#3: What is a Bullish Engulfing Pattern

Lesson 3

What is a Bullish Engulfing Pattern

In this video, you'll learn about the Bullish Engulfing pattern.

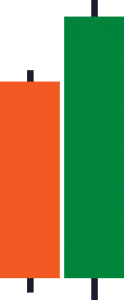

Let me share with you what it looks like:

Let me explain to you the concept behind it.

You can see that when the first candle opens, the sellers came in and took control and pushed price all the way down lower, closing near the lows.

What happened next, is that the subsequent candle opened near the lows.

The buyers stepped in and pushed price all the way back higher.

Even higher than the previous day highs.

And then finally closing near the highs.

You can see that this a Bullish Engulfing pattern.

Because it has “engulfed” the previous candle.

This is a bullish reversal pattern, a bullish engulfing pattern.

One thing to note is that, the larger the bullish engulfing pattern, the more significant it is!

Right now...

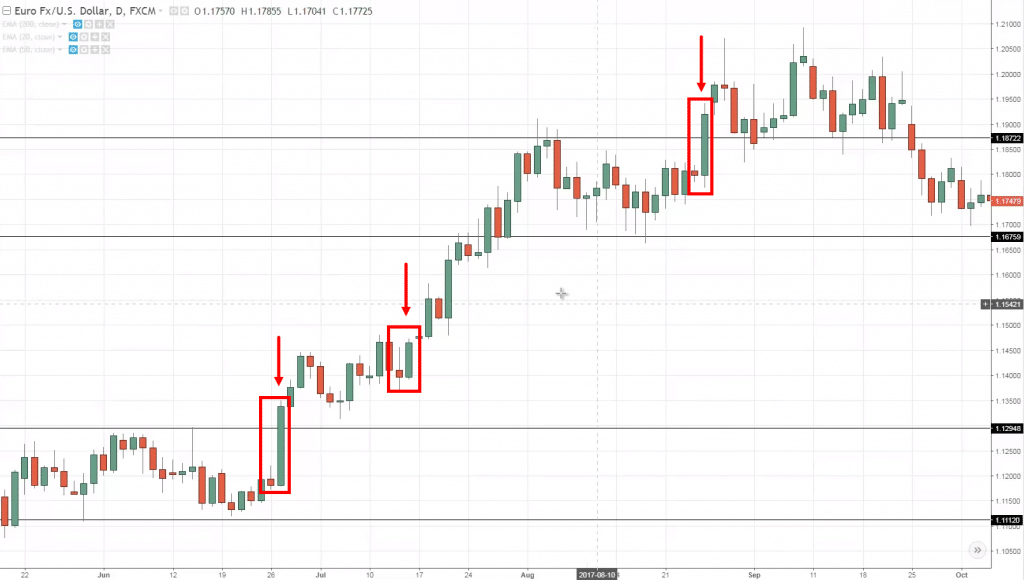

I'm just going to walk you through and share with you an example:

You can see over here, this is the EUR/USD Chart.

You can see that the candle opened near the lows, and then closed above the previous candle open.

To me, my definition of a bullish engulfing is that the candle has to be larger than the body of the previous candle.

I hope you have an idea of how it is.

Remember, never ever treat candlestick patterns in isolation.

This means that if you see a bullish engulfing pattern on your chart, don't just blindly go long.

This is not enough.

It doesn't give you an edge in the markets.

With that said, here's a quick recap…

Recap

- A bullish engulfing pattern is a bullish reversal pattern.

- Buyers are momentarily in control.

- The larger it is, the more significant the pattern is.