Here’s the thing:

If you study most trading textbooks, you’ll learn the Bear Flag is a bearish chart pattern.

And what would most new traders do?

You identify a Bear Flag Pattern and go short immediately.

Then the next thing you know…

The market reverses higher and whips you out of your trade.

And then you wonder:

“Wtf is wrong? I thought it’s supposed to be an EASY pattern to trade.”

Well, that’s because you’re making this big mistake.

But don’t worry.

I’ll show you how to fix it (and more) in today’s post.

You’ll learn:

- What is the definition of a Bear Flag and how does it work

- Don’t make this BIG mistake when you’re trading the Bear Flag

- How to better time your entries when trading the Bear Flag

- Bear Flag: How to maximize your profits and ride enormous trends

- A Bear Flag Trading Strategy (a formula you can use)

Ready?

Then let’s get started…

Bear Flag definition: What is it and how does it work?

A Bear Flag is a bearish chart pattern that signals the market is likely to head lower (and the opposite is called a Bull Flag).

Sometimes, traders often call it the inverted flag pattern as opposed to the bull flag.

You’ll see:

- A strong momentum move lower with large range candles

- A weak pullback with small range candles

Here’s what it looks like…

1. A strong momentum move lower with large range candles

This means the sellers are in control with little-to-no buying pressure.

That’s why the range of the candles is large as the sellers could easily push the price lower.

2. A weak pullback with small range candles

There’s some buying pressure pushing the price higher and it’s likely from traders taking profit on their short positions.

If nothing changes, the market is likely to continue lower by forming a bearish flag.

Now, you’re probably thinking:

“Let me find some Bear Flag patterns to short and make some easy profits!”

Well, not so fast.

Here’s why…

Don’t make this BIG mistake when you’re trading the Bear Flag

Here’s the thing:

A bear flag pattern, inverted flag pattern, or whatever you call it…

Is NOT created equal.

You might see two identical Bear Flags but, one is worth trading, and the other you want to avoid at all cost.

Why?

Because the location of the Bear Flag matters, a lot.

I’ll explain…

When the market is in a downtrend, there’s an ebb and flow to it.

It makes a move lower, does a pullback, and then makes a new low.

Think of it like a rubber band.

It will “stretch” so far before moving back towards the mean.

So, what has it got to do with trading the Bear Flag?

Simple.

When the market is “overstretch” (or far from the Moving Average), you don’t want to short the Bear Flag pattern because the price is likely to reverse higher.

Here’s an example:

Great!

Moving on…

So, when should you trade the Bear Flag pattern?

Based on my experience, these are the 2 best times to trade the Bear Flag…

- The price is near the Moving Average

- The first pullback after a break of Support

I’ll explain…

The price is near the Moving Average (MA)

As mentioned earlier…

You don’t want to short the Bear Flag when the price is far from the Moving Average because the price is likely to reverse higher.

Instead, wait for the price to retrace towards the Moving Average (like the 20MA) and then look for short opportunities.

Here’s an example:

The first Bear Flag after a break of Support

Now:

When Support breaks, many traders will “chase” the market lower hoping to catch a piece of the move.

But that’s a bad idea.

And here’s why…

- You have a poor risk to reward

- You have a low probability trade

- You have a high risk of getting stopped out

So, what should you do?

You wait for a Bear Flag to form (after the breakdown of Support).

Here’s what I mean…

- You have a more favorable risk to reward

- You have a higher probability trade (as the buyers are not showing strength)

- You can set your stop loss at a logical level (above the high of the Bear Flag)

Now at this point:

You’ve learned WHEN to trade the Bear Flag.

So in the next section, you’ll discover HOW to time your entries with precision on a bearish flag.

Read on…

How to time your entries (with precision) when trading the Bear Flag

Here are 2 techniques you can use:

- Short the break of the swing low

- Short the Break of the Trendline

Let me explain…

Short the break of the swing low

Here’s how it works…

If the price forms a Bear Flag, then you can short the break of the swing low.

Here’s an example:

Short the break of trendline

Alternatively…

You can short the break of the trendline of that bearish flag.

Here’s what I mean…

“So where do I set my stop loss on a bearish flag pattern?”

Well, you can set it 1 ATR above the high of the Bear Flag pattern.

Because if the price reaches that level, it invalidates the Bear Flag pattern and there’s no reason to stay in the trade.

If you want to learn more, go watch this training below…

https://youtu.be/M79kxiOMJJg

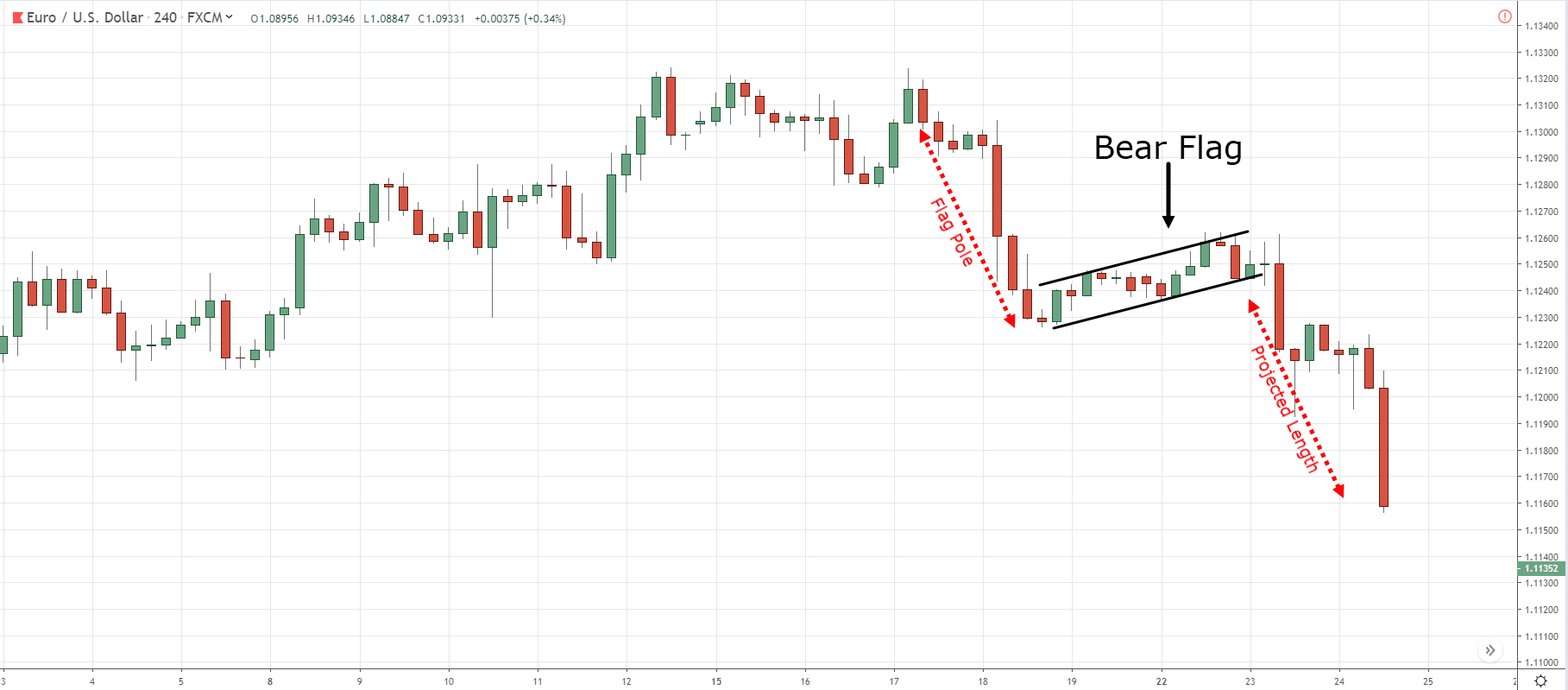

Bear Flag: How to maximize your profits and ride enormous trends

Now…

If you’re looking to only capture 1 swing lower, you can use the price projection technique.

Here’s how it works:

- Measure the length of the “flagpole”

- Project this length downwards from the breakdown of the “flag”

For example:

But if you want to capture the MEAT of the trend after entering a bearish flag pattern…

Then you’ve got to use a trailing stop loss.

Here’s what I’ve noticed…

Often when you short the Bear Flag, the price is usually below the 20MA.

This means you can trail your stop loss with the 20MA and ride the move lower.

An example:

If you want to ride the medium-term trend, you can trail your stop loss with the 50MA.

If you want to ride the long-term trend, you can trail your stop loss with the 200MA.

Now…

If you don’t want to ride a trend and just want to capture “one swing”, then you can trail your stop loss using the previous candle high.

This means you’ll exit your trade when the price closes above the previous candle high.

Here’s what I mean…

“So which method is better?”

Well, there’s no best method.

It depends on you — your goals and what you want from trading.

Once you figured it out, then you can find an approach that suits you best.

A Bear Flag Trading Strategy (a template you can use)

Now, for any trading strategy to be complete, it needs to answer these 4 questions…

- What’s the market condition?

- What’s the entry trigger?

- Where will you set your stop loss?

- How will you exit your winners?

And if you realized, these are stuff you’ve just learned earlier.

So, let’s write it out in the form of a trading strategy (that you can refer to).

Here goes…

If the price breaks below Support, then wait for a Bear Flag to form.

If a Bear Flag is formed, then short the break of the swing low and set your stop loss 1 ATR above the swing high.

If the price moves in your favor, then trail your stop loss with the 20MA.

Here are a few examples…

PLATINUM Daily:

You can “adjust” the trading strategy to your own needs (like having a fixed target profit, trailing with different MA, etc.).

And whatever the case is, you must do your own testing and not just “blindly” copy what’s been shared.

Conclusion

So, here’s what you’ve learned today:

- The Bear Flag Pattern is a bearish trend continuation pattern

- Don’t trade the Bear Flag when the price is far from the Moving Average

- The best times to trade the Bear Flag is when the price is near the Moving Average or the first pullback after a break of Support

- You can enter a Bear Flag on the break of the swing low or a trendline

- A Bear Flag Trading Strategy (a template you can use)

Now, here’s a question for you…

How do you trade the Bear Flag pattern?

Leave a comment below and share your thoughts with me.

I was finding flag patterns anywhere.. but Now will find only after just breakout.

Thank you very much Rayner for best lesson.

My pleasure!

very good. detail and.logic explanation/narration.

Cheers

Hey ma friend.. Sorry this is no the answer to the question.. I just wanted to say Thank you for always updating and giving us content which nobody else gives us.. You’re the best. Please continue to bless us with this knowledge.

You’re welcome, Ruan!

Excellent one. After reading this post now getting confident. Continue it..thank you…

Awesome!

Thanks for sharing your trading guides.

You’re welcome, Alex.

In fact Rayner after reading evry thing u illustrate I understand and picture as if u re closer to me teaching. U re a professional indeed. I ve immensely learnt something new. Continue to share ur knowledge in trading to us.

Awesome to hear that, Anthony!

Hi Rayner

I have read many of your training emails in recent years with interest. You are very knowledgeable. My question to you is this, do you make a good living trading? I know you make money training? They say 80% of retail traders lose money? What’s going on?

Happy Christmas & Happy New Year to you And your Family

Yes, I do both trading and training.

Well, it’s good enough for me to put 50% of my own capital into the financial markets.

Thanks for this Rayner. I’m just curious if this can also be used on taking long for an uptrend? Also, once MA 20 support was broken (downtrend), is 1ATR below could also be considered a good entry?

The concept can be applied the same, it would be called a Bull Flag pattern.

Very educating. Thank you

You’re welcome!

Please what time frame is the best with this strategy.

There’s no best time frame.

You’ll need to find something that suits you given your own commitment and approach.

Hi Rayner,

Been following you for a little while now. Love your videos and teachings. You put a great spin on trading education.

I have a suggestion. Can you do a lesson on how to trade in a bear market sucj as what we are facing now. Many traders say they avoid trading downtrending stocks, but what to do when the whole market is in a down trend? Do you simply short the market, or is there a better trading strategy, or are you better to just sit on your cash?

Thanks!

I’ll look into it, cheers.

Thank you Rayner. You are one of the best teachers in trading.

I appreciate it, Ronny.

I learning lot of trading strategy with your lessons and its very important strategy (price action / candlstick pattern / support &resistance ) then the other indicators and analysis

Awesome to hear that, Pad!

Amazing and simple knowledgeable lesson!

Thanks so much!

Excellent, thank you

You’re welcome!

Crystal clear post. You are really a good teacher. Thanks.

You’re welcome!

very useful post. thanks Rayner as always.

My pleasure!

Sir,

How to you download your bolg in PDF formate

This isn’t available in PDF.

[…] https://www.tradingwithrayner.com/bear-flag-trading-strategy-guide/ […]

I was finding flag patterns anywhere.. but Now will find only after just breakout.

Thank you very much Rayner for best lesson.

You’re welcome, Rahul!

I will trade bear flag pattern after breakout confirmation and it must be formed near the MA.

Thank you Rayner for your support

Awesome let me know how it works out for you, cheers.

Hey Reynor, Does a trend always reverse with a reversal pattern?

Not necessarily, it can slowly grind lower and end up being a reversal.

If I trade Four(4) hour candlestick daily, is it good end the same day or let it continue

I’m not sure what you mean… could you explain?

For example, one pair in D1 forming the bear flag whereas in H4 bear flag completed. So for trading which time frame consider

May I have It in PDF since I live in Italy?

Hey, Rayner you are awesome ,

I respect your knowledge and thank you so much for this valuable knowledge .

Hi Prathamesh,

You are most welcome!

Thank you so much I’ve been watching your videos for the past 7 months and following your website you’re superbly a pro I’m peaceful with Myself now coz by reading your wonderful thesis daily as made me to be energetically poised

Thank you rayner

Stay bless as always

Thank you, Yusufah!

You are my super hero

It’s our pleasure, Zafar!