I love reading best trading quotes because you can learn from experienced traders — especially those out of reach (like Market Wizards, Hedge Fund managers or those who have passed on).

That’s why in today’s post, I want to share with you my favourite trading quotes, the real meaning of it, and how to apply these quotes about trading to get results.

Sounds good?

Then let’s begin…

Jesse Livermore Trading Quotes

Jesse Livermore is possibly the most famous trader in history.

Born in 1877, Jesse Livermore started trading at the age of 14 and had a net worth of around $100 million at his peak.

However, the story of Jesse Livermore didn’t end well, and he eventually committed suicide.

(If you want to know the full story, go read the book, Reminiscences of a Stock Operator.)

Still, there are powerful lessons you can learn as the trading principles that worked 100 years ago is still valid today.

And that’s what you’re about to discover right now…

“Watch the market leaders.”

This is one of the best trading quotes out there, regardless of whether you’re a trader or an investor.

Here’s the deal:

If you want to buy stocks, then focus on the strongest ones.

Because these are the ones likely to outperform the market in the future.

Why?

Because Jesse Livermore said so.

Academy research said so.

And Rayner said so.

But nah, that isn’t enough so let’s do a simple backtest to validate it.

Here goes…

Buy rule:

Go long when a stock hits a 50-week high

Exit rule:

20% trailing stop loss

Filter:

Pick the top 20 stocks with the largest price increase over the last 40 weeks (the market leaders)

Sometimes you’ll get too many stocks to choose from. So, a filter like this helps you select which stocks to trade.

Other parameters:

Transaction Costs: $0.01 per share

Test universe: Russell 1000 stocks

Execution: Monday open

Maximum open positions: 20

Test period: 1990 – 2018

Positions size: 5%

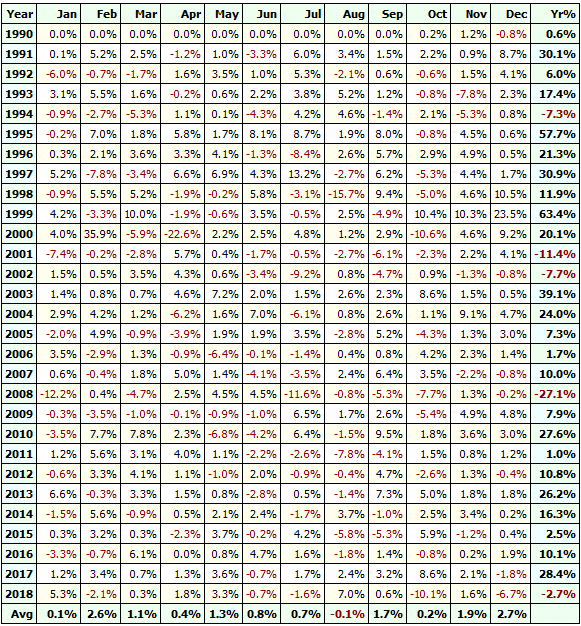

And here are the results over the last 29 years…

- Number of trades: 710

- Payoff ratio: 2.43

- Winning rate: 48.59%

- Annual return: 12.77%

- Maximum drawdown: 41.73%

As you can see, this simple trading system beats the market (and with lower drawdown).

So the lesson is this:

If you trade stocks, focus on buying market leaders.

Focus on buying the strongest stocks.

Because these are the ones likely to outperform the market.

“Remember that stocks are never too high for you to begin buying or too low to begin selling.”

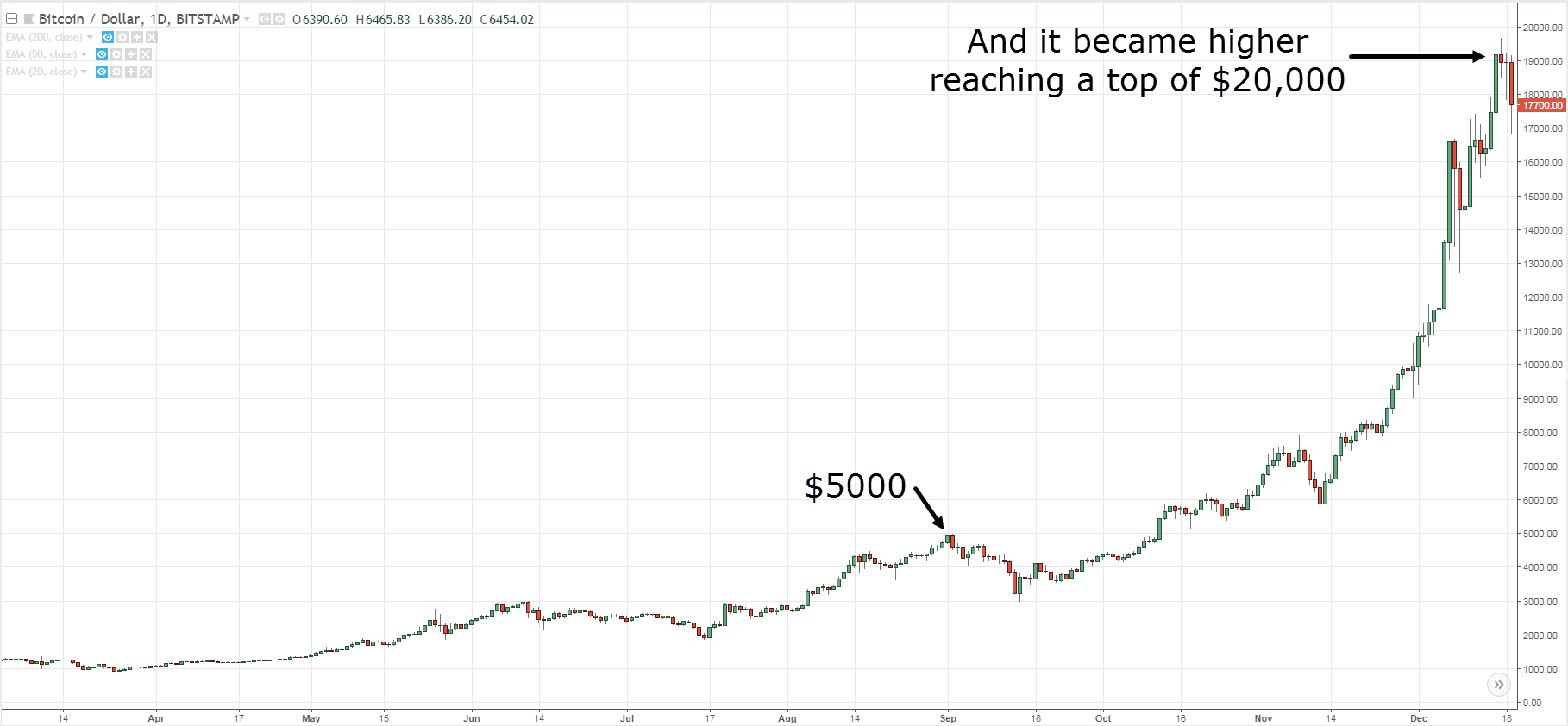

Look at the chart below:

You’re probably thinking:

“The price is so high and the market will reverse soon.”

I get what you mean.

Now, check out the next chart below…

Apparently, what’s high just became higher.

So here’s the lesson:

Buy low sell high isn’t the only way to make money.

Because you can also buy high and sell higher.

And if you embrace both methods, your trading will never be the same again.

“I trade my own information and follow my own methods.”

Here’s the deal:

There are countless trading strategies and methods out there.

And you’re probably wondering…

“So which is the best one for me?”

There’s no such thing because it doesn’t exist.

It depends on your goals, personality and circumstances.

Let me explain…

Let’s say you are working full time and can’t watch the markets all day, then swing or position trading are possibilities to consider.

Or, if you want to trade full-time, then you can consider day trading or scalping.

Or if you want trading to be systematic, then systems trading suits you.

So remember…

There’s no one size fits all when it comes to trading.

You’ve got to figure out what you want first, then adopt a trading method that suits you.

Clear?

“Markets are never wrong, but opinions often are.”

Have you ever heard traders’ quotes like these?

“Gold is already at the lows. It can’t go down any lower.”

“I’m not wrong. My fundamental analysis is correct.”

“The market doesn’t know what it’s doing!“

Here’s the deal:

If you play the blame game, you’ll never become a better trader.

You’ll fault the market, the broker, the strategy, etc.

But if you’re willing to accept you can be wrong, then you can make changes and improve.

You’ll respect the markets and accept that anything can happen.

You’ll have a stop loss in place so you don’t let a trade get out of hand.

You’ll adopt proper risk management so you don’t blow up your trading account.

And remember…

Trading isn’t about whether you’re right or wrong.

Instead, it’s about how much you make when you’re right, and how much you lose when you’re wrong.

“I don’t buy long stocks on a scale down, I buy on scale-up.”

This Jesse Livermore quote tells you he buys stocks in an uptrend — not a downtrend.

In other words, buy high and sell higher.

Now, you might be thinking…

“But what about buy low and sell high?”

Well here’s the thing…

When you buy low-priced stocks, you never know how long it’ll remain low.

It could be weeks, months, years — or forever (as it gets delisted).

And that’s not all…

Because you’re also buying when the price movement of the stock is against you.

Now if you buy stocks in an uptrend, you’ve no idea how long it’ll last.

But at least, it’s moving in the right direction.

The best part?

Academic studies have proven that stocks moving higher tends to continue in the same direction over the next 3 – 12 months period.

Sweet!

Ed Seykota Trading Quotes

Ed Seykota is one of the best Trend Followers of our time.

According to Michael Covel, in his book Trend Following, Ed Seykota turned $5000 into $15,000,000 over a 12-year period.

That’s insane, right?

With such a mind-blowing track record, I dug further to find out what are some lessons we can learn from Ed Seykota.

Now…

I took an afternoon to piece everything together, and finally, I’ve distilled 19 of his best trading lessons into one blog post (with my own commentaries and insights).

And after you study the lessons, you’ll probably get a few “AHA” moments that could take your trading to the next level.

Are you ready?

Then let’s get started…

In order of importance to me are: (1) the long-term trend, (2) the current chart pattern, and (3) picking a good spot to buy or sell.

Here’s the thing:

You don’t want to hit the buy button just because you spot a bullish Hammer (or some indicator is “oversold”).

Those tools don’t tell you what the market is doing.

If you want to read the market, ask yourself…

- What’s the long-term trend?

- Any chart pattern that’s forming?

- Where is an area of value to trade from?

- Who’s winning, buyers or sellers?

And only then, you pick a spot to buy or sell.

Now, I don’t know what chart patterns Ed Seykota looks for.

But for me, I like to trade bullish chart patterns (like Ascending Triangle, Bull Flag, buildup at Resistance, etc.) in an uptrend.

Here’s an example: An Ascending Triangle in an uptrend

Another example: Bull Flag in an uptrend

If you want to learn more, then go check out my chart pattern trading strategy guides below…

The Bull Flag Trading Strategy Guide

The Head and Shoulders Pattern Strategy Guide

The Cup and Handle Trading Strategy Guide

I set protective stops at the same time I enter a trade. I normally move these stops to lock in a profit as the trend continues.

As a trader, you never know if the next trade will be a winner or a loser.

That’s why you have a stop loss to protect your downside — so you don’t lose everything in one trade.

At the same time…

You never know how much further the market can move in your favor.

Another 10%, 100%, or 10,000% like Bitcoin?

So here’s the lesson…

If you want to ride big trends in the market, you must trail your stop loss and give the market a chance to “pay you even more”.

Now if you’re not sure how to do it, then go watch this training video below…

Moving on…

Before I enter a trade, I set stops at a point which the chart sours.

Here’s the thing:

When you put on a trade, you must know when to get out if you’re wrong.

You want to ask yourself…

“Where on the chart will the price “destroy” my trading setup?”

Once you’ve identified the level, that’s where you should put your stop loss.

Here’s an example:

Let’s say you buy on a breakout.

And if the price falls back into the range, it means you’re wrong and you should exit the trade.

Here’s what I mean…

This concept can be applied whether you’re trading breakouts, pullback, reversal, etc.

If you want to learn more, then check out this training video below…

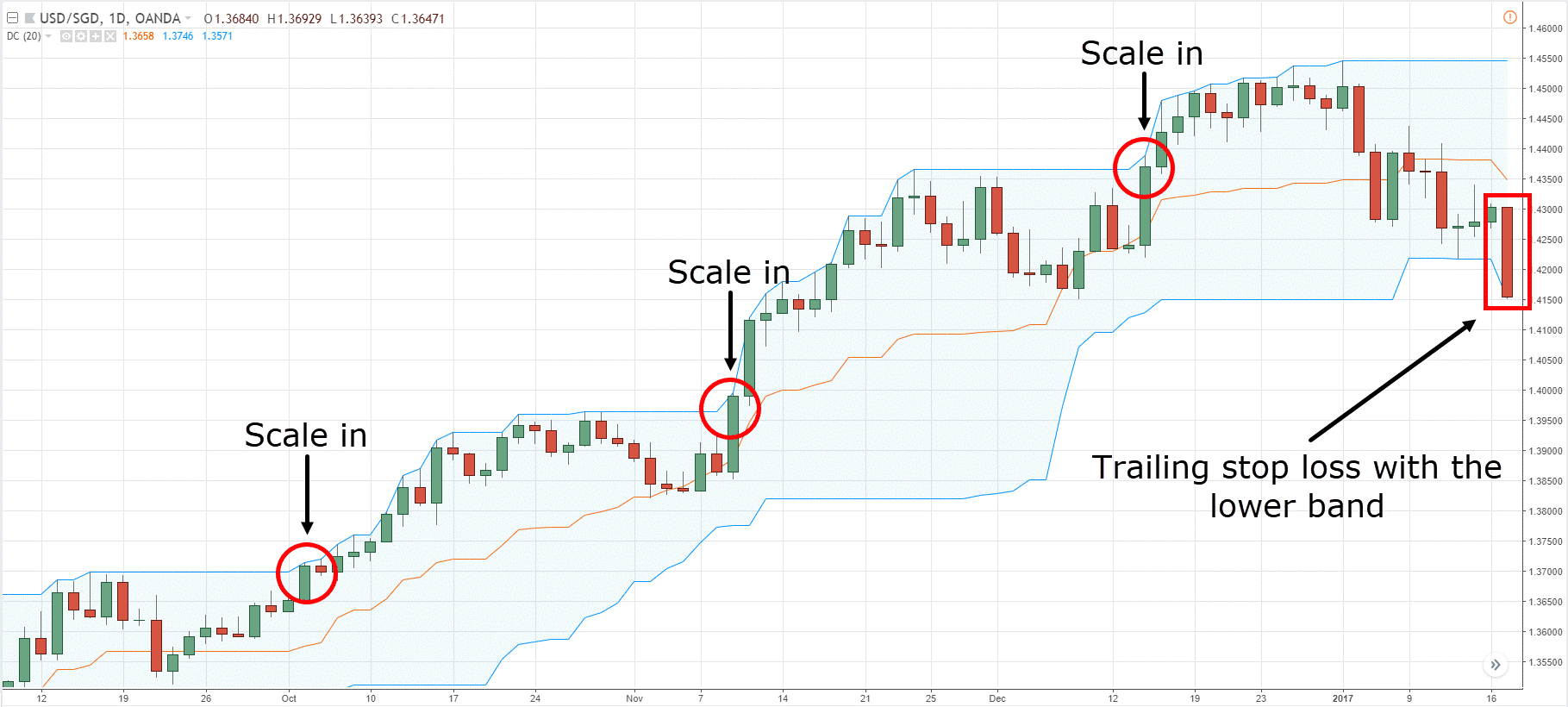

Pyramiding instructions appear on dollar bills. Add smaller and smaller amounts on the way up.

Pyramiding your trade refers to add in new positions as the market goes in your favor.

It sounds sexy as you can milk a lot of profits if you catch a trend.

But here’s the thing:

More often than not, it’s not going to happen.

So, when you’re pyramiding your trades, you want to be conservative.

You don’t want to pyramid your trades aggressively, or else when the pullback comes, you’ll lose everything (and more).

So here’s how you can do it…

1. Have open profits of at least 2R

Because if the market goes against you, you have a “buffer” to withstand the pullback.

If you have no open profits and you scale in your trade, you might lose more than intended.

2. Scale in your winners with reduced risk

Next, you can use the Donchian Channel breakout as an entry trigger.

Now, you don’t want to risk 1R on your later trades because you could lose all your open profits (when the market does a pullback).

Instead, scale in with 0.5R (or less).

This lets you better withstand the pullback and still earn a larger profit if the market moves in your favor.

3. Determine your exit

Lastly, you must know where to exit your positions.

Will you exit all at once or treat each position as a new trade?

In my experience, it’s easier to exit all positions when your trailing stop is hit and then “restart” all over again.

Here’s an example:

Trading Systems don’t eliminate whipsaws. They just include them as part of the process.

I seldom use the word guarantee when it comes to trading.

But one thing I can GUARANTEE you is this…

Every trading system has whipsaws.

Look:

I don’t care what system you’re trading (whether it’s mean reversion, Trend Following, etc.).

But it’ll make money only in certain market condition.

And when the markets change, it’ll go into a whipsaw (otherwise known as a drawdown).

Now…

A new trader will make the mistake of concluding the system doesn’t work and jump onto the next best thing.

But a professional trader understands this and will manage his risk and ride out the drawdown — till the market condition is favorable again.

Richard Dennis Trading Quotes

Richard Dennis was a Systematic Trend Follower who trades the Futures market (during the 70s and 80s)

His rise to fame came when he was featured in Market Wizards as he took a $400 trading account and turned it into $200 million.

He is also the founder of the Turtle Traders (which came from a bet he made with his partner to determine if trading can be taught, or not).

And yes, he won the bet that trading can be taught.

However, not all stories have a happy ending.

According to sources, Richard Dennis’s hedge fund suffered huge drawdown (in excess of 50%) due to aggressive risk management, and he eventually shut it down.

However, there are valuable lessons you can learn from Richard Dennis — which are still applicable today.

And I want to share them with you right now…

Whatever method you use to enter trades, the most critical thing is that if there is a major trend, your approach should assure that you get in that trend.

If you think about it…

Breakouts are the only entries that will ensure you’ll catch every single trend — every single time.

And that’s why most Systematic Trend Followers trade breakouts as their entry method.

You might be wondering:

“But what about pullbacks?”

I know pullbacks are psychologically easier to execute because you’re buying low and selling higher.

But it comes with a price — and that’s missing the entire trend because the market didn’t offer a pullback.

So if you want to be involved in every trend that comes along, then you must trade breakouts.

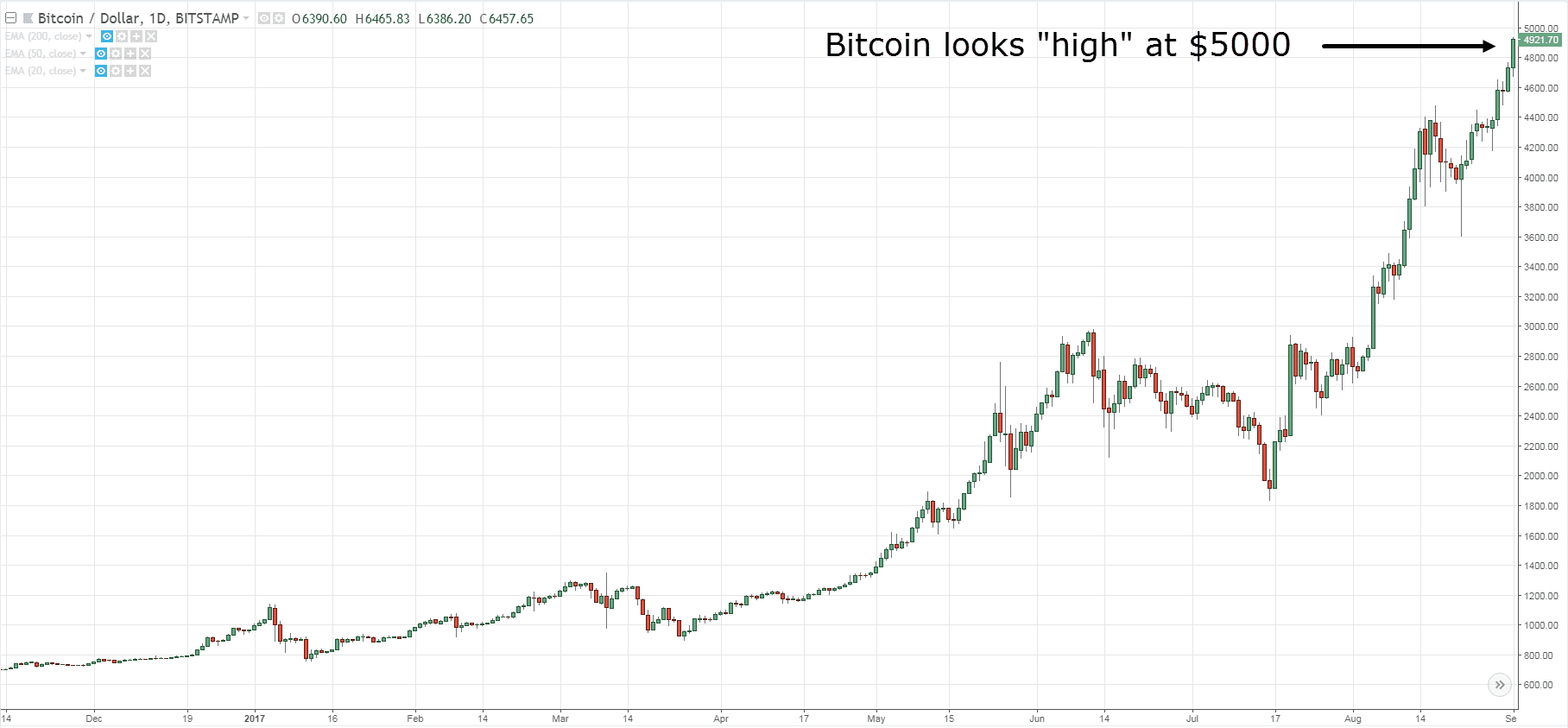

You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do.

Look at the chart below:

You’re probably thinking:

“Insane! The price is so high. I’m sure the market is about to reverse lower.”

And here’s what happens next…

BOOM!

The market exploded even higher.

I know it’s hard to believe the market can just continue to make new highs especially when it looks “overbought”.

So the lesson is this:

You can never tell if the market is too high to buy or too low to short.

Because what’s high can go higher and what’s lower can go lower.

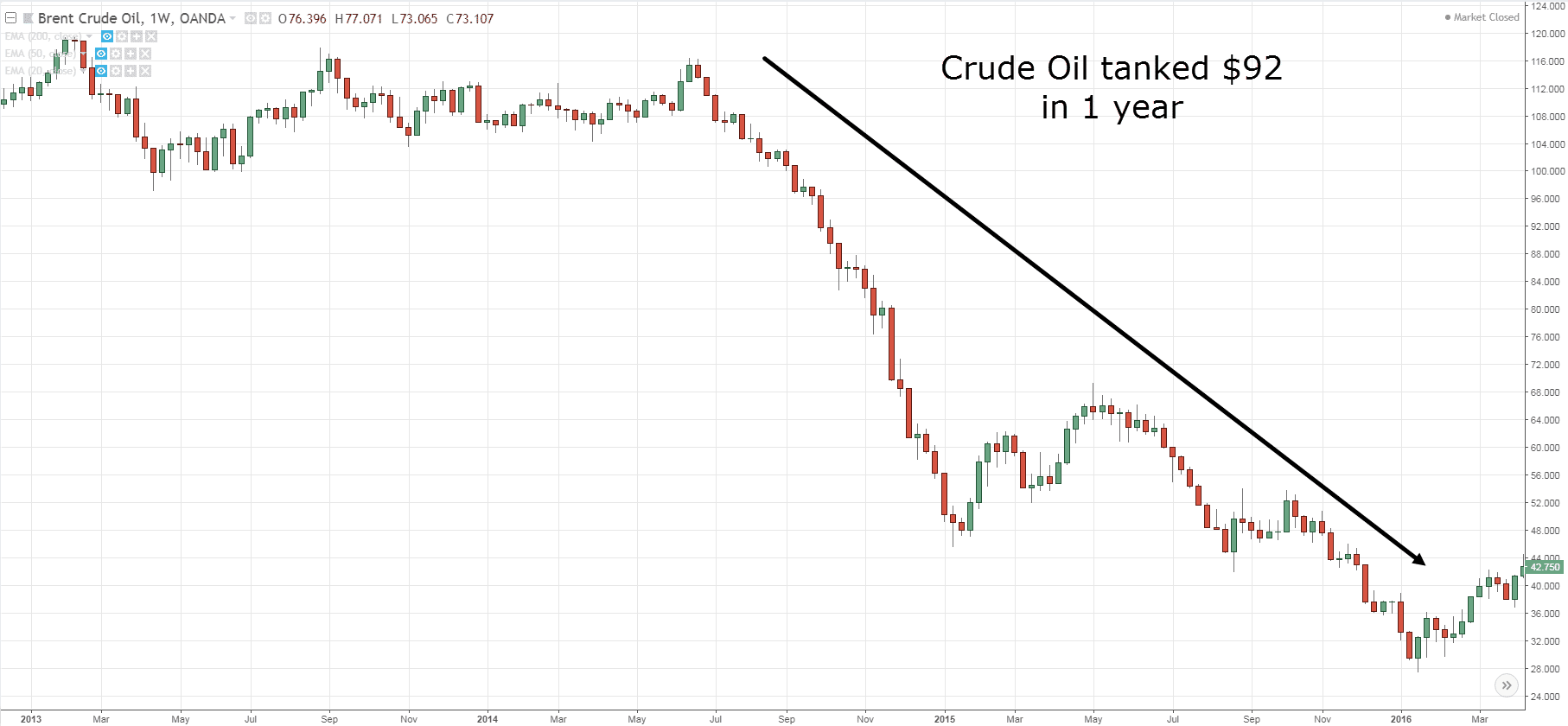

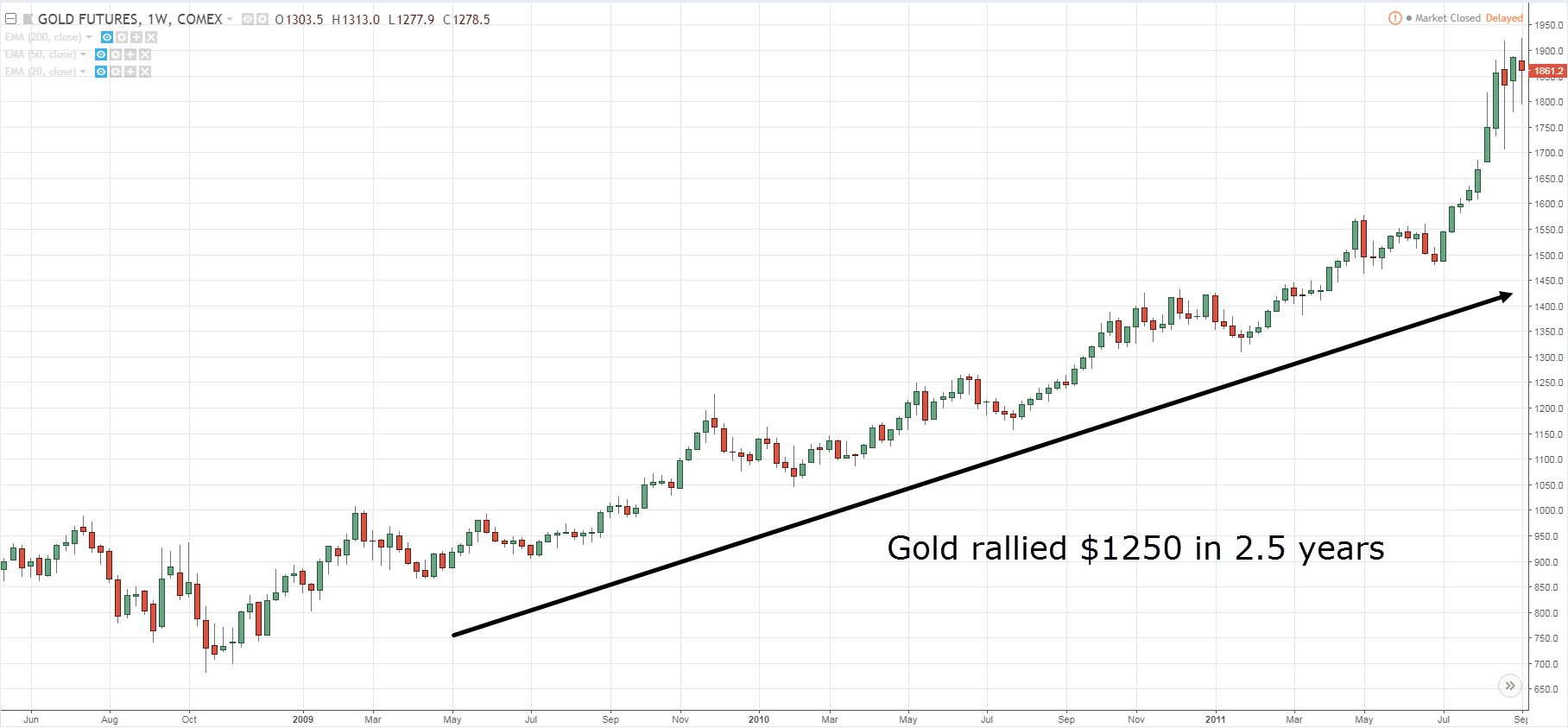

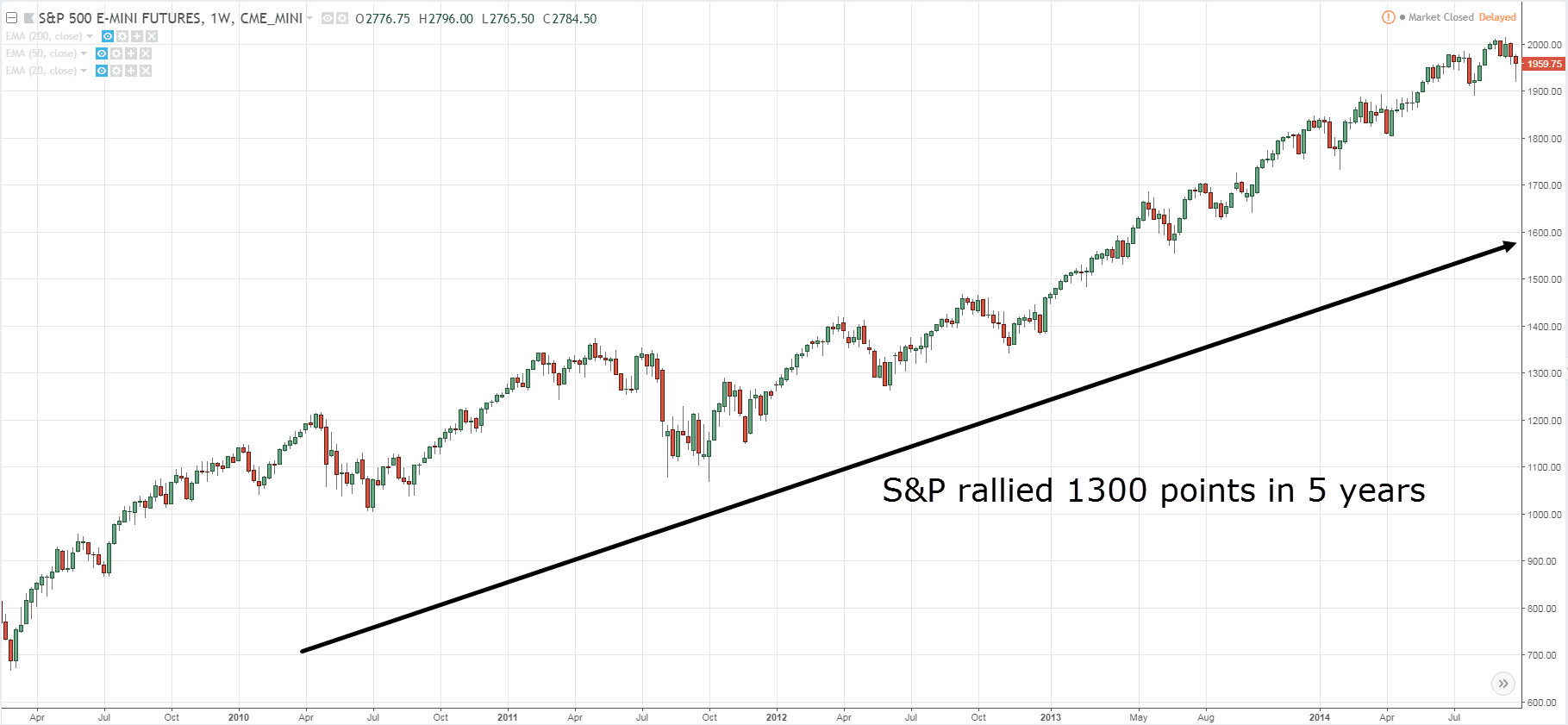

If there is any lesson I have learned in the nearly twenty years that I’ve been in this business, it is that the unexpected and the impossible happen every now and then.

If you saw the earlier Bitcoin example, you might think that such “extreme” moves rarely occurs.

Wrong!

Here are more examples…

Now don’t get me wrong.

You shouldn’t expect these moves every week or month.

But chances are, you can find these trends once every few years (and they can last for YEARS).

The bottom line is this…

If you have the discipline to ride your winners, it’ll be a matter of time before you catch one of these “monsters”.

Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

Let me ask you…

If you want to be a brain surgeon, will you immediately operate on a live human brain?

Of course not!

You’ll probably start off practicing on a “dummy” brain.

As you get better, you’ll work on a live human but only on a minor segment of it (so it doesn’t cause danger to the person).

Then as you level up, you’ll work on the major parts and finally, you have the confidence to do it on your own.

And it’s the same for trading!

You want to trade small because you’ll make mistakes — plenty of it.

So, why pay more in “tuition fees” to Mr. Market when you can do so at a fraction of the cost?

I could trade without knowing the name of the market.

You’re probably wondering:

“How is that possible?”

Well, that’s because you’re trading the price in front of you without concerning where the price is derived from.

It could be Soybean, Crude Oil, Copper, Rubber, or Cotton, who cares.

The only thing that matter is price, and nothing else.

Because the price is moved by an imbalance of buying & selling pressure which is based on emotions like fear, greed, hope, and regret.

These emotions or biases can last for a long time which in turn becomes a trend — something Trend Followers can capitalize on.

And that’s why you don’t need to know the name of the market.

All you need to know is…

- Buy what’s going up

- Sell what’s going down

- Repeat

In the real world, it is not too wise to have your stop where everyone else has their stop.

Let me ask you…

Do you always get stopped out only to watch the market reverse back in your intended direction?

Because you put your stop loss where everyone else puts it (like below Support) — which creates an incentive for the “smart money” to hunt your stop loss.

So, how can you avoid it?

By setting your stop loss AWAY from the obvious market structure.

This means don’t place your stop loss smack under Support, or just above Resistance.

I cover in more details here: How to Avoid Stop Hunting While Other Traders Get Stopped Out

Richard Rhodes Trading Quotes

Do you know who’s Richard Rhodes?

I’ve no idea as well.

But I came across a few of his trading quotes and I really enjoyed them.

Also, this shows you can learn stuff from any traders you come across, not just the famous ones.

So here goes…

In a bull market, one can only be long or on the sidelines. Remember, not having a position is a position.

Here’s the deal:

Many traders think just because a market is in an uptrend, you’re supposed to buy.

Not true.

Because sometimes there just isn’t any trading opportunity even though the market is in an uptrend.

This is especially so when the market has gone parabolic and it’s too late to enter.

An example:

Bitcoin made a meteoric rise to $20,000 (December 2017) in just a few weeks.

Clearly, Bitcoin is in a strong uptrend.

But the problem is, where do you enter the trade?

The nearest market structure is around $13,000.

This means if you were to buy right now (around $19,000), a logical stop loss is in the region of $12,000.

Do you want to swallow a $7,000 move as your stop loss?

So remember, just because the market is trending doesn’t mean you have to be in a position.

And not having a position is a position itself.

Buy that which is showing strength – sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied.

Let me tell you a story…

When I was young, my parents would always bring me to the supermarket to buy groceries.

Whenever I want to buy something, they had to make sure it’s cheap (or it’s no go).

For example:

- Buying apples at 3 for $2

- Buying milk at $1 per litre

- And etc.

Now, this makes sense when you’re a consumer of goods.

But if you’re speculating the markets, buying cheap isn’t a good idea.

Here’s why…

#1 What’s cheap can become cheaper

You might have heard the saying…

“What goes down must come up.”

Well, guess what?

It doesn’t apply to the financial markets.

Because what’s cheap can become cheaper and you’re left holding crap that can’t be consumed.

#2 You’re trading against the trend

When you buy cheap stocks, you’re trading against the trend — and the probability of a loss is higher.

When comparing various stocks within a group, buy only the strongest and sell the weakest.

At this point:

You’re convinced you should avoid cheap stocks and focus on the strongest ones.

And here’s how you do it…

Let’s say, for example, you’re bullish on the Technology sector.

So, what you can do is identify the strongest performing stocks in the Technology sector.

You can use an indicator like the 200-day Rate of Change (ROC) and rank these stocks from the highest ROC value to the lowest.

Stocks with the highest ROC value are the strongest and you want to focus on buying these stocks (as they have increased the most in price over the last 200 days).

Pro Tip:

You can also use the ROC indicator to identify the strongest performing sectors.

Then within the sector, identify the strongest performing stocks.

Be patient. If a trade is missed, wait for a correction to occur before putting the trade on.

I know it’s tempting to chase the markets.

You see a strong breakout with big bullish candles.

And you think to yourself…

“Man, this market is still going higher! Let me buy some and exit for a quick profit.”

Bad move.

Why?

Because that’s when the market is about to make a pullback or reverse altogether — and you get stopped out.

So, what’s the solution?

Let the price to retrace towards an area of value (like Support, Trendline, Moving Average, etc.).

Then, let the market show signs of strength before buying (this can be in the form of bullish reversal candlestick patterns).

Finally, use the area of value to set your stop loss so you have “something” that’s working in your favour.

An example:

Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expect.

When you enter a trade, it’s unlikely the market will immediately go into profit.

Instead, it’ll test your mental strength.

It goes a little bit in your favour, and then it reverses.

Next, it starts chopping up and down and just when you think it’s about to breakout…

BOOM.

It makes a huge reversal.

And when you’re close to getting stopped out… then it finally breaks out and moves in your favour.

So it’s a profitable trade?

Nah.

You exited the trade too early and miss the move — ouch.

So here’s the deal:

Whenever you put on a trade, you must have a plan to manage your trades (also known as trade management).

Or else, you’ll exit your trades at the worst possible time (just when the market is about to explode in your favour).

And to help you with your trade management, here are 2 questions to ask yourself…

- Where will I exit if the market moves against me?

- Where will I exit if the market moves in my favour?

Moving on…

Market form their lows in quiet conditions.

In a downtrend, the market behaves in a volatile manner.

You can expect a massive drop in price as traders/investors sell in panic. This appears as big bearish candles on your chart.

Now, this can’t go on forever.

Eventually, the weak hands have sold their holdings and that’s when the market stabilizes.

As the market stabilizes, the volatility of the market is reduced and that’s when the “smart money” accumulates their position.

Here’s what I mean:

So here’s the lesson:

When the market plunge day after day, you don’t want to catch the falling knife because you never know where the low is.

Instead, let the market consolidate and form a range (otherwise known as an accumulation stage).

Once you’ve identified the highs of the range (which is Resistance), you can use it to time your breakout and catch the next wave higher.

Make sense?

Markets form their tops in violence; the final 10% of the time of a bull run will usually encompass 50% or more of the price movement.

When the market is in a strong bull market, everyone who buys is making money.

And there’s little selling pressure because everyone is thinking along the lines of…

“Why sell now when my open profits are growing each day?”

That’s how the price goes parabolic and reaches an unsustainable level.

But as you know, the market cannot go up forever.

Eventually, there’s no one left to buy and the market collapses.

Here’s an example on Bitcoin:

Now as a trader, your job is not to predict how high the markets will go.

So, if you happen to catch a parabolic move, don’t be too happy, yet.

This is the time to tighten your stop loss as you don’t want to see your open profits vaporize before your eyes.

That’s why you want to trail your stop loss using the previous day (this means if the price closes below the previous day low, you exit the trade).

You’ll never exit at the highs, but at least, you capture a good chunk of the move others can only dream off.

Conclusion

Here’s the deal:

There are many ways to skin a cat. And that’s why it’s common to hear trading quotes contradict one another.

For example, you have heard the saying…

“Never let your winners become losers.”

But if you’re a Trend Follower, you’ll be familiar with…

“Get comfortable with watching your winners become losers. That’s the cost of doing business”

Clearly, there’s no right or wrong here because it depends on your trading approach.

So the bottom line is this:

You’ve got to think for yourself and decide what is relevant to your trading and what’s noise (no one can do it for you).

Now here’s what I’d like to know…

What’s your favourite trading quote?

Leave a comment below and share your thoughts with me.

nice one and unique

cheers

Very good quotes.

Thank you, Rajaram.

You should expect the unexpected in this business,expect the extreme,don’t think in terms of boundaries that limit what the market might do . I like this quote the most

Thanks for sharing!

I studied the whipsaw period during a trend reversal proces. I used to open positions in this period and lost a lot of money because price went ‘against’ me. I now use 50ema and 100ema and now I know I have to wait. I enter after the price is above the 100 ema AND the 50ema is (almost) above the 100ema on the 5 minute scala. Works also in a down move. And then…patience!

Thanks for sharing, Bas!

Sir please provide print option on your articles as your articles are important so that i can print and read these articles in book format

Thank you Sir. I have been following your posts since the beginning of this Year2019 and iv learn a lot……I cannot wait to subscribe for PRO TRADERS EDGE next year. mmmmmh

Cheers bud

“You should expect the unexpected in this business; expect the extreme. Don’t think in terms of boundaries that limit what the market might do” This quote is my favorite one

Thanks Rayner for not being tired of publishing these articles.

My pleasure, Rajabu!

Hi!

This is a really good read for me. Thanks for the excellent contribution to the discussion.It is very informative blog for me…..Thank you!

My pleasure!

This is a very good article. As far as I’ve read several articles. Thank you.

My pleasure!

Thanks a million

Cheers Michael

very nice and intresting facts

Hey Sravanisuresh,

You are most welcome!

Small profits-ok

Small loss-ok

Big profits-ok

Big loss- Not ok

There is no 100% holy grail strategy, risk management works forever.

My Favorite Quote

“Buy that which is showing strength – sell that which is showing weakness. The public continues to buy when prices have fallen. The professional buys because prices have rallied”.

I just wait till there is money lying in the corner and all I have to do is go there and pick it up. In the meanwhile I do nothing at all. — Jim Rogers.

The way you share your knowledge is simply superb

Hi Raghu,

I’m so glad to hear that!

Trade small because that’s when you are as bad as you are ever going to be. Learn from your mistakes.

Hi Deepak,

Nice one there!

Cheers.

My favorite quote addresses my biggest fault: “Be patient. Once a trade is put on, allow it time to develop and give it time to create the profits you expect.”

Set and forget trades is better, you just need to look at your chart once in a while, it creates room for mental healthiness in trading

Hi Richy,

Not forgetting risk management.

Thanks you for your contribution!

You should be doing a video about creating a trading system with small accounts and if not already

Always great advice. Thanks

Thank you, Pat!

What goes up, must come down! (Sometime) even bitcoin…

Thank you. Life saving article for me as a beginner. I just had $200 account blown off because I didn’t know some of the things discussed here. I will put them in practice as I fund the account again.

Awesome, Neyo!

“In the real world, it is not too wise to have your stop where everyone else has their stop.” This has helped me to be a better trader

Awesome, Success!

Great article

Thank you, Taffy!

There is no CERTAINTY In TRADING, only PROBABILITIES

Thank you for sharing, Uchefuna!

We’re glad you find our materials informative!

Cheers!

Thanks Thanks very much

Nice stetige l learn very much

Happy New year

You’re most welcome!

You’re not going to play a winning hand everyday and that’s okay

Yeah! Thank you for sharing your thoughts, Zelio!

Cheers!

You are the best bro