#9: What is a Doji

Lesson 9

What is a Doji Candlestick Pattern

In this video, I'll be explaining to you what is a Doji!

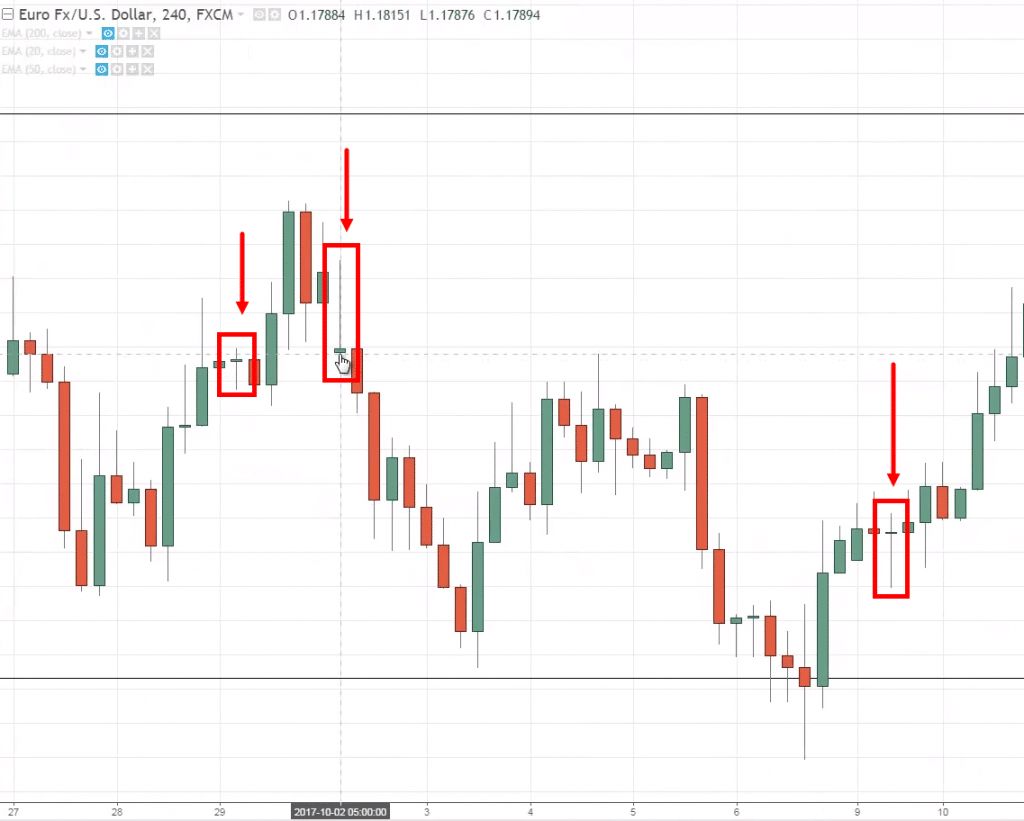

So, a Doji looks something like this:

There are different variations to it but I'll explain to you what is the technical definition of a Doji.

A Doji basically means that the open and the close are at the same price level.

This is why you don't see any colored body on this candlestick pattern.

To read the price action of the Doji, the key thing to look at is the wick to show you how strong the price rejection is.

Because if you have a Doji that has an equal upper and lower wick, it's telling you that the buyers and sellers are pretty much in equilibrium.

With that said, there are variations of this pattern:

- Gravestone Doji

- Dragonfly

I’ll explain…

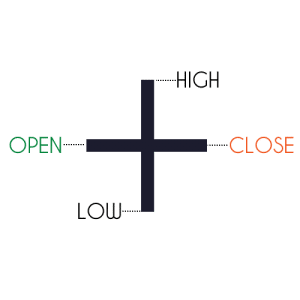

Gravestone Doji

This one over here is telling you that the sellers are in control because it has pushed price lower from the highs all the way to the closing where it last opened.

A Gravestone Doji looks something like this:

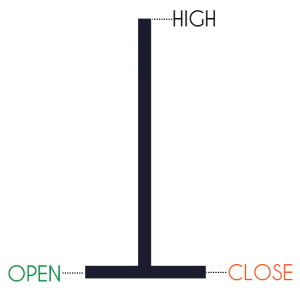

Dragonfly Doji

A Dragonfly Doji is something like this:

It's the opposite of the gravestone where you have a very strong price rejection of lower prices!

And the price closes back where it opened.

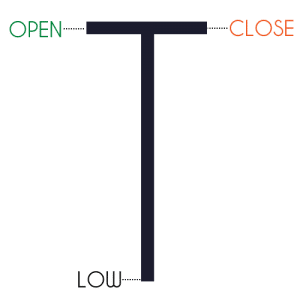

With that said, let's have a look at some Doji on this chart:

You can see that the price has actually opened and closed at the same level but you can see that it rejected lower prices.

I'm not really a fan of going straight that will lead to the technical definition.

I think what's more important is the context of the candlestick pattern.

There's really no need to memorize the exact pattern if you can understand what the market is trying to tell you.

Okay, so let's do a quick recap...

Recap

- Doji basically tells you that the candlestick pattern has opened and closed at the same price. But with a marginal close, you can consider them as a Doji.

- There are definitely variations of it. Dragonfly Doji, which tells you bullish price rejection. And the gravestone Doji, which is more of a bearish price rejection.

- The longer the wick the greater the price rejection.