#4: Stop Loss Strategy Secrets

Lesson 4

Hey hey, what's up my friends!

In today's lesson, we'll be discussing stop loss strategies.

I know that stop loss is a term that triggers a lot of bad feelings for traders.

It brings back memories like…

“But Rayner my broker always hunts my stop loss.”

“The market always knows where my stops are!”

“It triggers my stops and then reverses back in my original direction, putting me out of the trade.” Okay.

I get it, that’s why in today's lesson…

We're going to tackle it once and for all and fix it so you know how to use a proper stop loss so you don't get stopped out too early.

So, the first secret that I want to share with you regarding stop loss is that there is no one size fits all.

Secret #1: No one size fits all

I always cringe whenever traders have a fixed 20 pip stop or a fixed 50 pip stop loss.

But the thing is…

It doesn't make sense!

Let me explain…

If you look at the daily chart of USD/SGD with the ATR indicator…

This market moves about 46 pips on average based on the ATR indicator.

This means, if you were to use a stop loss of 50 or 60 pips, I would say that is pretty reasonable.

Why?

Because it is outside of the average daily range for this market.

On the other hand, if you look at the daily chart of GBP/JPY…

Notice that the average range for the day is about 126 pips.

This means that this pair moves about 126 pips on average.

So if you're still going to use a fixed 50 to 60 pip stop loss on this market…

Then it doesn’t quite make sense.

The market would probably hit your stop loss before it can even move in your direction because this market typically has an average range of 126 pips per day.

Compared to USD/SGD earlier which has about 42 pips per day on average.

This is why the first thing that I want to share with you is that when you use a stop loss, there is no one size fits all.

You have to take into consideration the volatility of the market and you also must take into consideration the time frame you're trading.

On GBP/JPY, the daily timeframe moves about 126 pips on average.

But on the 1-hour timeframe…

The hourly range is about 21 pips.

You can see that the smaller the time frame then your trading, the tighter the stop loss that you can use.

Next…

Secret #2: Your Broker Doesn’t Hunt Your Stop Loss

I know this is hard to believe, and I agree that there might be a few bad brokers out there (less than 1% of brokers).

But the vast majority of brokers who are regulated by MAS, FCA, ASIC and other regulatory bodies…

They don’t hunt your stop loss.

Because from a risk to reward perspective, it doesn't make sense.

Why?

Let me ask you…

What is the size of your trading account?

Chances are, most of you reading this right now would have about a few hundred to a few thousand dollars.

Now, if your broker wants to hunt your stop loss, what’s his reward?

50 dollars?

100 dollars?

500 dollars?

1,000 dollars?

But the risk to the broker is that you might screen-capture your charts.

You can actually prove it.

For example, you compare your broker’s data feed to another broker and realize that there is no spike.

All you would need to do is to screenshot it and upload to social media and that’s it.

The broker risks losing the license because of trying to hunt your stop loss.

So from a risk to reward perspective…

Trying to make just a few hundred to a few thousand dollars off you with a risk of losing their license, reputation, and credibility just doesn’t make sense.

This is why I say that most brokers don't hunt your stop loss.

With that aside, I do agree that whenever you enter a trade…

The market somehow seems to know where your stop is, triggers it, and moves back in your intended direction.

Why is that?

Let me explain why this happens…

Secret #3: How to Avoid Getting Stopped Out by Using the Average True Range Indicator

If you studied textbooks, they will tell you to put your stop loss above resistance…

Or put your stop loss below support…

Because if the price breaks above resistance, that's where your trade is invalidated and wouldn’t want to stay in the trade any longer.

Makes sense right?

However, this is actually one

of the worst places that you can put your stop loss.

Why is that?

Let’s say that this market is in a range and it starts to retrace a little bit…

You know that traders will go short because they know that if the price is at resistance, selling pressure would come in.

So you go short…

Where will the short traders put their stop loss?

Well, if you follow textbooks, forums, and blogs, they will tell you to put your stop loss above these highs…

When more traders are short, buy orders (stop orders) would accumulate.

But at the same time, there will be traders who are currently long from the lows…

There may be institutions (smart money) who can really move the market.

If you are the smart money or you are someone with a 10 to 100-billion-dollar account, you know you can’t just exit a trade at any price level.

Why is that?

It's because of something called “slippage.”

If you just randomly exit your trades…

You will move the markets and you could potentially reverse the move all by yourself even before you exit all of your positions.

So, what institutions will do is that they want to exit their trade where there is an opposing order to help them liquidate or “neutralize” their position without moving the markets.

And who will they sell or neutralize their long positions to?

They sell it to the traders who have their stops above the resistance level…

And a cluster of stop orders get triggered by those who are long…

The long position of institutions gets liquidated and then the price collapses as the selling pressure negated the buying pressure…

Can you see what I mean?

This is why you’ll often see the market trade above the highs and reverse.

This is why you get “stop hunted”

Because your stop loss is always placed at an obvious price level where the smart money has the incentive to push the price higher, exit their trades, and then have the market reverse back in your direction.

So the brokers are not really out to get you, it’s just the way the market moves.

But how would you actually avoid this so-called stop hunting?

A tip that I have for you is that you don't put your stop loss at an obvious level.

Give it some room to breathe.

For example, if you went long in the support level EUR/CAD…

You want to give your stop loss more room to breathe.

What you can do is to use the Average True Range indicator which value is 39 pips (0.0039) when you went long…

What you have to do now is to identify the swing low’s price which is 1.51076 and deduct 39 pips from it.

= 1.51076 – 0.0039

= 1.50286

Therefore, your stop loss would be at 1.50286…

If the market were to spike down, you won't get stopped out immediately.

Because now, your trade has more room to breathe compared to other traders who set their stop loss just below the lows and get stopped out immediately.

Moving on…

Secret #4: The Larger Your Stop Loss, The Smaller The Position Size

This is quite logical because if you want to risk $100 per trade on EUR/USD and your stop loss is 10 pips…

Your position size would be 1.0 lot since having a 1.0 lot position size would cost/gain you $10 per pip.

And if the market moves against you by 10 pips excluding slippage or commissions…

You would lose about $100 (10 pips x $10), adhering to your risk management rules.

However, if you increase the distance of your stop loss from 10 pips to 100 pips…

You cannot be using the same position size of 1.0 lot, or else you’ll be putting $1,000 on the line.

So in this case, you would be trading with 0.1 lot, since having a 0.1 lot position size would cost/gain you $1 per pip for EUR/USD

The general idea that I want to bring across to you is that the larger your stop loss, the smaller your position size should be.

Now…

If you somehow sense that, “Hey my stop loss is large but my position size is still the same” then this is a red flag.

It's something that you want to check and make sure that you didn't mess up anything with your calculations.

The final secret I want to share with you is this…

Secret #5: Should You Trade Without a Stop Loss?

I'm sure you’ve heard someone saying, “Oh I don’t use stop loss because after all, the market always comes back in my favor!”

Let me just share with you a very classical example…

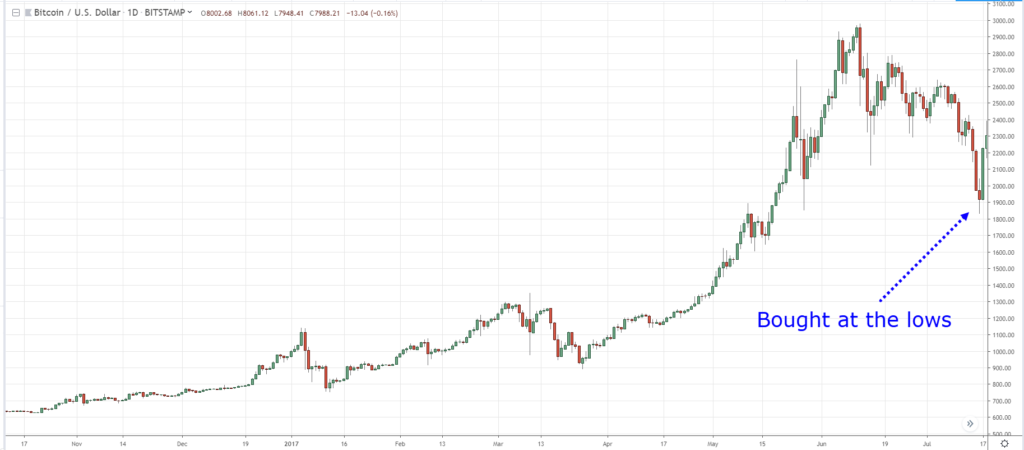

If you recall, Bitcoin in 2017 made a huge bull run…

You can see that back in July, Bitcoin made a pullback and traders went long…

They may not buy it at the lowest price but after all…

The market is an uptrend, traders would say that you don't need a stop loss, right?

So the market went in their favor and exited at the highs…

Wow, a winning trade!

This time around, the market pulls back again and they buy at the lows somewhere here…

Even as the price retraces a little bit, they still HODL (Hold On to Dear Life) and continues to believe in the mantra that the “markets always rebound.”

Then, they take profits at the highs once again…

Whoa, another winning trade!

Again, the market retraces and traders BTFD (Buy The F***ing dip)…

For the third time, they take profit at the highs once again..

Then, the market has made its strongest rally…

Even as the price retraces a little bit, they still HODL (Hold On to Dear Life) and continues to believe in the mantra that the “markets always rebound.”

Then, they take profits at the highs once again…

Whoa, another winning trade!

Again, the market retraces and traders BTFD (Buy The F***ing dip)…

For the third time, they take profit at the highs once again..

Then, the market has made its strongest rally…

There are cases where you don't necessarily need a stop loss is if you're an options trader.

You buy a call option and whatever you can lose is really in the premium that you have paid.

So being an options trader has a leeway of trading without stops.

Alternatively, if your broker or stock exchange does not offer a stop loss order…

Then you must have an alert app or system to inform you that the market has hit your stop loss price to and that you would exit manually.

Either way, you would need a stop loss.

With that said, let’s do a quick summary…

Summary

- No one size fits all

- Your broker doesn't hunt your stops

- Set your stops a distance away from Market Structure and use the Average True Range indicator

- Profit from your mistakes

- Larger stops = Smaller position size

- Trade with stops unless you know what you're doing