The RET Formula

Previously…

You’ve learned that systems trading allows you to trade without emotions, avoid wasting time & money, and help you get results, faster.

Then you’ve discovered that…

- Systems trading is simple to understand

- Systems trading is used by the richest traders in the world

- You don’t need to spend a lot of time to be a systems trader

- You don’t need a huge starting capital to be a systems trader

- You don’t need programming knowledge to be a systems trader

If you missed the earlier posts, then you can read them here…

My jobs sucks

A new way to trade

Now as promised, I’m going to share with you a proven formula to develop winning trading systems (even if you don’t know a single line of code).

Plus, you’ll discover a simple stock trading system that you can use to profit in the stock markets.

Cool?

Then let me introduce to you, the RET Formula.

Let me explain…

R: Read trading books with backtested results

In my opinion, the easiest way to find proven trading systems is to read books with backtested results.

(Now, it doesn’t have to be only from books because you can also get it from blog posts, research papers, videos, etc.)

That’s because when you write a book, your name, branding, and reputation are at stake.

Imagine…

You write a trading book and claim that your trading system works.

But when others test it out and realized it isn’t true, your reputation will take a hit.

Would you want that? Of course not.

That’s why most trading books that come with backtested results have a good chance of working out.

So here are a few trading books to get you started…

- Following the Trend by Andreas Clenow

- The Weekend Trend Trader by Nick Radge

- Mean Reversion Trading Systems by Howard B Bandy

Also, some of these books are written by people who run a hedge fund (like Andreas Clenow).

They have more at stake which means the stuff they publish is usually good.

Now, once you’ve read trading books with backtested results, then it’s time to move on to the next step…

E: Extract the concepts

I recall…

Back in my secondary school days, I failed all my subjects except English.

Do you know why?

That’s because I memorized answers for my exams and when the exam questions change, I got stuck and couldn’t answer them.

From then on, I stopped memorizing stuff.

So, what did I do?

I chose to understand the concepts.

This way, even if the questions “change”, I can still answer them because I’ve mastered the concepts.

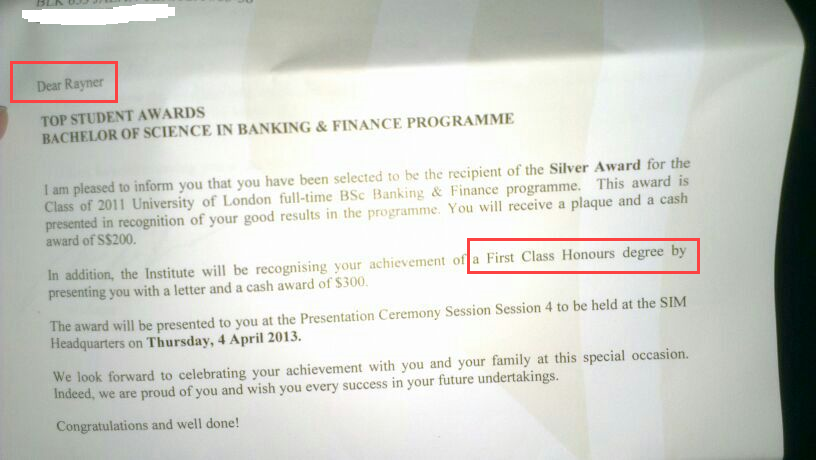

Now, this technique is so powerful that I’ve used it to graduate with First Class Honours.

Here’s the screenshot of it…

Now you’re probably wondering:

“What has this got to do with trading?”

Everything!

Because the concept is what matters.

Don’t blindly follow a trading system just because you read it from a book—you won’t understand how it works and why.

Instead, understand the concepts behind it. This way, you can use it to develop a trading system that suits you.

Let me give you an example. I’ve read books on mean-reversion trading and here are the concepts behind it…

- Buy stocks in an uptrend because it’s likely to continue higher

- Buy the pullback

- Sell the rally

- Reduce your risk by trading multiple stocks

Once you understand the concepts, then it’s time to move on to the next step…

T: Test the trading system

Now if you want to, you can give test the exact trading rules given in the book.

But in this case, I’ll modify the rules slightly so as not to give away the authors “secrets” for free.

So here are the trading rules…

Market traded:

- Stocks in Russell 1000

Entry:

- The stock is above the 200-day moving average

- The stock 10-period RSI is below 30 (on daily timeframe)

- Place a 2% buy limit order below the previous day closing price

Exit:

- Sell the stock when it closes above your entry price (or after 10 trading days)

Here’s an example of the trading setup…

NortonLifeLock Entry (Daily Timeframe)

1: The stock is above the 200-day moving average which means it’s in an uptrend.

2: The 10-period RSI is below 30 which means the stock is “oversold” in the short term.

3: The stock price went 2% below the previous day closing price which triggered the buy limit order.

Now, let’s have a look at the exit…

NortonLifeLock Exit (Daily Timeframe)

4. The stock price closed above the entry price so that’s your signal to exit the trade.

5. When the market opens the next day, you exit the trade (the gap up made this trade even more profitable).

Now you’re probably thinking:

“This is a cherry-picked example. Not all trades will be this good.”

You’re right, this is a cherry-picked chart to illustrate how this trading system works.

And yes, there are losers along the way.

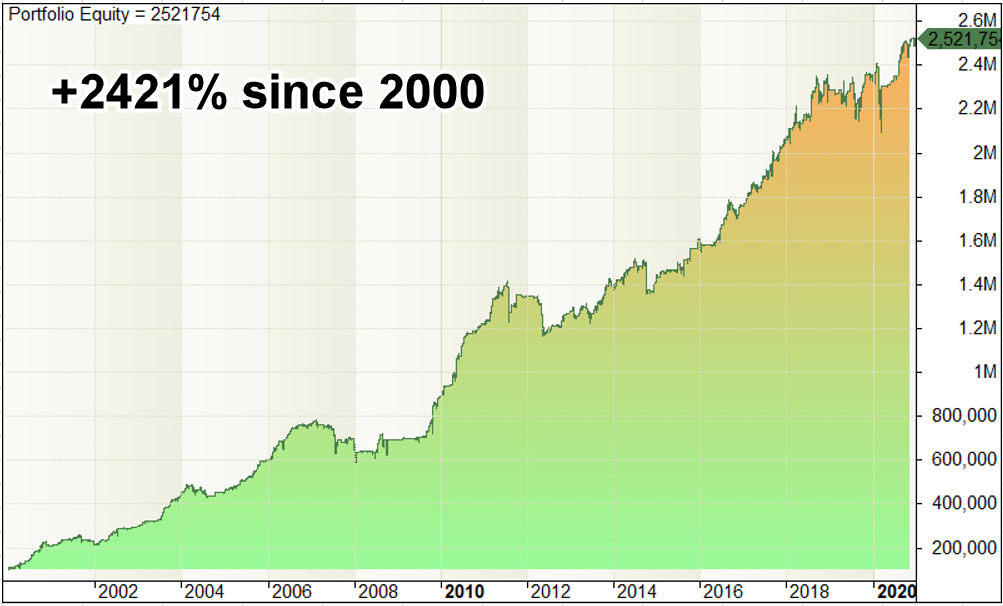

So, let me show you the results of this trading system so you can see how it has performed over the last 21 years…

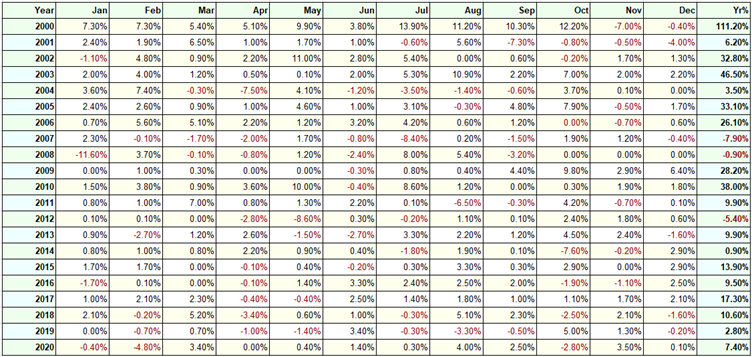

And here’s the breakdown on a month-to-month and year-to-year basis…

As you can see, this trading system has:

- Generated 2421% over the last 21 years

- 64.19% winning rate

- 3 losing years out of 21

Now, this is where things get exciting…

What if there’s a way to reduce the number of losing years?

This means you can make money almost every year.

Do you want to know how?

Here’s the secret…

Diversification.

This means you trade multiple trading systems so you can profit in different market conditions.

Let me give you an example…

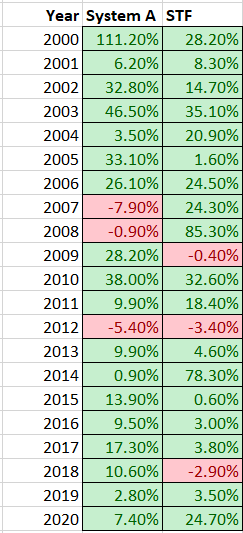

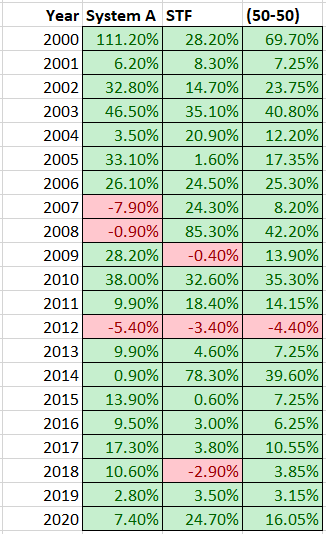

Here are the results of 2 trading systems…

(System A is the system I shared with you earlier and STF is a systematic trend following system I teach in The Ultimate Systems Trader.)

As you can see, both trading systems work in the long run. But they still have losing years.

Now, what if we allocate 50% of our capital to teach trading system?

In other words, you put 50% of your money in System A and 50% of your money in STF.

How would things change?

Here’s the result…

Now when you trade both systems together, you have only 1 losing year—and it’s a measly loss of 4.4%.

And what if you trade 3 trading systems or more?

You could reduce your losing years to almost zero and profit every year from the markets—even during a recession or a financial crisis.

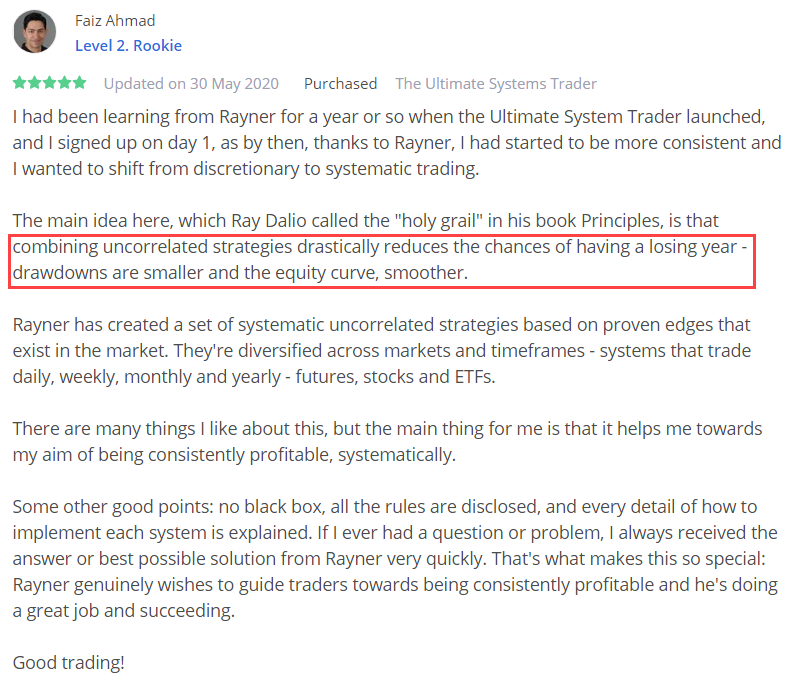

Here’s what Faiz has to say about systems trading…

“Combining uncorrelated strategies drastically reduces the chances of having a losing year—drawdowns are smaller and the equity curve, smoother.” – Faiz Ahmad

Now you’re probably wondering…

“How do I backtest a trading system without programming knowledge?”

This is the technique I used to backtest my trading systems without knowing a single line of code.

Here’s what you need…

- Backtesting platform

- Data source

- Code of the trading system

Let me explain…

1. Backtesting platform

A backtesting platform allows you to run the code of your trading system against the data source.

In return, it gives out statistics, numbers, and the equity curve of your trading system.

You can consider Amibroker as your backtesting platform.

2. Data source

A data source provides historical data which your trading system will run against.

You can consider Norgate Data for your data source.

3. Code of the trading system

If you have programming knowledge, then great! You can develop the code yourself.

If not, then you can hire a freelancer to help you with it.

Here’s how…

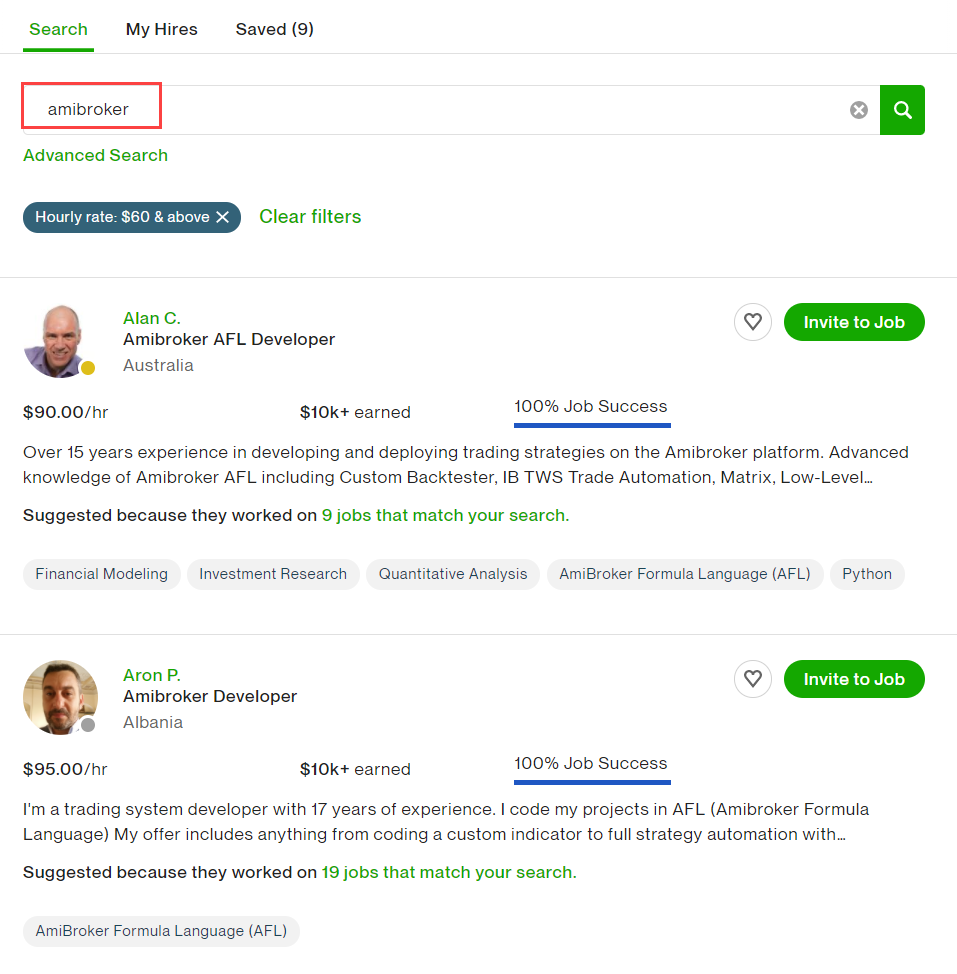

Let’s say I’m using Amibroker and I want to find a programmer who can code in Amibroker.

So, I’ll search for “Amibroker” on Upwork.

Here’s what I mean…

As you can see, Upwork will provide you with relevant people who can code your trading system in Amibroker.

Simple, right?

Now at this point…

You’ve learned a simple trading system that has generated 2421% over the last 21 years.

Then, you’ve seen how adopting multiple trading systems allows you to reduce your risk and generate consistent profits.

And finally, you’ve discovered the RET formula so you can develop proven trading systems that work even if you have no programming knowledge.

Now you might be thinking…

“I’m not sure I can do it.”

“Hiring a programmer sounds expensive and I’m not sure who to trust.”

“What if the trading systems that I test doesn’t work out?”

Well, here’s the good news…

Over the next few days, I’ll open enrolment to The Ultimate Systems Trader (UST).

You’ll discover proven trading systems that work so you can generate an extra 10%, 20%, or even 40% a year.

The best part?

You don’t have to do any backtesting work or research new ideas because all the work is done for you—and handed to you on a silver platter.

More details soon. Stay tuned…