#3: What is a short position

Lesson 3

What is a short position

If you’re bearish about the market, you expect the price to go down in the future.

So what should you do?

You’ll enter a short position.

This means you’ll short sell a financial instrument.

And the exact opposite of a short position is a long position.

Let me explain…

Forex example:

Let’s say EUR/USD is 1.1234 right now.

If you’re bearish on it, you can enter a short position at 1.1234.

This means that you’re selling EUR and buying USD.

And if you buy EUR/USD to close your position at 1.1134, you’ve earned 100 pips.

Next…

Stock example:

Let’s say Apple share price is $100 at this moment.

If you’re bearish on Apple’s share price…

You’ll enter a short position to short sell its shares at $100 each.

And if you buy Apple shares at $80 each to close your position, you’ll bag a gain of $20 per share.

When do you enter a short position?

Here are two scenarios to enter a short position:

- Enter on a pullback to the moving average

- Enter on a breakdown from support

I’ll explain…

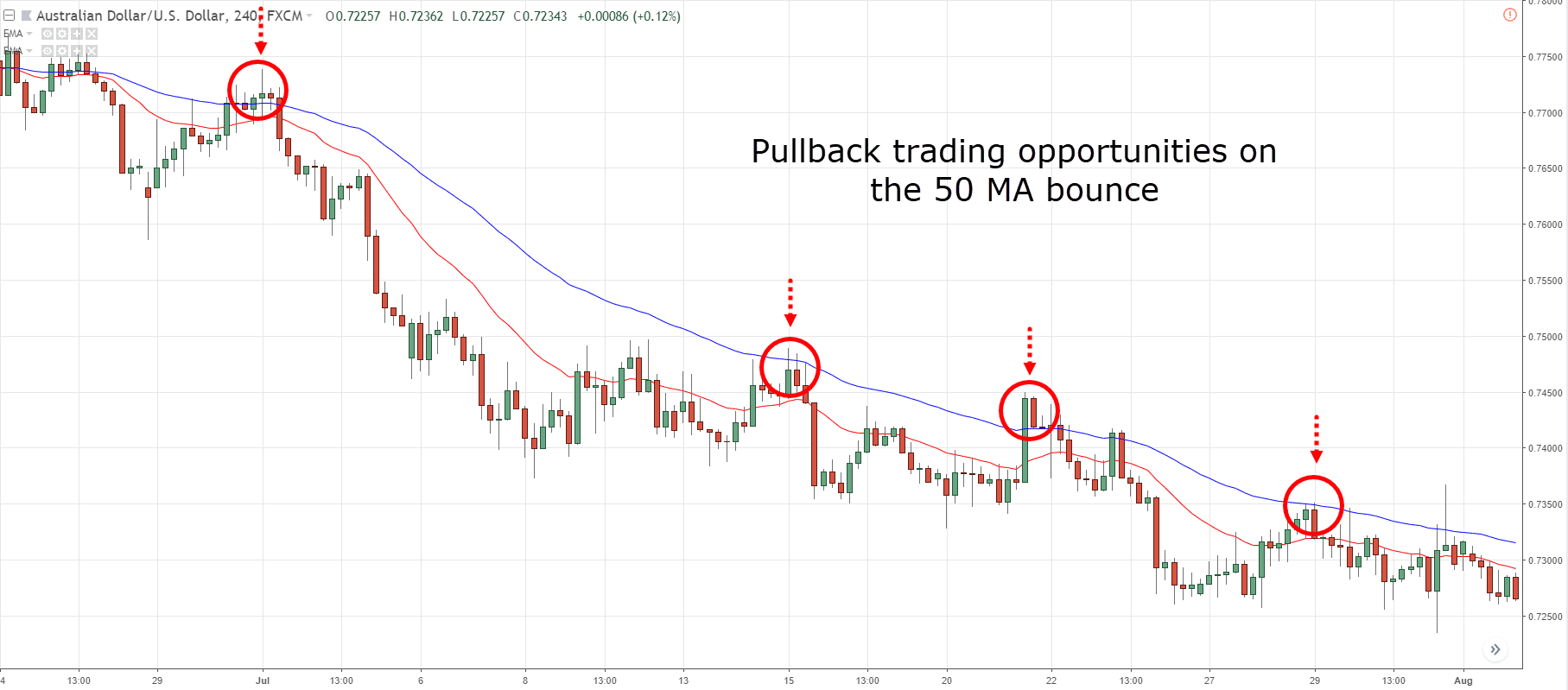

Scenario #1: Enter on a pullback to the moving averages

If the price is below the moving average, then the market is in a downtrend.

If the market is in a downtrend, then enter a short position when price pullbacks to the moving average.

Here’s what I mean:

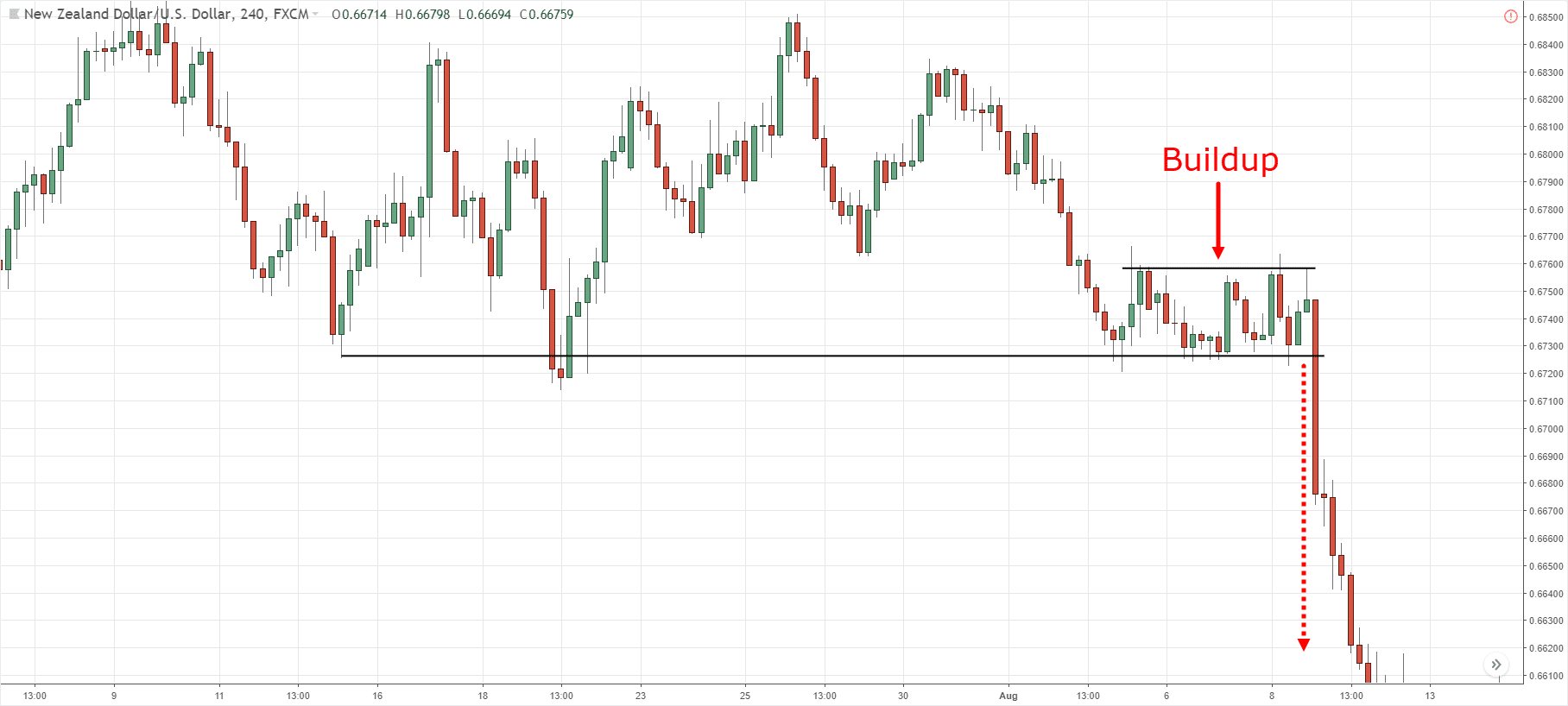

Scenario #2: Enter on a breakdown from support

If the price consolidates near support, then chances are, that support will be broken.

If price breaks below support, then enter a short position on the breakdown from support.

Now, here’s the thing:

There’s honestly no fixed way to enter a short position.

You’ll have to find the trading style that suits you over time.

If you want to learn more, go check out: