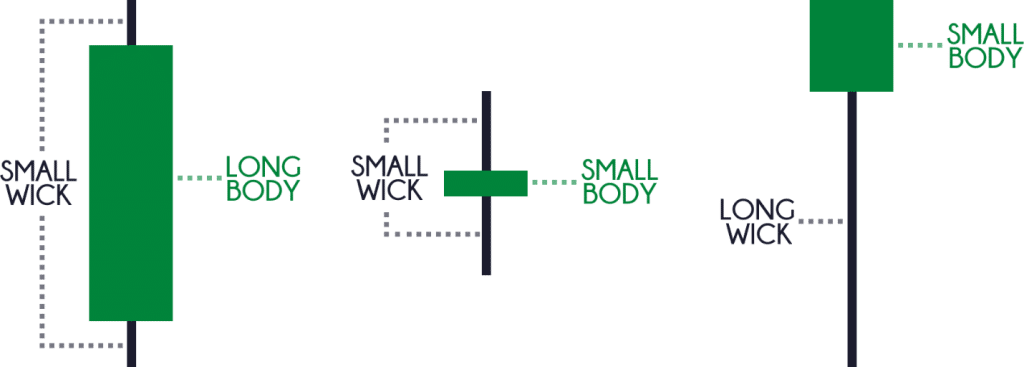

Let's have a look at this illustration…

We can see over here the first candle you have a strong body close, buyers are in control.

If you look at the wick of the candle, It's relatively short so there isn't really much price rejection.

This one you can state that for the candlestick that you see on the first candle, the buyers are in control.

The second candle has a small body.

So, the buyers are not really in control.

The wick got rejected near the highs and the lows.

It's telling you that it's somewhat undecided because the length of the wick is pretty much proportionate to one another!

The third candle has closed higher, the buyers are in control.

The length of the wick is a very long wick, rejecting lower prices.

So, it's telling you that this candle shows that buyers are in control and has rejected lower prices.

This is a very strong price rejection because if you look at the wick relative to the body the wick is so much longer than the body.

Moving on…

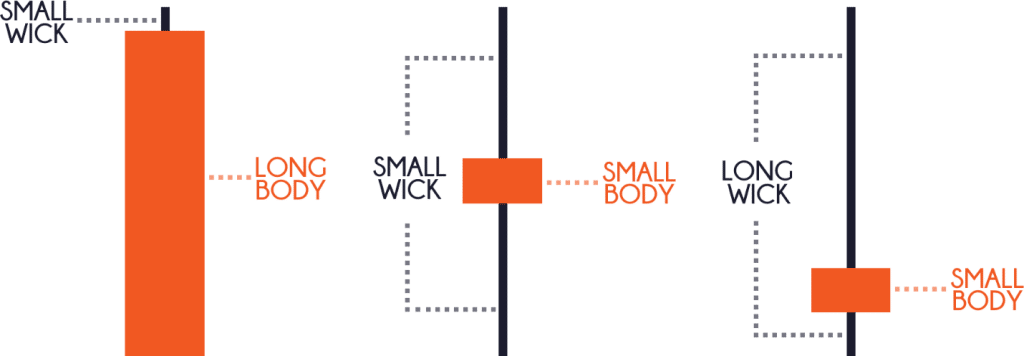

You can see that this is just the opposite example.

On the first candle, you have a very small wick and a very large body candle towards the downside, sellers are in control.

The second candle, again, you can see that the price rejection of these highs and these lows are somewhat proportionate.

So, it's more of an indecision candle as the buyers and sellers are pretty much similar to one another.

The third one is more bearish.

As you can see, you have a body that is a lower close and not a very large body.

But it doesn't matter because you notice that this long wick that has rejected.

On top of it, the length of the wick relative to the body is so much longer.

As it tells you that it has rejected all these higher prices.

Finally, closing near the lows!

With that said, here’s a recap…

Recap

- Length of the body shows who is in control.

- The length of the wick shows you the price rejection.

- To get a complete picture you want to look at the ratio of the wick to the body to get the complete picture.