#5: What is a Piercing Pattern

Lesson 5

What is a Piercing Pattern

In this video, we will be discussing the piercing pattern.

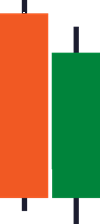

Here’s what it looks like:

In the first candle, you can see that the sellers are in control.

The market opened at the highs, and the sellers came and pushed price all the way down lower.

And eventually, it closed somewhere near the lows.

The first candle is bearish as the sellers have pushed price lower.

Where the piercing pattern comes into play is on this second candle where the market opened near the lows.

And the buyers push the price higher, and it closes somewhere near the highs of the bullish candle.

One thing to note is that the piercing pattern is actually a variation of the engulfing pattern.

In fact, I would say the piercing pattern is not as strong as the engulfing pattern.

Because if you think about this…

The engulfing pattern that you've learned earlier, the candle has closed above the open of the first candle.

Whereas the piercing pattern only closes two-thirds of the first candle!

This is still a bullish reversal candle, but it's not as strong as the engulfing pattern.

It’s a bullish reversal pattern, but it's secondary the bullish engulfing pattern.

Buyers are momentarily in control.

The larger it is, the more significant the pattern is.

The larger it is, it would become a bullish engulfing already.

Let's have a look at a few of these examples:

Notice that the candle has closed at the upper echelon of the previous candle.

I would say that the way to define whether it's a piercing pattern or not is that it has to close at least half of the previous candle close above the halfway mark of the previous candle.

Now that you know what it looks like, let's do a quick recap…

Recap

- A piercing pattern is a bullish reversal pattern, but it's secondary to the bullish engulfing, because it tends to be smaller in size, and it doesn't close above the previous candle.

- Buyers are momentarily in control.

- The larger the pattern is the more significant it becomes.

- The most important thing is that you don't trade these candlestick patterns in isolation.