#15: The Wrong Way to Trade Candlestick Patterns

Lesson 15

How NOT to trade Candlestick Patterns

In this video, we will be discussing how not to trade candlestick patterns:

The first thing is…

1. Don't trade it in isolation

This is something that I have been grinding to you since I think the first few videos!

Don't trade it in isolation.

Why?

Because if you see a bullish hammer, you go long.

You see a shooting star, you go short.

Chances are you're not going to make money in the long run.

Because it does not have a statistical edge in the markets.

The second thing is…

2. Candlestick patterns by and itself is not a trading strategy

If you think back, what is a trading strategy?

A trading strategy entails the conditions of your trading set up, a set of conditions.

May it be trading with the trend, market structure, support and resistance, etc.

Then, it has to have an entry trigger.

What is the entry trigger that will get you in the trade?

After which it needs to have an exit.

How will you take your profits, or what happens if the trade goes against you?

Where will you put your stop loss and take profits?

What is your trade management?

If the trade goes in your favor and then start reversing against you, what will you do?

Will you bail out half of the position, everything, or something like that?

Then, you also have risk management.

How much will you be risking on each trade, and stuff like that.

As you can see…

The candlestick pattern is not a trading strategy!

Because a candlestick pattern by and itself will not give you all these important elements that a trading strategy requires.

If you ask me…

What it can offer is possibly just the entry and exit triggers.

But you can see that it definitely will not fulfill these important elements that you see over here.

Candlestick pattern, it is a not a trading strategy.

Another thing is that don't use it for trend bias.

I know it's a mistake that I used to make is that when I see a bullish engulfing pattern.

In my mind, the market is going higher.

I better be long because I don't want to miss the move!

But again…

If you study the earlier videos I mentioned that it can be misleading.

Because candlestick pattern tells you momentarily what has happened for the moment.

But if you are to get a trend bias, it always pays to look at what is the trend of the market.

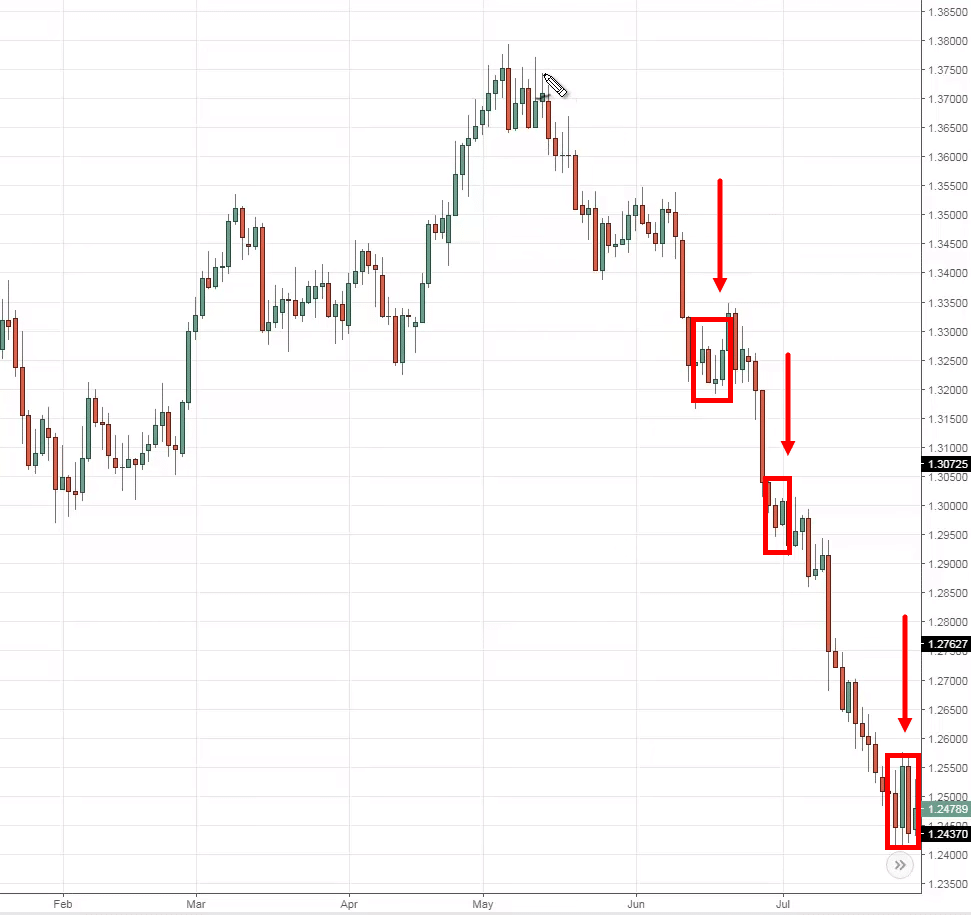

For example, this is a chart of USD/CAD.

And any ten-year-old kid would look at this and can you tell that the trend is very strong to the downside.

Here's the thing…

If you choose to ignore the trend, the momentum, and you just want to look at candlestick patterns to give you a bias.

You can see that it can be very painful to trade against it!

On the chart, you have an engulfing, piercing pattern, and morning star.

You can see that true, these are all bullish reversal patterns...

But if you just look at them blindly, you don't look at what is going on, what is the trend.

It's going to be very painful to trade them.

This is another aspect which I want to emphasize.

Look at the trend.

It is your friend.

A candlestick pattern will not tell you what is the market likely to do.

The trend will tell you what the market is likely to do.

Now that you know how not to trade candlestick patterns, here is a quick recap…

Recap

- Don't trade it in isolation because it does not give you an edge in the markets.

- It is not a trading strategy by and itself because as I've mentioned earlier, you need many components in a trading strategy.

- Look at what the trend is. Don't look at your candlestick pattern to tell you whether you should be long or short.

If you're wondering, “Rayner, how do I define the trend and stuff like that?”

Again, go back to the start of this video.

Download the Ultimate Guide to Price Action Trading.

I cover a lot more topics like marketing structure, trend, and stuff like that.

Go and download it, and I believe it will really compliment to whatever you're learning so far.

With that said, I have come to the end of this video and I'll see you in the next.