Follow The Money

How to earn an extra 13 – 26% a year without reading financial reports, studying chart patterns, or following the news.

You’re probably thinking: “What is follow the money?”

Well, it means tracking what hedge funds and banks are doing because they are the largest players in the financial markets. When they buy, their size is in the billions of dollars.

This means when they decide to take on a position, they can move the market for weeks, and sometimes even months.

For example, in October 2011, the Bank of Japan intervene the currency market and bought a ton of USD/JPY.

Here’s what happened next…

If you pay close attention, you’d realize the rally took many months to play out. In other words, a retail trader like you can reap massive gains just by following the money.

So far so good?

Great!

Now let me share with you 3 secrets I’ve discovered while learning from hedge funds and banks…

1: Focus on larger markets

Large markets refer to markets that have a large market capitalization like the S&P 500, gold, bonds, etc. These are some of the largest markets traded by hedge funds and banks. Why?

Recall, hedge funds and banks move millions if not billions of dollars. If the market is too small, they can’t trade it because they end up becoming the market.

That’s why hedge funds and banks prefer to trade in the largest markets. And that’s not all because trends in these markets can persist for a long time.

Here’s the performance of the S&P 500 over the last 10 years…

Pretty sweet, right?

On the flip side, smaller markets are manipulated with pumps and dumps.

Here’s an example of a pump and dump on GME stock…

So if you want to follow the money, stick to larger markets.

They are less manipulated and the trends persist longer (which makes it easier for you to profit from it).

But as you know, there are hundreds of markets out there. So which should you trade?

Let’s find out…

2: Risk on and risk off

When you hear the term risk on, it means investors are willing to take on more risk and they will buy riskier assets like stocks.

On the other hand, when you hear the term risk off, it means investors are more cautious and prefer to buy safe-haven assets like gold, bonds, etc.

So to cover both sides, the markets in your watchlist should contain both risk on and risk off assets.

This way, if one market doesn’t do well, you can still find opportunities in other markets.

Let me give you an example: during the 2008 financial crisis, the S&P 500 collapsed 55% lower…

If you were only long stocks, then you’re shit out of luck.

On the other hand, if you were to pay attention to gold, then you’d have buying opportunities as it was in a steady uptrend…

This means…

If you only trade one asset class like stocks, and the bear market hits, guess what? You’ve soiled your pants.

But when you have both risk on and risk off assets in your watchlist, the bear market isn’t as painful, and you might even profit from it.

Moving on…

3: Momentum — the most powerful force in the market

This has nothing to do with Star Wars, lol.

So, what is momentum?

Momentum refers to buying strong markets that have recently shown signs of strength because they are likely to continue higher.

To prove my point, I’ve developed a momentum trading system called, Follow The Money.

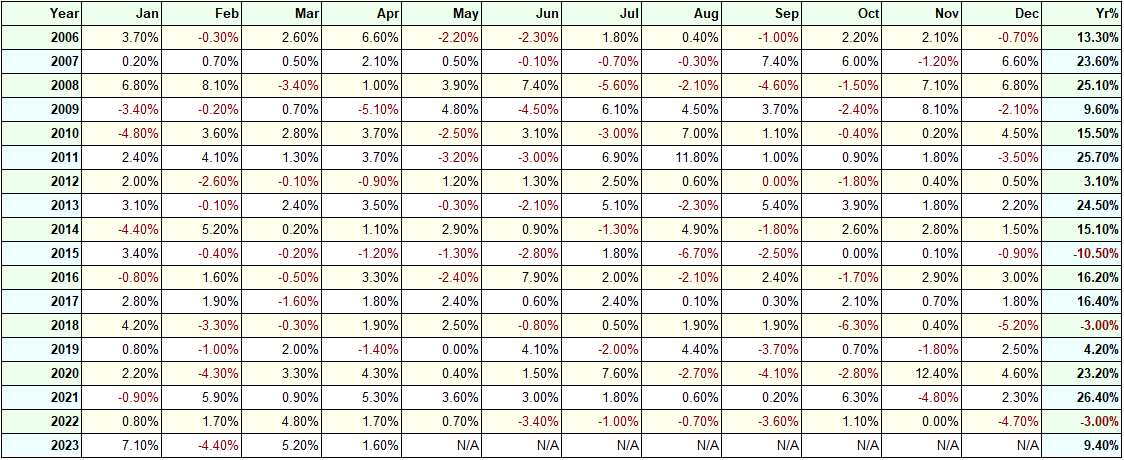

Here’s the result of it over the last 17 years…

Now there are many reasons why momentum works.

For one, trading is an emotional endeavour. When you see the market going higher, you can’t help but get tempted to buy because you have the fear of missing out.

So when thousands of traders feel the same way, it can trigger a strong buying momentum that lasts for months.

So now the question is, how do you define momentum and use it to your advantage?

One useful technique is to use the rate of change (ROC) indicator.

The ROC indicator measures the change in price over a fixed period.

For example, if the 300-day ROC has a value of 50, then it means the market has increased 50% over the last 300 days.

So with this in mind have a look at this below…

Invesco DB Commodity Index Tracking Fund (Daily Timeframe)

As you can see, Invesco DB Commodity Index Tracking Fund (CNQ) is showing signs of strength and its 300-day ROC value is 57.32. This means DBC has increased by 57.32% over the last 300 days. Next…

Ishares 20+ Year Treasury Bond ETF (Daily Timeframe)

As you can see, Ishares 20+ Year Treasury Bond (TLT) is showing weakness and its ROC value is -9.89. This means TLT has decreased by 9.89% over the last 300 days.

Now, if you want to buy the strongest ETF, which would you choose?

DBC, of course!

That’s because it showed stronger momentum (an increase of 57.32%) compared to TLT (a decrease of 9.89%).

And here’s what happened 3 months later…

DBC experienced a gain of 38.7% over the next 3 months.

On the other hand…

TLT experienced a loss of 19.4% over the next 3 months.

Can you see how powerful momentum is?

By the way, you can use this technique to trade other markets as well like stocks, commodities, etc.

Does it make sense?

Great!

As a quick recap…

To follow the money, you need to…

- Focus on larger markets so there’s less price manipulation

- Trade both risk on and risk off assets so you can profit in different market conditions

- Trade with momentum because it’s the most powerful force in the financial markets

Now…

If you want to take things a step further, then I’d like to introduce to you a trading system called…

Follow The Money (FTM)

Follow The Money (FTM) is a trading system that helps you earn an extra 13 – 26% without reading financial reports, studying chart patterns, or following the news.

Here’s an overview…

- Follow The Money is a trading system that takes less than 10 minutes per month so you have the freedom to do the things you love

- It trades some of the largest ETF markets so you are less susceptible to market manipulation and can ride long-term trends

- Profitable over the last 15 out of 17 years (including the 2008 financial crisis)

And here’s the result over the last 17 years…

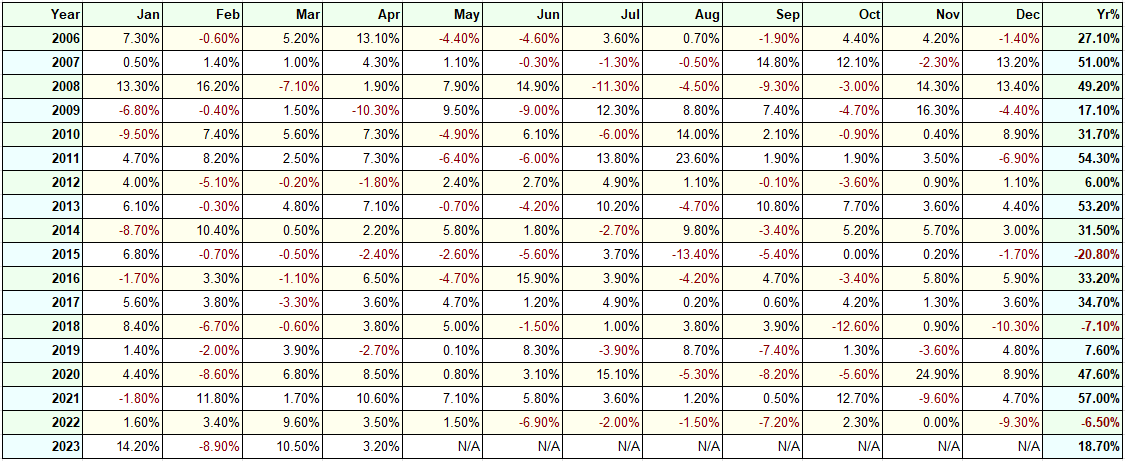

Since this is a low-risk trading system with a maximum drawdown of 16%, you can use leverage to boost your returns.

And here’s the results of it (using leverage)…

Now, as much as I would like to say Follow The Money system is the best and you should get your hands on it!

But the truth is, it’s not for everybody.

So read carefully to find out if you’re a good fit…

Follow The Money system is FOR you if…

- You want to generate an extra 13 - 26% a year without watching the markets all-day

- You want to trade in a rule-based manner without guesswork

- You are open to trading exchange-traded funds (ETFs)

Follow The Money system is NOT for you if…

- You want to be a discretionary trader and learn things like candlestick patterns, chart patterns, trendlines, etc.

- You are borrowing money to trade

- You have a get-rich-quick mindset and looking to earn 100% return in a few months

Still reading?

Great! Then it means you’re interested and likely to be a good fit.

So here’s what you’ll get when you enrol today…

1: Follow The Money (Masterclass)

8-part video series

In this 8-video masterclass, you’ll discover:

2: Follow The Money (Monthly Trade Alerts)

Once you’ve learned how Follow The Money system works, the next step is to trade it.

But you might be thinking…

“I’m not sure if I can identify the setup correctly or if my entries & exits are correct.”

No worries!

Because every month, you’ll get an email update that tells you what ETFs to buy, hold, or sell.

This means you’ll be able to execute the trading system flawlessly and can quickly get consistent results.

3: Follow The Money (Monthly Performance Report)

After you place a few trades using Follow The Money system, you’ll wonder…

“What kind of results can I expect?”

Well, you’re in luck!

Every month, you’ll get a report that tells you how Follow The Money trading system is performing (whether it’s making or losing money, I’m transparent about it).

If your results are similar to the report, then it means you are doing the right thing and this gives you confidence to place future trades.

But if your results differ, it means something is off and we’ll help you fix things immediately.

Also, you’re protected by my legendary make money your money back guarantee

Here’s how it works…

- Go through Follow The Money masterclass so you know how the trading system works.

- Execute 50 trades by following our monthly trade alerts.

- If you have lost money after 50 trades, I'll happily refund you in full and even give you an extra $500 for wasting your time.

The best part?

You can trade the system on a demo account so you have zero risk (and you’re still covered by my money-back guarantee).

However…

If you just want to check things out and refuse to do the work, then please don’t sign up—you won't be covered under our guarantee.Frequently Asked Questions (FAQ)

Got questions? No problem, here are your answers…

Which markets does Follow The Money (FTM) trading system work on?

FTM trading system trades ETFs (also known as exchange-traded funds).

These markets have huge liquidity which makes it less susceptible to price manipulation.

The specific ETFs to trade will be covered in our masterclass.

Do I need programming knowledge?

No, you don’t.

I am new to trading. Will FTM work for me?

Yes.

The FTM masterclass is taught in a step-by-step manner so you’re not overwhelmed or confused.

Each lesson is less than 10mins so you can quickly master the trading system without sitting through hours of boring lectures.

Can I use FTM trading system to trade forex, stock, or crypto markets?

No. FTM trading system is designed only to trade the ETFs market.

As a recap, here’s what you’ll get:

Click the button below and get instant access to Follow The Money trading system for just $390 /year.

By enrolling, you agree to the terms and conditions stated below:

- The information provided by TradingwithRayner is for educational purposes and in no instance to be regarded as investment advice.

- TradingwithRayner is not liable for any losses incurred from your investment activities.

- Any financial numbers referenced here are estimates or projections or past results, and should not be considered exact, actual or as a promise of potential earnings — all numbers are illustrative only.